Macy’s: Shares Putting In Floor Despite Negative Profit Growth

Wolterk/iStock Editorial via Getty Images

Ahead of the all-important holiday shopping season, retailers’ Q3 results hit the tape this week. October Retail Sales data also comes on Wednesday.

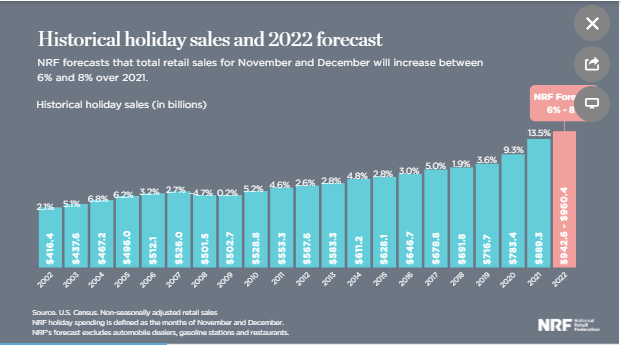

The National Retail Federation expects 2022 winter holiday sales to grow by about the rate of inflation this year, between 6% and 8%. Will well-known Macy’s see a rebound this week after its Q3 report Thursday morning?

Holiday Cheer? A Small Sales Advance Forecast

National Retail Federation

According to Bank of America Global Research, Macy’s (NYSE:M) is the largest national department store chain by revenue. Regional department stores have undergone heavy consolidation over the years, and the present-day Macy’s organization is the result of a 2005 merger between Federated Department Stores and the May Company. The company also operates the luxury chain Bloomingdale’s. Macy’s offers a wide assortment of apparel, accessories, footwear, furniture, and home goods.

The New York-based $5 billion market cap Multiline Retail industry company within the Consumer Discretionary sector trades at a low 4.0 trailing 12-month GAAP price-to-earnings ratio and pays an above-market dividend yield of 3.1%, according to The Wall Street Journal. Ahead of earnings Thursday, the stock has a 7.2% short interest.

Macy’s has struggled in 2022 amid rising shipping expenses, sluggish sales growth compared to other retailers, and investment cuts required to help finance store and omnichannel upgrades. A slower consumer in 2023 could lead to significant operating leverage to the downside. While downside risks are obvious – a dismal consumer, credit income falling, lower sales growth, and margin threats, the upside potential stems from sales initiatives going well, effective cost-cutting and management execution, and favorable real estate income.

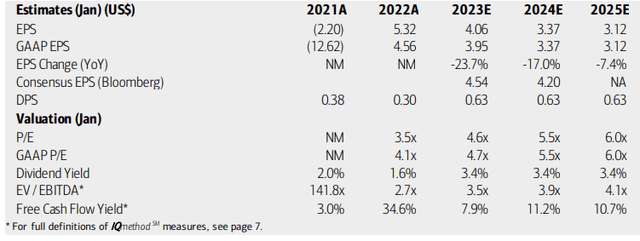

On valuation, analysts at BofA see earnings indeed falling big next year and continuing lower through 2025. The Bloomberg consensus forecast is more optimistic than BofA, but earnings uncertainty is high. Dividends, meanwhile, are seen as holding steady at $0.63 per share.

The question is, how much of the negativity is priced into Macy’s stock price? With operating and GAAP P/Es under 5 for next year, that’s extremely cheap. Moreover, M’s EV/EBITDA multiple is among the lowest you will find in the market. Finally, free cash flow is strong. Overall, I think a lot has been discounted into the share price.

