Japan Tobacco: Interesting Buy, 2023 Growth Prospects A Concern (JAPAY)

lamyai

Overview

Japan Tobacco (OTCPK:JAPAY) still looks like an interesting buy at $8-10/share. Growth in global markets has offset other concerns such as poor performance in Japan, a weaker yen, and rising global inflation. I am focusing on Takeda Pharma (TAK) and the Japan Equity Fund (JEQ) for the time being but will buy Japan Tobacco on any weakness in 2023.

Global Tobacco Growth

The outlook for global tobacco consumption is a mixed bag, as growth will only be moderate at best during the next decade. Grandview Research projects around 2% growth per annum through 2030, largely driven by consumers in developing countries. 80% of current tobacco users live in low or middle-income countries. 22.3% of the global population currently uses tobacco products, and this % is typically higher in developing countries.

Thailand, Sri Lanka, and Australia are three of many interesting examples to examine. Pictorial warnings and advertising bans on cigarettes can help reduce the number of smokers, although success is mixed:

-

Thailand: Pictorial warnings on cigarettes in Thailand had a greater impact than text-only warnings. The prevalence of smokers dropped from 31.7% in 2000 to 22.1% in 2020.

-

Australia: Around 14% of Australia’s population smokes, even though stores can’t advertise cigarettes, and cigarettes are much more expensive in Australia.

-

Sri Lanka: An IMF reform in 2017 created a new VAT on many items, including cigarettes, which resulted in a boom in demand for cheaper alternatives ( beedi)

All three of these strategies ( price hikes, pictorial warnings, and banning advertising) have a somewhat significant, but limited impact on consumer habits. Moreover, a lot of these restrictions have already been implemented and most consumers are well-educated about the negative impacts of smoking. I think the bigger risk for lower demand for cigarettes is related to macroeconomic factors, not health restrictions.

Taxes can sometimes help reduce cigarette consumption. According to the WHO, a 10% increase in cigarette prices results in a 4% decline in consumption in developing countries and a 5% decline in low and middle-income countries. A recent NCBI report notes that some educational issues could potentially inflate tobacco consumption. For example, some non-smokers in China were unaware of how addicting cigarettes were, and younger people in the United States were unaware of how addicting cigarettes were. Market interventions are unlikely to destroy demand globally, and may at best deter demand in developing countries.

Market Share Changes

Japan Tobacco has been delivering substantial growth in many markets, including developing markets. This expansion has allowed Japan Tobacco to make up for weaker performance in the domestic market.

|

2020 |

2021 |

|

|

Japan |

60.4% |

59.1% |

|

Taiwan |

45.2% |

48.1% |

|

UK |

43.6% |

45.8% |

|

Russia |

39.0% |

39.8% |

|

Turkey |

28.3% |

27.7% |

|

Spain |

25.7% |

27.8% |

|

Italy |

24.5% |

26.7% |

Source: Statista

Global Markets: Markets that I didn’t previously list in my last article include Romania ( 29.8% market share) and the Philippines (36.7% market share). Japan Tobacco was able to grow its volume in more than 60 markets, including some of its top markets like Turkey, Taiwan, Spain, Italy, the Philippines, and Russia. Total volume only declined by 0.6% YoY this quarter, while revenue increased by 4.5% at constant FX. Total volume sold in Japan declined by 11% during the first nine months of this year, as Japan Tobacco has been losing market share in Japan despite its new product launch.

Japan and UK: Overall, stronger performance in other markets has offset sluggish growth in the UK and Japan, and the weaker yen has not been a huge risk because of its global operations. The company’s new PloomX product has gained a 7.9% market share in Japan, and it was launched in the UK last month.

The Outlook For 2022 Is Still Positive

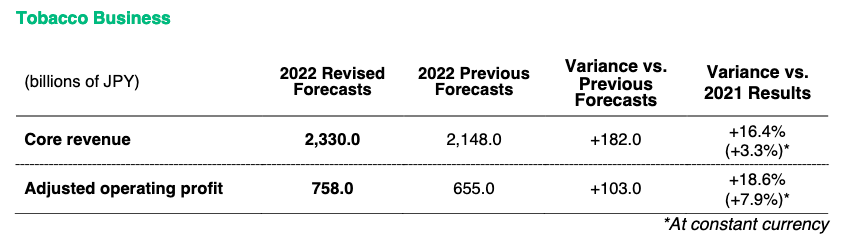

Japan Tobacco’s tobacco segment is on track to deliver respectable growth this year. There will likely be weaker growth in 2023, as consumers can either reduce smoking or more likely turn to cheaper alternatives. The illegal trade is currently valued at $40 billion, and there are also cheaper legal alternatives available like Beedi/Bidi.

