Kayne Anderson Energy Infrastructure Prospects And DIY Portfolio (Part 2) (NYSE:KYN)

alvarez/E+ via Getty Images

In Part 1 of this series, I provided a business summary of each of Kayne Anderson Energy Infrastructure Fund, Inc.’s (NYSE:KYN) Top 10 Holdings directly from each of their own respective websites. I followed that by an analysis of 12-month performances and provided a sample reallocation, based on the product-centricity of the business, natural gas liquids v. petroleum.

In Part 2, I discuss the short- and longer-term market outlooks for natural gas liquids v, petroleum. I end with my conclusions about a DIY portfolio v. KYN.

Market Outlook Through 2023

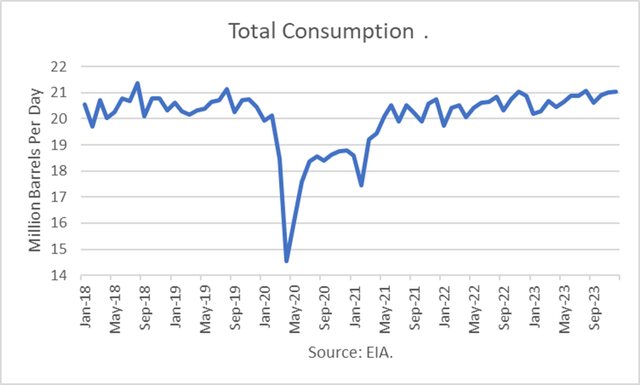

The Energy Information Administration (“EIA”) publishes its Short-Term Oil Outlook (“STEO”) monthly. For June, it projects that total product consumption in 2022 will average 20.53 million barrels per day (“mmbd”), just below 2019. And for 2023, it will rise by just 1.0%

EIA

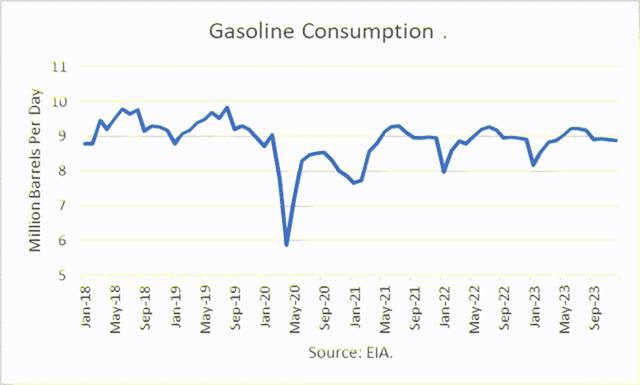

The EIA projects that gasoline consumption will rise by 1.2% in 2022 and by 0.1% in 2023. However, the 2023 consumption projection of 8.90 mmbd remains well below the pre-pandemic average in 2019 of 9.31 mmbd.

EIA

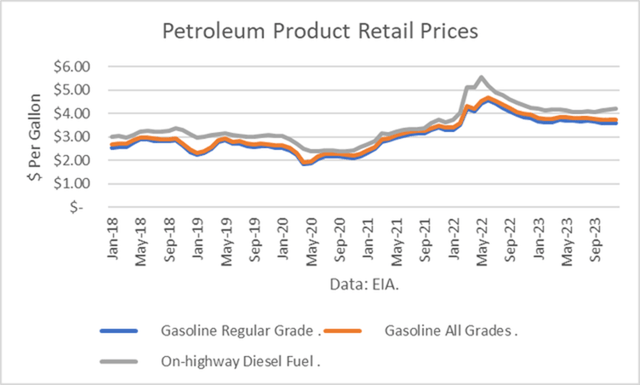

But that is based upon an assumption that retail gasoline prices will come down from current levels. If retail prices remain at today’s levels, consumption is likely to be lower.

