Islamic Benchmarks Continued To Fall In Q3, In Line With Conventional Indices

Phiromya Intawongpan/E+ via Getty Images

By Eduardo Olazabal

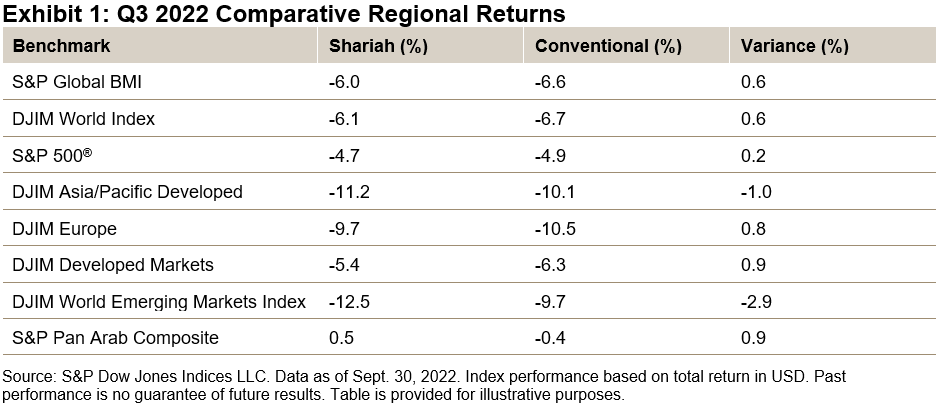

Global equities dropped 6.6% in Q3 2022, as measured by the S&P Global BMI, accumulating a loss of 25.6% YTD. Meanwhile, Shariah compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market World Index (DJIM), managed to outperform their conventional counterparts by 0.6%.

Overall, regional broad-based Shariah and conventional equity benchmark accumulated further losses this quarter, as interest rates continued to rise, leading to the strengthening of the U.S. dollar and further impacts on non-U.S. equities. The Pan Arab region remained unaffected, as the Shariah benchmark finished the quarter with marginal gains.

Drivers of Shariah Index Performance in Q3 2022

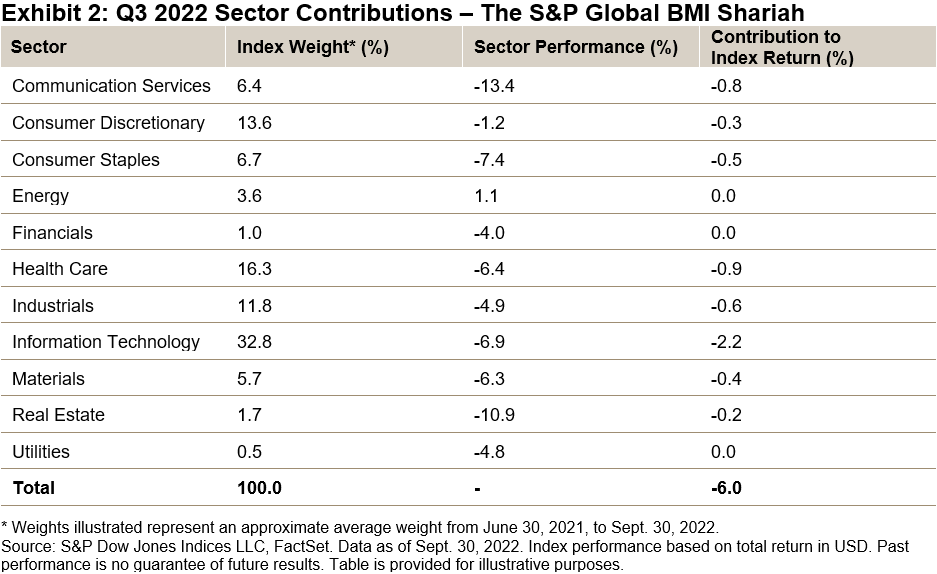

While this year’s broad negative trend continued through Q3, sector compositions can provide some explanation for this quarter’s results. Higher exposure to growth-oriented Information Technology stocks within Islamic indices contributed most to the negative performance, as growth-oriented IT shares sank 6.9% in Q3.

Health Care and Communication Services also had a significant negative impact on the S&P Global BMI Shariah, dropping 6.4% and 13.4% during the quarter, respectively.

Energy continued to be an outlier sector, as it was the sole sector to manage gains during the period. However, due to its low weight of 3.6% in Islamic indices, the impact was minimal.

Mixed Results in MENA Equities

MENA regional equities experienced mixed results in Q3. The regional S&P Pan Arab Composite increased marginally by 0.5% in Q3, accumulating a minor loss of 0.5% YTD. GCC country performance was generally positive, with significant gains in Oman (up 9.3%) and Bahrain (up 6.8%) and major losses in Kuwait (down 6.7%). The case of Oman is notable, as it is one of the world’s best-performing country indices, with a YTD gain of 21.3%.

For more information on how Shariah-compliant benchmarks performed in Q3 2022, read our latest Shariah Scorecard.

This article was first published in IFN Volume 19 Issue 41 dated Oct. 12, 2022.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.