Is Oracle Stock A Buy After Earnings? 1.8% Dividend Yield, 13x Earnings (NYSE:ORCL)

Justin Sullivan/Getty Images News

Oracle (NYSE:ORCL) is one of those tech stocks that does not trade similarly to other tech stocks, probably because it is very different from the typical tech stock. Investors might think that all tech stocks are new and in hyper-growth mode, but they might forget that they eventually mature into cash-generating companies. ORCL has seen its growth slow down considerably, but it has tried to offset that slowing growth with generous dividends, share repurchases, as well as leveraging the balance sheet with M&A. ORCL is trading quite cheaply on the basis of earnings, which should allow for future upside in spite of the limited potential growth.

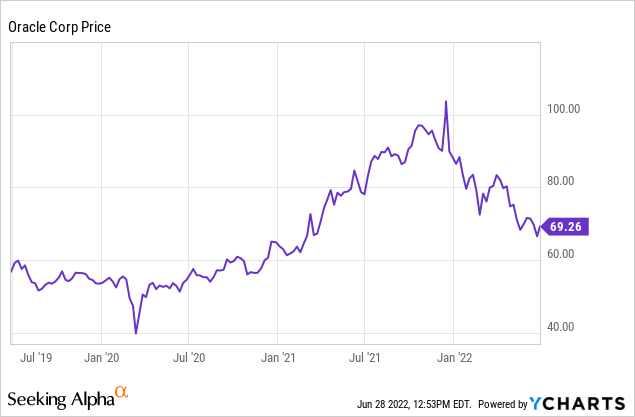

ORCL Stock Price

ORCL peaked around $106 per share and now trades at around $70 per share.

What Were Oracle’s Expected Earnings?

Wall Street consensus estimates called for ORCL to see mild revenue growth and a double-digit decline in non-GAAP EPS.

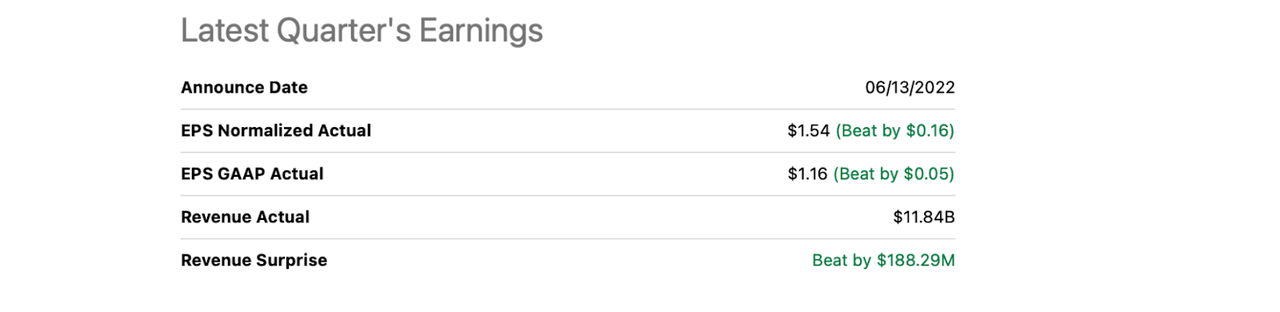

Did Oracle Beat Earnings?

ORCL delivered slightly less mild revenue growth while significantly beating on non-GAAP EPS of $1.54 per share, which was stable year over year. These were solid results considering that the company suffered from currency headwinds in the quarter.

Seeking Alpha

For a mature tech company like ORCL, these kinds of results are considered quite strong as few are expecting the same sizable beats seen at hyper-growth peers.

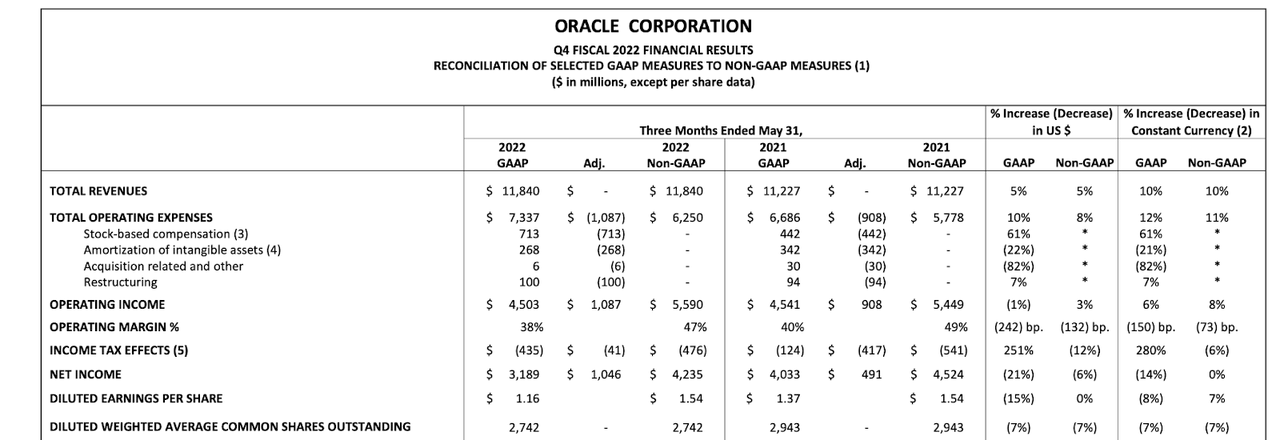

ORCL Stock Key Metrics

On the surface, ORCL looks like a fast-growing cloud company. Its cloud revenue grew 22% in constant currency. This included 39% growth in infrastructure cloud revenue, 23% growth in Fusion ERP cloud revenue, and 30% growth in NetSuite ERP cloud revenue (all constant currency).

