Gold Standard Ventures: Patience Might Be A Virtue (NYSE:GSV)

Whops, I have burnt the cake! skynesher/E+ via Getty Images

Gold Standard Ventures (NYSE:GSV) is about to be acquired by Orla Mining (ORLA) in an almost-all-paper deal, apparently amounting to a C$242M consideration and a juicy 35% premium — if you are willing to believe the news release.

For what it’s worth, if you follow the logic of the news release and consider the June 10 end-of-day share price for GSV ($0.399) and Orla ($4.29), and if you also consider the proposed exchange ratio of 0.1193 Orla shares for each GSV share, the premium computes to 26.5%.

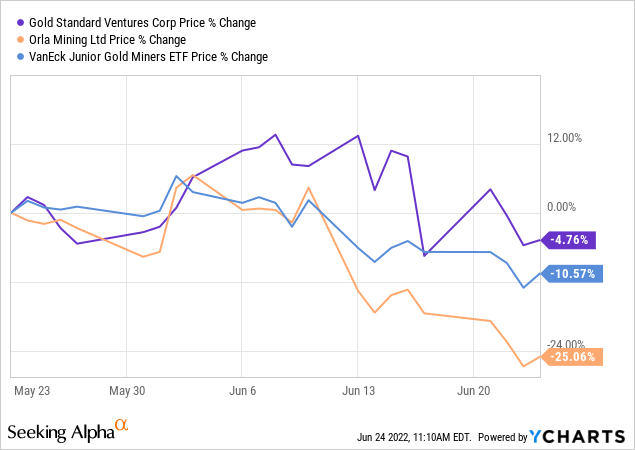

But that’s well beside the point, because whatever the theoretical premium was immediately before the news release, it all evaporated once the market found out about the deal.

But let’s go with the headline number anyway, and generously assume the quoted deal value of C$242M (or $187.6M in US denomination), and let’s check how this valuation pans out for GSV investors.

GSV controls the Railroad-Pinion gold project as well as the Lewis Project, both in Nevada. The former is clearly the flagship asset for this junior development company and the recent feasibility study computed an after-tax NPV(5%) of $487M at around the current gold price. Accounting for GSV’s C$17.5M (US$13.5) treasury and assigning no value at all for the Lewis project, the multiple offered by Orla computes to just 0.36xNPV. Much less developed projects, and dare we say, much less attractive projects have garnered better multiples in the recent past.

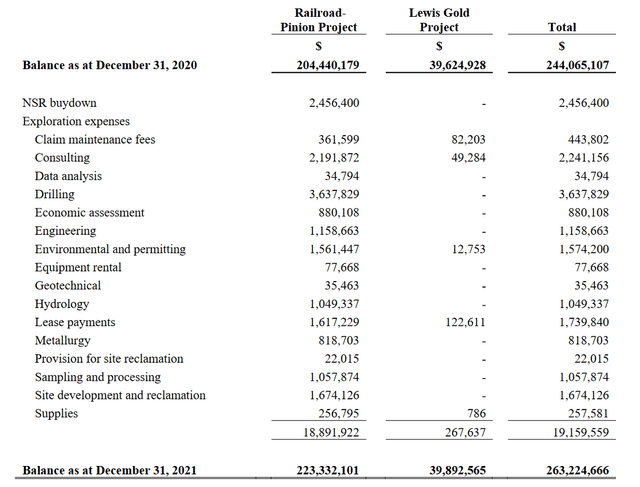

Or take a different angle and consider the book value for GSV’s assets, as filed for the end of Q1 this year.

GSV book value. (company filings)

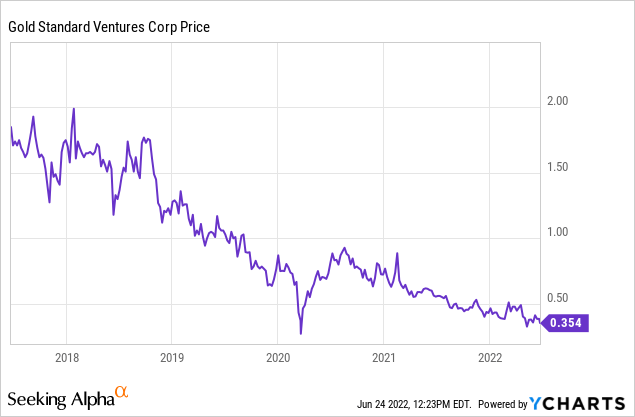

Hardly a premium to be seen from this angle either. After all these years of investment, Orla is buying GSV well below book value at the multi-year share price low. The news release goes on to list further “benefits” for GSV shareholders emanating from this deal, but this is not the time to add insult to injury, so let’s just say this list of “benefits” is about as far removed from investors’ reality as the 35% premium claim.

