Friedman Industries Stock: Recent Deal Is Transformational (NYSE:FRD)

Maks_Lab/iStock via Getty Images

Introduction

I’m returning to investing in the U.S. stock market and my first position is Friedman Industries (NYSE:FRD). The reason I chose this company is because it has a good moat, and it recently announced the purchase of two coil processing facilities from Plateplus, which will more than double its output. In addition, Friedman looks cheap at the moment as falling hot-rolled coil steel prices have put a lot of pressure on the share price. Let’s review.

Overview of the acquisition

I covered Friedman on SA in January and in case you haven’t read that article, here’s a brief description of the business. The company has been around since 1965, and it currently operates two hot-rolled coil processing facilities that are located close to steel mills of Nucor (NUE). They have a combined annual production capacity of 310,000 tons, and Friedman also owns a tube mill in Texas that can produce 60,000 tons per year. During FY22 ended March 31, the sales volume for the coil segment was 152,000 tons, but this number is set to soar in the future for two reasons.

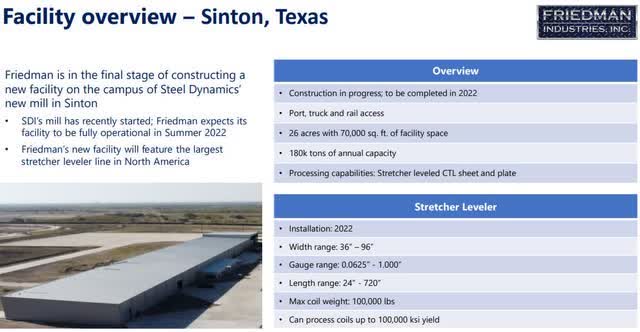

First, Friedman is building a facility on the campus of the new flat roll steel mill of Steel Dynamics (STLD) in Sinton, and the company claims that it will be the most advanced electric arc furnace mini mill in the world. It will have the largest stretcher leveler line in North America and its annual capacity will be 180,000 tons per year. This facility will cost around $21 million, and it’s set to open in August 2022. Friedman projects rapid payback as EBITDA is expected to be in the range of $4.5 million to $5.5 million based on historical average margins and an annual output of 110,000 tons to 140,000 tons.

Friedman Industries

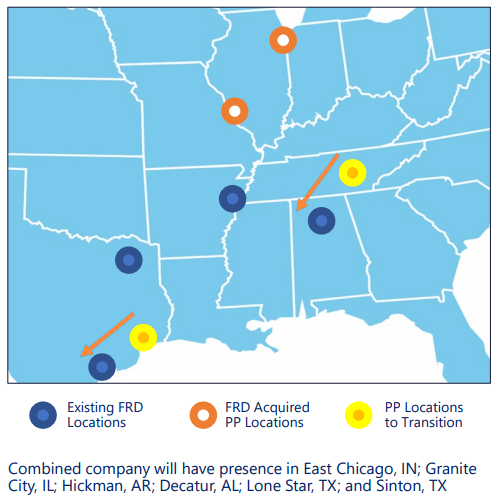

Second, Friedman recently bought two coil processing facilities for $63.8 million in cash and 516,041 shares from Plateplus which had a combined production volume of 163,000 tons for the year ended March 31, 2022. The deal also includes steel inventory and customer relationships from two other facilities, which had a combined production of 113,000 tons for the same period. This part is crucial as a large number of orders will be transferred to Friedman’s nearby Decatur and Sinton locations, allowing the latter to ramp up production fast.

Friedman Industries

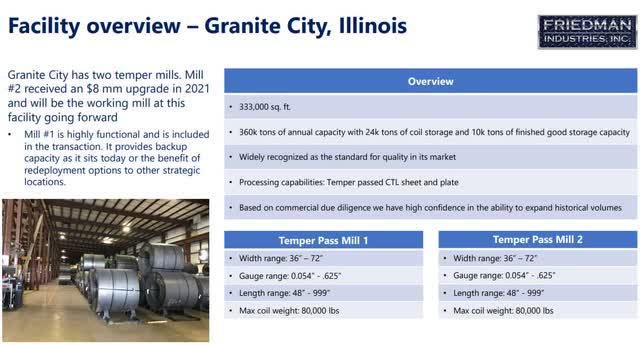

In my view, this is a good deal considering steel inventory accounts for about $45 million of the purchase price. The 516,041 shares and the other $18 million are for facilities with an annual production capacity of 512,000 tons, and one of them has a mill that underwent an $8 million upgrade in 2021. The two facilities should be easily integrated into Friedman’s business as the company’s CEO Mike Taylor is already familiar with them. You see, he served as president of Cargill’s metals service center business between 2002 to 2014 when these assets formed part of the group’s metals service center portfolio.

