Meta: Discounted Core Business (NASDAQ:META)

We Are

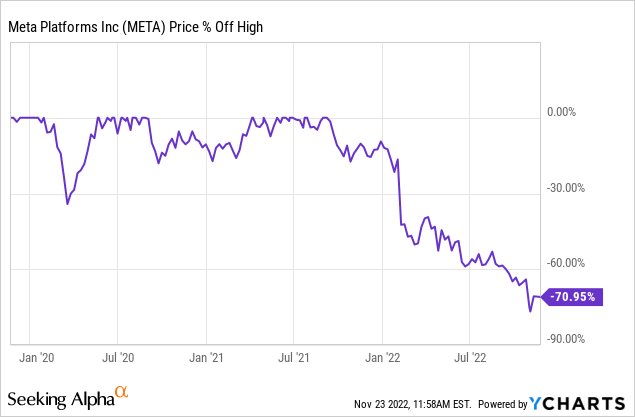

Generations have been evolving throughout the years, which has only been possible by innovations. Changes made our lives more efficient, safer and created better living conditions. Meta (NASDAQ:META) realigned their embodiment of innovation to meet the needs of the following generation. However, investors are punishing Meta’s actions. As a result, the stock is now down 70% from all-time highs, which makes it a good time to take a deeper dive.

The Core Business

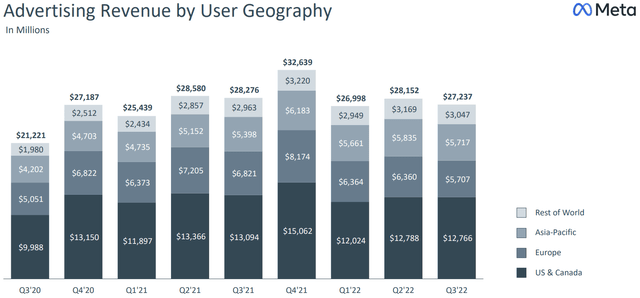

Let’s start off with saying that Meta’s core business is far from dead. Although the advertising market is weaker at the moment, in particular Europe, it is still generating a ton of money. Year-over-year advertising revenue stayed stable in all regions but Europe. Europe’s consumer market is currently extremely weak, this is also clearly visible in other businesses. So it is no shock that advertising revenue is down by 16.3% in Europe, as companies try to cut back on marketing efforts in the region.

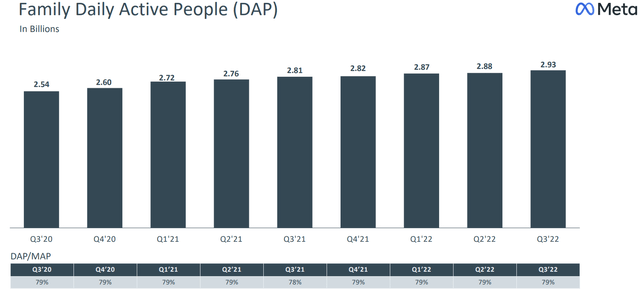

Still, this does not mean people are using less social media. Meta has been able to increase daily active people and monthly active people on their platforms. Last weekend, I have visited Barcelona (Spain), where I could witness the social media activity in the metro, train and busses. Barcelona, known as one of the busiest cities in Europe, is using Instagram, Reels and WhatsApp very frequently. By surprise, I have not seen a single person use TikTok. AI advancements in the scaling of recommendation models have led to watch time increases of 15% for Reels. Hence, I suspect that people are using Reels more and more, as a replacement for the competitor TikTok.

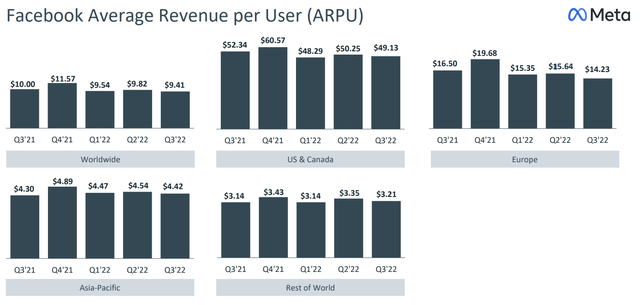

So, Meta’s platforms are completely fine and Europe is the only real laggard for now. Europe is not lagging in terms of active users, but in revenue earned per user. In Asia-Pacific and the rest of the world, ARPUs have increased year-over-year.

