Enterprise Products Partners (EPD): 3 Implications From The 2.2% Distribution Hike

imaginima

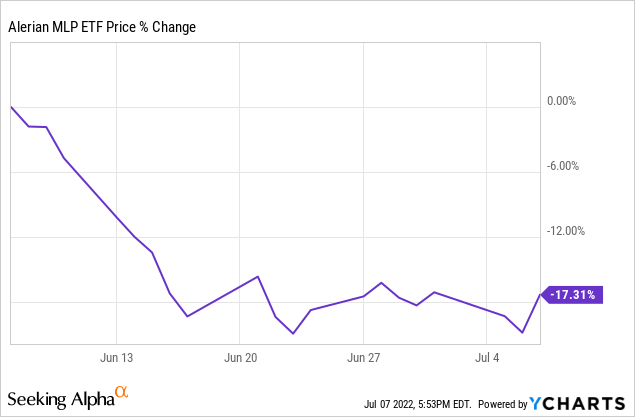

The midstream sector (AMLP) has sold off over the past month along with oil prices amid fears of a recession leading to demand destruction:

While it is certainly true that a steep decline in economic activity would likely lead to a decline in demand for energy, Enterprise Products Partners (NYSE:EPD) recently signaled confidence to the market by announcing its second distribution hike of 2022.

In announcing the distribution increase, management stated:

Enterprise Products Partners announced today that the board of directors of its general partner declared the quarterly cash distribution paid to limited partners holding Enterprise common units with respect to the second quarter of 2022 of $0.475 per unit, or $1.90 per unit on an annualized basis…This distribution represents a 5.6 percent increase over the distribution declared with regard to the second quarter of 2021.

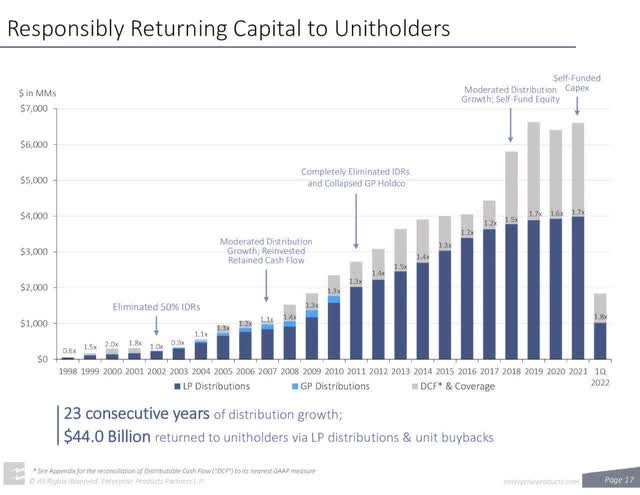

This distribution increase is the partnership’s 74th distribution increase since its initial public offering in 1998. This year will be the 24th consecutive year of distribution growth. During the second quarter of 2022, Enterprise repurchased $35 million of its common units in the open market. Inclusive of these purchases, the partnership has utilized 26 percent of its authorized $2.0 billion buyback program.

Here are three important implications from this announcement for EPD.

#1. EPD Is A Table-Pounding Strong Buy

What this effectively means is that 7.73% yielding EPD is also growing its distribution by at least 5.6% this year, resulting in a yield plus growth of 13.3% relative to the current unit price. Given that nearly 60% of that return is coming from the distribution itself and that EPD boasts a BBB+ credit rating and one of the highest quality business models in the midstream sector, EPD looks like an extremely attractive risk-adjusted investment right now.

On top of that, EPD is also gradually repurchasing units. While not as many as some would like, the fact that EPD continues to buy its units in addition to growing its distribution is a further sign that management has a lot of confidence in the value proposition of the common equity here.

#2. EPD Has A Very Strong Cash Flow Profile

In addition to painting a mouthwatering total return image for investors, this distribution hike also means that EPD has considerable confidence in the cash flow profile of the business, even in the face of a potential recession and plunging oil prices.

Back in December of last year we interviewed EPD and asked them the following question:

you had also mentioned on the earnings call that you wanted to increase the distribution probably by a larger amount this year than you had in the last few years. You specifically mentioned on the earnings call that you are trying to maintain purchase power parity in your distribution in the context of inflation. So, in other words, keep the buying power of your distribution somewhat the same year to year. I know you don’t give guidance, but as we look at the inflation numbers is that one of the main things that come into the calculus in terms of the exact amount you would raise it or are there other things that you consider that are more important?

Here was their answer (emphasis ours):

Yes. That is definitely a consideration, but our cash flow position is probably more important. In other words, we go through our budgeting process and ask, ok, what’s our cash from operations? What would happen if we had outsized earnings this year from the freeze and other things, and some of our assets come back down to a norm. What would our coverage be if we keep the distribution the same, if we raise it 3% if we raise it 5%, what’s the coverage? These are all things we look at. Coverage is very important. Balance sheets are very important. Cash flow is very important.

So, we look at all that and then if we can come in and pop it 3%, 4%, whatever the number is and we go through those gymnastics and inflation 3 ½% or whatever, those are things we look at…I think we are focused on what does ’22 look like? What’s my cash flow from operations? If I were to pay out 60%, what would that be? How do I want to split that? Because if you look at our history, it’s around 55/60% of cash flow from operations is what we payout to our shareholders.

What this tells us is that EPD is committed to distributing up to 60% of its cash flow from operations to unitholders and uses this guidepost as the metric by which it decides what level to set the distribution at.

At a $1.90 per unit annualized pace, that means that EPD believes it will generate at least $3.17 in cash flow from operations per unit over the next year. Cash flow from operations is essentially equivalent to distributable cash flow given management’s method for tabulating it and the example chart they provided in their latest investor presentation:

EPD Payout (Investor Presentation)

In 2021 they paid out roughly 60% of distributable cash flow per unit in distributions, which means that this increase implies that their forward DCF per unit growth profile is at least 5.6% and that they have considerable confidence in their ability to sustain that payout level through a potentially challenging economic and energy price environment.

While this appears to be news to Mr. Market, it should not be news to investors, who saw EPD brave the COVID-19 collapse of the energy markets without any issues. In fact, distributable cash flow only fell by 3.3% in 2020 and EPD’s board still increased the distribution by 1.1%.

#3. Management Is Actually Becoming More Bullish

While the first two takeaways are pretty clear cut, it is also important to note that this second hike of 2022 is unusual in two important ways:

- It marks the first time that EPD has hiked its quarterly distribution more than once per year since 2019.

- It marks a significant acceleration in distribution growth. Over the past five years the distribution has only grown at a measly 2.4% CAGR and over the past two years it has only grown at a 1.4% CAGR. This year’s 5.6%+ distribution growth rate shows that management is actually becoming more bullish on EPD’s growth potential moving forward.

Investor Takeaway

While Mr. Market may be selling off EPD and other midstream equities under the expectation that a recession will lead to demand destruction, EPD’s management is signaling to the markets that it is only growing more bullish on its own cash flow profile. By significantly accelerating its distribution growth rate, EPD is signaling that – with its stellar balance sheet and top-tier collection of commodity price resistant assets – it is very confident in its ability to not only weather but thrive through any storms sent its way for the foreseeable future.

As a result, we remain highly bullish on EPD and recently added to our large position.