Long Intel, Short AMD: The King Is Coming Back

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis:

I believe that from a long-term perspective, one phenomenal pair trade to execute is going long Intel (NASDAQ:INTC) and shorting AMD (NASDAQ:AMD), which will produce above-market annual returns. My thesis is based on just a few simple factors regarding AMD and Intel in relation to the overall semiconductor sector. First, when utilizing conservative assumptions for both companies, due to looming macroeconomic risks, increased competition, and the somewhat volatile nature of their businesses, it appears that Intel is significantly undervalued while AMD is largely overvalued (I will elaborate further at a later point). Now, although most companies in the semiconductor space tend to correlate with each other, I believe it’s probable that AMD will depreciate over time closer to its intrinsic value while Intel does the opposite. Then, it’s probable that within the next 5-7 years Intel will be able to retake significant market share from AMD due to increased manufacturing capabilities paired with superior technology. Although Intel and AMD don’t compete on the foundry side of the semiconductor business, Intel’s large expenditures into manufacturing will ultimately boost the overall fiscal state of the company, which they will churn into further R&D investments allowing them to gain a technological edge. Lastly, the recent invasion of Ukraine has brought light to the fact that a Chinese invasion of Taiwan is more likely than previously thought, and with AMD outsourcing virtually all of its manufacturing to TSM, an extremely prevalent risk is apparent in the supply chains of AMD. Yet, Intel is pivoting towards its own domestic foundries which will also receive support from the government. Overall, to me it appears likely that Intel will retake its throne as the absolute king of the semiconductor space in manufacturing and CPUs, while AMD will suffer as the market is pricing in very generous growth rates relative to what I believe it will achieve.

Investor Meeting 2022; Outlining Products (MarketWatch)

Intel & AMD Financial Breakdowns:

Both Intel and AMD appear to be in a strong fiscal state that will allow their businesses to operate efficiently going into the future. Importantly, when comparing key metrics relative to their valuations and ability to grow going into the future, Intel has a remarking edge over AMD from a financial perspective.

Income Statements:

When comparing Intel and AMD, it’s crucial to factor in how Intel is just 18% larger than AMD in terms of market cap and although they are projected to grow at a significantly faster pace, a sizable difference in their financials becomes apparent. In the TTM, Intel had revenue of $77 billion compared to AMD’s $18.8 billion. This gives Intel a P/S of just 2 while AMD’s is over 3 times as large at 6.59. This trend becomes more apparent when comparing Intel’s net income of $24.6 billion to AMD’s $3.4 billion. Once again, AMD’s P/E of 36 is over six times larger than Intel’s P/E of 6. One important factor to take into account is how AMD’s accounts have yet to incorporate Xilinx’s financials, therefore they have to be adjusted when properly valuing the company and the real P/E as of now is 28.

Balance Sheets:

Similar to their income statements, both companies are in a healthy fiscal state but Intel’s financials continue to dwarf AMD’s. Intel has over $38 billion in cash & cash equivalents; this number is simply phenomenal as it gives it tremendous amounts of maneuverability regarding acquisitions and the ability to prosper during tough times. AMD has just $3.8 billion in cash & cash equivalents which is still respectable relative to its debt. Then, both companies have a significant amount of assets relative to their liabilities with Intel’s book value being slightly smaller than AMD’s (1.5 : 2.2) yet book value isn’t an extremely relevant valuation metric in the semiconductor space. Then, when observing quite possibly the most important line on the balance sheet, shares outstanding, it appears Intel is doing modestly better once again. Since 2017, Intel’s shares outstanding have declined 12.4% from 4.6 billion to 4.089 billion. In that same time period, AMD’s shares outstanding have increased over 62% from 1 billion to 1.62 billion. This represents a complete disregard from AMD’s management for shareholder value as it has significantly diluted shareholders by simply issuing shares for additional funding and the acquisition of Xilinx. Although AMD’s management has imposed a small share buyback program, it’s evident it’s only done this to offset the massive dilution from the Xilinx acquisition. Lastly, both Intel and AMD’s net debt is similar at $(3213) and $(4375), which is nice to see going into a high interest rate environment. Overall, from these companies’ balance sheets, we can conclude that both are in similar fiscal states where high debt levels aren’t a concern and book value is sufficient relative to their valuation, with the only major discrepancy being Intel’s ridiculously larger cash pile. One important factor to take into consideration is how the significance of Intel’s cash pile is not simply 10 times better than AMD’s as it also has higher total debt than AMD which offsets the benefits of that cash pile; nonetheless, it’s still quite profound.