EIA

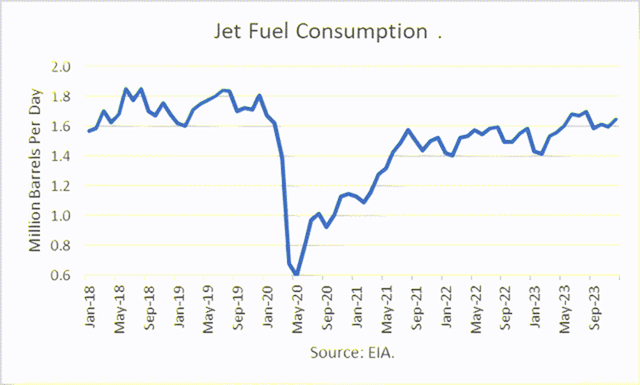

The prognosis for jet fuel is a rise of 11.5% and 4.0% in 2022 and 2023, respectively. However, the 2023 level would still be below the pre-pandemic average in 2019.

EIA

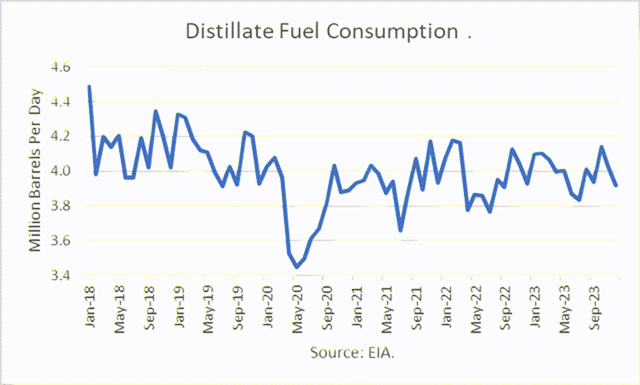

It projects distillate fuels will rise by 0.6 % and 0.8% in 2022 and 2023, respectively. But 2023 demand will also be lower than in 2019.

EIA

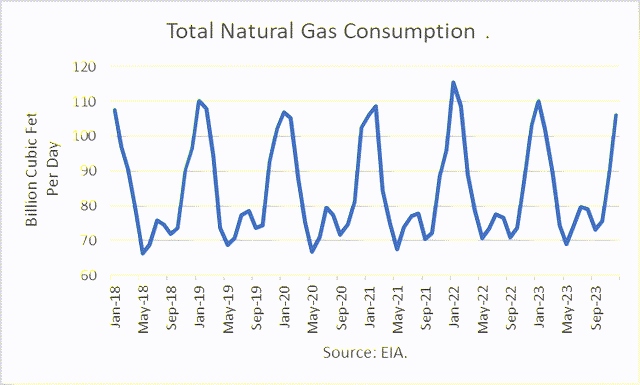

The EIA projects that natural gas consumption will rise by 2.8% in 2022 over 2021 levels. And in 2023, it will fall by 0.3%. However, the forecast is highly sensitive to heating degree days (“HDD”), and in January 2022, they were 7% above normal (i.e., colder), and the EIA uses normal HDD in its forecasts.

EIA

Market Outlook Through 2050

While the shorter-term outlook may be important to some investors who want to time their investments, the longer-term outlook is more important in valuing a company. The EIA released its Annual Energy Outlook in early March 2022 and includes projections through 2050.

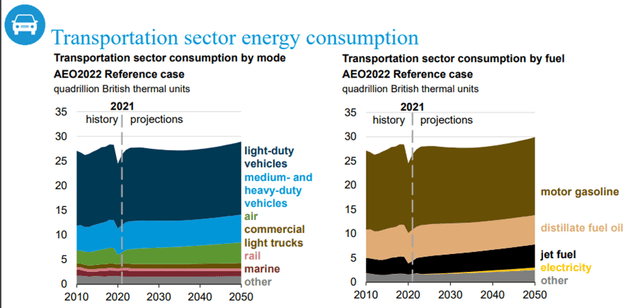

Liquid fuels that are shipped through pipelines and utilize much of the energy infrastructure are largely used for transportation fuels. And it is that sector that is likely to be most disrupted by electrification.