Macy’s: Earnings, Valuation, Free Cash Flow Yield Forecasts

BofA Global Research

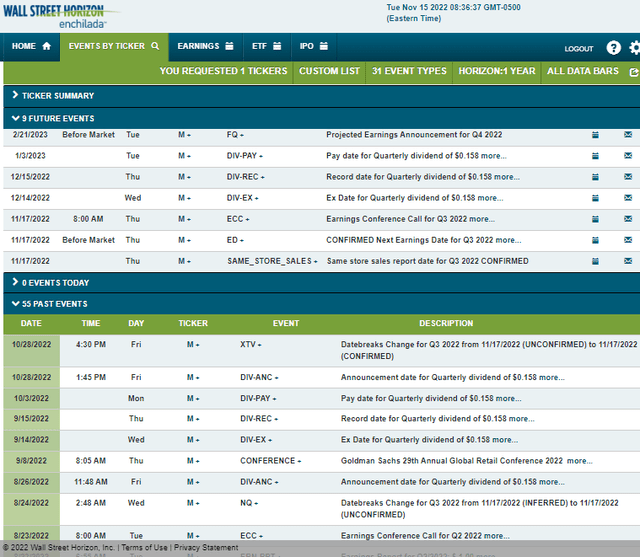

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2022 earnings date of Thursday, Nov. 17 before market open with a conference call immediately after results hit the tape. You can listen live here. Later, the stock trades ex-div on Dec. 14.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

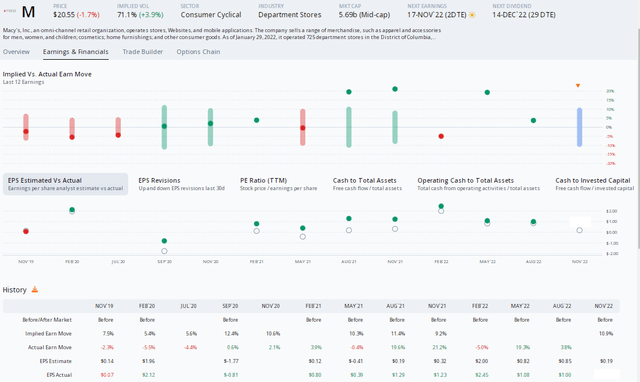

Digging into Thursday’s earnings report expectation, Option Research & Technology Services (ORATS) shows a consensus analyst EPS figure of $0.19 – that would be a steep decline from $1.23 in per-share profits earnings in the same period a year ago. Bulls can point to a strong EPS beat rate history with Macy’s, topping analysts’ estimates in each of the last seven quarters, per ORATS.

Meanwhile, options traders have priced in a large 10.9% post-earnings stock price swing, according to the nearest-expiring at-the-money straddle. A move of that amount would be about in line with the last three reports, so the options appear fairly valued to me. They might be a bit on the expensive side considering market-wide volatility is down sharply in recent weeks.

Macy’s: Options Imply A Big Move This Week, Major YoY EPS Drop

ORATS

The Technical Take

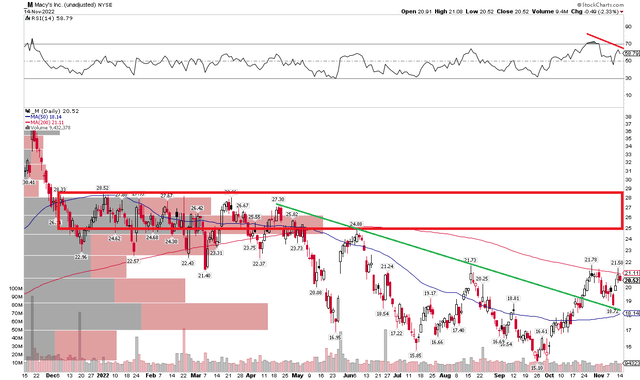

M has signs of life. While not a screaming buy, the stock appears to be wanting to take out its downward-sloping 200-day moving average which has been in resistance since June. Also notice that shares broke above a downtrend resistance line in October and the 50-day moving average has turned higher.

On the bearish side of the ledger, I see potential bearish divergence between the stock price and momentum and there’s a high number of shares traded in the $24 to $26 range. Going into earnings, I think a long position is warranted, but profits should be taken in the mid-$20s. A stop under $18 makes sense.

Macy’s: Shares Bottoming, But Resistance In Play Soon

Stockcharts.com

The Bottom Line

I like M for a long-term value case here despite the high risks. This is by no means a blue-chip portfolio stalwart, but with such low P/Es and decent free cash flow, I think it’s worth a shot. Short-term traders also have key levels to play around earnings.