Generac Stock: Trade Short-Term Uncertainty For Long-Term Value (NYSE:GNRC)

nycshooter/iStock via Getty Images

Generac (NYSE:GNRC), the Waukesha, WI based designer and manufacturer of energy and power technologies and products, has experienced incredibly poor performance so far this year, much worse than the broader markets. The company is probably best known for its residential back-up electrical generator units but has expanded into other areas including grid management software, and solar battery storage solutions for both residential and commercial customers globally. Despite growing its top and bottom lines significantly over the last decade, and the likely secular trend of innovation in decentralized power systems, the stock has been declining for more than a year. While many of the concerns with the company are well-founded, they are more likely to drive short-term volatility in the stock price and not the value creation that can be captured by long-term investors.

This company fits well with other articles I have written about renewable energy generation and the potential gains of some decentralization to reduce the load on our aging grid system. Furthermore, with increased frequency and intensity of weather events, combined with an aging population, I believe that this company is well-positioned to generate value for investors for years to come.

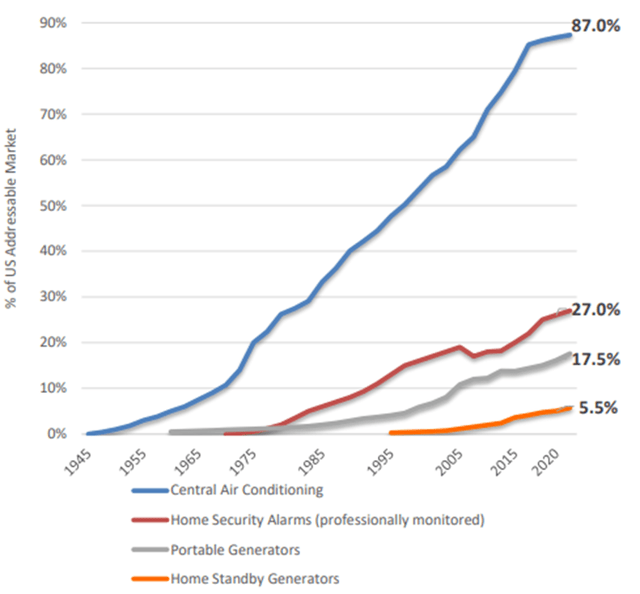

Currently, residential sales represent about 66% of the business as of the end of the third quarter, with commercial & industrial accounting for another 26%. The company has a history of growing both organically as well as through the acquisition of complementary businesses to enhance the user experience. Product penetration rates across the country are relatively low compared to other large household amenities, particularly within large and vulnerable markets in California, Texas, and Florida.

Adoption of Large-Scale Household Amenities (Generac)

Recent performance

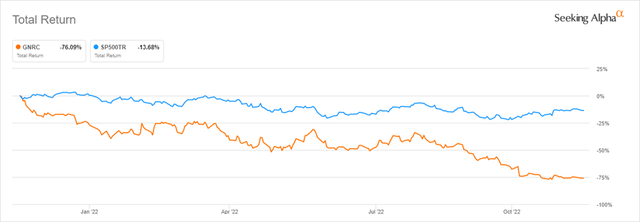

As mentioned in the introduction, Generac’s performance has been terrible both year-to-date and since the peak it reached in early November 2021. Instead of seeing this downward trend as a reason to avoid the stock, the solid fundamentals in the face of the declining stock price present an opportunity. In fact, given the recent volatility and uncertainty in both the market and this stock, this selloff creates an attractive entry point for long-term investors.

1-Year Total Return (Seeking Alpha)

Resilient Fundamentals and Opportunities for Growth

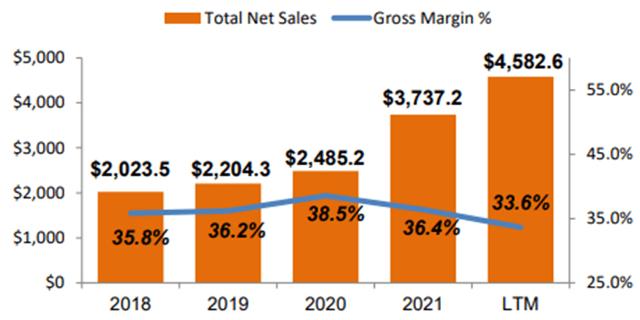

While the stock has declined significantly over the last year, it is less clear that the fundamentals of the business have also suffered to the same degree. Reviewing the financial statements, it is clear that there has been a large build in inventory, which has significantly impacted operating cash flow in recent quarters. While company management sees some continued weakness through the first half of 2023, it anticipates a pickup in the second half of the year, returning sales growth to longer term trends.

