Maersk: Only One Downside, And It’s Small – A ‘Buy’ (OTCMKTS:AMKBY)

Cristian Borrego Sala

Dear readers/followers,

Shipping and logistics are far from the easiest sort of segment to cover with only limited time – but I believe it’s one of the more crucial sectors to actually stay invested in and to invest in when we’re in a downturn for the long term. Because Ocean Freight and freight overall aren’t going anywhere.

Furthermore, A.P. Møller – Mærsk A/S (OTCPK:AMKBY), doesn’t suffer from many of the same margin pressure issues that some of the more land-bound logistic companies suffer from.

A.P. Møller – Mærsk – an update is warranted

With 2Q22 out in August and 3Q22 now out in November, we have a good case for checking results in the latest quarter, 3Q22. Like before, it remains a chaotic time in worldwide shipping, as I am sure you are aware – but this remains a net benefit to an operator like AMKBY.

Last article I said that Maersk has been able to deliver record results again and again – so has the company been able to keep up the trend?

Short answer, yes.

Longer answer, we have some things to look at.

First off, the company recorded a new set of record quarterly results. AMKBY does give us continued successful execution. But at the same time, things have continued to be very much in benefit for shipping operators – not just for this company, but many companies in the segment.

The company confirms the FY22 outlook, and this is despite the global deterioration of macro and the overall outlook (a recession in this case). How has the company done this? Pricing and efficiency basically. It doesn’t really matter how bad the market gets if you have a quasi-monopoly of superbly important services, such as this company does.

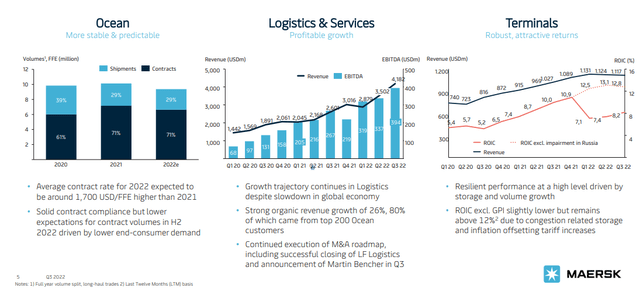

At the same time and despite record results, AMKBY has begun to see normalization indicators in the Ocean segment.

The company’s work on its strategic transformation has been solid in this quarter.

The company delivers on its 2025E targets, which is what we need to keep in mind here. ROIC is moving to a level where the company can comfortable reach a double-digit 10-12% average for 2021-2025, and specific Ocean margins are currently close to 47%. Service revenue growth is doing a 33% positive trend as well, and the margin in terms of EBIT is at around 6%+ as well, which is also in accordance to goals.

The one segment that’s not up to par yet is the Terminals segment – ROIC is below 9% here, which is the target, even just at 70 bps below that target.

AMKBY remains M&A-heavy, and its completed its FL logistics M&A, with the integration process already begun. This tack-on business has annual sales revenues of $1B, with further growth expected for the 2022 fiscal as well as 2023. The company expects this to be a very solid sort of integration, delivering good EPS growth.

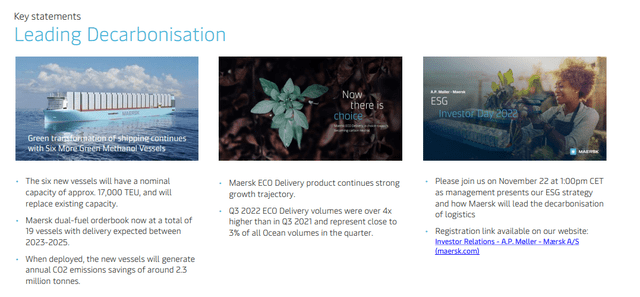

The company’s ESG ambitions go forward as well…

…but full-year guidance and future expectations are the star of the show here. The company now expects underlying EBITDA of no less than $37B, and free cash flow of $24B, and CapEx of around $10B on the high end.

More importantly, the company now expects the global demand for container shipping to decline upwards of -4%, to a previous mostly flat range. Again, in line with current trends, especially out of China.

The company’s cash conversion cycle remains superb – 87% FCF as things stand for 3Q22, and the balance sheet remains very solid, with a net debt that’s very low considering what sort of revenues, earnings and cash flows the company manages. AMKBY will continue to push investments, as well as buybacks, which is one of its primary targets for shareholder returns at this time.

The company has a $12B share buyback program until 2025 and continue to pay out up to half of the underlying net result.

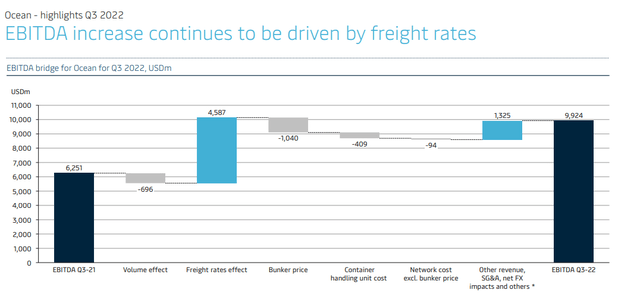

The success story of continued high freight rates continues to push the company’s results upward, weighing up all volume problems that the company gets faced with due to softening demand. EBITDA margins are up to 55.1%, and EBITDA overall is driven by the current insane freight rates – check out the freight rate effect here.