Yet overall revenues grew by only 10% on a constant currency basis, largely due to the company having a much larger legacy revenue base which is growing far slower. For this reason, I do not support using a “sum of the parts” valuation methodology here because some of the growth in cloud may be due to cannibalizing non-cloud revenues.

2022 Q4 Press Release

ORCL ended the quarter with $54 billion of net debt, up from $37.7 billion year over year. Leverage ticked up due to both an aggressive share repurchase program as well as funding raised for its recently closed acquisition of Cerner. That represents a debt to EBITDA ratio of around 3.2x (based on my calculation of $16.7 billion in full year EBITDA).

What To Expect After Earnings

Looking forward, management has guided for more than 30% constant currency growth for its cloud business.

ORCL expects currency to have as much as a 4% negative impact on total revenue in the next quarter. Management expects total revenues to grow by 22% in constant currency for the next quarter, which includes contribution from Cerner. Cerner earned $5.8 billion in revenues last year versus $42.4 billion for ORCL, implying that ex-Cerner, ORCL might grow at an 8% to 9% clip (this was an all-cash transaction). Management expects non-GAAP EPS to grow up to 5% to $1.08 next year, reflecting a 5% impact from currency headwinds.

On the conference call, management gave greater clarity regarding its share repurchase plans:

As we’ve said before, we’re committed to returning value to our shareholders through technical innovation, strategic acquisitions, stock repurchases, prudent use of debt and a dividend. This quarter, we repurchased 8 million shares for a total of $600 million. In addition, we paid out dividends of $3.5 billion over the last 12 months, and the Board of Directors declared a quarterly dividend of $0.32 per share.

With the completion of the Cerner acquisition, which happened after the end of Q4, actually, this last week, we’ve added about $15.8 billion of debt. And we anticipate retaining our investment-grade credit rating, meaning that for the time being, we’re going to focus on reducing our debt balance while continuing our share repurchases at current levels. In addition, I don’t believe the dividend will be impacted at all. Once the debt level has declined, we’ll reexamine share repurchase levels.

Cerner carried around $800 million of net debt and generated $1.6 billion of EBITDA in 2021. I estimate pro forma debt to EBITDA to stand at just under 3x before incorporating any growth this year. That is a higher leverage ratio than typically seen in the tech sector (many high-growth tech companies have deep net cash positions), but is arguably reasonable considering that ORCL is generating consistent profits. ORCL previously had a debt to EBITDA ratio of just under 2x – the company might need several quarters before it can bring leverage ratios down to prior levels and therefore boost its share repurchase program.

Is ORCL A Good Investment Long Term?

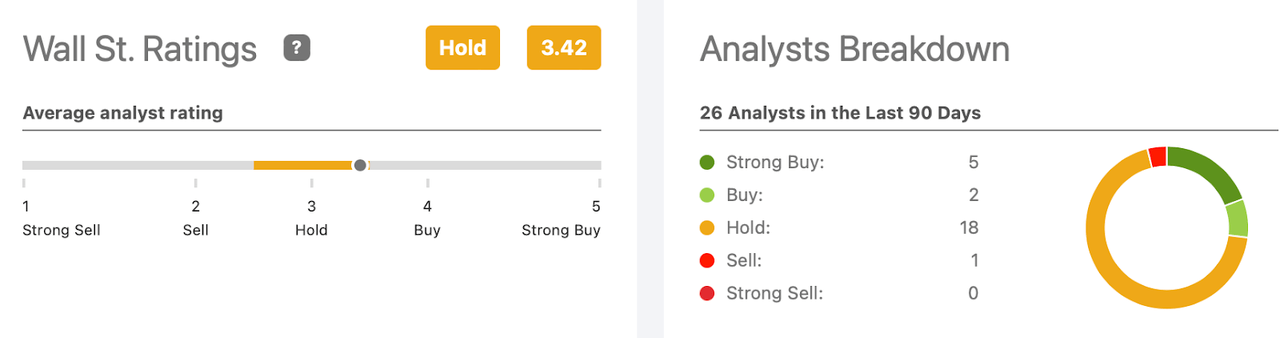

Wall Street analysts are split on the company, with an average rating of 3.42 out of 5.