Personally, I still see opportunities of growth in the core business. Reels has a good chance to take back market share from TikTok. Reels are included in Instagram and Facebook, which makes it a better all-in-one experience. Further, the monetization of Messenger and WhatsApp is another huge opportunity. Mark Zuckerberg, CEO of Meta, said in the Q3 2022 earnings call:

We started with Click-to-Messaging ads, which let businesses run ads on Facebook and Instagram that start a thread on Messenger, WhatsApp or Instagram Direct so they can communicate with customers directly. This is one of our fastest growing ads products, with a $9 billion annual run rate. This revenue is mostly on Click-to-Messenger today since we started there first, but Click-to-WhatsApp just passed a $1.5 billion run rate, growing more than 80% year-over-year.

Paid messaging is another opportunity that we’re starting to tap into, and it continues to grow quickly but from a smaller base. We’re putting the foundation in place now to scale this with key partnerships like Salesforce, which lets all businesses on their platform use WhatsApp as the main messaging service to answer customer questions, send updates, and sell directly in chat. We also launched JioMart on WhatsApp in India and it’s our first end-to-end shopping experience that shows the potential for chatbased commerce through messaging.

Between Click-to-Messaging and paid messaging, I’m confident that this is going to be a big opportunity.

Click-to-Messenger/WhatsApp is growing extremely fast and could take a bigger percentage of total revenue in the following years.

Overall, advertising is experiencing a temporary downturn, but this should not be troublesome for investors in the long term, since the underlying business is still sturdy.

The Valuation

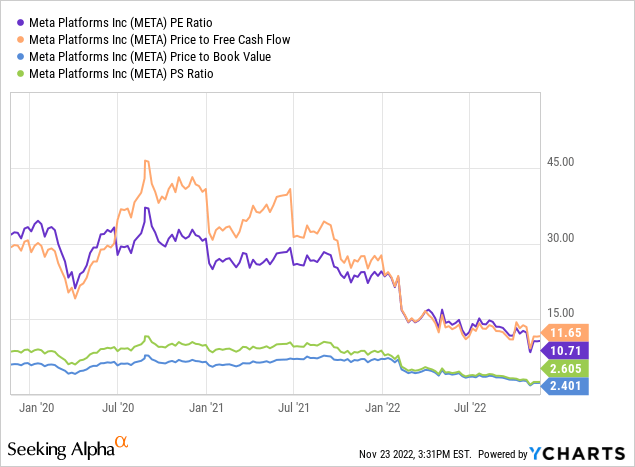

So far, I have not talked about the metaverse business, for the reason that it does not matter. Meta is trading at 11.65x earnings and 10.71x free cash flow, even in the COVID-19 crash the company was not this cheap. The metaverse has a negative impact on PE and PFCF ratios, since it generates negative earnings and needs a lot of free cash flow, yet these metrics are going lower.

So, if Meta’s adventure in the metaverse comes to an end, no more negative impacts on earnings and free cash flow, then the stock would look even more discounted. Similarly, if the metaverse starts producing positive earnings and free cash flow, then the stock would also look more discounted. Further, the current valuation could be the bottom, as Meta is cutting costs and the core business and the dollar strength is stabilizing.

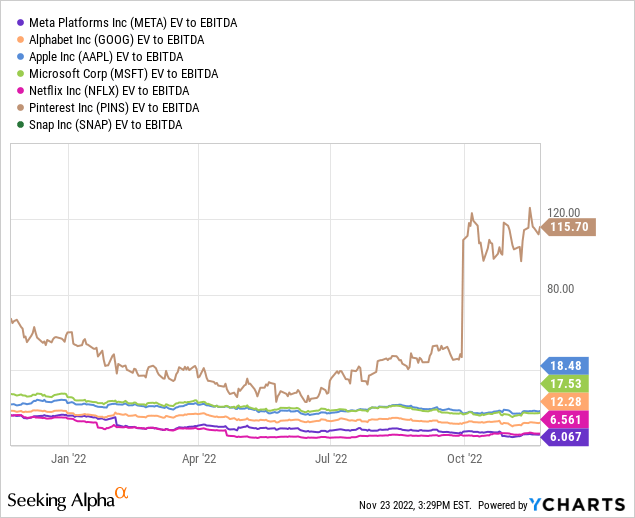

In terms of EV-to-EBITDA, only Netflix (NFLX) is close to the valuation of Meta. Other peers and advertising-based companies trade at a significant higher multiple.