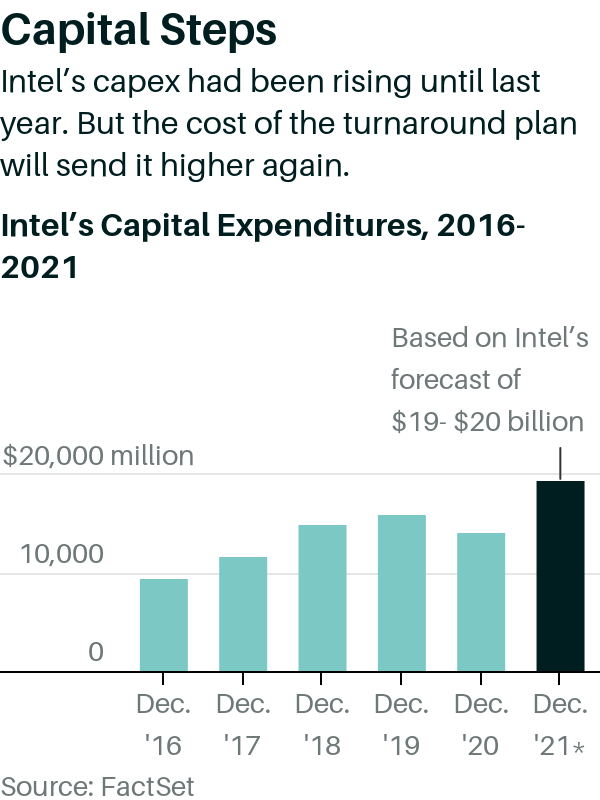

Capex and R&D:

In the income statement, I’ve purposely ignored R&D expenses and I haven’t highlighted the cash flow statements of the companies as their FCF largely correlates with net income and the only exception being higher capital expenditures which is the case with Intel. I’ve chosen to highlight R&D and capex as they are indicative of investments back into the company regarding technological development and manufacturing. On the R&D front, Intel’s is $15.9 billion which is over 5 times larger than AMD’s $3.3 billion. Then, on the capital expenditure side of its business, Intel’s capex ($20.7 billion) is over 67.7 times greater than AMD’s (306 million). Now, although large capex is typically viewed in a negative way as it impacts free cash flow, Intel’s capex is primarily going into factories which will bolster their manufacturing capabilities and greatly benefit the business going into the future. Lastly, it’s apparent that Intel is investing capital into its business at a rate significantly higher than AMD; and although its technology is currently lagging behind, if it can sustain these large investments into R&D, it is bound to catch up and surpass AMD on the technological front even if AMD is currently leading. One popular argument that I commonly see regarding Intel is that it is so far behind AMD and it can never catch up. I find this argument to be wrong for two main reasons: 1) We have seen companies do a lot more with a lot less; in 2017 AMD was on the verge of bankruptcy and in just 5 years has become a juggernaut in the chip industry. After observing this, one question that naturally emerges is why would Intel not be able to achieve a much easier task of taking back market share while being in an exponentially better fiscal state and has a competent management team? 2) The numbers don’t lie; everyone can acknowledge that Intel is currently behind with its chips, but over time it is unlikely that AMD can successfully fight off Intel’s massive R&D and capex investments.

Intel Capex spending (FactSet)

Growth Prospects:

Both Intel and AMD have promising growth prospects heading into the future. AMD has had exponential growth over the past 5 years and plans on further accelerating its growth. Its primary strategy is remaining focused on high performance computing technology, software, and product leadership by delivering high performance CPUs and GPUs. It utilize its CPUs for client systems, computing solutions, and cloud infrastructure. As a result of its clean and concise strategy with few uncertainties, especially when compared to Intel’s plan. For the next 2 years, AMD forecasts net income growth of 11.25% and 11.84%. From these estimates, a CAGR of 10% for the next 5 years and a drop off to 5% for the five-year period after is quite generous as we can presume growth will drop off over time. Then, regarding Intel’s growth plans, Intel aims to implement its IDM 2.0 strategy, which is a three-component strategy to drive sustained technology and product leadership through its internal factory network for at-scale manufacturing which enables a key competitive advantage allowing for product optimization. To support this strategy, Intel is making significant capital investments to support its manufacturing capacity and accelerate its process technology roadmap. Due to all of these factors, Intel estimates that in 5-6 years it will have begun to accelerate revenue growth to 10-12%, which is phenomenal. Overall, both companies have ambitious growth strategies, and although Intel’s strategy seems uncertain as of today, if it can successfully execute its plan, then AMD’s future could be in jeopardy.

