Generac: The Cheaper Alternative To Enphase Energy (NYSE:GNRC)

George Frey/Getty Images News

Investment Thesis

Over the past year, Generac (NYSE:GNRC) shares have gone from grossly overpriced, to relatively cheap. Since October 2021, Generac shares have fallen roughly 80% due to macroeconomic factors that are putting pressure on margins and demand. Generac shares are now trading at their lowest valuation since their IPO in 2010. However, the long-term growth story has not changed, and Generac will still benefit from the strategic acquisitions that have positioned them to benefit from the “Grid 2.0” megatrend. Other Grid 2.0 companies like Enphase (ENPH) and SolarEdge (SEDG) are trading at multiples over 10x Generac’s valuation. Generac’s growth drivers are being largely ignored in their valuation, as they trade at multiples that are lower/in line with “regular” generator manufacturers. With overlooked long-term tailwinds and short-term headwinds, I’m projecting a 15.6% IRR through 2027.

Market Overview

Generac operates in two entwined markets: the generator market and the decentralized power resources market. Let’s talk about both.

Generator Market

According to MarketsandMarkets Research, the global generator market is expected to reach $28.6B by 2027, with a 5.8% CAGR. This includes both residential and commercial & industrial segments. Industries such as telecommunications, data centers, and health care are some of the industries with the most pressing need for backup power. The 5.8% CAGR is being driven by several factors:

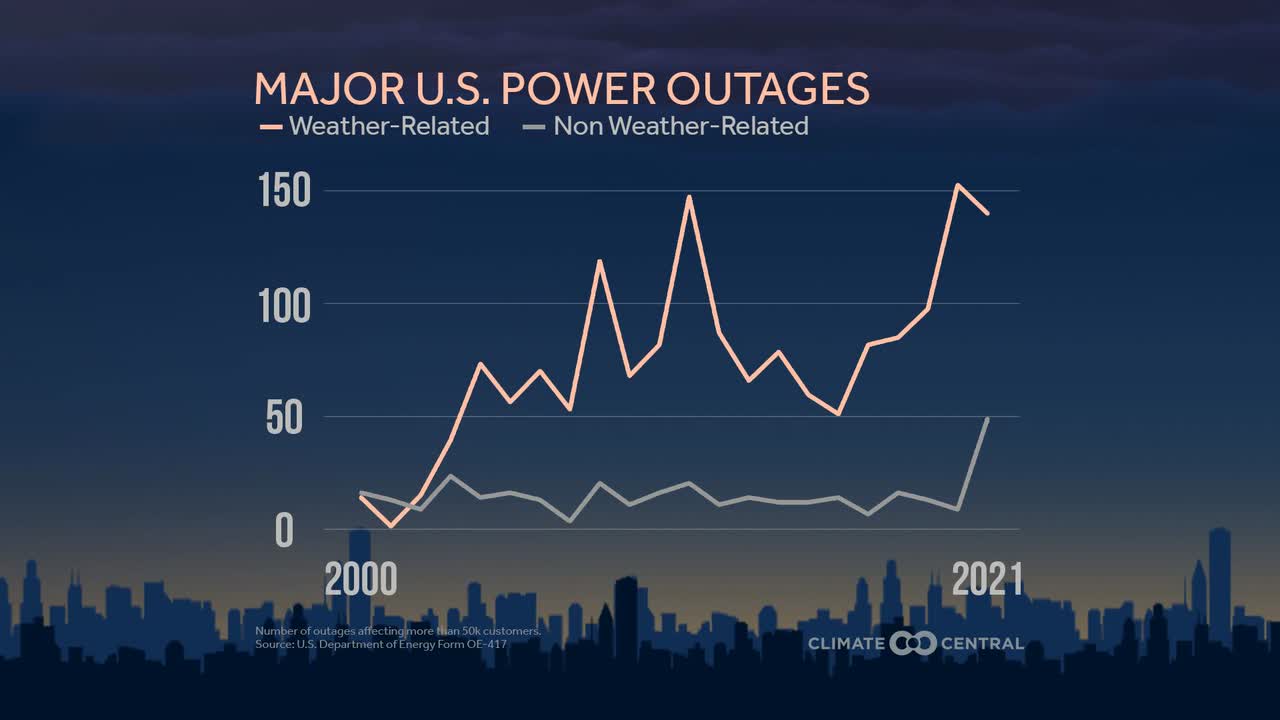

1. Increased power outage frequency.

Climate Central

2. Aging utility infrastructure.

To say that the United States has an aging electric transmission infrastructure is a sizable understatement. The average age of the installed base is forty years old, with more than a quarter of the grid fifty years old or older. -Public Utilities Fortnightly Magazine