Japan Tobacco

The latest projection for free cash flow is 342bn Japanese Yen ( US$2.3 billion), which is a 140bn decrease from FY21. This is equivalent to a circa 7% free cash flow yield, compared to a previous 9.8% FCF yield.

Risks In 2023

I still think Japan Tobacco is a good hold. I didn’t have the insight to accumulate during some of the lows of 2022 but may initiate a position in 2023 on the back of weaker global macro data.

Concerns over Russia and Ukraine were overstated, resulting in a strategic low in the share price. Russia currently accounts for around 11% of the company’s revenue, and performance in this market has been acceptable during 2022.

It wouldn’t surprise me if the 2023-2024 guidance calls for a modest decline in revenue as more countries begin to enter into a recession. Japan Tobacco should be able to push back with modest price increases and it may be able to gain market share. Japan Tobacco has been able to maintain its historical 9-11% market share.

I am not too concerned with its performance in Japan, nor too optimistic about its new product launches. I am much more focused on its global success in other markets, particularly in emerging markets. Any sell-off on weak Japan macro data, or weak company earnings reports in 2023, would present a good buy opportunity.

Valuation

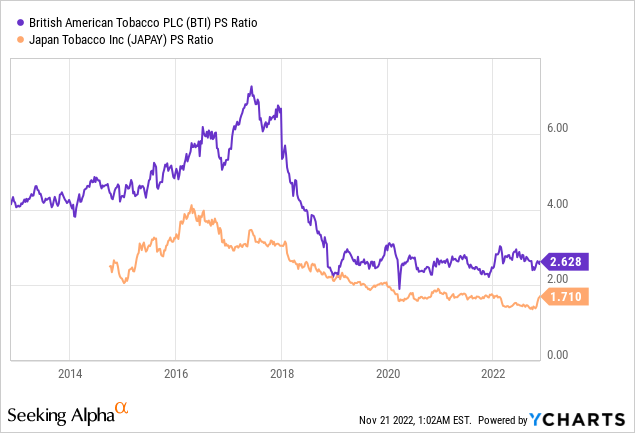

Japan Tobacco previously trades at around 4x revenue, but I doubt this will occur during 2023-2024 due to lackluster sentiment.

Anything between 1.5-1.7x sales looks ok for accumulating, and I may initiate a position during 2023. For now, I am going to either invest in a Japan-focused ETF or closed-end fund to maintain exposure and then initiate a position during 2023 if there is a pullback or weak earnings report.

YCharts

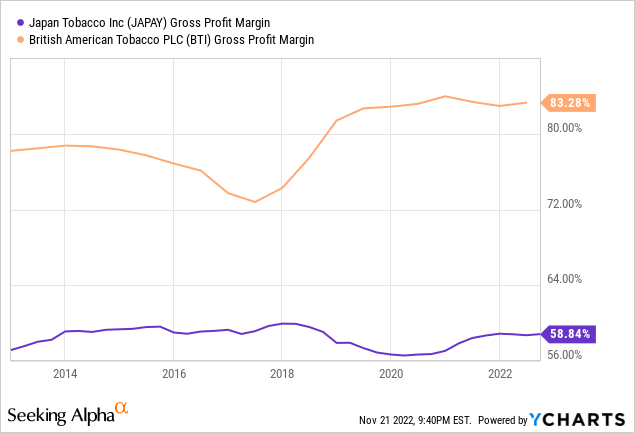

Japan Tobacco also has a considerably lower GPM relative to British American Tobacco (BTI). Its profit margin of 15.4% also lags behind the 2019 industry average of 31.4%.

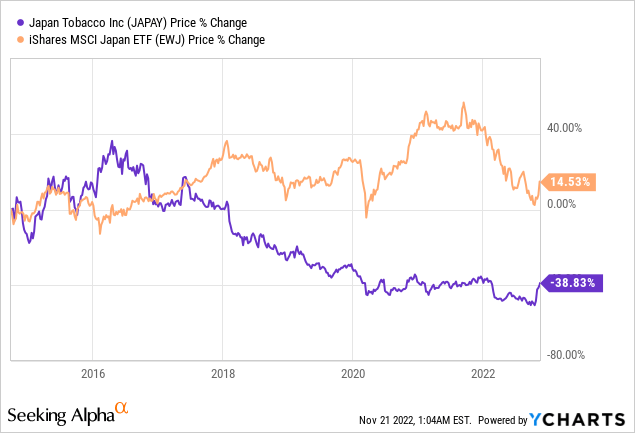

Japan Tobacco has significantly underperformed the broader market since 2016. However, accumulating at a low in 2023 could be an interesting way to potentially outperform the market this decade.