Endeavour Silver: Margins In Trouble Until Silver Price Rebounds

DarioGaona/E+ via Getty Images

It’s been a rough two-month stretch for the Silver Miners Index (SIL), with the sector erasing its positive year-to-date performance, and falling deep into negative territory, underperforming even the Nasdaq-100 (QQQ). While some investors might cry of manipulation, the fact is that most of this decline is justified, given that silver producers entered the year with lofty valuations and up against very difficult year-over-year comps. The good news was that these difficult comps from lapping the attempted “silver squeeze” were supposed to end in Q2 2022.

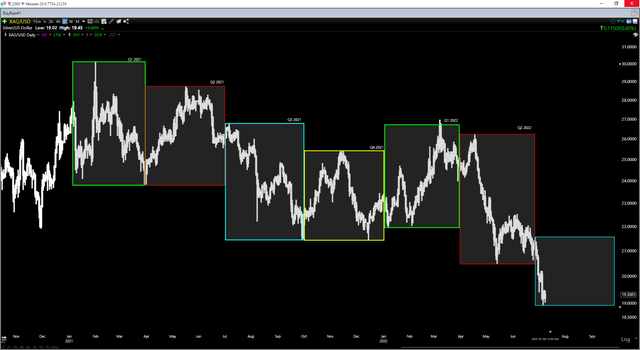

These year-over-year comparison issues are why I had warned against owning most silver producers until after Q2 Earnings Season. Unfortunately, the silver price weakness has put a dent in this outlook, given that it’s sitting well below Q3 2021 levels. One name that’s ultra-sensitive to this negative development is Endeavour Silver (NYSE:EXK), a high-cost producer in Mexico. With EXK trading near support ($3.00), a bounce in the stock is quite possible. However, with margin contraction ahead in Q3/Q4, I would view sharp rallies as selling opportunities.

Endeavour Silver Operations (Company Presentation)

Q2 Production

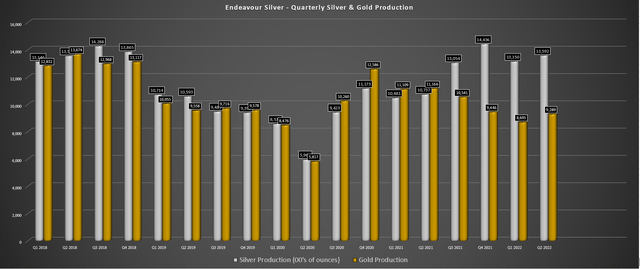

Endeavour Silver (“Endeavour”) released its preliminary Q2 results last week, reporting quarterly production of ~1.36 million ounces of silver and ~9,300 ounces of gold. This translated to a 27% increase in silver production vs. Q2 2021 levels, offset by a 17% decline in gold production with no benefit from production at El Compas, which is now in care & maintenance. The increase in silver-equivalent ounce [SEO] production despite operating two mines vs. three in the year-ago period was attributed to Guanacevi, which had another phenomenal quarter. At the same time, Bolanitos also saw a sharp increase in silver ounces produced. Let’s take a closer look below:

Endeavour Silver Quarterly Production (Company Filings, Author’s Chart)

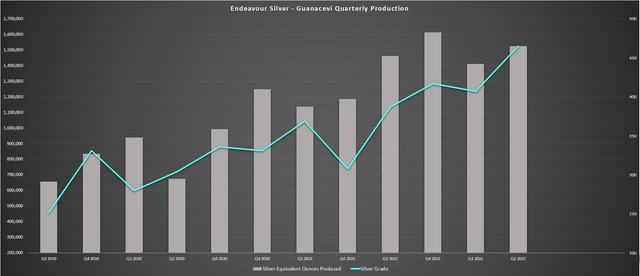

Beginning with the company’s flagship Guanacevi Mine, the mine posted better than expected grades in the period, partially offset by fewer tonnes milled. During the quarter, silver grades jumped to 465 grams per tonne, while gold grades increased to 1.37 grams per tonne, translating to an impressive silver-equivalent grade of nearly 600 grams per tonne. This compared favorably to the year-ago period, with an average silver-equivalent grade of ~400 grams per tonne on a constant gold/silver ratio basis. Based on this impressive grade performance, the mine produced over 1.5 million SEOs in the period.

Guanacevi Mine Production & Grades (Company Filings, Author’s Chart)

Moving over to Bolanitos, the mine also had a solid performance, producing ~165,100 ounces of silver, up more than 35% from the year-ago period (Q2 2021: ~120,000 ounces). This was partially offset by fewer gold ounces produced (~6,800 vs. ~5,600), but production was still up nicely on an SEO basis. Like Guanacevi, the increase in production year-over-year was driven by higher grades, with Bolanitos reporting similar throughput at 37% higher silver grades and similar recovery rates (~88%).

Following the solid Q2 results, Endeavor has produced ~2.67 million ounces and ~18,000 ounces of gold in H1. This has placed the company on track to easily beat its January guidance mid-point assumptions of 4.5 million ounces of silver and 33,000 ounces of gold. The improving operational results are a welcome surprise and certainly a much better performance than under the previous CEO, with a recent trend towards under-promising and over-delivering. Combined with a weaker Mexican Peso, we could see costs come in below the high end of guidance ($21.00/oz) and below my estimates of $22.50/oz for the year. The problem is that the company is getting no help from the silver price. Let’s take a look below:

Costs & Margins

Endeavour Silver was operating at a profit in Q2 and should have been past its period of difficult comps, which might have lifted a weight off the stock. Unfortunately, after the recent plunge in the silver price, it will now come up against relatively tough comps again in Q3. This is because the Q3 2021 average silver futures price came in at $24.30/oz ($24.56/oz for Endeavour Silver), and we’re now starting Q3 2022 below $20.00/oz. Even if we were to see a sharp rebound and Endeavour’s average realized price came in at $22.00/oz, this would represent a ~$2.50/oz headwind year-over-year in a period where costs are up due to inflationary pressures.

