I’ve Invested Significant Capital Into These Two EU Businesses With 6%+ Yield

koto_feja

Author’s Note: This article was previously published in October of 2022 on iREIT on Alpha/Dividend Kings.

Dear readers/followers,

In this article, I revisit two businesses that I’ve written about separately before, but not really as two beyond-solid investments for the long term for your portfolio.

Choices for investing in this climate are numerous. It’s hard to know what you should be going for.

So, here are two of my current highest-conviction ideas in the European space.

The logic behind my picks

There are numerous reasons why I went and chose these specific businesses. However, they primarily relate to my demands for investing in a company. These are namely:

- The company is overall qualitative/fundamentally safe.

- The company pays a well-covered dividend.

- The company is currently cheap.

- The company has a realistic upside based on a valuation that can be forecasted/expected.

Fairly simple demands right there – but you’d be surprised how often investors ignore them, or just don’t pay enough attention to them. Me, I don’t really care for the short term. One of the companies I’m going to present to you, I’m actually down 5% even including this year’s dividends. But my cost basis and the company’s appeal are so good, that I don’t really mind.

You see, I see that we have two choices in this current environment. Everyone seems to be trying to call a bottom or ask for someone else to call it for them.

That doesn’t work.

No one can know with certainty when or how far down we need to go before things start looking up. This last week, we had a bit of a rally, only to go back down with key reports coming out. Instead of trying to call a bottom, we should decide on either wanting to “wait”, or simply investing in cheap companies continuously.

I obviously opt for the latter, because I don’t believe in market timing, and it’s been fairly consistently proven that time in the market beats market timing in the long term. Given that I’m 36 years old, I have plenty of time in the market and I don’t see any real profitable avenue by trying to time the market.

Aside from this, I also look at asset classes and sectors that do well in the environment we’re currently in, historically.

One of my businesses is a commodities company, picked here. I also invest heavily in other commodity-based businesses, primarily in chemicals/petrochemicals, other fertilizer businesses, plastics, cardboard/paper, and similar segments. All of these are pretty volatile and under pressure, but they do have the common denominator that they generally do well in inflationary environments. Why?

Because the companies simply raise prices alongside inflation. Just as many of the companies – BASF (OTCQX:BASFY), Heidelberg (OTCPK:HDELY), UPM (OTCPK:UPMKF), and others have been doing. Their profits are fine. Their share prices are under pressure – but profits? Nah – those are doing well.

Real estate has traditionally been a very solid pick during inflation, and REITs as well, but I have been focusing only on A-graded alternatives here given that there is a current supply/demand and sector imbalance that is spooking some of the typical ebbs and flows here. In short, yes to Real estate/REITs, but be careful what you pick.

Finance companies also tend to do well in rising interest rate environments, given that it flows pretty much straight to their bottom line. We see this in expected profit increases for banks, translating into increasing payouts and dividends – and this is the reason for my first pick.

Without further ado, let me showcase my picks for you.

