MCHP: A Strong, Diversified Chip Leader With Promising Growth Prospects (NASDAQ:MCHP)

Pavlo Sukharchuk/iStock via Getty Images

MCHP Reports Strong Results with Upbeat Forecast

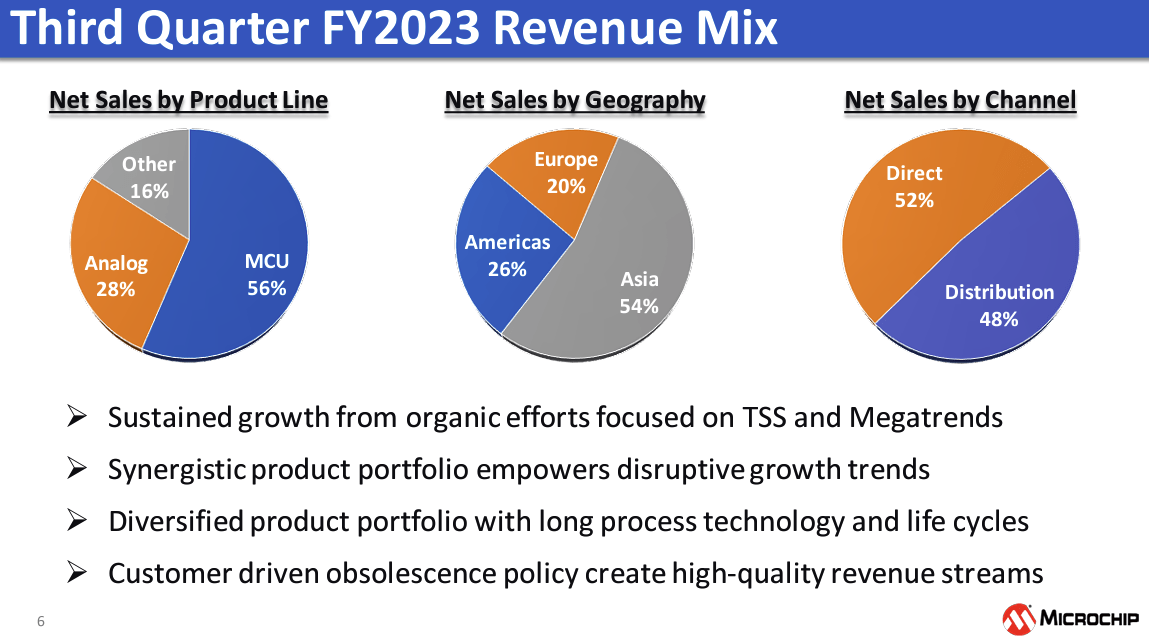

Microchip Technology Inc. (NASDAQ:MCHP) delivered strong results for its fiscal Q3 and is optimistic about Q4. The company predicts sequential growth in Q4 of 2023, thanks to favorable product mix and market share gains through total system solutions. In Q3, MCHP saw a 5% increase in revenue, reaching $2.169 billion, driven by the automotive, industrial, and data center industries, which accounted for 86%. The company achieved a record 68.1% adjusted gross margin and 47.5% adjusted operating margin. The revenue segmentation by product line, geography and channel are illustrated below.