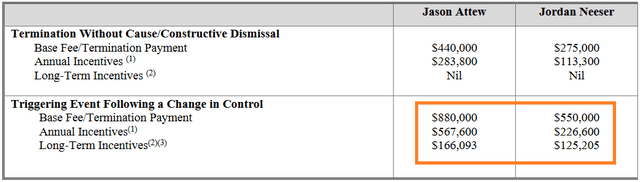

And before you ask, yes, we did call the company and we have voiced our view; and we were most certainly fed the line that this deal was deemed to be in the best shareholder interest, despite all the evidence to the contrary. However, not all is lost. GSV might have failed miserably to create shareholder value along the development path of the Railroad project, but there are exceptions: CEO Mr Attew and CFO Mr Neeser are two shareholders who will actually benefit from this deal — their parachutes are worth C$1.6M and C$0.9M, respectively.

Golden handshake (company filings)

To be clear, GSV is not any odd junior explorer with a scrawny project in the middle of nowhere in a questionable jurisdiction. Quite to the contrary in fact. The company’s Railroad gold project is located in Nevada, close to infrastructure, and has a solid feasibility study to its name. We toured the project before the pandemic and came away thoroughly impressed, convinced that this is a stand-out project in its own right with ample exploration upside to boot, a project that will be turned into a highly profitable mine in the not-too-distant future (Orla Mining would probably agree).

And to be clear again, there is no pressing financial need to enter into this deal right now. The company has sufficient cash to carry out the planned permitting work and conduct exploration work as outlined in the April 18 news release. Surely, there is value in getting the permits across the line, as Mr Attew has promised to do only a little while ago.

So why oh why?

Frankly, there is no rational justification for this deal that comes to our minds. Except for one nagging inkling that has been bugging us ever since we found out about this transaction. Let us explain, and bear with us as we go back to 2017. A certain Mr Chuck Jeannes had been Goldcorp’s (now Newmont (NEM)) CEO when the major acquired the Camino Rojo project. Goldcorp spent around C$500M on the project before selling it to — Mr Chuck Jeannes again, who had moved on and had become Chairman at Orla Mining. The man paid only C$32M in Orla shares the second time around – literally pennies on the Dollar. (Rude Otto has the full story on his blog here).

Fast forward to 2022, and we can’t help but suspect the Goldcorp Connection has been at work again, this time orchestrating the GSV deal. GSV’s CEO Mr Attew used to be Goldcorp’s CFO up until the merger with Newmont. When he took the CEO position with GSV in late 2020, expectations were high, and those expectations explicitly included Mr Attew taking the Railroad project into production. Instead, we find him selling the company at a multi-year low to Orla Mining, where ex-Goldcorp boss Mr Chuck Jeannes is still the Chairman of the Board.

This may just be a nagging inkling and there may well be much less sinister forces at play, but at this point, our lessons learned include avoiding junior miners with attractive heap leach projects run by ex-Goldcorp executives; and noting down the names of the players involved and never entrusting these people again with our investment money.

Where To Go From Here?

Looking at the present share prices of the two companies, the arbitrage has narrowed to just 3%, indicating a market convinced this deal will most likely close. Orla’s share price has suffered from the deal announcement, and for investors interested in this company, this dip arguably represents a buying opportunity. GSV shareholders can simply hang on to their position and wait for their shares to be exchanged for Orla shares upon deal closure if they wish to go down this path.

And surely, there is plenty to like about Orla Mining. The company has recently announced commercial production at its Camino Rojo mine, after a remarkably uneventful construction period. Orla clearly has the expertise to do the same at Railroad in due time, and it controls a third project with similar characteristics in Panama. If management continues to orchestrate deals as it has with Camino Rojo and now the Railroad project, then there is good reason to believe that Orla will turn into a mid-tier gold miner in just a few years and create value along the way.

GSV investors not interested in exchanging their shares for Orla shares are probably best served to sell their shares immediately before the deal with Orla closes. GSV’s share price will be tied to Orla’s going forward, and there is reason to speculate that Orla will recover at least a portion of the dip it has suffered as the closure of the GSV acquisition draws closer and short-term traders exit, so patience might be a virtue in this case.