Friedman Industries Friedman Industries

Overall, I expect to see cost and operating synergies and there could also be increased order flow, as one company taking a 7% stake in Friedman in this deal is a large Japanese steelmaker named Metal One. Thanks to this transaction, Friedman will soon have 6 strategic locations, all of which are located near water. In addition, 5 of them have rail access. And the proximity to mills of Nucor and Steel Dynamics provides them with a strong moat from a logistics point of view.

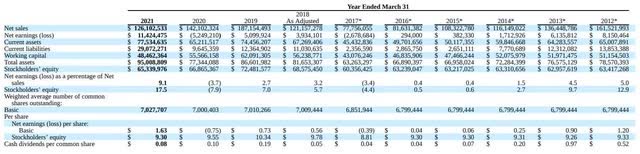

So, how are the financial results looking? Well, it’s difficult to forecast, but I think that annual net income could top $10 million in a normal market thanks to the Sinton facility and the Plateplus acquisition. The reason I say this is because hot-rolled coil steel prices have been very high and very volatile over the past two years.

This has resulted in the best financial results in Friedman’s history, and the company expects to book a net income of around $14 million for the year ended March 31, 2022.

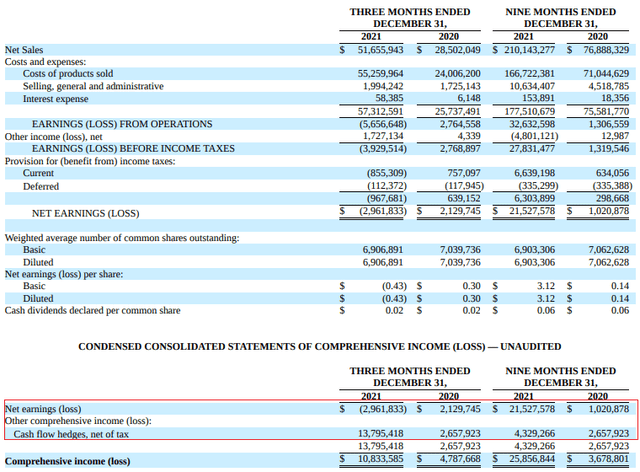

Friedman Industries

The issue here is that the net income over the past two years gets soaked up by inventories and there was no free cash flow. On the other hand, Friedman uses hedge contracts and the profits or losses from those are reflected in other comprehensive income. In Q4 2021 alone, gains from cash flow hedges came in at $13.8 million.

My point here is that falling hot-rolled coil steel prices could be good for the company as the hedges kick in and impact cash flow. In addition, lower prices are likely to boost orders from customers. However, the net earnings line will suffer, and you can see that Friedman’s net earnings for the first nine months of its FY were about $7.5 million higher than its expected annual profits of $14 million.

Looking at a more stable period, average annual net earnings between FY12 and FY19 were $2.9 million. Considering the Decatur facility went through a $7.2 million refurbishment in early 2021, I think we can bump the net earnings number up to $3.5 million when making forecasts. Add another $3 million for the Sinton facility and maybe another $3.5 million for the two Plateplus sites plus synergies, and we get to my $10 million figure. Overall, I think that Friedman should be worth at least $15 per share as this would mean it’s trading at about 10x P/E based on my earnings expectations.

So, what are the risks for the bull case? Well, I think the major one is that investors could focus their attention on falling hot-rolled coil steel prices and declining profits instead of on cash flow from operations and gains from cash flow hedges, and this puts more pressure on the share price. Also, Friedman is a microcap with low trading volume and the lack of net income over a quarter or two could lead to it dropping from the stock screeners of some investors.

Investor takeaway

I view Friedman as a small company with a good moat that has helped it weather financial storms over the past five decades. The future is looking bright as the new facility in Sinton is expected to bring in EBITDA of about $5 million per year and the deal for the Plateplus properties will more than double output as well as bring synergies.

I think that Friedman has the potential to generate an annual net income of over $10 million and that the recent decline in hot-rolled coil steel prices creates a window of opportunity to buy shares cheaply. My price target is $15 per share.