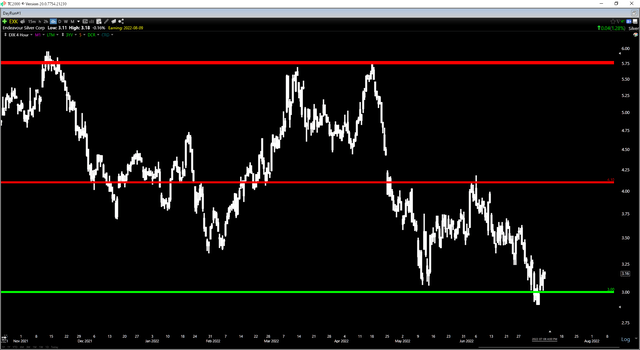

Silver Futures Price (TC2000.com)

Assuming all-in sustaining costs of $21.30/oz in Q3 2021 and an average realized silver price of $22.00/oz, we would see margins plunge from $7.10/oz in Q3 2021 to just $0.70/oz, and this is contingent on an immediate rebound in the price of silver. Besides, if we see costs come in above this level, we’d see a much uglier margin profile in Q3. Hence, the previous outlook that Endeavour Silver would have an easier back half looks to be off the table, potentially setting up what could be a rough Q3 financial report. Although Terronera would certainly fix this issue, it’s at least two years before this asset comes to the rescue to improve the margin profile.

The bull camp might argue that higher silver prices are on deck and that this decline in the silver price will be short-lived, helping EXK to return to positive margins. While this is a valid point, Endeavour needs more than $21.50/oz to improve its operations. In fact, a $27.00/oz silver price would be more beneficial to allow the company to aggressively drill out its properties and add to its reserve base. This is especially true in the case of Bolanitos, which is home to just ~820,000 ounces of silver reserves or barely one year of reserves at the Q2 run rate without meaningful reserve replacement in 2022. So, while EXK can get by with a $21.50/oz silver price, its operations are less sustainable at these prices.

Valuation & Technical Picture

Based on a current share price of $3.15 and ~187 million shares, Endeavour has a market cap of ~$590 million. This translates to a P/NAV of 1.0 compared to its estimated net asset value of $590 million. Although this is the cheapest valuation that Endeavour Silver has traded at in years, Endeavour is also in the weakest position it’s been in for the past two years, staring down a sub $20.00/oz silver price with operating costs expected to come in above $20.50/oz this year.

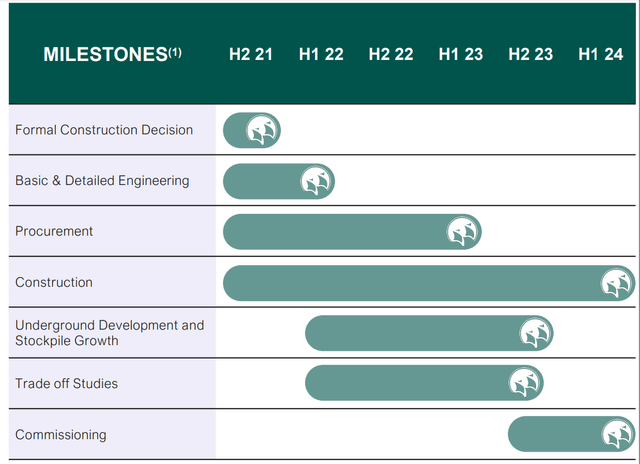

Some investors will point to Terronera being a game-changer once it’s in commercial production, allowing Endeavour to improve its margin profile significantly. However, I would not rule out cost overruns, suggesting that we could see additional share dilution before commercial production is reached. In addition, while Terronera could be in commercial production by Q1 2025, that doesn’t help Endeavour today if the silver price doesn’t recover sharply. Therefore, this is not the same as a story like Alamos Gold (AGI), which also has meaningful margin expansion on the horizon but is currently operating at a ~30% AISC margin.

Endeavour Silver – Terronera Projected Timeline (Company Presentation)

To summarize, Endeavour may benefit from being a producer with a relatively low-capex project that can transform its margin profile, but I don’t see any investment case here. This is because it has razor-thin margins even if the silver price rebounds and could be operating at a loss during Terronera construction from an all-in cost standpoint unless the silver price gets back above $23.50/oz. In my view, this increases the risk of share dilution over the next two years, making Endeavour a trading stock only due to its high sensitivity to the silver price and potential inability to weather a deeper downturn.

Technical Picture

Fortunately, from a technical standpoint, EXK has found itself sitting right on a key support level at $3.00, with no strong resistance until $4.10. This leaves the stock in a low-risk buy zone for nimble traders. However, Endeavour is not an investment vehicle, and if I were trading the stock from a swing-trading standpoint, I would not be greedy and look to book profits into strength if they materialize. Hence, if we were to see the stock rally above $3.75 before October, I would view this as a profit-taking opportunity.

Summary

Endeavour put together a solid Q2 performance, benefiting from higher gold and silver grades at Guanacevi, and it’s tracking ahead of 2022 guidance. However, this has been completely overshadowed by the silver price being pummeled, leaving Endeavour with razor-thin margins on existing operations. The silver lining is that the stock is short-term oversold and could enjoy a sharp bounce. However, with it being one of the weakest producers sector-wide from a margin standpoint, I continue to see EXK as un-investable. Hence, I would view rallies above $3.75 before October as an opportunity to book profits.