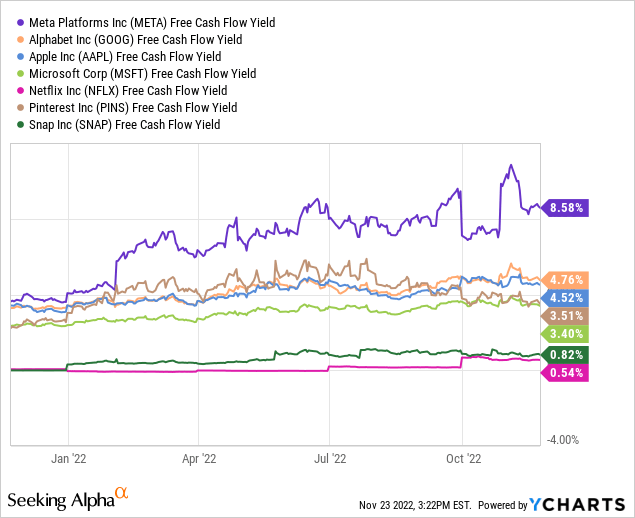

In addition, Meta’s free-cash-flow yield is way superior than companies like Alphabet (GOOG) and Apple (AAPL). Therefore, Meta looks discounted based on fundamentals. One might argue that Apple, Microsoft (MSFT) and Alphabet are higher quality businesses and deserve a more premium valuation. However, the discrepancy between them is too large for me to consider that argument.

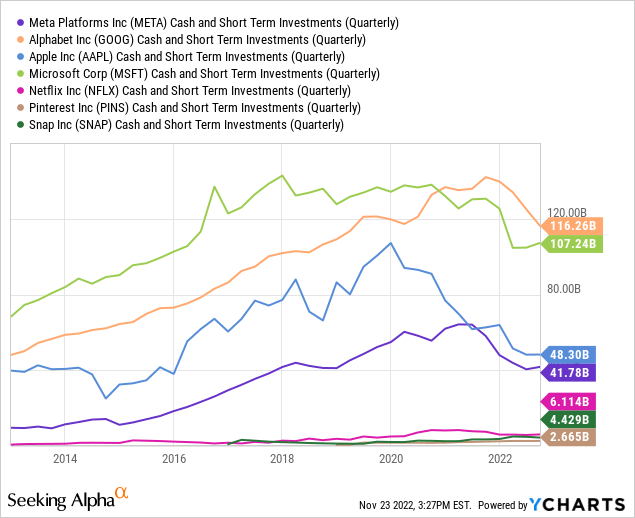

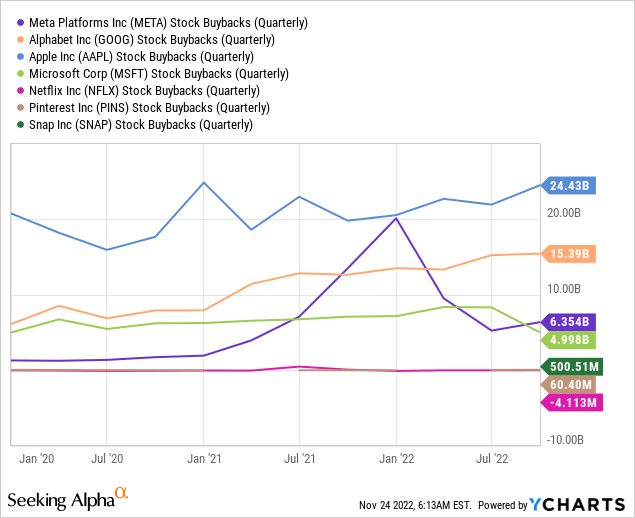

Lastly, Meta’s liquidity is matching that of Apple’s. The balance sheet makes it possible to do investments or give back to shareholders through buybacks. Meta has been actively buying back shares, yet the company still has 14% of the current market cap in liquidity. Snap (SNAP)’s and Pinterest (PINS)’s cash and short-term investments are hard to compare with that of the larger companies.

The Metaverse

I have always had this thought; that whatever is unknown, is strenuous to comprehend, until it becomes reality. Trying to imagine what lies beyond the known boundaries of the universe is a pretty difficult exercise. What creatures could be out there? Your mind will flood you with images that you have seen in the past; but can’t there be something new that has never been seen before? Something even your mind struggles to envision…

There is… and it is called innovation. Innovation is a broad term and stands for implementing a new product, service or process. As investors, we are cautious about this term:

Since the profits that companies can earn are finite, the price that investors should be willing to pay for stocks must also be finite – Benjamin Graham.

