IFRA ETF: Infrastructure Investors Might Be Getting Lazy

AscentXmedia

The iShares U.S. Infrastructure ETF (BATS:IFRA) is a pretty broad ETF with some super core, core and core plus investments in mostly utilities, but also in infrastructural heavy industry and renewables. The exposures are pretty good, and the ETF has been resilient even with some materials exposures. Our bigger concern is that private market multiples, especially infra multiples are getting out of hand. It’s just not very compelling – we’d be more inclined to speculate on risk assets now since we may be nearing a close on cost-push inflation.

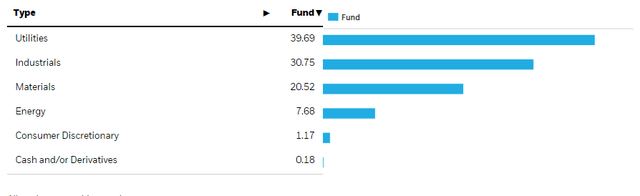

Breakdown of IFRA

Allocations have changed slightly since we last covered the ETF. Utilities exposures have declined a couple of points and materials exposures have grown a couple of points. Besides that, the exposures remain pretty similar. There are a lot of regulated utilities, which would be considered super core investments. They are remunerated on a pretty fixed scheme, in some cases the income is exactly fixed, and they usually have either built in flexion to higher inflation and interest rates, or at least benefit from periodic reviews to the remuneration schemes so that they can be updated to provide a fairer return given the evolving rate environment.

Otherwise there’s a lot of unregulated midstream pipeline players that don’t have direct commodity exposure. Kinder Morgan (KMI) is a pretty representative example of what a lot of the utilities exposures are. These simply depend on NGL, gas and oil flows continuing, which they surely will for a long time to come.

Relative to a European utility ETF, IFRA is going to have a lot less renewable exposure within the renewable bucket. The real push by utilities to invest in renewable resources came later in the US than Europe, so we point out that there is some backwardness in this ETF with respect to where renewable trends are going.

The materials exposures are the most cyclical within the ETF. A few points go into steelmakers or other metal processors, and that capacity has become less valuable as major construction markets are seeing a slowdown. Moreover, these processes are seeing margin erosion from energy price inflation in particular, where steel production and aluminium production are very energy intensive.

The industrial bucket is similarly mixed with heavy industry and equipment manufacturers, but there are also some nice exposures like the railways, which are extremely resilient and account for about 3% of the overall portfolio. These should be public utilities but they’re not, and railway companies in the US get away with minimal CAPEXing and all sorts of behaviour that keeps their ageing locomotives valuable. They are under a little pressure from labor unions that are looking to strike, but overall they are getting everything out of their railways, where they actually own the land the railways are on, and the economic quality of these businesses remains high.

Remarks

While a lot of the companies are infrastructural, some are more akin to heavy industry on industry cyclical companies. The material exposures, while of course heavily endowed with hard production assets, are also rather cyclical, with steel seeming like a difficult area given regional demand conditions declining for heavy construction but also Chinese demand shortfalls putting pressure on steel prices.

The biggest problem of all for the IFRA ETF is the valuation. The PE is 12x, and that is being weighed down by the pretty substantial cyclical exposures that dominate the materials allocation and have a big pull on the industrial allocations. The exposures at risk from a harsher recession are about 30-40% of the overall portfolio. These companies may have fairer valuations actually as markets eschew cyclical stocks. But in the core infrastructure exposures things get more expensive because private markets for infrastructure is getting more wild. Structurally, it is a risk-off asset that is winning share of dry powder. At the same time, lots of infra could get disrupted at some point in the next 10 years. Gas pipelines may need to be repurposed for hydrogen, and there’ll be less demand regardless, and power grids, which have a big representation in this ETF require quite a lot of CAPEX. Oil pipelines in theory also have the peak oil risk, and while energy is the name of the game right now, oil companies have no incentive to expand capacity substantially because there’s no guarantee those assets won’t become stranded.

Returns on infrastructure are generally expected to fall, likely before any disruption to infrastructure assets is accounted for, and this is just because there’s so much money sloshing around in low-risk private assets. Unfortunately those multiples inform some of the publicly traded comps, so the yields on IFRA are too low and the PE too high despite the averaging down from cyclical companies.