Seeking Alpha

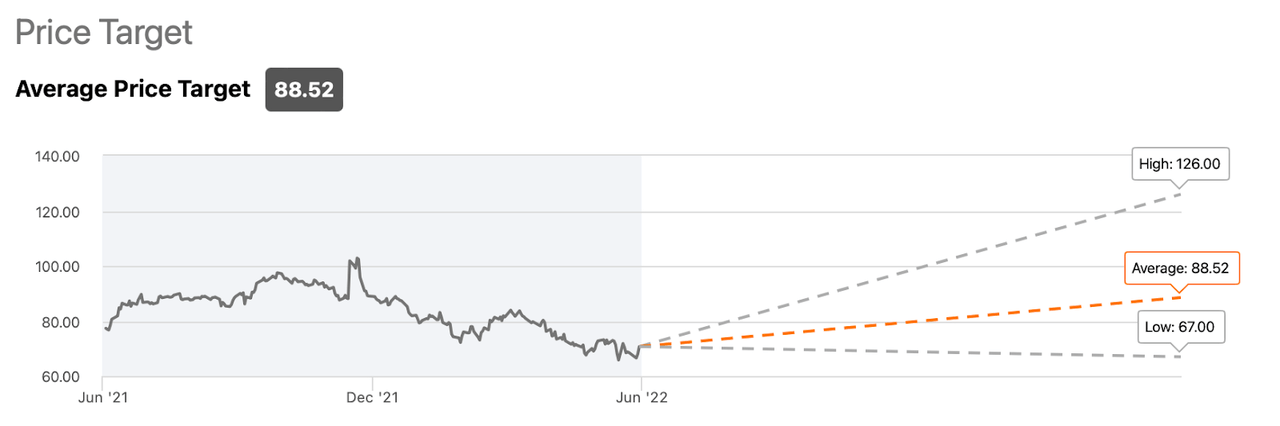

The average price target of $88.52 per share reflects around 26% of potential upside.

Seeking Alpha

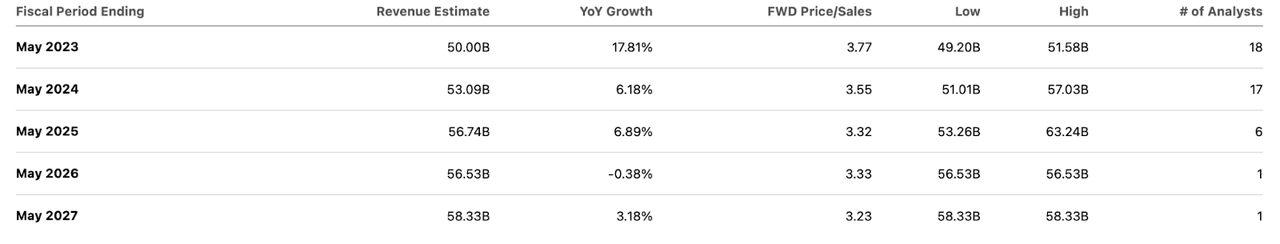

The company is expected to generate strong growth this year – largely due to its Cerner acquisition – before returning to its single-digit growth rates thereafter.

Seeking Alpha

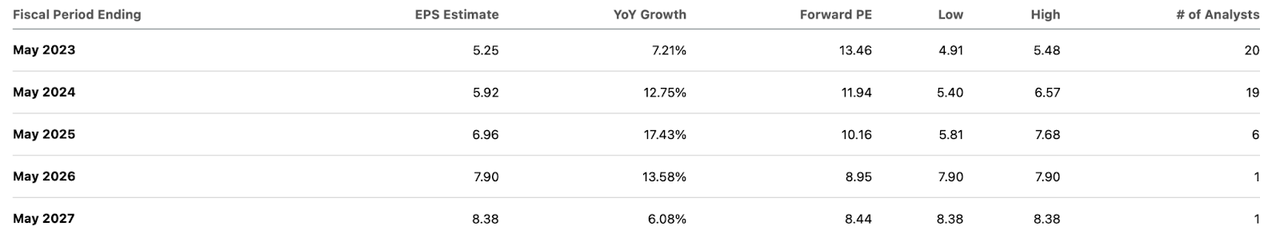

Earnings per share is expected to grow faster, reflecting both operating leverage and share repurchases.

Seeking Alpha

Is ORCL Stock A Buy, Sell, Or Hold?

ORCL is not the most exciting stock in the tech sector and certainly does not have the most exciting upside either. Yet, at 13x forward earnings, this is a company which can provide some tech-like growth coupled with robust earnings. The stock trades at an attractive 1.8% dividend yield, and the company will buy back around 1.3% of shares outstanding annually (until it reduces leverage). ORCL is unlikely to provide juicy return potential, but it can generate market-beating returns even with down-to-earth expectations. I could see ORCL sustaining a 15x earnings multiple over the long term, especially once it reduces debt and returns to directing all of free cash flow towards share repurchases. That suggests a share price of $124 per share by 2027, representing around 14% annual returns including dividends. Due to the high leverage, persistent growth is a must to support the stock price. 13x earnings is not a demanding valuation, but if ORCL begins to see secular declines, then the stock could see its multiple compress quite rapidly. The underlying cloud businesses are growing quite strongly and the company has sizable cash flows to directly reduce debt. The rising interest rate environment may lead to increased interest expense, but the leverage remains quite manageable. I rate the stock a buy due to the visible catalysts of debt paydown and aggressive share repurchases.