Kering’s Sell-Off Opens Up An Attractive Entry Point

Kevin Frayer/Getty Images News

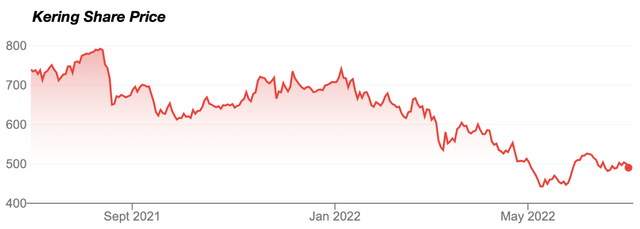

Kering (OTCPK:PPRUF)(OTCPK:PPRUY) has had a tough time of it lately. Shares of the Gucci and Yves Saint Laurent owner have lost over 35% of their value since hitting a peak last summer, with most of the damage occurring these past few months.

As with the wider market, it is events largely out of the company’s control that are weighing here. COVID-related lockdowns are threatening sales and earnings in the increasingly important Greater China market for one, while elsewhere the increased chance of economic recession brought on by ballooning inflation poses a similar problem. Those developments have overshadowed hitherto solid financial results, including a fairly robust first quarter revenue update released back in April.

While the sell-off is obviously unwelcome for shareholders, it does provide a nice entry point for prospective investors, with mid-single-digit long-term annualized growth now more than enough to justify the current share price. Buy.

Making The Right Moves

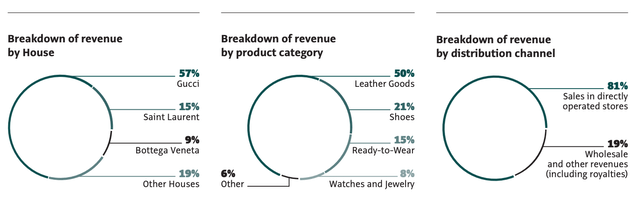

Kering unsurprisingly has quite a bit in common with recently covered Burberry. It isn’t a mono brand player, of course, but the company’s flagship Gucci brand does account for around 57% of sales and an even bigger slice of operating income (~75% in fiscal 2021). Saint Laurent (~15% of 2021 revenue) and Bottega Veneta (~9%) represent the group’s next two largest houses.

Source: Kering 2021 Annual Report

Like Burberry, Kering has benefitted from a couple of trends. The first is the economic rise of China, whose consumers (both at home and in terms of tourism) have been a huge tailwind to revenue and earnings growth, with the prospect of many more years of growth to come. Asia Pacific sales have more than doubled these past five years, helping to drive robust overall top line growth.

Data Source: Kering Annual Reports

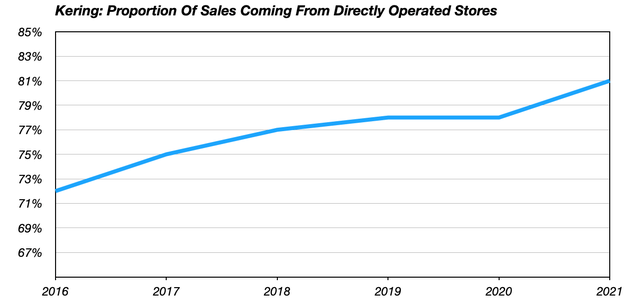

Secondly, and on a more micro level, Kering has also made a conscious move to increase the share of its sales from its own retail outlets (both physical and online) at the expense of the wholesale channel. Luxury goods firms are forever having to balance the desire for revenue and profit growth with the need to maintain the perception of exclusivity. Increasing control over its major brands – Gucci generates over 90% of sales from its own retail channel – reduces the risks of saturation, and brings the firm more into line with top-performing peers LVMH (OTCPK:LVMHF)(OTCPK:LVMUY) and Hermès (OTCPK:HESAY)(OTCPK:HESAF), which both exercise tight control over distribution.

A Strong Start To The Year, But Near-Term Caution Warranted

2021 had already seen Kering surpass pre-COVID levels on a number of metrics, including revenue and record levels of free cash flow, and that positive trend continued into the first quarter of the year.

