Google Stock: Deep Recession Value (NASDAQ:GOOG)

Sean Gallup/Getty Images News

Google parent company Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) is going to execute a 20-for-1 stock split in July and I believe investors may want to consider the stock before it splits. The massive stock split will make Google stock significantly more affordable for investors interested in the company and the high price of $2,180 has likely held back demand. After a 24.6% drop in pricing this year, shares of Google represent strong (recession) value and the stock split could be a catalyst for an upleg!

The upcoming stock split could be a catalyst for Google

Google was not the only company that announced a stock split lately. Amazon (AMZN) also executed a 20-for-1 stock split while Tesla (TSLA) plans to split its stock in a 3-for-1 deal. E-Commerce company Shopify (SHOP) just executed a 10-for-1 stock split, but the stock has, despite the potential split catalyst, under-performed expectations.

Companies split their stocks to make them more affordable for investors, often after a material stock rally has taken place. Google’s stock split is expected to be completed on July 15, 2022 which is when shares are going to trade at the split-adjusted price. Shares of Google currently trade at $2,182, implying that the split adjusted prices will be around $109 (1/20th of the pre-split price), but the math could certainly change until July 15, 2022. If Google’s shares were to go through yet another drop in pricing pre-split, this lower price level would of course be maintained post-split.

Stock splits only superficially affect the affordability of a stock, which means that valuation ratios are not affected by a stock split itself. However, stock splits could result in increased trading and higher prices post-split as more investors can buy a stock that they may have viewed as out of reach before the split.

Google has enormous recession value

Now that the market is bracing for a recession, investors may want to think about investing in companies that are going to grow their top lines, free cash flows and profits despite growing economic headwinds. I believe Google represents enormous value during a recession because the search giant will continue to expand its business even when the economy as a whole starts to struggle. The key reason for this belief lies in Google’s strong market position in search and the positive business trends in cloud computing.

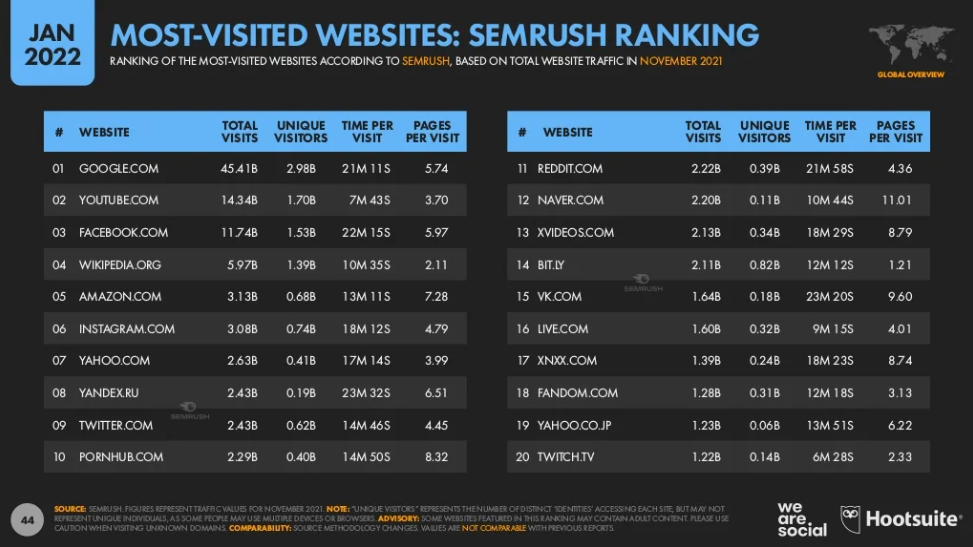

Based on information from Hootsuite, Google.com and Youtube.com are the two most-visited websites in the world (outside of China) which creates a foundation for sustainable growth in advertising revenues. Owning the two most-visited websites has enormous value for Google and its shareholders: Google generated approximately 58% of its total revenues in Q1’22, a total of $39.62B, solely from its Google Search-affiliated businesses.