The metaverse is almost fully calculated into the stock price. Not to the upside, but to the downside. Investors assume nothing will come out of the Metaverse, for that reason, the stock might be a great opportunity. As we know, a decreased stock price lowers the risk and creates a higher possible return. The stock is now down 70%, which means the stock is less risky than it was at higher prices. Therefore, I would say that the margin of safety on Meta is sizeable at today’s price.

However, if the metaverse would somehow manage to make some positive free cash flow, the stock price could see some promising returns. And as a matter of fact, the metaverse does look quite realistic. Learning through vision and physically practicing are the best ways to improve your skills. Globalization could be even more efficient than the current internet of things that we have now. Additionally, productivity has still room to grow. People want progress, something better, more efficient, compact and so on… If those things are available, it will be bought in no time.

However, I do agree that Meta’s storytelling has not been the best. It is very important to understand that the metaverse does not only resemble virtual reality, but also augmented reality. Unlike virtual reality, which creates a totally artificial environment, augmented reality users experience a real-world environment with generated perceptual information overlaid on top of it.

Personally, I see more real-life use in augmented reality. At the moment, deaf people finally have a chance to create meaningful conversations through augmented reality glasses. The glasses can transcript spoken language to subtitles that appear in the glasses.

Right now, I am writing this article on my pc with a second screen. But with the Meta headset, you can have as many screens as you want and even choose where to place them with augmented reality. Furthermore, the screens can have touchscreen functionalities to increase productivity. Space and cable management won’t be a problem any longer.

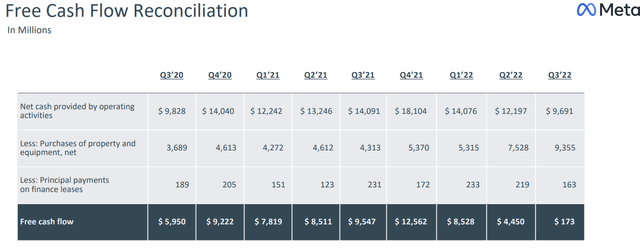

This innovation is not all glamour, the company is spending billions of dollars in the project, which is soaking up a lot of the free cash flow. Yet, it is important to know that Meta is not only spending on the metaverse. Meta is in a new investment cycle to improve infrastructure, expand AI capacity and bring more data center capacity online. In Q3, Meta spent $4billion on Reality Labs, the rest went into other parts of the business. For example, AI advancements have led to watch time increases for Reels.

Meta is partnering up with companies like Microsoft, Adobe (ADBE), Autodesk (ADSK), Zoom (ZM), Accenture (ACN) and many more to create new solutions and applications on the metaverse devices.

Investing in a start-up is quite risky as the company is not making any money, burns cash and dilutes shareholders. In an increasing interest rate environment, it is not as easy as before to get hold on capital. Consequently, it should be avoided by intelligent investors. Nevertheless, Meta has the capital, the infrastructure and a strong underlying business to make this metaverse start-up work.

Takeaway

The downturn in the advertising cycle combined with towering investments make Meta a scary place for investors. The company is now harder to model with numbers and business analysts are blacked out.

Even so, Meta’s business has been around for almost 2 decades, has a strong core business with 2.93 billion daily users and does not dilute shareholders (in fact in decreasing outstanding share count). Would you really mind them innovating to satisfy the needs of the next generation?

Surely, free cash flow will be suffering for some years by the high investments. But better returns could come forward shortly in the Reels, Messenger and WhatsApp segments, since the core business is not out of focus. The weak advertising market and the strong dollar headwinds temporarily overshadow the quality of the business.

In my opinion, investors are way too bearish; therefore I see value in Meta. The risk-reward balance is favourable at the current prices. I will say that Alphabet offers a safer deal for me with less risk and a similar reward. Always remember that you have to look for an investment that fits you.

I rate Meta a Buy. Must the stock price go down under $100 a share, I might re-rate it to a Strong Buy.

Let’s end with a thoughtful quote of Carl Jung:

The creation of something new is not accomplished by the intellect but by the play instinct acting from inner necessity. The creative mind plays with the objects it loves.