Sales and Gross Margins (Generac)

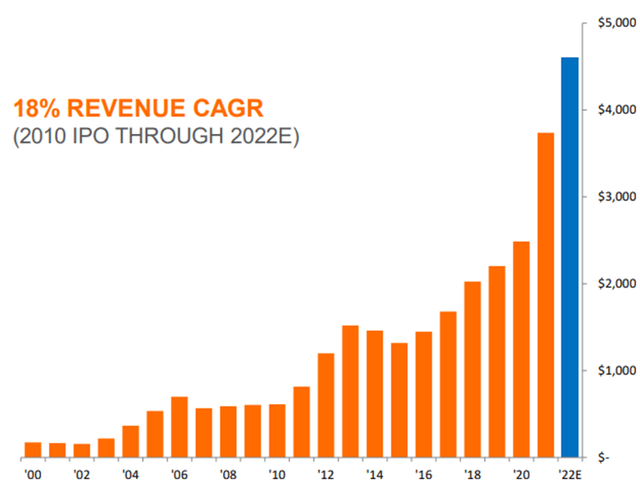

Revenue has grown at an 18% compound annual growth rate since the company’s 2010 IPO.

Revenue Compound Annual Growth Rate (Generac)

Valuation

In the wake of the year-long selloff in the stock, valuation is now near long-term averages for P/E, Price/Sales and Price/Book.

|

Valuation Metric |

Current |

Sector Median |

GNRC 5-year Average |

|

P/E GAAP (‘TTM’) |

15.37 |

19.24 |

30.86 |

|

P/S (‘TTM’) |

1.41 |

1.33 |

3.90 |

|

P/B (‘TTM’) |

2.79 |

2.48 |

8.13 |

Margins

Generac generates margins that are above its industry peers. While recent margins have been below the company’s 5-year averages, they remain resilient during this period of relative weakness, providing some confidence that the company will resume its pre-pandemic trajectory across revenue and profitability.

|

Margin Metrics |

Current |

Sector Median |

GNRC 5-year Average |

|

Gross Profit Margin (‘TTM’) |

33.64% |

29.20% |

36.49% |

|

EBITDA Margin (‘TTM’) |

17.13% |

12.98% |

20.55% |

|

Net Income Margin (‘TTM’) |

10.29% |

6.74% |

12.49% |

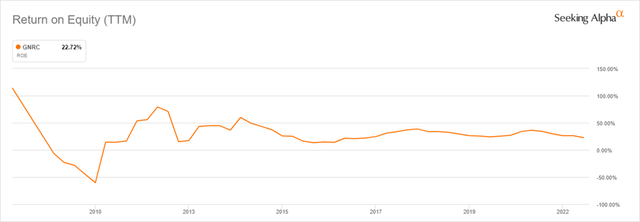

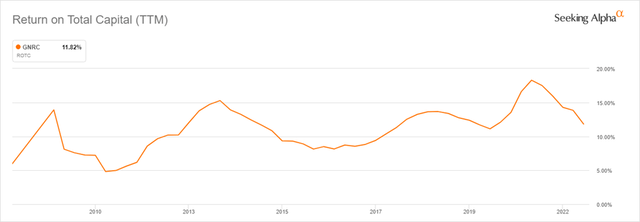

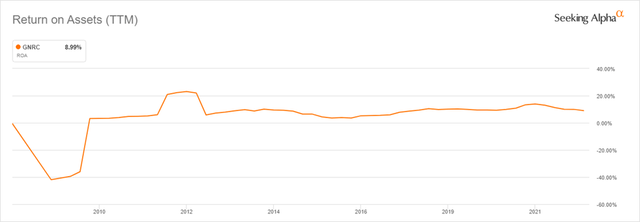

The company’s return on equity over the last 12 months is in-line with what it has generated over the last decade, while the return on total capital is above trend, although below the high reached in mid-2021. Return on assets has also been steady over the last decade with few exceptions.

12-year Return on Equity (Seeking Alpha)

12-year Return on Total Capital (Seeking Alpha)

12-year Return on Assets (Seeking Alpha)

Dividend

The company only paid out dividends to shareholders for a relatively brief period during the mid-2010s, although, given the strength of its balance sheet and operating cash (with the exception of the recent surge in inventory), the company could possibly reinstate a dividend. However, that is not a primary driver of my investment thesis at this time. Meanwhile, the company is still authorized to repurchase as much as $500 million of its own stock, providing another avenue to return value to shareholders.

Catalysts

It is reasonable to expect faster sales growth due to the increasing occurrence and intensity of weather events in areas where population continues to grow, particularly within the Southeastern U.S. This migration has been driven by several factors, but one that has underpinned the trend for decades is the movement of the aging population to warmer climates for retirement. Regardless of the individual drivers of this migration, the growing population in these areas adds to already existing challenges: growing population threatened by storms, increased stress on regional electricity grids, and increased demand for medical care in those areas (and any other areas with retirees) with individuals that will choose to remain in their homes (“aging in place”) and will require back-up power so medical care is not interrupted.

