European Wax Center: Decent Returns Even At Current Valuation

AleksandarNakic/E+ via Getty Images

Summary

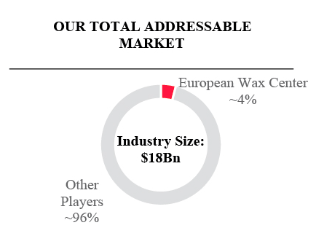

I recommend a HOLD rating on European Wax Center (NASDAQ:EWCZ). EWCZ is the franchisor and operator of out-of-home [OOH] waxing services, owning 4% of the total addressable market in the industry. Even though its current valuation is not attractive enough for new investors, the company’s discretionary market with recurring demand, leading market reach, unique franchise model, and positive brand recognition is a good reason for current shareholders to keep their position.

Company overview

EWCZ has straightforward business operations. In the United States, the firm is a franchisor and operator of OOH waxing services. The European Wax Center brand is reliable, effective, and accessible. In all of its convenient locations, the company’s licensed and EWC-trained estheticians provide clients with waxing services of the highest possible quality and level of hygiene. The technology-enabled guest interface provided by EWCZ helps to simplify and streamline the guest experience by automating appointment scheduling and providing the ability to check in remotely. The EWCZ pre-paid Wax Pass program makes payment simple and hassle-free, which in turn encourages customer loyalty and repeat visits.

Discretionary market with recurring demand

In the U.S., the majority of women and many men include hair removal as a regular and necessary part of their personal care and beauty routines. Given the recurring nature of hair growth, there is a consistent demand for products and services that can remove unwanted hair. For their hair removal needs, consumers turn to a variety of OOH services as well as at-home treatments. But people often find out that at-home solutions are less effective, messier, and more painful, and that they take a lot more time than OOH services given by highly trained professionals.

Based on the results of customer surveys, EWCZ thinks that about 40% of people looking for hair removal services wouldn’t consider laser hair removal and that 50% of people who have tried laser hair removal have given up on it because of the cost. According to the filings made by EWCZ, it is estimated that the company’s entire addressable domestic market is worth $18 billion and includes about 69 million individuals in the United States. They are either waxing at the present time or considering beginning the practice. The at-home waxing market, in which EWCZ competes, is the hair removal alternative that is growing at the fastest rate.

Based on recent estimates referenced from EWCZ S-1, the at-home waxing market has increased at a compound annual growth rate of 8% between 2015 and 2019, whereas the overall hair removal market grew at a 3% CAGR during the same time period. As we can see, OOH waxing services are becoming an increasingly non-discretionary and routine part of personal care and beauty regimens, which is fueling growth in the industry. Other secular trends that are contributing to the growth of OOH waxing include:

Increasing consumer interest in personal care and self-expression:

- Customer awareness of the efficiency and efficacy of OOH waxing in comparison to at-home solutions

- Affordability of OOH waxing is in contrast to other OOH solutions.

- Expanding geographical reach across the board

- Interest from a variety of age groups and genders

EWCZ is a leading player in the industry

I believe that EWCZ’s unmatched scale and exclusive concentration on waxing services make it possible for the business to take advantage of its potential and vast market opportunity. Even though EWCZ only has 4% of the addressable market at the moment, the company thinks that it is about 10x larger than its closest waxing-focused competitor in the OOH waxing industry in terms of system-wide sales and about 6x larger in terms of center count.

Furthermore, the market industry for EWCZ’s products and services is still highly fragmented, with more than 10,000 individual waxing-focused operators who lack scale and approximately 100,000 beauty salons that only provide waxing as a minor portion of their more comprehensive service offering (figures referenced from EWCZ S-1). Waxing is not a core competency for many beauty salons and other similar operators. As a result, waxing services are frequently provided in “backrooms” without significant investment in improving the customer experience as a whole. As a consequence of this fragmentation, the industry has become defined by variable quality, a lack of technological accessibility and scheduling, and one-time transactional services that are unable to establish trust in customers or encourage their engagement.

S-1

I have to add that the track record the EWCZ franchisees have of successfully building new centers and continually generating attractive unit-level economics confirms its strategy to expand its footprint and grow its capacity to accommodate more guests. EWCZ believes it has a significant opportunity for a whitespace of approximately 3,000 locations for its standard center format across the United States. This is because none of the company’s existing markets have been completely penetrated. In addition, approximately 75% of its whitespace opportunity is located in markets where EWCZ already has a presence today. This gives the company a lot of confidence that new locations will be well received and do well, which is good for the company’s business.

Beyond EWCZ’s immediate whitespace, it has an opportunity to expand center expansion and product distribution into non-traditional locales, overseas markets, and alternative center formats. By combining data from its guest database with internal analysis and external research, EWCZ can identify the optimal markets and places for expansion. EWCZ’s new centers need a modest initial investment and follow a highly predictable maturation curve across cohorts and geographies. This will make it easy for EWCZ and its franchisees to see how much money each new center has the potential to make.