In a research report, WELLS, WIRES, AND WHEELS… – EROCI AND THE TOUGH ROAD AHEAD FOR OIL, Mark Lewis, the Global Head of Sustainability Research for BNP Paribas Asset Management, concluded “that oil needs a long-term breakeven price of USD 10 – 20/barrel to remain competitive in mobility.”

The economics of renewables are impossible for oil to compete with when looked at over the cycle.

Renewable electricity has a short-run marginal cost of zero, is cleaner environmentally, could readily replace up to 40% of global oil demand.

The oil industry should remember the fate of utilities.”

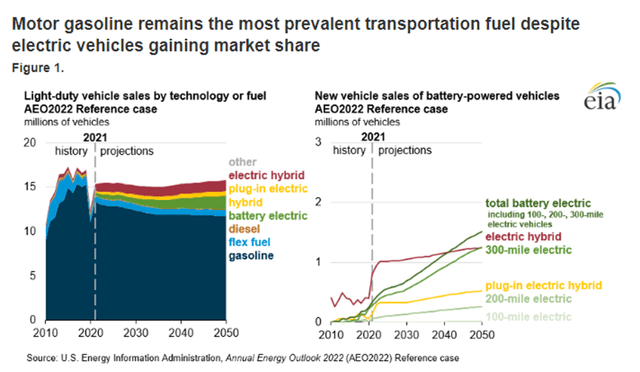

Though electric vehicles are likely to gain market share over time, the EIA concluded that gasoline is still likely to be the most prevalent transportation fuel.

EIA

However, it forecasts that U.S. gasoline consumption in light-duty vehicles (“LDV”) does not return to pre-pandemic levels through 2050.

EIA

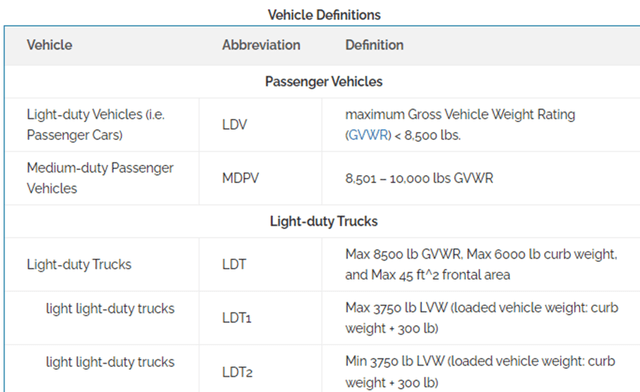

The EPA defines LDV passenger vehicles and trucks as shown below.

EPA

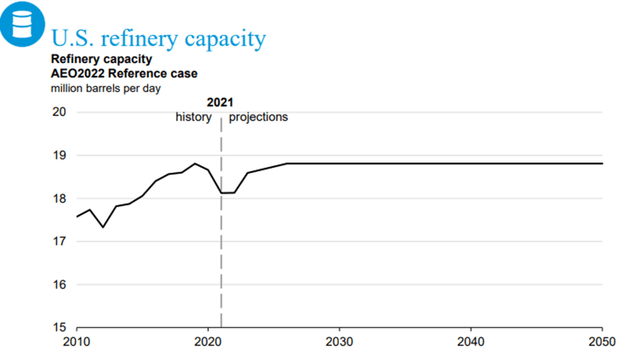

U.S. petroleum refining capacity is not expected to rise.

EIA

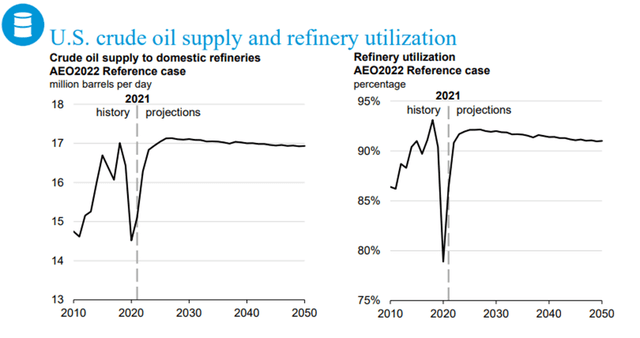

And existing refinery inputs and utilization are expected to decline.