You’ve heard all about congestion in the harbors and terminals at this point – well, the company’s terminal segment is still delivering strong growth in both earnings and revenues, which marks the 8th consecutive quarter of terminal segment growth.

The company is therefore delivering on every part of its 2021-2025 transformation plan.

It’s continuing to build both through organic growth and means, as well as through accretive and inorganic means, including acquisitions.

Even if legacy operations have been a core part of it as well especially with the shipping crisis, the company’s M&As have delivered some very impressive results, in particular when considering the M&As of visible and PT.

In the last 10 quarters, the company’s L&S business has grown 143%, of which 55% was contributed by the company’s M&As.

Congestion also continues to be a very real impact to business, in addition to a macro slowdown. For North America, the congestion is driven by sustained, high import levels. In Europe on the other hand, it’s not import at all, but a result of labor and the Russian war against Ukraine. The problem also isn’t seaside congestion, at least not as a root cause. The reason why ships are “standing” in line in the ports is that the bottlenecks in the system are found in on the land side of things.

That’s part of why the company continues, also in this quarter, to revise their FY22 expectations. The company expects a gradual normalization as opposed to a quicker one, with a beginning in 4Q22, and the CapEx guidance remains unchanged.

Fundamentally speaking, Maersk remains at a high BBB+ credit rating with a stable outlook. The dividend for the company is typically low, but because of the surge in results, the company has significantly elevated its payout. It pays a dividend this year of 2500DKK for this year, coming to a yield of well over 8% based on the current share price.

This dividend remains an outlier, and the typical yield for Maersk is closer to 2-3%.

Remember this when you want to invest in the company.

This current dividend is the result of a massively attractive set of 2021 results, with a strong 2022 expected due to the very strong current trends in shipping – so it’s possible we’ll see increased, positive dividends for this fiscal payable in 2023 as well. Remember also that Maersk is a business with a high percentage of family ownership, and that its operations are tiered around 75% to container shipping.

All of these current momentary trends, once they normalize, will drive things down to more stable levels again. Hopefully, the company will manage better margins once that happens, but it’s important to really point to how insane some of these trends are.

Compared to historical levels, current freight rates are well above $4,000 on average, compared to $2,900 in 2011. It’s the highest price we’ve seen in well over a decade – and it shows no sign of slowing down.

The volatility in this business is highly dependent on the world macroeconomic environment and geopolitical considerations. You can imagine what the crisis in Russia could do to freight prices, for instance. The latest biggest impact here was the US/Chinese trade war/trade restrictions, which impacted trade by an estimated $630 billion back in 2018-2019, and reduced the demand by a full 100 bps.

In short – plenty of things can happen, but at the same time the current trends seem continually positive for the company, and similar companies like Maersk.

So, let’s look where the valuation puts us.

A.P. Møller – Mærsk – Valuation

As I said before, Maersk valuation remains a task that isn’t easy.

In DCF valuation, the thesis is based on modest revenue growth and EBITDA growth at a GDP level of 1.5-2.5%, with CapEx growth at the same levels. I retain these growth estimates for the future period – even with the downturn we might see as the world enters a recessionary period.

Maersk has a WACC of around 8%, with a relatively low cost of debt below 4%, though it wouldn’t be wrong to bump this up to around 4.5-5% given the current rate increases – so let’s put that to 5% to be sure here.

Taking current data and trends into account, our estimates are for normalization of company sales as freight costs normalize somewhat. This now brings us to an implied EV of between 18,200 DKK and 19,000 DKK, or thereabouts, for the DCF valuation.

We can forecast AMKBY at a 15x forward P/E and still get 7-9% annual RoR, even if the company drops its profits by 61% in 2023E another 68% in 2024E. This would imply a full normalization of freight rates, with a slight bump up for inflation. Even in this scenario, the RoR for the investment at this valuation would be around 20% – not the highest, but enough to safeguard your returns in this BBB+ rated investment.

I continue to view this investment as a positive one here – not just because of DCF, but because of forecasts and multiples here. Current analyst estimates come to around 24,000 DKK on average, which is still too high – but that’s also significantly lower than in my recent articles on the company. Out of 16 analysts, 9 still have the company at a “BUY” or equivalent here.

Maersk has an ADR called AMKBY which we are discussing here, and which offers the opportunity to invest at a cheap share price due to the 0.005X nature of the ADR.

I personally invest in the native share, as this is one of the most liquid stocks traded in Copenhagen.

I have been investing in a few of the company’s native shares, and intend to continue to buy slowly at what I believe is a long-term appealing investment valuation.

As things look now, I buy around 2-3 shares per month of this company, to a long-term allocation target of 2-3%.

For now, this one remains a “BUY” for me.

Thesis

My thesis for Maersk is as follows:

- This is one of the world’s most important shipping companies. At a good valuation, this company is, to me, a no-nonsense “BUY” with no looking back. The flow of goods dictates the state of our national economies, which makes the company a major player in macro.

- I view the company currently as fairly or even slightly undervalued in the face of what is an unprecedented logistic crisis.

- It’s a “BUY” here to me – and I view it with a target of around 21,000 DKK/share, lowering it by 500 DKK to account for the revision this quarter.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company therefore fulfills all of my investment criteria here.