Another indirect, but important factor is the loss of faith in the federal government. Not since the 1950s and 1960s have average citizens had confidence in real change driven by the federal government. In the 1950s it was the construction of the interstate highway system, and in the 1960s the space program. For at least 40 years, this country has watched as its critical infrastructure has deteriorated, and presidents and legislatures of both political parties have either done nothing or have failed to do anything of any real substance on a large scale. This decrepit infrastructure includes the power grid that has become less reliable in many areas, especially those in major population hubs, including those growing around the Gulf Coast. For citizens to ensure their comfort and safety, it is reasonable to expect countless more households to purchase backup power and storage.

With Generac’s wide array of offerings, ranging from relatively small backup generators for rural homes to larger scale commercial and industrial uses, the company offers flexibility to customers of many sizes and budgets. More households can afford standalone backup generators than can afford a fully-integrated solar/battery storage/generator system (which Generac also offers) – more flexibility means decentralization, resulting in greater penetration in key markets.

Potential Acquirers And Competition

Given its relatively small market cap of $6.7 billion, leadership in its space, and a large and growing untapped market opportunity, it is not unreasonable to view Generac as a potential take-out target, particularly at the current valuation. While probably too small and mundane for a company like Tesla (TSLA), I could see companies including Enphase (ENPH), NextEra (NEE), or some other large traditional utility taking an interest in the business. The model of decentralized power generation at households and businesses could serve as an advantageous complement to larger regional players. A firm like NextEra already has a large footprint and leadership position within the utilities in the Southeast U.S., a market that is currently underserved by back-up power despite higher-than-average risks of interruptions. Of course, this is only speculation based on my research and perspective.

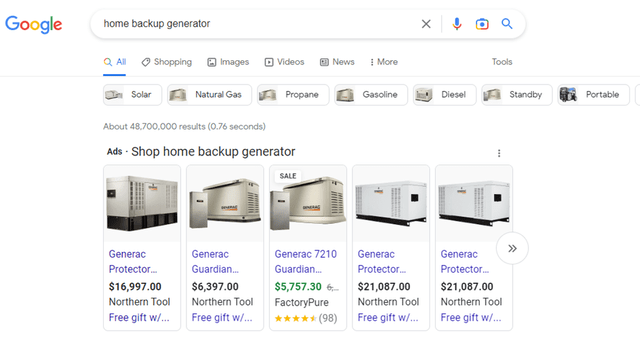

In terms of more direct competition in the household back-up generator space, that field is slim, and most “direct competitors” do not have the same name brand recognition, nor the wide distribution through retail partners that Generac currently enjoys.

Screenshot From Google Search (Google)

This doesn’t mean that those dynamics can’t change, it means they are unlikely to do so, and if they do, it will be incremental over a long period of time. It is difficult to see immediate threats to the current business in this environment with the technology currently available. Even the closest competitors generally offer a bundled package with solar or some other type of integration that is of a larger scale than most Generac customers want. Generac may not have been a first mover, but given the simplicity of the technology, the company’s reputation for reliability and value, it will be a significant challenge for competitors to overtake them, particularly in the residential space.

Risks

Like with most businesses, high inflation, volatile interest rates, economic and geopolitical uncertainty weight on the business and its stock’s performance. Like with most macro headwinds, I expect these challenges to be relatively short-lived.

More specific to this business is the pull-forward of sales that happened during the pandemic, combined with supply chain issues, and what that has meant for the business. Like many other companies, recent conditions have caused Generac to overshoot on its inventory build. There is a risk that it has built up inventory to a level that it won’t be able to “work off” quickly, resulting in a multi-year hit to financial performance.

Other less likely risks would include a slowdown or reversal of demographics and the associated migration to the South and Southeast. Like it or not, given the aging population of the country and growing job opportunities in the South, it is unlikely for this trend to reverse any time soon. Related to that is that this growing southeastern population will become increasingly more vulnerable to more frequent and intense storms, causing more interruptions to power service. I do not expect the frequency and intensity of storms to reverse course any time soon either.

And finally, I believe that the trend for retirees to “age-in-place” will continue, whether it’s in the South or elsewhere in the country, creating the need for uninterrupted electrical service to support medical care despite storms or threats of any kind.

Final Thoughts

Like many businesses, a material level of demand for Generac’s products and services may have been pulled forward during the pandemic. This was met with supply chain and other bottlenecks that made catching up with demand difficult. Unfortunately, as these bottlenecks have clear and demand has returned to a more normal growth rate, there has been a significant buildup in inventory. While this has negatively impacted operating cash flows, ideally it will be a temporary setback. The catalysts and risks discussed above are long-term, as is this investment thesis. While the stock price might be dominated by short-term volatility driven by both macro and company factors, I believe that the company is well positioned, well managed, and set up to deliver strong performance for years and decades to come for those rare patient investors.

As I have discussed in previous articles, I am a long-term investor who believes that patience is one of the only advantages remaining for individual investors. That is the perspective that underpins this outlook for Generac. While I typically advocate for using broad-based ETFs with the goal of always remaining diversified, I believe that finding value in specific areas and employing an enhanced indexing approach can add value. Thank you for reading, and I look forward to seeing your comments below.