EIA

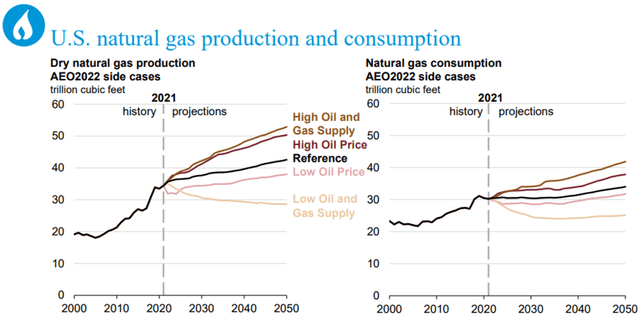

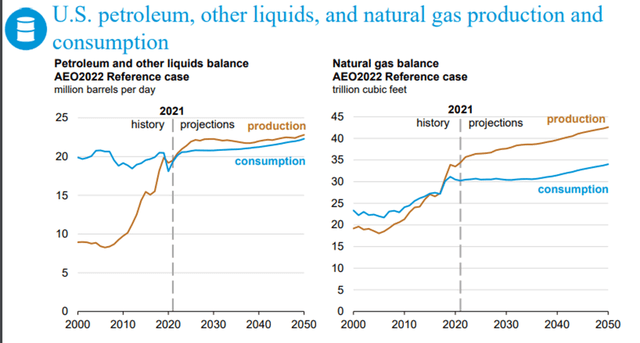

Natural gas production and consumption are forecasted to increase over time.

EIA

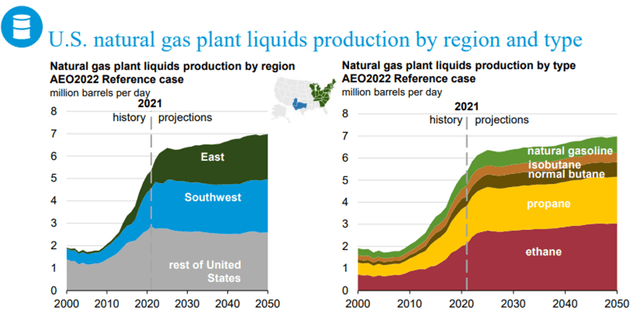

In particular, natural gas plants liquids are expected to rise.

EIA

So when natural gas is added into the equation, liquids production and consumption exhibit a continued growth pattern. However, production rises faster than consumption, implying export opportunities.

EIA

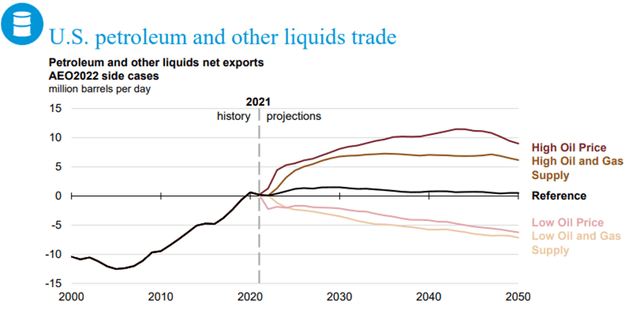

And petroleum and other liquids trade is indeed expected to grow.