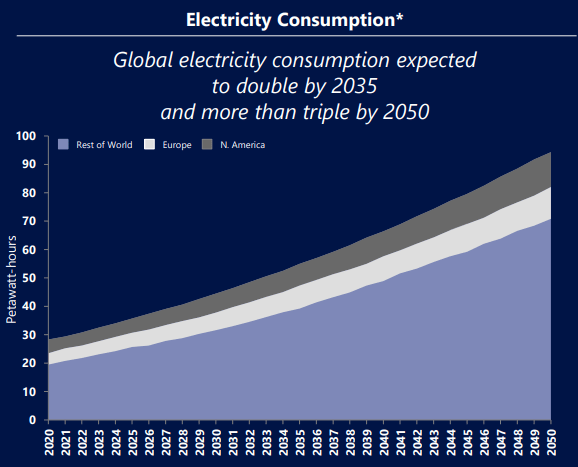

3. Mass electrification leading demand to outpace supply.

SolarEdge Investor Presentation

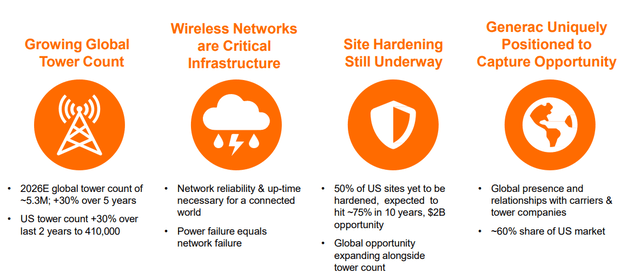

4. Growth of 5G infrastructure, which requires backup generation for cell towers.

Generac has 60% market share in the tellecom back-up power generation space.

These are all growth drivers that have increased the demand for generators over the past decade. These trends have only intensified and will continue to drive demand globally for backup generation. Top generator manufacturers include:

Decentralized Energy Resources (DER) Market

According to Grand View Research, the Distributed Energy Generation market is projected to reach $580.8B by 2027, with an 11.5% CAGR. Distributed energy resources are essentially the decentralization of energy resources. This is the shift away from purely relying on centralized power generation facilities, to a highly fragmented power generation system. This includes solar panels at home, generators (diesel, natural gas, b-gas), fuel cells, battery storage, etc. This market is benefitting from most of the same growth drivers that are pushing the generator market forward:

- Increased power outage frequency.

- Aging utility infrastructure.

- Mass electrification leading demand to outpace supply

Additionally, the DER market is benefiting from:

- The shift towards environmentally friendly energy sources

- Various tax credits for installing solar panels

The biggest players in the DER market are:

- Enphase

- Generac

- SolarEdge

Product Comparison

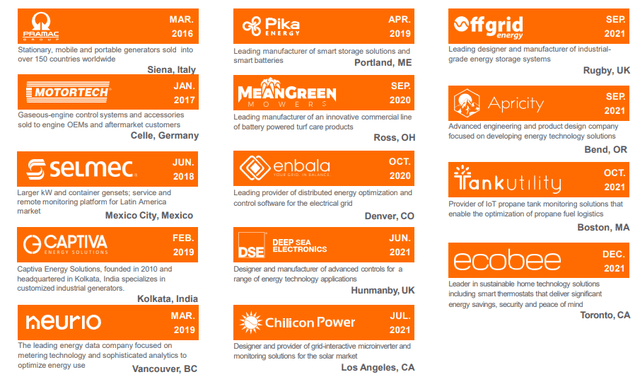

So how does Generac compare to its competitors? For the most part, we’ll focus on the DER comparison with Enphase and SolarEdge. As I first started researching this space, I assumed Generac would be miles behind given their valuation. However, this is not the case. Over the last several years, Generac has made many strategic acquisitions to improve its DER offerings:

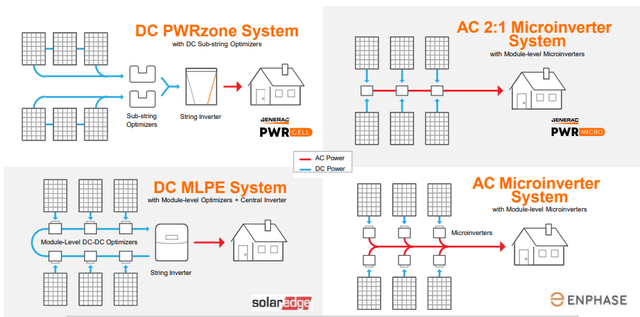

Through these acquisitions, Generac has created a level playing field between itself and its competitors. Enphase touts that they have a competitive advantage through their microinverter, instead of the traditional string inverter. (Don’t worry if you don’t know what this is, I don’t really either) However, both SolarEdge and Generac also use microinverters:

Here is a look at an overall product comparison between the 3 businesses:

| Companies | Solar Power Generation | Battery Storage | Grid Services | Energy Software | Installer Software |

| Enphase | Microinverter | IQ Battery | ConnectedSolutions | IQ Load Controller | Solargraf |

| SolarEdge Technologies | Microinverter | SolarEdge Home Battery | Home Backup | mySolarEdge | None |

| Generac | Microinverter | PWERcell battery | Concerto | PWRManager | None |

| Companies | EV Charger | Smart Home | Backup Power | Residential Generators | C&I Generators |

| Enphase | ClipperCreak | Home Connect | Integrates w/Generator | None | None |

| SolarEdge Technologies | Home EV Charger | SolarEdge Home Devices | Integrates w/Generator | None | None |

| Generac | None | ecobee | PWRgenerator | NG, Diesel, Propane | Gas, Diesel, Biofuel |

- All of the companies have microinverter solar generation offerings.

- All of the companies allow energy to be pumped back into the electric grid for profit.

- Enphase is the only one that has solar installer software (many other companies solely offer this software)

- Generac does not offer EV chargers

- Generac is the only company that has its own generator offering, while SolarEdge and Enphase simply integrate with other generators (potentially a Generac generator)

The ability for Generac (and other generator companies) to sell generators to Enphase’s and SolarEdge’s customers is an innate advantage. Additionally, customers who already have a Generac generator will likely be more inclined to use Generac solar and battery systems. The same applies to Generac’s deeply established network of over 8,000 distributers. Since Generac has been selling generators since 1959, they have established a massive distributer/installer network, giving them an advantage over the two newer competitors.

Overall, besides from some small details, it appears that the 3 companies have relatively similar products, with minimal levels of differentiation. The overall market sentiment appears to believe that Enphase’s product offering is far superior, but “far” superior seems to be a stretch. However, current public comps don’t suggest that Generac has a very competitive product offering. Let’s take a look.

Valuation

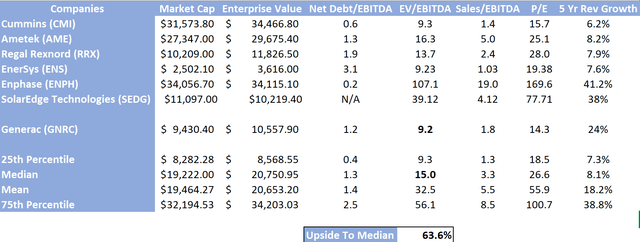

In our comps, we found that Generac is trading at 1/11 Enphase’s EV/EBITDA, and 1/4 of SolarEdge’s EV/EBITDA. Enphase does have higher growth than Generac, but does it warrant an 11x valuaion? Probably not. It appears that the market is underappreciating Generac’s ability in this space, and is overrating Enphase’s advantage. Their closest generator comp is Cummins, who is trading at roughly the same valuation, but only has 1/4 of the growth. Overall, our comp analysis shows a roughly 64% upside.

I aslo looked at Generac’s current valuation relative to their historic valuation.