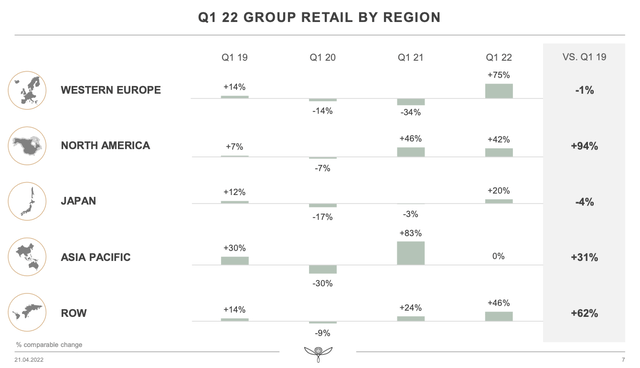

Q1 revenue was €4,956m, up around 21% on a FX-neutral basis. Performance was broadly strong across all houses, with Gucci sales (up around 13% on a comparable basis) lagging owing to its higher exposure to China, where COVID-related restrictions negatively impacted sales. That was offset by stronger performance in North America and Western Europe – the latter benefiting from a very soft comp in the prior period (which was heavily affected by COVID lockdowns).

Source: Kering Q1 2022 Trading Update Presentation

Looking ahead, the operating environment has almost certainly deteriorated compared to earlier in the year. Previously, management had shared third-party forecasts which saw 2022 global GDP growth of 3.4% and 6-10% growth in global demand for luxury goods. On a medium-term horizon, annualized growth of the latter was seen at 6-8% out to 2025.

Suffice to say that recent developments place those forecasts into doubt. Firstly, ongoing COVID restrictions in China threaten sales for obvious reasons, and Gucci’s outsized exposure to the region perhaps makes that a more acute issue for Kering, especially since the brand’s margins are also ahead of the group average.

Moreover, higher inflation poses a similar threat to sales and earnings here. While it may be tempting to lean on the fact that Kering’s customers are typically more affluent than the average, and thus are better able to weather cost of living increases, I would flag these two sentences from peer Burberry’s FY21/22 earnings call regarding the firm’s sensitivity to the wealth effect:

We’re much more impacted by real estate prices and the stock market. In terms of the correlation with various macro factors, those are the two main factors that we need to keep an eye on.

That is a sentiment that almost certainly applies here given the similarities between the two companies, and especially in North America, where trading coming out of the pandemic has hitherto been strong.

An Attractive Long-Term Entry Point

Kering shares change hands for around €490 apiece in Paris trading at time of writing, equivalent to around 18x 2021 earnings and around 15x increasingly tentative 2022 earnings estimates. The dividend yield is 2.45% based on the €12 per share 2021 payout. The shares have fallen from over €700 at the start of the year and from over €790 at the peak last summer.

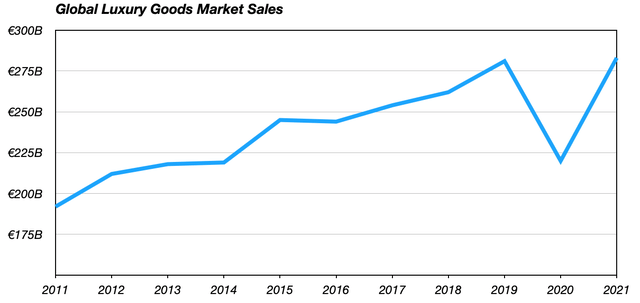

That looks like an attractive long-term entry point, notwithstanding the increasing near-term uncertainty to earnings. Pre-COVID, the global luxury goods market had grown at a circa 5% per annum clip, according to data shared in the firm’s annual reports. Incorporating the pandemic lowers that figure by around a point or so over the past decade.

Data Source: Kering Annual Reports

Importantly, similar future performance would now be enough to leave these shares significantly undervalued. Indeed, discounting 5% annual revenue growth and stable margins over the next decade, falling to 3% annualized growth thereafter, leads me to a fair value in the €600 per share area, implying over 20% upside from current levels. Buy.