EIA

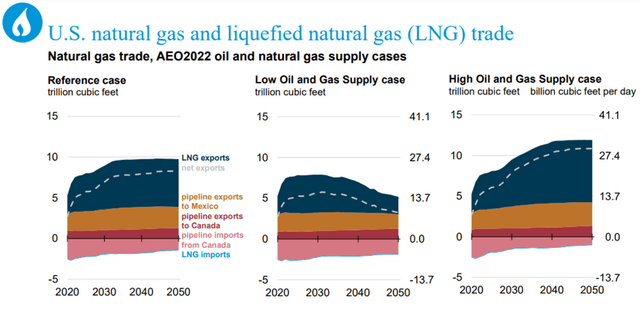

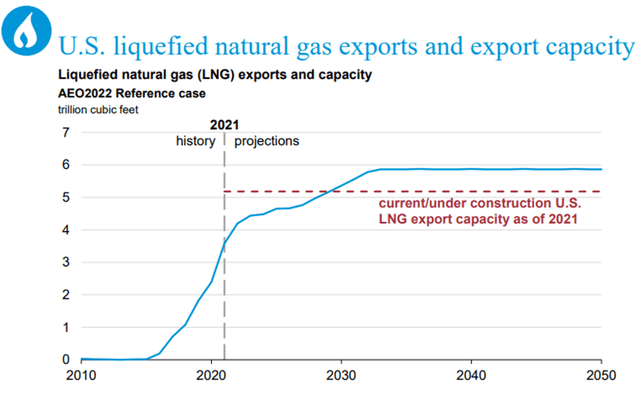

And natural gas and liquified natural gas (“LNG”) trade are expected to benefit. Given the current natural gas deficit in Europe due to the Russian invasion of Ukraine, the forecast below may be conservative.

EIA

However, LNG export capacity remains limited, and new construction will be required.

EIA

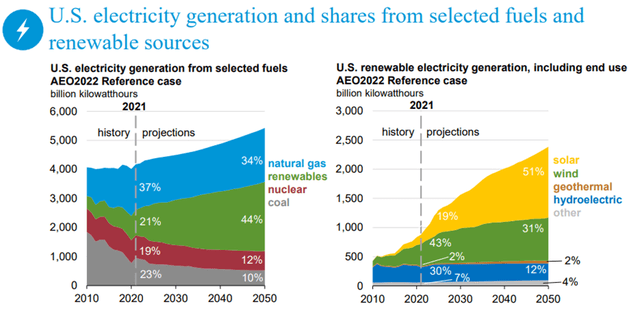

The predicted electrification of the economy, together with carbon issues, implies natural gas and renewables will rise to meet future electricity needs.

EIA

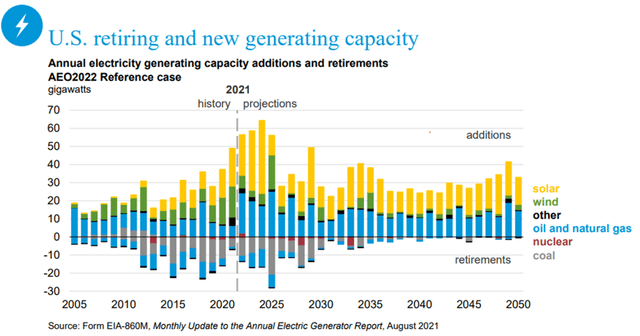

Coal and petroleum-fired units will be retired and solar is expected to be the major new source of supply.

EIA

Conclusions

The long-term total return to investors in KYN has been relatively poor, despite the dividends. And investments involving fossil fuels face a tough future, given investor sentiment and climate change imperatives.

However, energy infrastructure investments are required, and there are some bright areas, such as natural gas liquids and renewables. The international demand for LNG appears to be particularly promising, especially given that the EU wants to replace natural gas from Russia, and Cheniere Energy (LNG) is best-positioned and has been rewarded by shareholders since their inception.

KYN will likely benefit over time, depending on their portfolio allocations. However, I believe that a larger allocation in LNG and renewables is warranted, and a lower allocation in petroleum-related infrastructure companies is in order. My reallocation of the top 5, which are natural gas liquids weighted, and my calculated return over the past 12 months, supports that view.

I rate KYN as a Hold for those who own it, due to their objectives and risk tolerances. But for those who are interested in a portfolio along the lines I outlined, perhaps a DIY portfolio would be best of the 5 companies selected in Part 1. However, KYN provides simplified tax reporting with a single Form 1099 (no K-1), and that may be more or less important to investors.