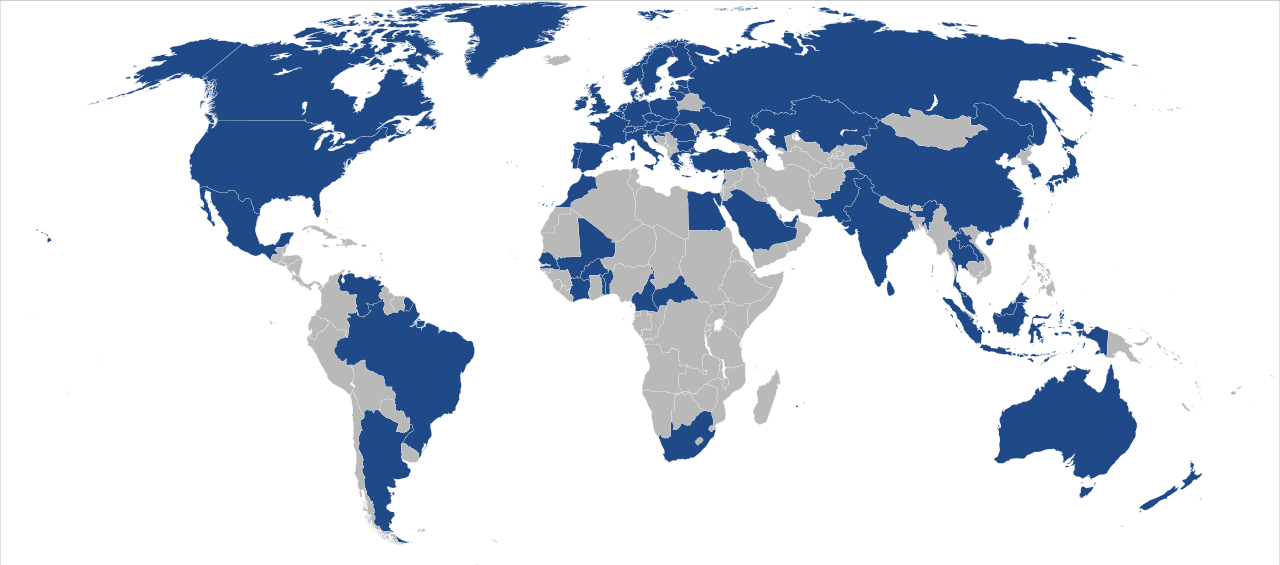

No company can boast of being the world’s largest insurance business except this one. While its AUM and market cap has shifted in this environment, the company has annual sales revenues topping €140B, from which it earns an EBIT of over €10B and manages assets of over €2 trillion. Operations are global – and by global, I do mean global.

Allianz IR (Allianz IR)

Services include various types of insurance – a sector I’m very positive about. Specifically, ALIZY does P&C, Life/Health, and Asset management through a variety of ways.

Allianz has so many “#1” that it takes a while to list them all. The company is the biggest in P&C, Assistance services, global footprint, sustainability, payout, Life/Health, and Asset management. Simply put, Allianz is the largest player in everything it does.

Other operations might be classified as being somewhat “safer” or better balanced in terms of exposure, but Allianz is bigger and more diversified. Also, Allianz isn’t a typical insurance business as such, but an AM-weighted one. What this means is that Allianz has different dynamics than some of its insurance public comps, which rely on premiums while having a small wealth management arm.

Allianz instead earns most of its income from asset management, with only 30% of annual operating income coming from premiums. This is both a blessing and a curse. We know that insurance are continuous payers, but the real advantage and earnings push only comes in upward market environments.

The positive of this is that Allianz is more volatile than other players, because of its ties to AM. This means that you can pick the company up cheap if you are conscious of what you’re doing. I established my position early this year, but I did not push it to its max until a few weeks back, to a very attractive average cost basis.

And its asset management arm isn’t some unknown small shop. Allianz is the major shareholder of Pacific Investment Management Company, LLC, or PIMCO, which many of you may know. PIMCO operates as a subsidiary of Allianz following a 2000 takeover. Combining PIMCO operations and AGI operations makes Allianz one of the biggest in all of the space, with representation in most nations on earth.

In fact, it would be fair to say that Allianz insurance operations are sort of continuing “as-is” with few changes, while most of the company’s focus lies on its AUM business through PIMCO and AGI.

Dividends are very generous here. The company pays at least 50% of net, adjusted to volatility and extraordinary items. Keep in mind though, Allianz did not cut its dividend during COVID-19, when things were actually quite under pressure.

On a segment breakdown and in terms of revenues, Insurance in the form of life/non-life makes up about half of the annual revenues at €50 billion and €57 billion each, with Asset management contributing around €10 billion in revenues, but much of the pre-tax profit.

