Hitachi Stock: Valuation Remains Undemanding

KathyDewar

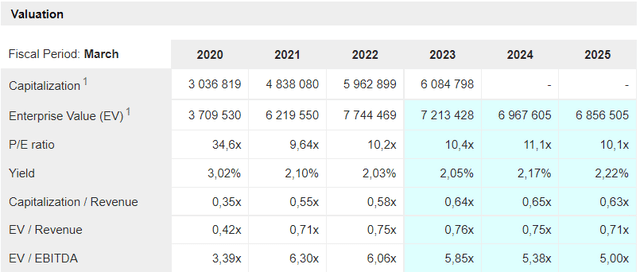

This year’s Hitachi (OTCPK:HTHIY) (OTCPK:HTHIF) investor day briefing provided lots of interesting color into the medium-term outlook. Fundamentally, the bright spot remains its acquisitions, with Lumada underpinning a new growth phase in its digital and green endeavors. Looking ahead, the continued rollout of Lumada under the leadership of President Kojima, along with any improvement in Green Energy & Mobility, will be key areas to monitor with regard to Hitachi’s transformation. And as the business restructuring winds down, there could even be potential for EPS accretion via share repurchases. Finally, the improved disclosures and increased management accountability, along with a standing commitment from President Keiji Kojima, represent considerable governance improvements and should help address any conglomerate discount attached to the shares. At an attractive c. 5x fiscal 2024 EV/EBITDA, the valuation is undemanding, supporting my bullish stance.

Medium-Term Targets Focused on Profitable Growth

Encouragingly, Hitachi’s annual sales growth target remains in the mid-single-digits (4-6%) following the recent reorganization of the business into three key segments (Digital Systems & Services, Green Energy & Mobility, and Connective Industries). In addition to organic growth, the growth forecast incorporates investment of JPY 500 billion in IT services M&A, the integration of Thales’ (OTCPK:THLEF) railway signaling business by the end of the fiscal year, and sales growth of c. JPY 170 billion from acquisitions in the connective business. However, I would note that concerns about Chinese competition in the railway and power grid operations were unaddressed, and therefore, any negative surprises on this front pose a key downside risk in the upcoming years.

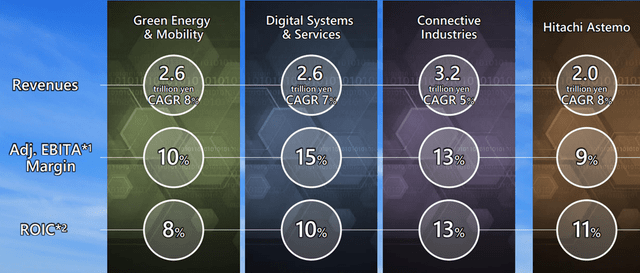

The improved financial disclosures were a key positive at this year’s investor day, with sales and adjusted EBITA ratio targets provided for all three sectors alongside ROIC and EBITDA ratios for the overall business. The recurring sales breakdowns across the Digital Systems & Devices and Connected Industries sectors were also helpful, emphasizing (even at this early stage) the underlying potential of these business models. Meanwhile, the company targets a medium-term adjusted EBITA ratio of 12% for the overall group – by segment, the adjusted EBITA ratio targets for the Digital Systems & Services, Connective Industries, and Green Energy & Mobility sectors stand at 15%, 13%, and 10%, respectively. The margin update was mostly as expected, with the only letdown being the 9% Hitachi auto parts unit (“Astemo”) margin target. The fact that there was also no Astemo presentation at the investor day was also worrying, likely indicating below-par progress to achieving the target model.

