Holcim: M&A Drives Long-Term Transformation Efforts (OTCMKTS:HCMLF)

yullz/iStock Editorial via Getty Images

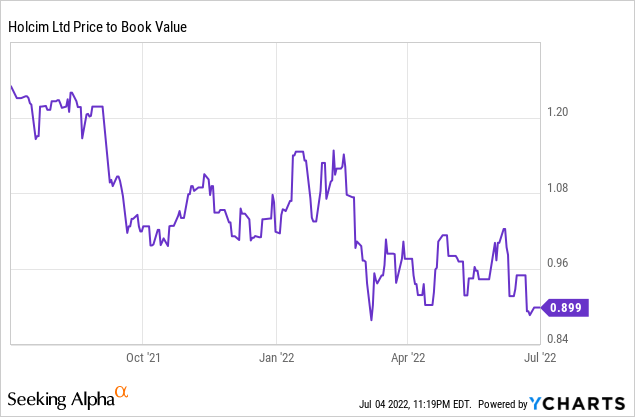

Global building materials and solutions leader Holcim (OTCPK:HCMLF, OTCPK:HCMLY) has been on the move lately, divesting its Indian assets at a strong valuation and accretively reinvesting a portion of the proceeds into expanding the Solutions & Products business via SES Foam. Expect similar steps in the coming months as management executes the long-term Holcim transformation – this likely means more portfolio simplification efforts to free up balance sheet capacity for transformational M&A or capital return. All this bodes well for Holcim’s non-material share of revenues, as the valuation of non-cement assets has come down following recent interest rate hikes, likely supporting an >50% contribution sooner rather than later. Coupled with the positive ESG impact of an improved carbon footprint and a higher light/sustainable product mix, Holcim’s overall cost of equity should trend lower, supporting the case for a re-rating of the multiple (vs. the current discount to book).

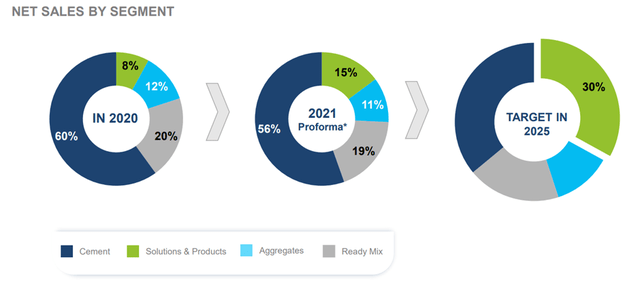

Further Expanding Solutions & Products with SES Foam Acquisition

Holcim’s recently announced acquisition of SES Foam LLC, the leading U.S.-based independent spray foam insulation company (estimated net sales of ~$200m), represents another clear step in its long-term transformation plans. Per disclosures, SES has sustained double-digit % growth in recent years, driven by advanced energy efficiency and bio-based solutions for new and green retrofitting projects. Given the addition of SES comes on the heels of the previous acquisition of roofing business Firestone and Malarkey, Holcim looks set to achieve its target for a ~30% revenue contribution from Solutions & Products well ahead of expectations.

Depending on M&A success, I suspect Holcim could even hit a ~50% revenue target in the mid-term – an important milestone as limiting cement exposure and increasing building product revenues would not only unlock carbon footprint improvements but also reduce cyclicality and boost the valuation multiple over time. Beyond the rollout of Firestone/roofing products in Europe, Holcim could also allocate more capital toward adjacent businesses such as insulation or construction chemicals to further accelerate its transformation.

Disposal of Indian Assets Frees Up ~CHF6.4bn in Cash

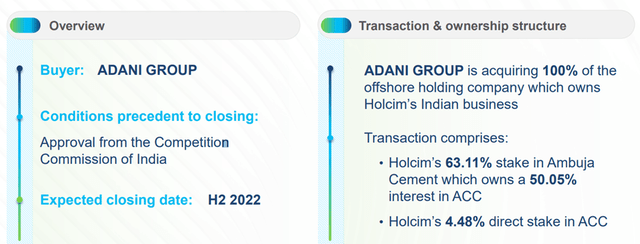

The recent acquisition announcement comes on the heels of Holcim disposing of its Indian assets to the Adani Group for CHF6.4bn in cash (equivalent to >20% of Holcim’s pre-announcement market cap). The assets comprise a ~63% stake in Ambuja Cement, which in turn owns a ~50% interest in subsidiary ACC Limited, as well as Holcim’s ~4.5% direct stake in ACC. Per disclosures, the Indian operations generated a sizeable CHF3.6bn of revenues and CHF749m of trailing EBITDA, with the transaction enterprise value of CHF11.3bn implying a strong 14.5x trailing EV/EBITDA (well above where Holcim trades). The deal is guided to close in the back half of the year, subject to regulatory approval from the Competition Commission of India.

While the transaction price is slightly below the ~$7bn first reported by Reuters leading up to the deal announcement, the 14.5x trailing exit EBITDA multiple is still a net positive outcome, in my view. Further, the divestment makes strategic sense given Holcim’s broader transformation strategy – the deal goes a long way toward crystallizing value from the emerging market cement portfolio and allows for accretive capital recycling toward the Solutions & Products expansion. As rebalancing the portfolio toward less cyclical, higher growth sustainable products should also reduce Holcim’s risk premium and raise the group’s growth/return profile, I see clear re-rating potential from the overall cost of equity trending downward over time.

Capital Allocation Optionality to Support Portfolio Optimization

Assuming the sale of its Indian assets goes through as anticipated, Holcim should have ample balance sheet capacity by year-end for further acquisitions – while the company likely won’t turn net cash, net debt is on track to reduce significantly to ~CHF4bn (or a very manageable ~0.6x net debt/EBITDA). While higher capital returns via special dividends or buybacks are also considerations, the focus is clearly on M&A in the foreseeable future. Per management, there are currently ten serious acquisition targets in the pipeline, all of which are aimed at growing the Solutions & Products segment further. This raises the possibility of an even faster than anticipated non-materials expansion, clearing the path to Holcim realizing its ambition to be the industry’s ESG standard-bearer in the coming years. Beyond non-materials, the availability of P/E-backed targets could also mean a larger move into distribution could be on the cards – particularly in Europe.

M&A Drives Long-Term Transformation Efforts

On balance, Holcim’s recent M&A efforts highlight its intent to differentiate itself from its cement peers by leaning further on growth in non-materials opportunities. Relative to its traditional heavy side focus, the company has already built out an industry-leading presence in the premium “green” concrete and cement solutions – a result of successfully rotating capital into areas with above market demand due to their more sustainable use cases. The divestment of its Indian assets signals more of the same, crystallizing value from the emerging market cement portfolio to enable M&A-led expansion into the Solutions & Products business. As Holcim’s transformation continues to take shape, the company should benefit from an improved return and growth profile as well as a lower overall cost of equity, supporting the case for a re-rating from the current valuation.