Valuation:

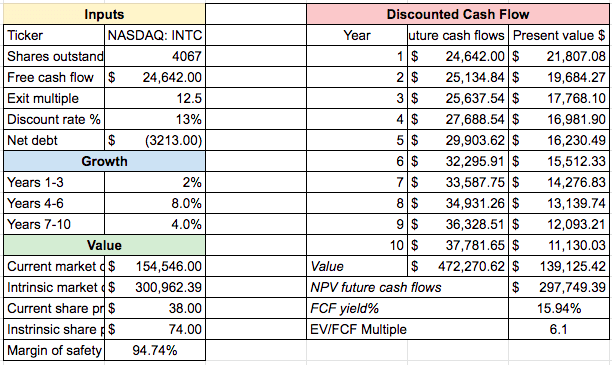

Now comes the fun part. Valuing both companies. For these valuations, I will be utilizing conservative estimates for both Intel and AMD simply to account for the challenging macroeconomic environment ahead, hyper competition, and to have a greater margin of safety thereby allowing you to feel more comfortable in your investment. First, regarding Intel, I have conservatively assumed 2% growth for the next 3 years as it will take time for its investments to produce sufficient returns, then 8% growth in the 3-year period after that which is below Intel’s management expectations but still represents its accelerating growth, and lastly 4% growth for the next 4 years as the benefits of its investments continue to trickle down and its business remains strong. I then discount its future streams of cash flows by 13% as I want to produce above-market returns. Lastly, I assumed an exit multiple of just 12.5 in order to maintain my conservative stance and it’s a reasonable multiple for a company that is growing close to 5% on average during that time period.

Intel DCF model (Seeking Alpha Financials: Hossin Rasoli)

As we can see from above, Intel’s intrinsic value in order to obtain a 13% return is over twice its current share price, representing an extreme margin of safety and potential for phenomenal returns.

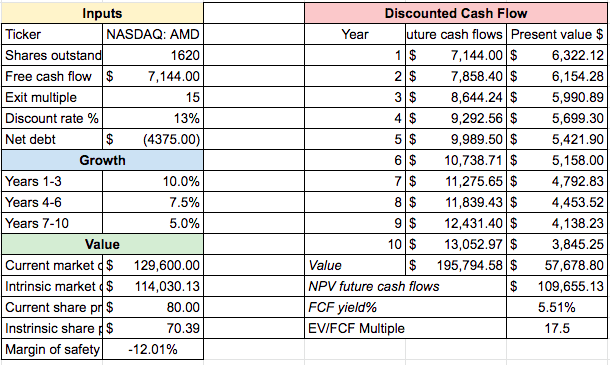

Then, moving onto AMD, I will take a similar conservative stance. First, it’s important to note how I’m using its EPS estimates for all of 2022 as it adequately accounts for the Xilinx acquisition. AMD is estimated to have $4.41 in EPS; therefore it will have approximately 7.1 billion in net income. For the next 3 years, I’m assuming 10% growth which almost matches its management expectations. Then, growth drops off by 2.5% every 3.5 years for the next 7 years. Lastly, I assume an exit multiple of 15 as it will achieve higher growth rates but the company will still be quite mature.

AMD DCF model (Seeking Alpha Financials: Hossin Rasoli)

Contrary to Intel, when using somewhat conservative assumptions, AMD’s intrinsic value is 12% below its current share price. Additionally, when picking stocks, I aim for a 30% margin of safety to limit downside potential as well as to prevent me from overpaying for a stock in case my assumptions are off. Overall, AMD appears slightly overvalued with my current assumptions and if this were to play out, a short is not worth it, but the primary reason I believe shorting AMD is effective is because a worst case scenario may play out if Intel were to execute properly.

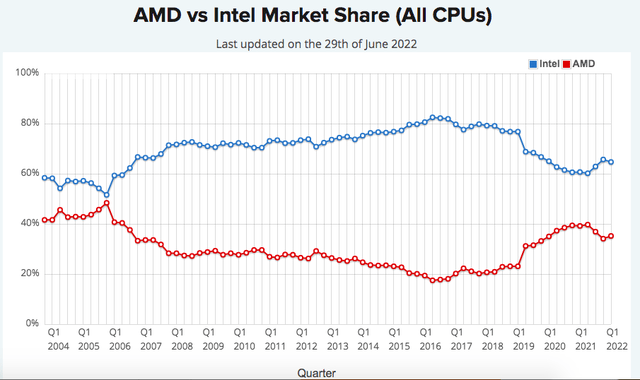

Market Share

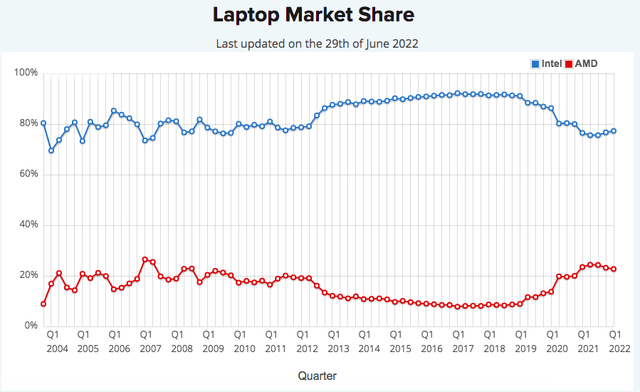

It’s also crucial to observe market share trends for the primary segments AMD and Intel are competing in. First, the majority of Intel’s revenue comes from its client computing group which includes products in the commercial, gaming, and connectivity areas. For all CPUs, Intel’s market share has declined from 76.8% to 64.7%. Now, although this is a drastic decline, Intel has started to recover with its market share increasing by 4% since Q3 of 2021. Additionally, for the laptop side of its business, Intel’s market share has also declined significantly from 91% to 77%. In both cases, Intel has maintained the majority of the market and has begun to recover some of its losses.