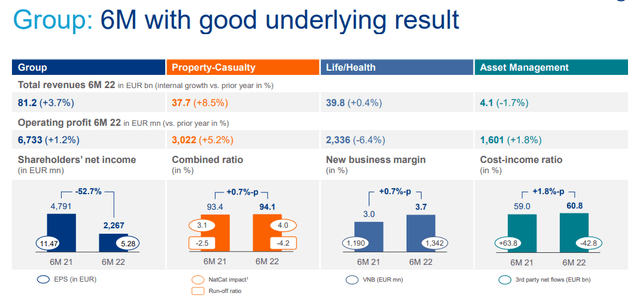

Recent results confirm much of the positive and resiliency we’re expecting from this business. For 1H22, the company increased sales by over €5B and EBIT essentially stayed flat (up €78M). The poor stock market performance impacted the company’s net earnings and EPS though, and interest rate increases as they are early on drive negative derivative results. The company also booked a structured alpha provision in 1Q22, which will color the full-year results.

However, underlying results remain solid.

The group’s EBIT is at the forecasted midpoint, and the company bought back €1B worth of shares in late 2Q22. Not a single segment is really performing poorly, even AM is at 47% of the outlook midpoint despite the market. However, given where we’ve gone since early 3Q22, I don’t expect the company to finish AM within its forecasts.

Still, solvency remains at 200%, and nothing conceivable in the current macro can really de-rail this company’s core operations. The ~€13.5B of operating profit forecast is confirmed, and with that, we can look at the company’s valuation – which can be said to be “beyond” solid here.

Allianz typically trades at a P/E of around 11-13x. The company is now down to 9.5x. This isn’t its record low for the past 20 years, but it’s low enough that the company’s native yield is now over 6.5%, and my own position YoC is close to 6.3%.

It’s very conceivable that this year’s results, on the back of the market, will be slightly negative – but a market revision will change this dynamic and turn it around, which is currently forecasted for 2023-2024.

A reversion then to the midpoint would bring about an RoR of 120%+.

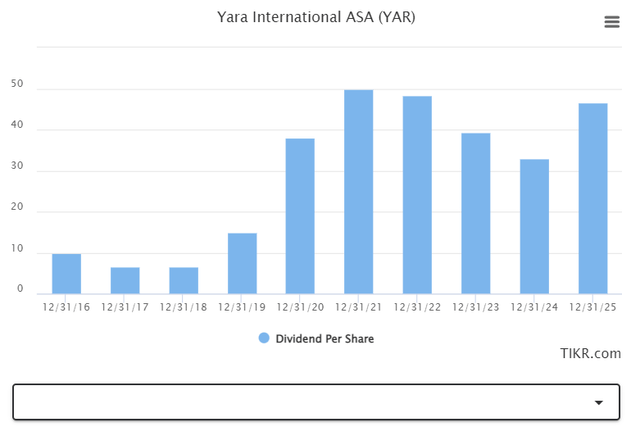

Allianz Valuation (F.A.S.T graphs)

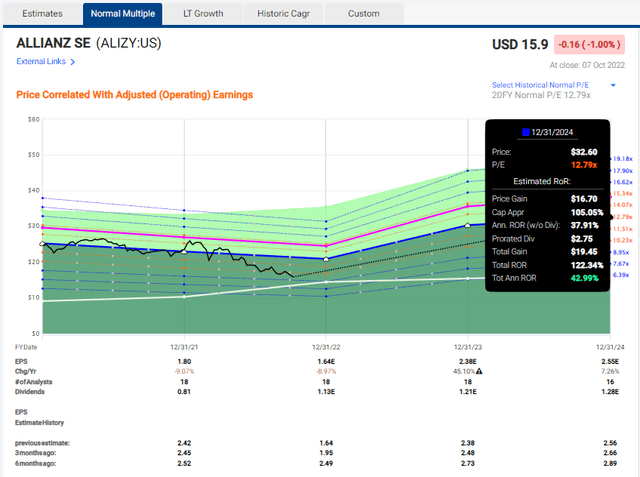

FactSet is far from the only analyst forecasting this sort of potential. GAAP EPS estimates are expected to be stable for the year, then bounce up significantly for 2023 and beyond with a potential dip in a number of years. The takeaway here, as I see it, is the following.

Allianz EPS forecasts (Tikr.com/S&P Global)

Neither company earnings nor dividends are expected to go anywhere in negative territory. No one expects the company to freeze or cut the dividend – least of all me. The company will likely continue its stair-stepping dividend, implying a YoC that’s inching closer to 7%.

And that’s from a company with an AA credit rating.