Company Presentation

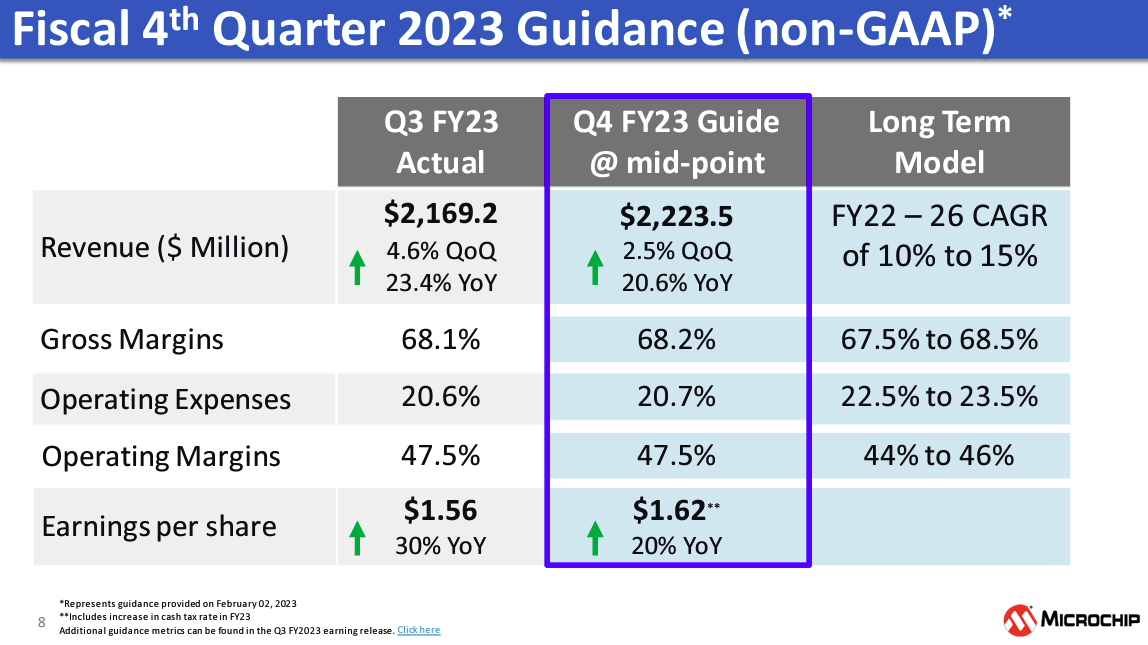

For Q4, MCHP forecasts a 1-4% increase in revenue, reaching $2.224 billion, with similar margins as Q3. The company intends to increase its capital return, with a 5% increase in shareholder returns each quarter until nearly all its free cash flow is paid out.

Company presentation

A Leader in Microcontroller and Analog Chip Solutions

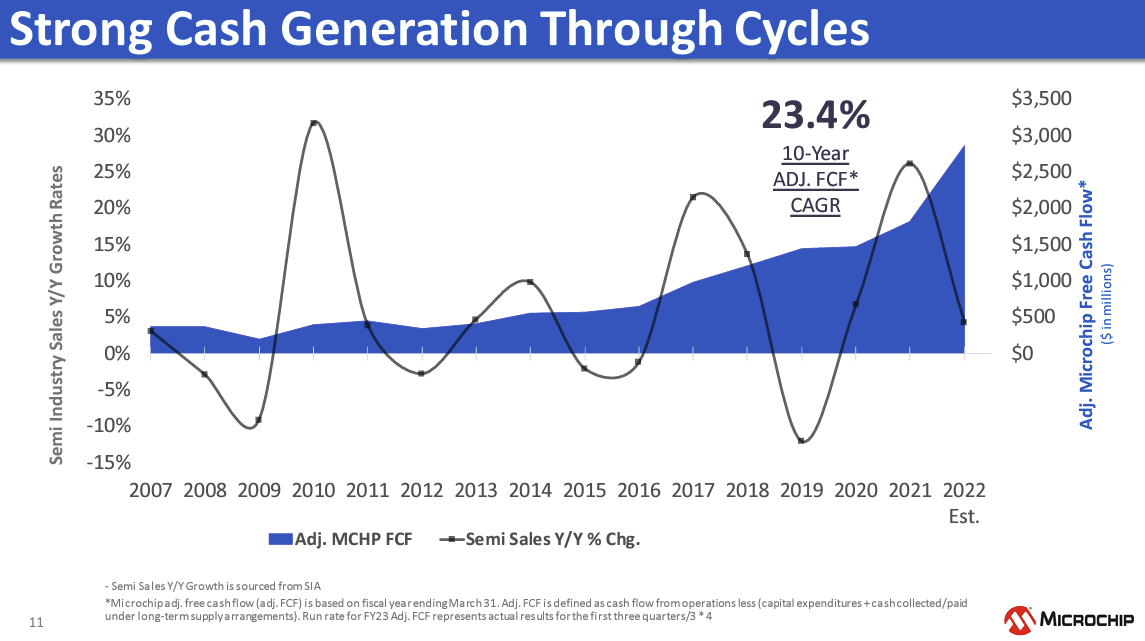

MCHP is a leading supplier of microcontrollers (MCUs), crucial components in various electronic devices ranging from garage door openers to home appliances. MCUs perform inputs processing, program execution, and output production, often in conjunction with analog chips that handle real-world inputs like temperature. Despite economic conditions, MCHP has been able to generate free cash flow.

Company Presentation

The MCU and analog chip markets offer attractive features, such as low capital investments, customer loyalty, and high margins. MCHP excels in 8-bit MCUs and is expanding into more advanced segments with its growing analog chip business. With the increasing demand for smart, connected devices, MCHP is positioned for growth through product expansion and potential acquisitions.

