HYLS: Strong High Yield Corporate Bond ETF, 6.3% Yield (NASDAQ:HYLS)

cagkansayin

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 26th.

Inflation has raged all year, reaching 8.2% this past September. The Federal Reserve has reacted by aggressively hiking rates. For investors, the short-term impact has been broadly negative, with asset prices down across the board. Lower asset prices and higher interest rates do present something of a buying opportunity for bond investors, as these can lock in stronger, higher, and growing dividends by investing in bonds and bond funds today.

The First Trust Tactical High Yield ETF (NASDAQ:HYLS) is an actively-managed corporate bond ETF, has outperformed its benchmark since inception, offers investors a 6.3% yield, and is a buy.

HYLS – Quick Overview

HYLS is an actively-managed ETF investing in U.S. high yield corporate bonds. These bonds are issued by relatively risky companies, with weak credit ratings, financials, and balance sheets. Risks are higher than average, but so are returns.

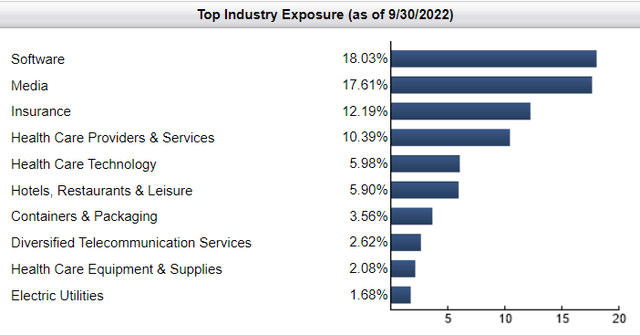

HYLS is a reasonably well-diversified fund, but somewhat less than average. The fund invests in 292 bonds from all relevant industry segments. Concentration is a bit higher than average, with the fund’s top ten holdings accounting for 23% of its value.

In general terms, the fund’s portfolio, fundamentals, and characteristics do not significantly differ from those of its benchmark, the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), or from those of its peers. The fund does provide a few small advantages and disadvantages relative to its benchmark and peers. Looking at these might prove instructive, so let’s do just that.

HYLS – Disadvantages Relative to Peers

Risky, Low-Quality Holdings

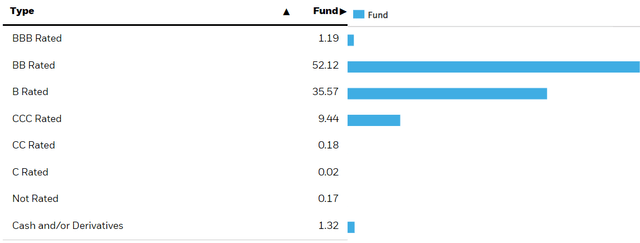

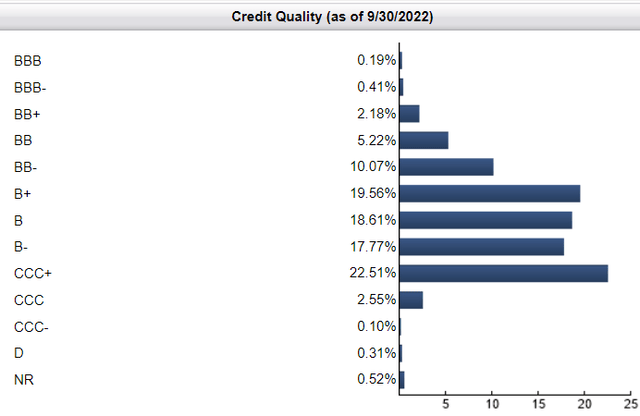

High yield corporate bond funds tend to be riskier than average, as these funds invest in securities issued by relatively risky companies, with non-investment grade credit ratings, and weak financials and balance sheets.

Most of these funds limit risk by focusing on companies with BB credit ratings, the highest non-investment grade rating available. As an example, HYG invests slightly over half of its portfolio in BB-rated securities.

HYLS, on the other hand, focuses on B-rated securities, with these accounting for slightly over 55% of the fund’s portfolio.

HYLS’s holdings are riskier than average, which increases risk, volatility, and potential losses during downturns, relative to peers.

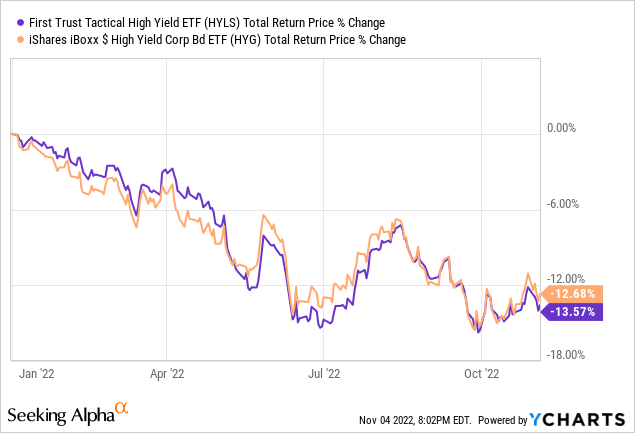

On a more positive note, these risks have mostly not materialized in the past, with the fund generally performing in line, very slightly underperforming, with its benchmark during prior downturns. This has been the case YTD.