Let’s move on to number 2.

My second pick isn’t BASF or HeidelbergCement – it’s Norwegian Fertilizer giant Yara International. On the face of it, Yara International seems like the perfect company to invest in for someone a bit conscious of the cyclical nature of parts of the business, but with a long-term perspective.

For those of you who don’t know what Yara is, it’s a Chemical Company. It produces nitrogen fertilizers, ammonia, urea, and nitrogen-based chemicals. Focal areas are, naturally, crops and farming.

YARIY IR (YARIY IR)

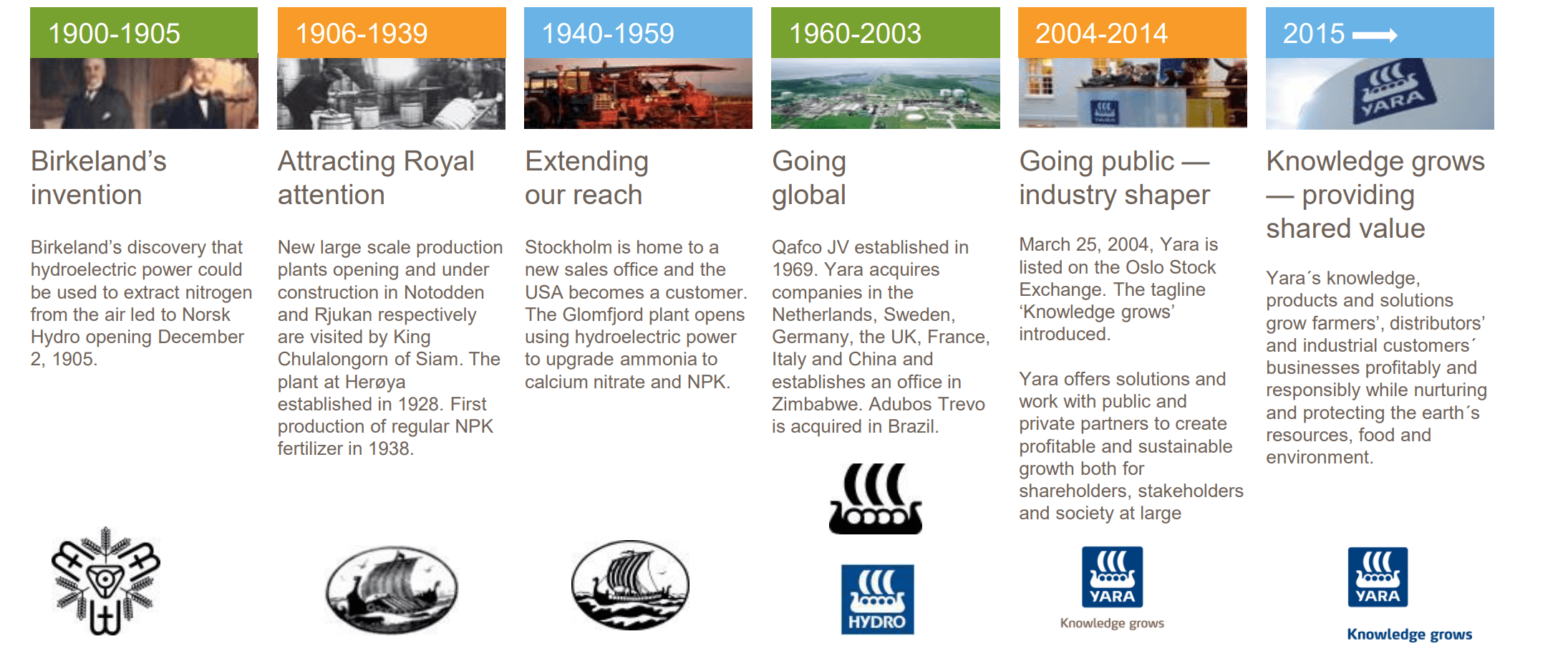

Historically speaking, the company was founded 115 years ago as Norsk Hydro (OTCQX:NHYDY). Yara was the world’s first producer of mineral nitrogen fertilizers. Back in 2004, Norsk Hydro and Yara International de-merged as part of a strategy to clarify and specialize, forming the aluminum company and the fertilizer company we now know.