MCHP’s Intangible Assets and Customer Switching Costs Drive Economic Moat

I hold the view that MCHP has a strong competitive advantage. This moat is derived from intangible assets such as exclusive chip designs, superior manufacturing knowledge, and the switching costs involved in changing to a different supplier once MCHP’s analog and MCU chips are integrated into an electronic device. The company has consistently demonstrated strong financial performance and maintains its dominant position in the MCU market while expanding its analog business.

Leading analog and MCU chip manufacturers must meet stringent quality standards, particularly in industries like the automotive sector where faults are not acceptable. New entrants find it challenging to achieve this level of quality while still producing at high volumes. MCHP’s 8-bit MCUs are built on its proprietary PIC architecture, making them unique.

MCHP’s moat is also strengthened by switching costs. Customers’ purchasing decisions are based on performance, not price, so MCHP retains its pricing power. Once electronic manufacturers choose a chip, they often stick with it for the duration of the device’s lifespan due to the cost of redesigning the product to switch to a competitor’s chip. The familiarity of engineers with MCHP’s design tools makes switching even more difficult.

MCHP has a diverse customer base and is not dependent on a single client or market segment. The company focuses on end markets with long product lines such as the automotive, industrial, and communications infrastructure sectors, where customers are unlikely to choose a lower-quality chip for minimal cost savings. By serving a broad range of customers, MCHP does not have to make the same price compromises as companies in the PC or handset markets.

Excellent Capital Allocation with a Strong Management Team

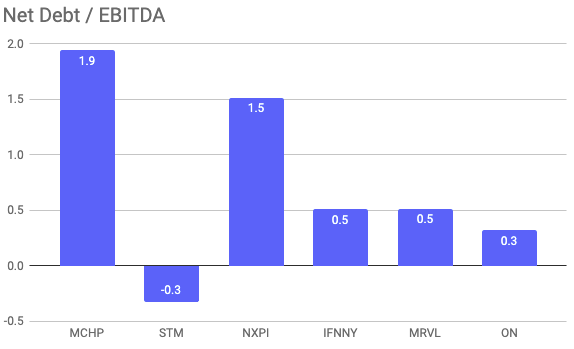

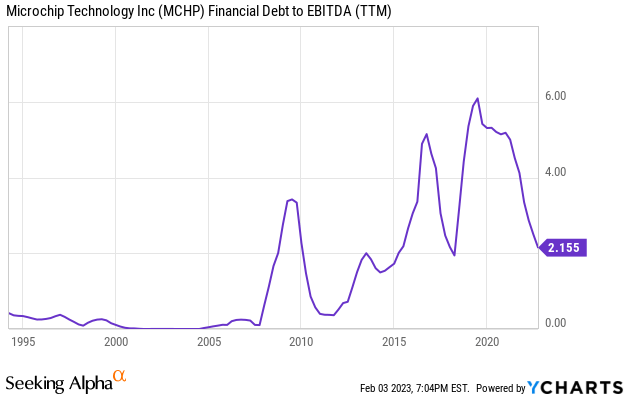

Although MCHP’s balance sheet has been weakened by debt taken on during the 10 billion USD acquisition of Microsemi, it has been actively paying down debt. The company is efficiently run, with a well-planned leadership succession, as former COO and President, Ganesh Moorthy, became CEO after Steve Sanghi stepped down. Despite its high debt levels compared to its peers, MCHP’s balance sheet has improved as it works to reduce debt.

Seeking Alpha Ycharts

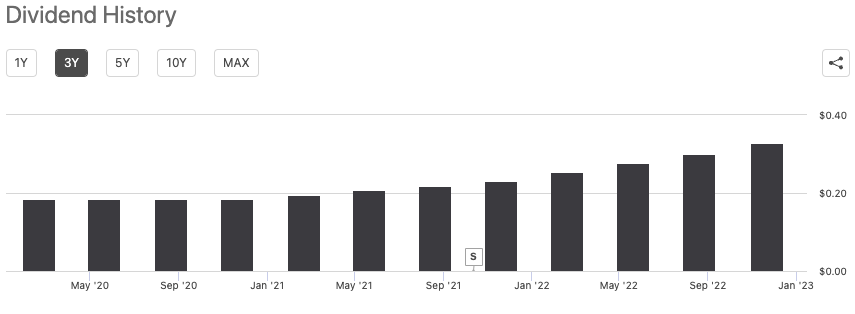

The company has a stable dividend policy and has increased payouts to investors since regaining an investment-grade rating and reducing its debt.