Lumada and GlobalLogic Acquisitions Underpin the Innovation Strategy

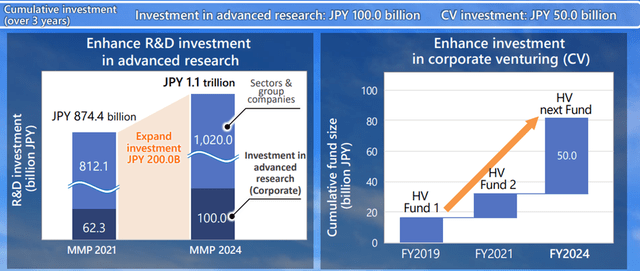

At the center of Hitachi’s medium-term plan is its focus on digital technology to drive innovation, building on the foundation laid out with its fiscal 2018 medium-term plan. The third iteration will see Hitachi establish an innovation growth strategy division, along with a digital service business to create disruptive innovation. Considering the DSS Lumada business is guided to outgrow the broader Digital Transformation market (+17% CAGR) through fiscal 2025 at an impressive +22% CAGR, the investment dollars should pay off over the medium to longer term. My only concern is the pace of the reinvestment run-rate – total spending has moved to JPY 100 billion on advanced research (up from the JPY 62 billion outlined in last year’s medium-term plan), with JPY 50 billion earmarked for corporate ventures (vs. less than JPY 20 billion last year).

In addition to Lumada’s sales growth, Hitachi’s move to further accelerate its global expansion by leveraging GlobalLogic’s overseas presence could unlock incremental longer-term earnings growth. Thus far, the post-merger integration has been progressing well, helped by synergetic collaboration with the Energy, Rail, Industry, Vantara businesses. GlobalLogic Japan even won its first domestic deal with Nojima (OTCPK:NJMLF) to support its digital store transformation – a key milestone. And with Hitachi actively working on cross-selling Lumada/GlobalLogic solutions across the existing customer base, current post-merger estimates could prove conservative. Looking ahead, Hitachi might even take cues from Panasonic’s (OTCPK:PCRFY) plans to spinoff Blue Yonder (acquired in 2021) to incentivize talent retention through stock options – likely via a GlobalLogic IPO.

Green Energy & Mobility Could Disappoint

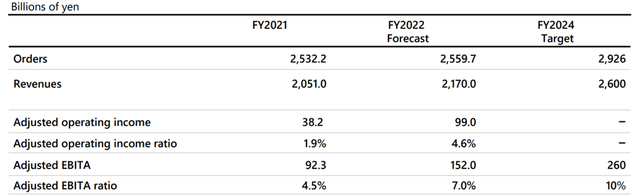

While Digital Systems & Services was touted as the key growth driver for Hitachi in general, green energy & mobility will also be worth watching, especially in light of the expanding business opportunities in decarbonization globally. Considering the range of businesses within the division, Hitachi is well-positioned to capitalize on secular growth trends within the space – c. 54% of sales come from power grids, followed by railway systems (c. 30% of sales), nuclear energy (c. 7% of sales), and energy (c. 9% of sales). However, the adjusted EBITA ratio for the sector is worrying at a below-par 4.5% in fiscal 2022, before rising to 7% in fiscal 2023 and c. 10% in fiscal 2025. In other words, even after a 5%-6% improvement, margins will remain below the other two sectors (Digital Systems & Services and Connective Industries).

Admittedly, the disappointing margin target is somewhat influenced by one-off factors such as the pandemic-induced supply chain disruptions and rising material costs in recent months. Yet, I think the contribution from execution delays of post-acquisition growth strategies should also be acknowledged. Furthermore, there were no recurring sales targets disclosed for Green Energy & Mobility (unlike the other two sectors). Coupled with the fact that it is being led by the CEO (also not the case for the other sectors), I believe the sector might be behind on the digitalization and business transformation fronts. Also, an interesting omission was Astemo, a sizeable unit at JPY 1.8 trillion of annual sales, which not only failed to make the investor day presentation this year but also appears to have been removed from Hitachi’s core strategies. As such, I would not be surprised to see an Astemo de-consolidation ahead, perhaps when market sentiment improves.

Final Take

Overall, this year’s Hitachi investor day hit the right notes, emphasizing the major transformation the company has gone through in streamlining its business portfolio and executing large-scale acquisitions to boost future growth. Relative to other Japanese industrial giants like Panasonic, Mitsubishi Electric (OTCPK:MIELY), and Toshiba (OTCPK:TOSBF), Hitachi’s measures to expand sales have yielded clear gains – likely helped by the fact it has far fewer unprofitable businesses to address.

With Hitachi’s balance sheet also on the mend following major M&A and the portfolio restructure progressing well, I would not rule out share repurchases either. Yet, the undemanding c. 5x fiscal 2024 EV/EBITDA valuation means the market continues to price in a pessimistic view of the medium-term plan. Looking ahead, other potential upside catalysts to watch out for are the potential sale/transfer of Hitachi Metals, along with a de-consolidation of the Astemo unit.