The company’s sales aren’t focused on any particular geography, though the largest is the European continent and Latin/South America. These continents/areas together account for more than 60% of Yara’s sales, with Asia coming in at 13% and NA at 10.5%.

The Yara portfolio consists of a number of products, all related to fertilizing and perfecting crops.

If we look at the current macro situation, my question becomes why wouldn’t one want to invest in the company long-term at an appealing price? The ownership is solid and not a concern, for one.

Why? Because like many Norwegian companies, the state has its arms around Yara. The government owns more than 40% of the company, both directly through the public ministries, and through the pension fund as well. History has shown us that the Norwegian state has been an able shareholder and has shareowner interests at heart.

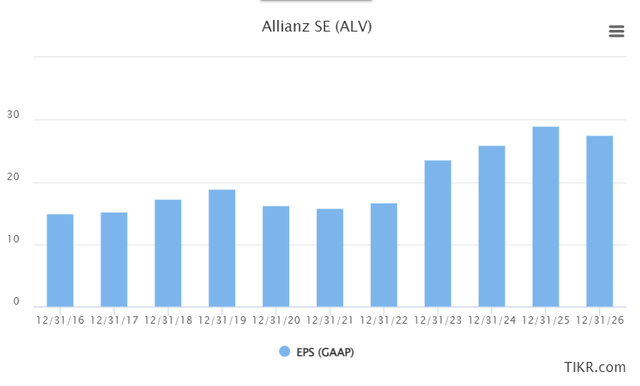

From seeing very unfavorable market dynamics for its products between the years of 2014-2018, the market shifted and we’re currently in a situation where the company is passing along any cost increase it can to customers, and can’t produce enough product to satisfy the market. This has also come in the form of multiple extraordinary dividends.

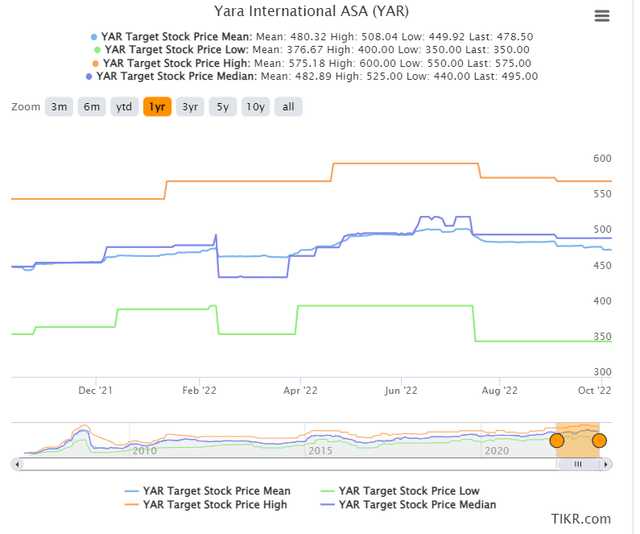

My own investment in Yara is old. I staked my position out in the 200s (native) originally, and currently own a cost basis of around 340 NOK for the company. I don’t want to buy it when it’s over 420 NOK, and I would sell at around ~500-510 NOK (I’ve partially rotated positions for profit at that valuation). All in all, price targets for the company are something I consider fairly “easy”, while acknowledging that this company can indeed be quite volatile.

However, take a look at some of these recent numbers.

YARIY IR (YARIY IR)

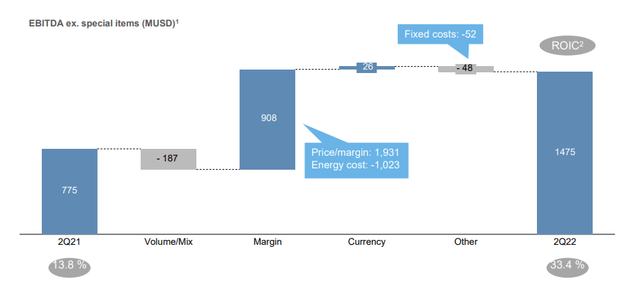

The company is, simply put, adjusting to the macro. Overseas production assets are producing great results while legacy assets are suffering from energy costs. Yara is pushing prices to premium levels to provision for risk premiums related to production cost exposures.