Hootsuite

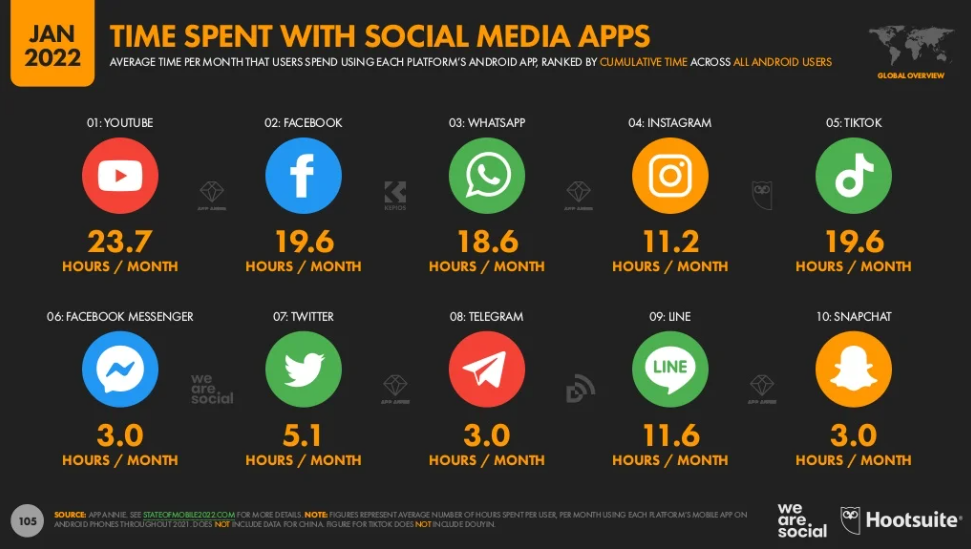

Also based on the Hootsuite Digital 2022 Global Overview Report, Google-owned YouTube is, by far, the most successful social media platform regarding capturing users’ attention. On average, users spent an average of 23.7 hours a month on YouTube which easily beat out rival social media platforms like Facebook, Instagram and TikTok. Revenues from YouTube ads soared 14% in Google’s first-quarter, reaching $6.87B and represented a 10% revenue share.

Hootsuite

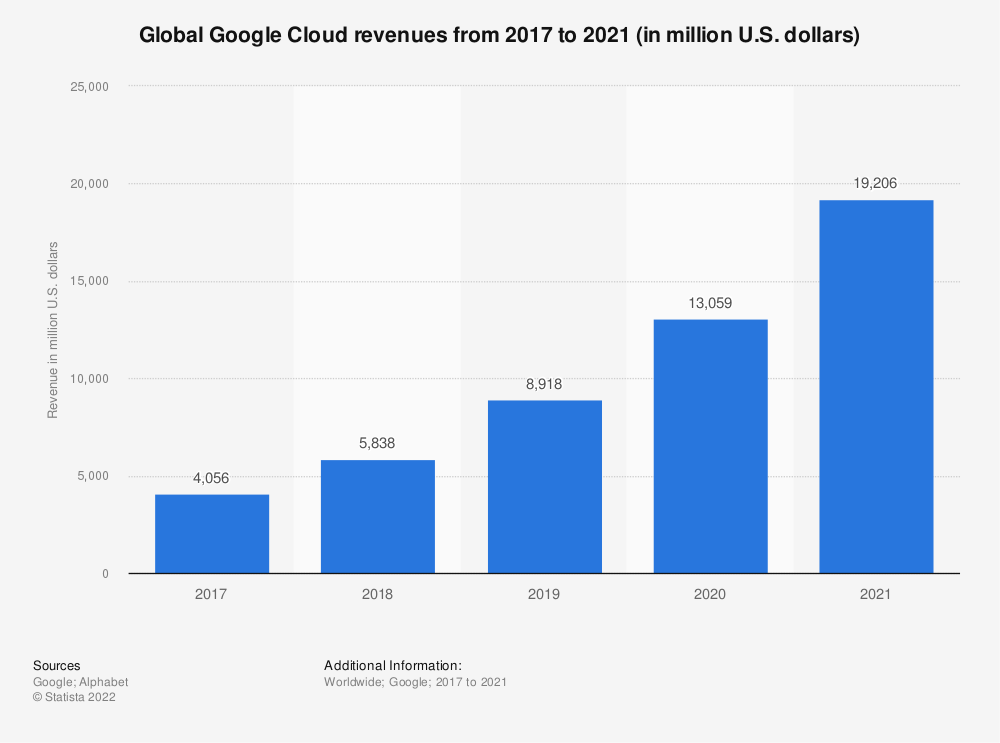

Google cloud revenues are in an upswing

Google’s cloud business is gathering momentum and the company has seen a strong increase in revenues in the last five years. Google cloud revenues chiefly include fees for the provision of infrastructure, platform, and other services. Google’s cloud revenues increased by a factor of 4.7 X between FY 2017 and FY 2021 to $19.21B and in Q1’22, the cloud business was the fastest growing business segment within Google with a growth rate of 44%. The cloud segment grew 80% faster than Google’s search business which grew at a 24% rate year over year in Q1’22.