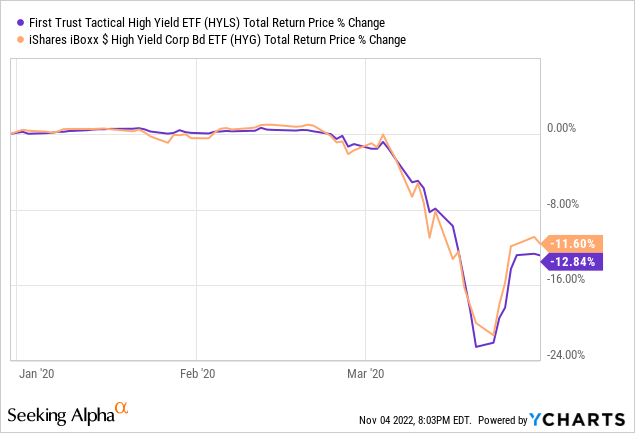

It was also the case during 1Q2020, the onset of the coronavirus pandemic.

From what I’ve seen, HYLS’s performance has exceeded expectations due to savvy investment decisions from fund management. Securities with weaker credit ratings are generally riskier, but a strong management team might be able to focus on securities and companies whose fundamentals are stronger than implied by their credit ratings, or in industries which end up performing better than average.

Notwithstanding the above, HYLS’s holdings remain riskier than average and then those of its peers, a negative for the fund and its shareholders.

Leverage / Short-Treasury Position

HYLS sometimes uses leverage, generally through shorting short-term treasuries, and using the proceeds to invest in riskier, longer-term securities. Leverage increases risk, volatility, and potential losses during downturns, all negatives for the fund and its shareholders. HYLS’s specific strategy also exposes the fund and its shareholders to the possibility of moderate losses if treasuries were to post strong gains.

HYLS has significantly reduced leverage ratios these past few months, with the fund sporting a 1.03x leverage ratio.

HYLS

Current leverage ratios are low enough that the fund’s use of leverage is more or less inconsequential for investors right now, but that might not necessarily be the case moving forward.

Expenses

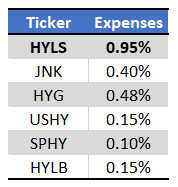

HYLS is a relatively expensive fund, with a 0.95% expense ratio. Expenses are higher than average for an ETF, for a bond fund, and higher than those of its peers.

Fund Filings – Chart by author

Expenses directly reduce a fund’s dividends and returns, a significant negative for investors. On a more positive note, the best actively-managed funds might provide sufficient advantages and benefits to make up for high fees. In my opinion, this is the case for HYLS, as the fund does offer many important advantages relative to its peers. Let’s have a look.

HYLS – Advantages Relative to Peers

Stronger Yield

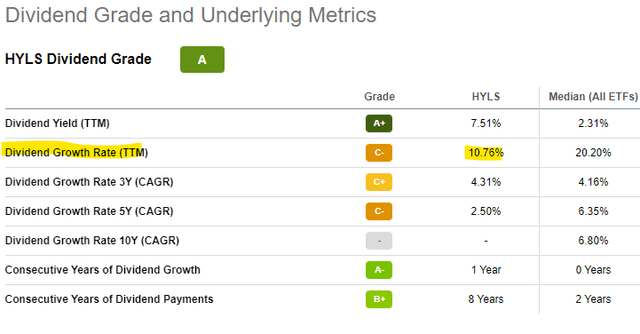

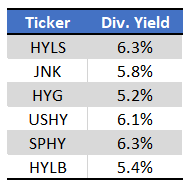

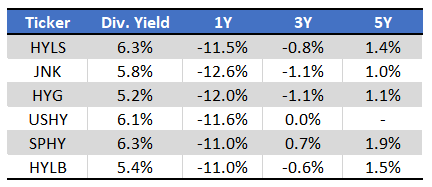

HYLS focuses on comparatively risky high yield corporate bonds, with weaker credit ratings than average for a fund of its type. HYLS’s holdings are riskier than average, but also sport higher interest rates, allowing the fund to generate more in income than its peers. Said income is ultimately returned to investors as dividends, with HYLS sporting a 6.3% dividend yield. It is a reasonably strong yield, higher than benchmark yields, and higher than those of its peers.

SeekingAlpha – Chart by Author

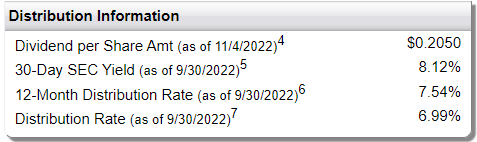

HYLS’s yield is more than covered by underlying generation of income, as evidenced by the fund’s 8.12% SEC yield. SEC yields are a standardized measure of a fund’s actual short-term generation of income, specifically excluding capital gains, return of capital distributions, and the like.