However, the company is very open about the fact that it intends to consider further extraordinary dividends as a result of this situation. The specific wording is that “Yara paid dividends of $796M in 2Q22 and the board will consider further cash returns in connection with 3Qresults”.

This, to me, is basically saying that “prepare for further dividends”. While this alone is not an investment argument, it becomes one at the right price given Yaras historical extraordinary dividends which at times have caused my YoC on an annual basis for the company to rise above 18%.

The foundation to the business and the underlying demand levers here are timeless. We’re talking about food.

And people need food.

If you thought 2021 was a good year for Yara, you will note that the quarterly results are currently doubling the company’s YoY results, hence the potential additional dividends. While the company is pushing CapEx and investments to make sure capacity stays on track, it’s also managing a precarious demand situation, where certain price levels mean that farmers can no longer afford fertilizers.

However, in the end, the company’s margin actions are protecting against energy costs and delivery decreases.

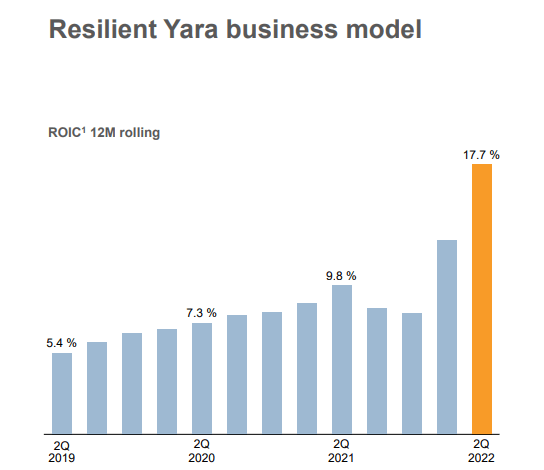

Return numbers for the company are absolutely solid despite many of the ongoing headwinds here. The current mix has Yara seeing extremely solid returns thanks in no small part to its international footprint, and the expectation for 2022 is for this to continue.

The way analysts view this company is typically giving the company a target ranging from the mid 400s to the low 500s.

Neither the high nor the lows are what you should go for here – but a good rule is that any time that price dips below 370, that should be something you might want to be looking at.

The current average target comes to around 478 NOK for the common, and the recent price close was 412, rising up massively in a single day. I bought my last share of my position at around 388 NOK.

Dividends are very volatile here, but the common denominator is expecting them to grow as we move forward, or at least stay relatively stable (note that these charts include extraordinary dividends, not just the “base” 30 NOK dividend, which currently implies a 7.2% yield.

In only a few days, we’ll see if the company decides to bump that dividend for this year with another extraordinary one. It’s entirely possible.

Investing in Yara is a play on commodities – specifically fertilizer – and I consider it one of the things you want to be investing in this climate.

Wrapping up

My core portfolio currently holds 44 stocks that are at a position/stake of 0.5% or above – and these are the “main” stocks I’m looking at to either invest in or expand where possible.

The two companies here are some of my current “highest”-conviction BUYS that I consider relevant for myself. Other companies I look at and invest in are Castellum (OTCPK:CWQXF) as well as Investor AB (OTCPK:IVSXF). Munich RE (OTCPK:MURGY) is also a good choice, but one that’s been keeping fairly strong in the recent decline, meaning ALIZY is “cheaper”. I also look at Vonovia (OTCPK:VONOY) as well as some steel and iron businesses as well as chemicals.

In essence, you can see my current approach as:

- Commodities

- Real Estate

- Finance

- (Telcos)

- (Utilities)

But within those segments, I only pick the best of the best and cheapest. The two last are in parentheses because I’m fully invested in everything I want to be there, and with utilities, there are some risks that I would consider general and need to be established before investing in any of them. That said, Enel (OTCPK:ENLAY) is a big holding of mine as well.

Questions?

Let me know!