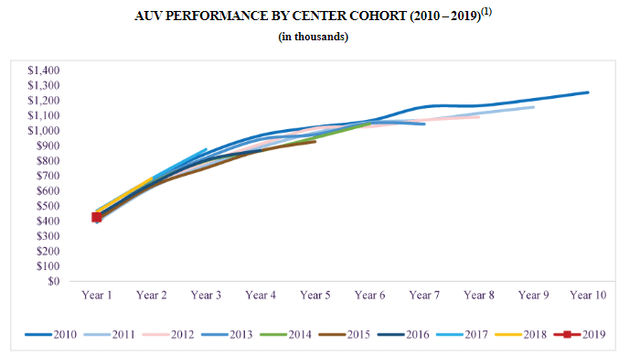

Attractive franchise model

EWCZ believes its value offer has built a franchisee base committed to brand growth. The attractive return on franchisees’ invested capital results from EWCZ’s simple yet difficult to replicate operational strategy. EWCZ centers require a modest initial capital investment, then quickly attain profitability and generate superior unit-level economics. A typical European Wax Center location typically reaches maturity in its fifth year of operation, at which point it earns an average yearly revenue of $1,000,000 and cash-on-cash returns of over 60%. The company obtains income from its franchisees through the sale of branded products and the payment of recurring fees, such as royalties and marketing fund contributions, which are based on the service sales of each center. EWCZ centers undergo a highly predictable maturation curve that is constant across cohorts and geographies, providing franchisees with a high level of assurance that they will generate significant returns. The following graph paints a very positive picture of how EWCZ franchisees have been performing over the past decade. (Note: AUV = average unit volume).

Brand matters

EWCZ believes that showing beautiful skin is the first step to revealing one’s best self, and its brand stands for providing guests with unabashed confidence. Waxing is a personal experience, and EWCZ clients expect a trusted, safe, and clean environment with a dependable wax specialist. I believe the company’s unmatched size allows it to have a nationwide presence and serve its dedicated customer base wherever it may be. EWCZ’s marketing activities have been creating national brand awareness and attention, which helps reaffirm the company’s exclusive dedication to providing the best service in its industry. Because the company is so certain in its capacity to fulfill its customers’ expectations, it has never charged any of its clients for the first wax that they receive. The NPS score of 85 demonstrates EWCZ guests’ devotion to its brand (NPS score as per S-1 filing).

EWCZ indicates that influential consumer trends will continue to grow the OOH waxing business and that the OOH market will continue to gain market share from alternative hair removal options. That’s why, even if its brand is well-known on a national scale, there are still ample opportunities for EWCZ to boost brand awareness to attract new visitors and increase the engagement of existing guests by increasing their visit frequency and the business’s products and services purchase. In addition, EWCZ believes there is a distinct chance to raise brand awareness among males, who make up 5% of the company’s total guests compared to 20% of the entire addressable market. Having said all of this, for the past five years, male interest in OOH waxing has increased significantly over the past five years. Through targeted male-oriented marketing literature and service options, EWCZ seeks to enhance its percentage of male visitors through male-oriented marketing materials and products and services designed for the male customer base.

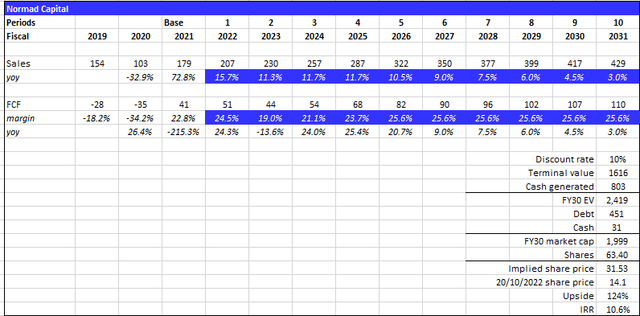

Valuation

At the current stock price of $14.1 and 63.4 million shares, the market cap is ~$900 million. I believe the current valuation is not attractive enough, although it can provide investors with market-like returns over the coming decade. I expect EWCZ to make $430 million in sales in FY31, giving it a market cap of $2 billion and a stock price of $31.53 in FY31 assuming a terminal growth rate of 3% and a discount rate of 10%.

Assumptions:

- Sales: to follow consensus’s estimates until FY26 and slowdown after to inflation levels over the next 5 years. Growth should eventually taper down as EWCZ has cleared all the low-hanging fruits as it reaches maturity levels.

- FCF margin: Similar to revenue, I used consensus’s estimates for first few years until 2025, and assumed that EWCZ has reached maturity in margins.

Risk

Quality assurance at franchisee level

The operational and financial success of EWCZ’s franchisees has a direct bearing on the company’s business, including such factors as the franchisees’ ability to implement strategic plans and their capacity to get necessary funding. If bad economic conditions hurt EWCZ franchisees and they can’t guarantee secure funding sources, their financial health may go down. This could mean that EWCZ’s sales go down, which could force the company to extend payment terms or make other changes.

Low barriers to entry

EWCZ competes with over 10,000 independent waxing operators and about 100,000 beauty salons that offer waxing as a sub-service of their overall service offerings. The company may be unable to compete effectively in certain markets in which it operates. Competitors may try to replicate the company’s business model or parts of it, which, I believe, might reduce EWCZ’s market share and brand recognition, as well as slow down the business’ growth pace and profitability.

Conclusion

The current valuation is not the best, but it could still yield investors decent market-like returns over the coming decade. EWCZ has been thriving to expand its business operations to a larger commercial scale and increase its profitability with modest investment costs. If current shareholders keep their position and the franchise business continues to expand, EWCZ may reach a market cap of $2 billion and a stock price of $31.53 in 2031.