EQT Stock: Buy This Dip, Get An +11% Return (NYSE:EQT)

imaginima/E+ via Getty Images

Investment Thesis

EQT (NYSE:EQT) has seen its share price sell-off in the past month. I make the case that this is actually better news than it seems.

Moreover, I lay out my assumptions for why EQT could return 50% of its 2023 free cash flows. This puts EQT on a potential path to returning an 11.8% combined yield in 2023, from today’s prices.

Altogether, investors paying 4x EQT’s 2023 free cash flows will be very well rewarded.

Here’s why I rate this stock a buy.

The Unjustified Drop, Spot a Pattern?

In the past month, since I wrote my bullish article on EQT, there has been a decidedly ”risk-off” stance from investors when it comes to energy stocks, particularly natural gas.

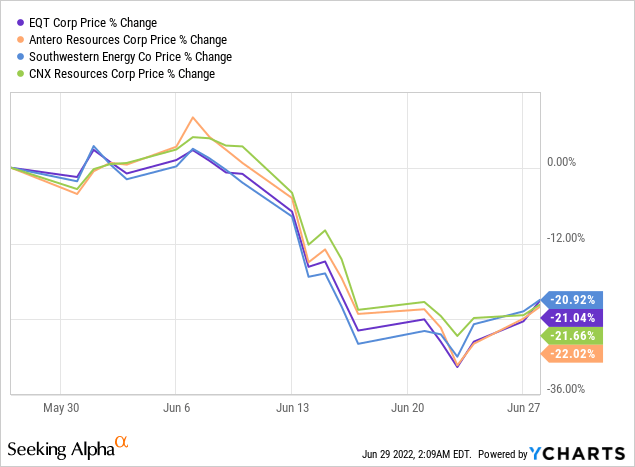

In the graphic above I demonstrate a select number of natural gas players that have all sold off by 20% in the past month. Why?

Here are a few reasons:

- The Freeport LNG caught fire. This led investors to argue that there could be a short-term, temporary, over-supply of natural gas in the US.

- In turn, this lent itself to natural gas prices on the spot market collapsing from $9.30 mmbtu to $6.00 mmbtu.

- Further, investors believed that natural stocks had rallied significantly, therefore they were overdue a pullback.

For these reasons, I make the case that investors were too quick to react. Still, in actuality, this mass selling of EQT is wealthy for the stock. The reason is that this pullback gets rid of ”weak hands” in the stock.

This means that investors that truly believed in the natural gas story didn’t want to sell, this group held on. While new shareholders now coming to the stock now, will be buying into a renewed bull thesis.

In sum, I make the argument that from this point, the risk-reward is even more favorable. Why?

Because we can see more and more data points to show investors that natural gas prices in the US are not likely to return to sub $5 any time soon.

There was a black swan event that took market participants by surprise. The fire at Freeport LNG. But with natural gas prices starting now to retrace higher, this demonstrably shows that demand is outstripping supply.

EQT’s Capital Allocation Strategy, 8.3% Combined Return

EQT has approximately $700 million worth of capital left authorized in its share repurchase program.

Given that EQT had repurchased $230 million worth of shares during the first 4 months of 2022, or approximately 2.5% of its outstanding shares, one can surmise the following.

EQT is likely to deploy the remaining $700 million in 2022. Hence, if EQT deploys $1 billion altogether throughout the whole of 2022, plus its 1.2% dividend yield, that puts its combined capital return at 8.3%.

The question this framework now puts forward is, will 2023 bring an even stronger capital return program? Before addressing this question, let’s first turn our focus to this important insight.

Blemish in the Bull Case

The one bearish consideration overhanging the bull case is that looking out to 2023, EQT’s book is 45% hedged.

While this doesn’t break the bull case, it does cap the amount of exposure investors will get from EQT.

That being said, there are investors that welcome the lack of volatility that EQT’s hedged book provides.

Having nearly half your natural gas volume hedged provides investors with visibility and a lack of negative surprises along the way.

Accordingly, this element could be valuable to the right sort of investor.

EQT Stock Valuation – 4x Free Cash Flow

EQT believes that as it moves to exit 2022, its net debt to EBITDA ratio could reach 0.8x.

From my perspective, this leads me to believe that EQT will be in a much better place in 2023 to increase its capital return.

In fact, remember that while EQT is guiding for $2.25 billion of free cash flow for 2022, EQT believes that it could make circa $3.5 billion of free cash flow in 2023.

This insight makes this investment very compelling from a few angles. Not only does this leave the stock priced at 4x next year’s free cash flows, a very low multiple, as you’ll no doubt agree?

But also, keep in mind what we’ve discussed earlier. Having nearly half of your 2023 book hedged provides investors with significant visibility all the way into next year.

And lastly, but by no means less meaningful, given that EQT will enter 2023, with its balance sheet in a much stronger position, this will leave EQT better positioned to meaningfully ramp up its capital return program next year.

The Bottom Line

In the past month, investors have seen EQT sell-off. Very few investors are now seriously considering EQT with a view toward EQT’s prospects as it enters 2023.

However, I make the argument that investors paying today 4x next year’s free cash flows are likely to benefit substantially. Not necessarily from EQT’s multiple expanding.

But more to do with the insight that as EQT enters 2023, EQT will have demonstrated that it can meet its 2022 free cash flow targets and pay down debt. And investors will then be positively ”surprised” by an increase in its capital allocation strategy.

In sum, it is not inconceivable that EQT will return 50% of its 2023 free cash flow back to shareholders. Perhaps, it could be said, that EQT returning 50% of its 2023 free cash flow is too conservative an assumption. After all, its balance sheet will be so much stronger, as discussed in the article.

Nevertheless, even using the 50% free cash flow capital return as a guide. That would mean that EQT would return $1.6 billion back to shareholders. Hence, today’s investors would be on a path to getting an 11.8% yield next year. That’s clearly very attractive, particularly in today’s market.