AMD vs. Intel Market share All CPUs (cpubenchmark.net) AMD vs. Intel Laptop Market Share (cpubenchmark.net)

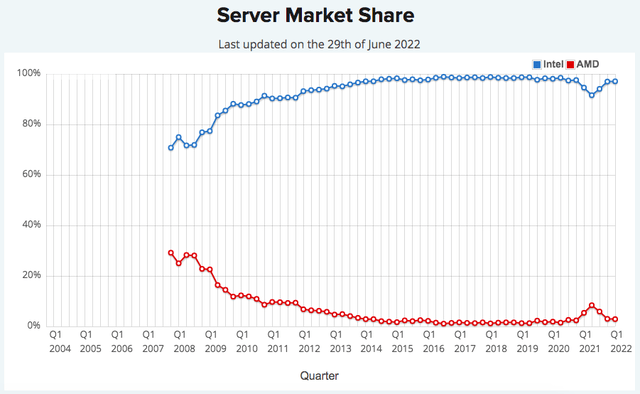

Lastly, it’s also crucial to observe server market share as that also accounts for a large portion of both companies’ revenue. In the case of Intel, it has the overwhelming majority of this segment with it controlling a commanding 97.1% which has slightly declined from a peak of 98.7%. This segment is extremely important as Intel has maintained virtually 100% market share for close to a decade now, therefore it’s essential it continues to sufficiently innovate.

AMD vs. Intel Server Market Share (cpubenchmark.net)

Risk Factors:

Although it is quite probable that Intel will successfully pull of its turnaround plan and harm AMD in the process, there are some risks that could emerge which will jeopardize the trade.

Execution Failure:

The most prevalent risk that Intel faces is the possibility of it failing to properly execute its turnaround plan. Although it’s unlikely Intel completely fails and its earnings continue to decline, the entire investment thesis would be at risk. If Intel sinks billions of dollars in capital towards investments that don’t see returns, it’s likely AMD would continue to take market share during this period of time and continue exponentially growing its earnings. Due to this, it’s likely Intel’s stock would continue to suffer while AMD generates phenomenal returns.

Macroeconomic Climate:

The over-looming macroeconomic environment is another threat towards this pair trade but the consequences won’t be as substantial and it only impacts a relatively short-term timeframe. As we all know, due to the Federal Reserve drastically raising interest rates and quantitative tightening, paired with high inflation, it will lead to a mild-severe recession. Now, the semiconductor industry is rapidly growing and everyday more items need chips. Even though this is true, a recession would still heavily impact chip companies as fewer overall goods would be bought. The upside is that with this pair trade, although the long on the Intel position will suffer, the short on AMD would greatly benefit and quite possibly offset the majority of the losses.

Pair Trade Execution

Lastly, it’s important to review how to enter this trade, the timeline, and how the position should be weighted. First, regarding the Intel long position, I believe that establishing a cost basis anywhere under the $40 range would be phenomenal and offers tremendous upside potential. Then, the AMD short should preferably be entered in the $85 range or higher as it would simply allow for greater downside potential. Then, regarding the weighting of the position, I have significantly greater conviction in going long Intel than shorting AMD as I believe the semiconductor industry will continue to grow as a whole and there are uncertainties in Intel’s turnaround plan that may prevent it from taking back significant market share. That’s why weighing the Intel long position as 65% of the trade and the AMD short as 35% will offer a hedge if AMD breaks out and to capitalize on Intel’s upside if it were to successfully execute but not severely harm AMD. Finally, my timeline for this trade is 5-7 years as I believe that is when Intel’s turnaround plan will be in full effect and AMD may feel the consequences.

Final Thoughts:

Overall, I believe that going long Intel and shorting AMD would be a beneficial pair trade due to numerous factors.

- Intel’s aggressive turnaround plan, if successfully executed, would greatly boost its earnings growth by allowing it to efficiently take back market share from AMD in its core consumer segments.

- Intel is greatly undervalued relative to its future earnings and its stock presents a huge margin of safety in order to receive above-market returns while AMD is slightly overvalued and its future could be jeopardized by Intel’s maneuvers.

Lastly, there are some risks that this trade presents, the primary one being an execution failure of Intel’s plan which would cause Intel to suffer vastly while AMD benefits, the opposite of what I have outlined and hope for.