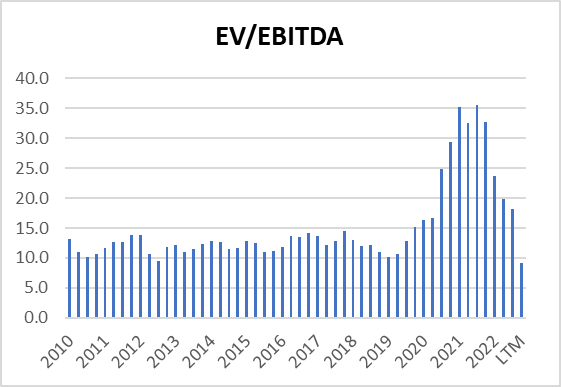

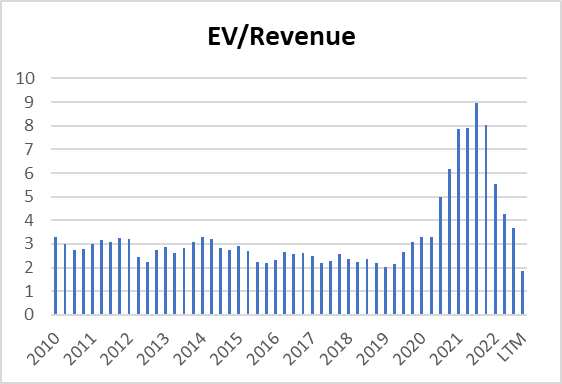

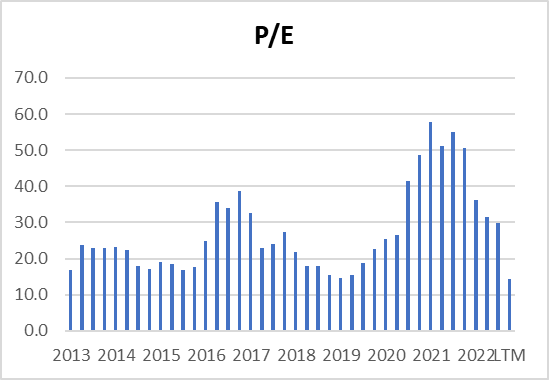

Author Author Author

Looking at all multiples, Generac is trading at their lowest valuation since their IPO in 2010.

Current EV/EBITDA: 9.2 Historic Median EV/EBITDA: 12.7

Current EV/Sales: 1.8 Historic Median EV/Sales: 2.8

Current P/E: 14.3 Historic Median P/E: 23.0

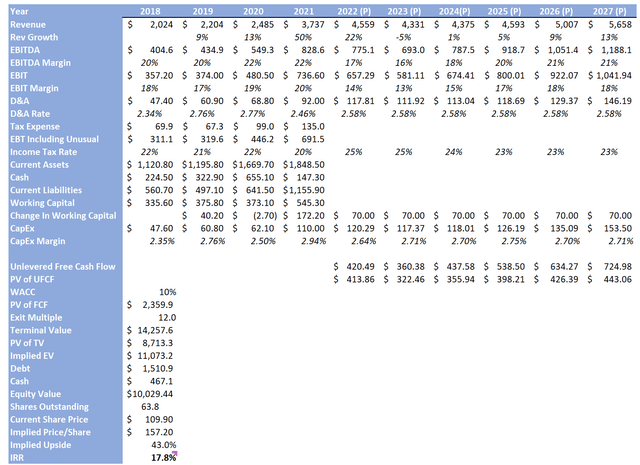

Last but not least, our DCF gave us an implied share price of $157.20, which represents an implied upside of 43%. Our assumptions included -5% growth in 2023, reduced margins in 2023/2024, and an exit multiple of 12 (below public comps). We used a 10% discount rate, so we arrived at a 5 year IRR of 17.8%.

Risks

Generac is certainly not risk-free. Two of the biggest risks associated are:

1. Macroeconomic trends will likely take a toll on Generac’s financial performance in the coming year. We already saw this in their Q3 earnings, where management reduced both revenue and earnings guidance. This is due to slowing demand as we enter a recessionary period, as generators and decentralized energy resources prove to still be discretionary.

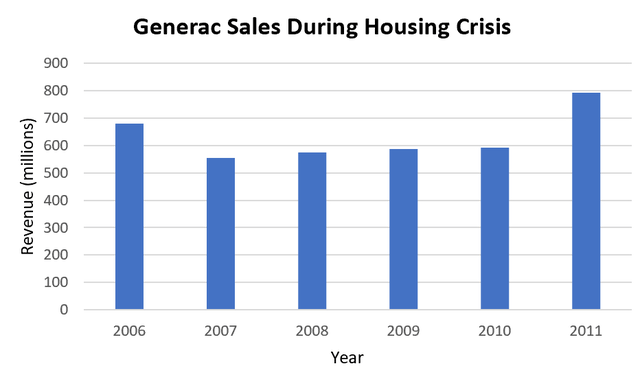

As shown in the graph, Generac has proven to be susceptible to adverse market conditions in the past. Generac saw sales growth of -18% in 2007 and saw relatively low growth until sales soared in 2011 and beyond.

2. Generac has made a substantial amount of acquisitions to position itself well for Grid 2.0. While this is largely good news, there is always the risk that the acquisition does not play out as planned. Synergies may not be realized, which would lead to a loss of capital on those acquisitions.

3. Lastly, the market is very competitive. While Generac currently appears to be in a strong position, the technology is constantly changing. With relatively low R&D spend, they could find themselves falling behind in terms of technology. However, we have seen that management is very capable of pursuing strategic acquisitions for the sole purpose of accessing new technology.

Final Recommendation

It appears that Generac is positioned quite well within the distributed energy resources industry, despite current market sentiment. With Generac trading at its lowest valuation since its IPO and the growth story remaining intact, it seems like a tough opportunity to ignore. Generac allows investors to invest in Grid 2.0 without having to withstand the wild multiples of their competitors. While short term headwinds are present, the long-term growth story stays the same. Through a long-term lens, the recent reduction of valuation present a great opportunity for investors. I believe now would be a good time to start dollar cost averaging in to a position, and hold for a prolonged period of time.