Seeking Alpha

Valuation

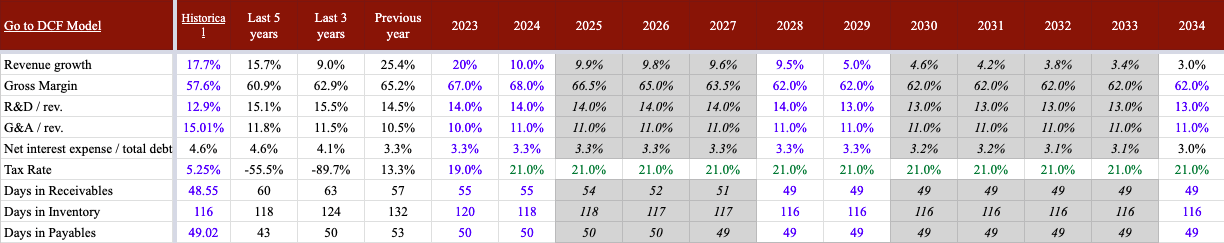

MCHP is expected to see steady growth in the coming years. My fair value estimate of $110 per share is based on the assumptions below. MCHP is poised to maintain its leading market share in 8-bit MCUs and grow its higher-end MCUs and analog semiconductors.

Author estimates & Company 10-k filings

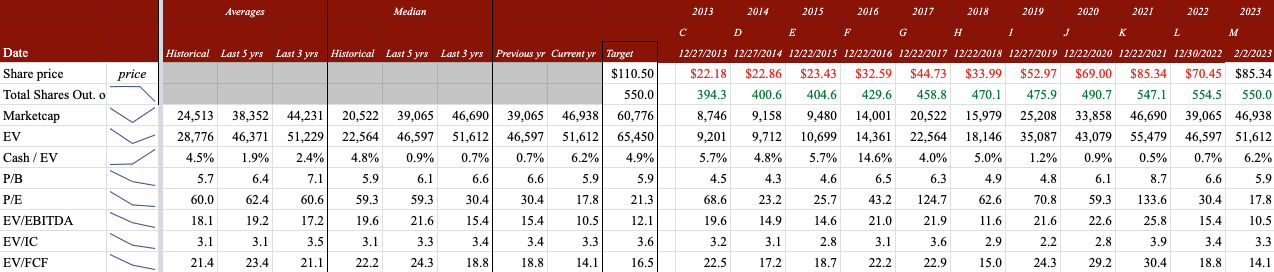

At a value of $110, the implied multiples are within historical ranges as shown below providing an extra margin of safety.

Seeking Alpha, Author estimates & Company 10-k filings

Risks and Uncertainties in a Cyclical Chip Industry

I see four main risks and uncertainties regarding MCHP that should be taken into account.

-

MCHP operates in the cyclical semiconductor industry, but its diverse customer base and long product life cycles offer some insulation compared to other chipmakers. However, the semiconductor industry is prone to fluctuations with the overall global economy and MCHP’s sales are not immune.

-

MCHP faces competition in the market for standalone analog chips and lags behind some larger firms in sales of 16- and 32-bit MCUs.

-

The possibility of U.S.-China trade tensions also present a near-term risk. This may cause Chinese customers to seek alternative suppliers for analog and embedded parts, specifically those based in Europe, such as STMicro (STM).

-

Despite their impressive track record of successful M&A integrations, the company has increased its debt to finance these acquisitions.

Conclusion

MCHP has delivered strong results in its fiscal Q3 with a 5% increase in revenue driven by the automotive, industrial, and data center industries. The company is a leader in microcontrollers and analog chip solutions, with a strong competitive advantage derived from its intangible assets, customer switching costs, and proprietary chip designs. MCHP’s diverse customer base and focus on long product life cycles offer insulation from the fluctuations of the cyclical semiconductor industry. MCHP is poised for growth through product expansion and potential acquisitions, and its leadership team has a well-planned succession and a stable dividend policy.

However, the company operates in a cyclical industry and faces competition in the market for standalone analog chips and lags behind in sales of 16- and 32-bit MCUs. Additionally, U.S.-China trade tensions and increased debt from acquisitions present near-term risks.

At a fair value estimate of $110 per share, I recommend buying the shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.