HYLS

HYLS’s dividends should see some growth in the coming months, the product of Federal Reserve interest rate hikes, and as the fund is currently generating more in income than it distributes to shareholders. HYLS’s dividends have grown 10.8% these past twelve months, but further growth is likely, at least under current conditions.

HYLS’s above-average, growing 6.3% yield is an important benefit for the fund, and advantage relative to its peers.

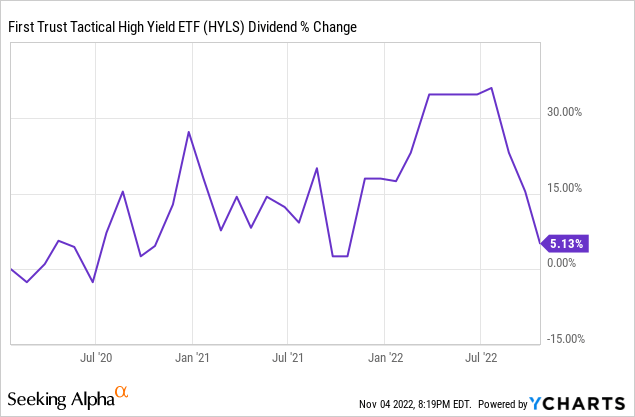

On a more negative note, HYLS’s dividends are quite volatile, much more so than average. Double-digit monthly movements are common, as evidenced by the graph below.

In my opinion, HYLS’s higher yield and dividend growth more than outweigh dividend volatility, but other investors might disagree.

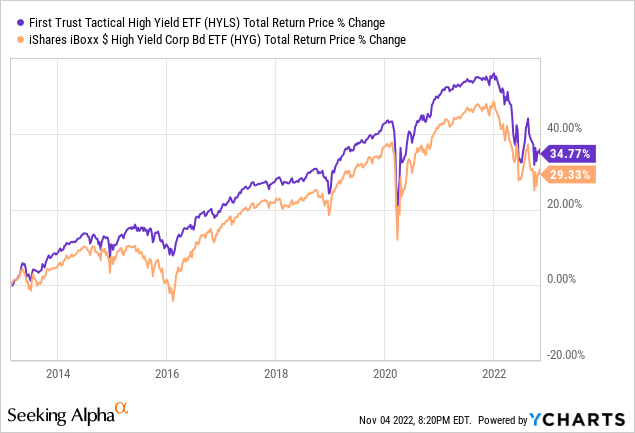

Above-Average Performance

High yield corporate bond funds are income vehicles: returns mostly consist of dividends. Long-term potential capital gains and losses are both quite low, barring a significant increase in default rates, or an incredibly successful / unsuccessful trading strategy. As such, the fund should outperform relative to its benchmark, as has been the case since inception.

On a more negative note, the fund’s outperformance mostly occurred in prior years, before 2016. Performance has remained reasonably good since, but nothing outstanding. At the same time, even though HYLS has outperformed relative to its benchmark, performance relative to its peers is mixed, with the fund slightly underperforming relative to the SPDR Portfolio High Yield Bond ETF (SPHY).

ETF.com – Chart by Author

In my opinion, it would be fair to characterize HYLS’s performance track record as above-average, as it tends to outperform relative to its benchmark. HYLS’s above-average performance is a benefit for the fund and its shareholders, but not a significant one, and one which also applies for some of the fund’s peers.

Low Duration

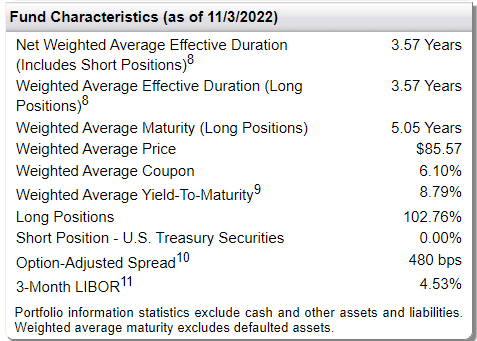

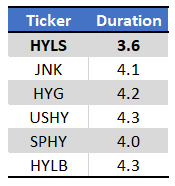

HYLS focuses on bonds with relatively short maturities, which reduces interest rate risk. The fund currently sports a duration of 3.6, a relatively low figure, and lower than that of its peers.

Fund Filings – Chart by Author

HYLS’s relatively low duration reduces losses when interest rates rise, a benefit for the fund and its shareholders. As the fund’s duration is only slightly lower than average, this is a small benefit, but a benefit nonetheless.

Conclusion – Buy

HYLS is an actively-managed corporate bond ETF, has outperformed its benchmark since inception, offers investors a 6.3% yield, and is a buy.