Statista

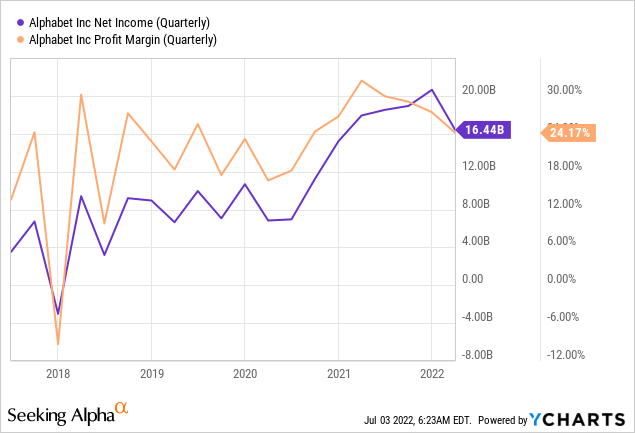

Google’s search business generates predictable revenues for the company during a recession while the cloud business could generate additional growth. During recessions, predictability of revenues and cash flow has great value for investors and it limits stock risks. Google also is an incredibly profitable enterprise, chiefly because of its search business, and the company now achieves net profit margins above 20%.

Google remains cheap

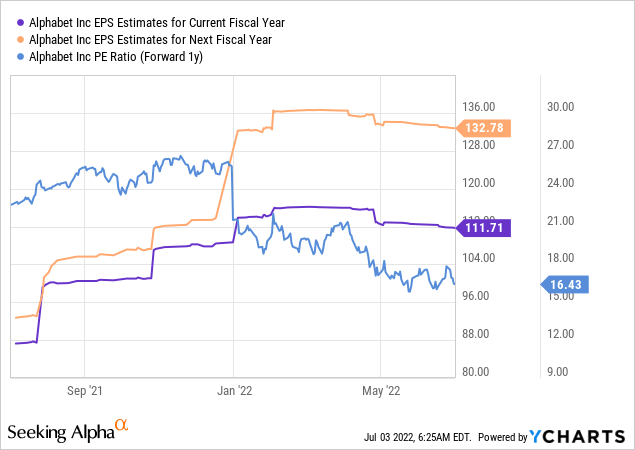

Consensus revenue forecasts imply average annual top line growth of 13% for Google between FY 2022 and FY 2027. Based off of next year’s EPS, Google now has a P-E ratio of 16.4 X which I believe undervalues the company enormously.

Google’s cash/investments represent deep value and lower risks

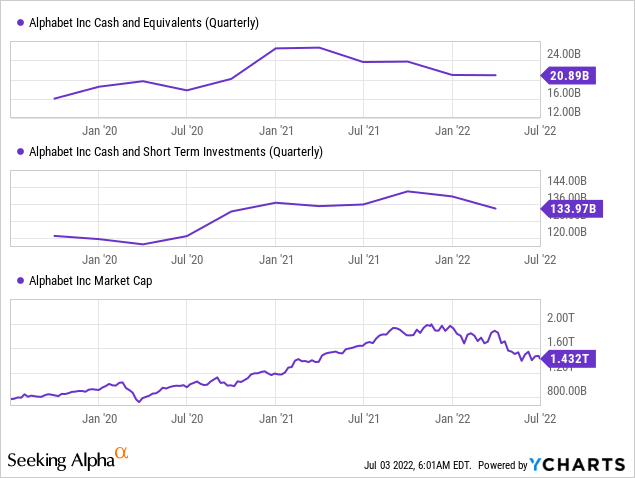

What also lowers stock risks for Google is the immense amount of free cash flow the business generates. Secondly, Google is extremely well capitalized. The firm’s balance sheet showed $133.97B in total cash and investments at the end of March which represents approximately 9% of the company’s total market cap.

Risks with Google Stock

There’s a short-term risk that Google underperforms after the stock split is completed in July, and there’s no assurance that the search giant is going to do as well as expected. Slowing top line growth going forward is a legitimate concern, but with Google owning the two most-visited websites in the English-speaking world, I believe the risks are very much controlled. What would change my mind about Google is if the company were to see a dramatic slowdown in the cloud business and a decline in free cash flow were to occur.

Final thoughts

Google is going to trade a lot closer to $100 in two weeks which opens up a whole new segment of potential buyers for the stock that were priced out of the market when the stock traded above $2,000. I also believe that Google has enormous recession value for investors because of the strength in the cloud business, enormous free cash flow and a massive pile of cash/investments sitting on the firm’s balance sheet. I believe investors may want to consider buying Google pre-split and holding the stock through a recession.