Elemental Royalties: Solid Q1 Results & Proposed Merger (OTCQX:ELEMF)

Falcor/E+ via Getty Images

It was a tough Q1 Earnings Season for the Gold Juniors Index (GDXJ), but the precious metal royalty companies bucked the trend, enjoying similar sales volumes at higher gold prices. One stand-out performer among the group was Elemental Royalties (OTCQX:ELEMF), which reported an 82% increase in sales on the back of much higher attributable gold-equivalent ounce volume. The big news, though, was the proposed merger with Altus Strategies (OTCQX:ALTUF). While a merger would benefit both companies, I don’t see a clear path to an upside re-rating, and I continue to see more attractive opportunities elsewhere.

All figures are in United States Dollars unless otherwise noted.

Karlawinda Gold Project – Elemental 2% NSR Royalty (Company Presentation)

Just over four months ago, I wrote on Elemental Royalties, noting that there was little value in owning the stock at US$1.30. This is because it was propped up by a premium in a Gold Royalty (GROY) takeover offer that was destined to fail, and there was no way for the company to justify this valuation standing on its own feet given the lack of portfolio depth. Since then, the stock has slid 25% and is one of the worst-performing royalty/streaming companies sector-wide. In fact, it’s underperformed Royal Gold (RGLD) by more than 2500 basis points in the past four months. In this update, we’ll look at whether this recent underperformance and recent developments justify taking a long position:

Q1 Results

Elemental released its Q1 results last month, reporting quarterly sales of 1,148 gold-equivalent ounces [GEOs], attributed to the start of commercial production at its largest Karlawinda royalty asset, and increased production by Zijin Mining (OTCPK:ZIJMF) at Mt. Pleasant. This was offset by lower attributable GEOs sold at all of its other assets, with Amancaya, Kwale, and Wahgnion all seeing lower production on a year-over-year basis. Notably, at Karlawinda, Capricorn Metals produced ~31,800 ounces at sub $850/oz all-in sustaining costs, making this one of the highest-margin sub-200,000-ounce per annum mines sector-wide in Q1 2022.

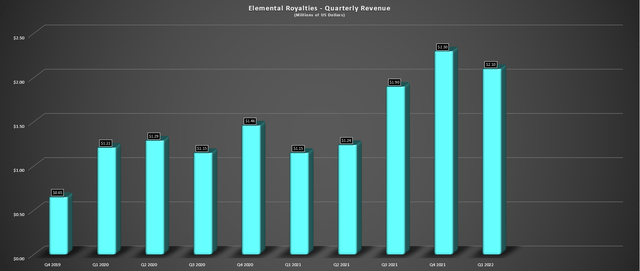

Elemental Royalties – Quarterly Revenue (Company Filings, Author’s Chart)

This increase in gold sales helped Elemental report revenue of ~$2.1 million, an 82% increase from the year-ago period and a more than 70% increase from Q1 2020 levels. Notably, further revenue growth is on deck as the company is set to see a contribution from the Mercedes Mine before year-end and a meaningful contribution from its recently acquired 50% gold stream on the Ming copper-gold mine in Newfoundland. Assuming a $1,800/oz gold price, Elemental will see a ~70% increase in revenue in FY2022, with its guidance of 5,700 – 6,700 attributable GEOs this year.

Proposed Merger Of Equals

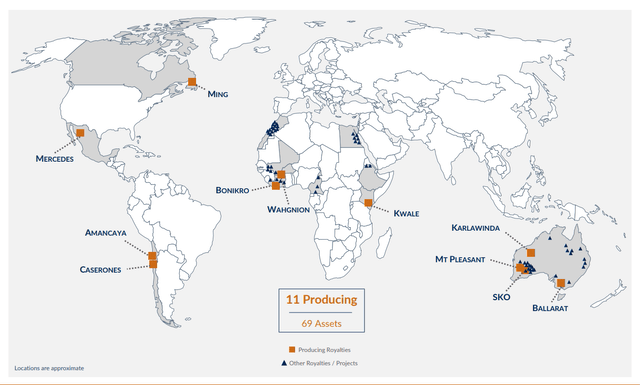

While the Q1 results were solid and H2 2022 results are expected to be even better, the major news in the quarter was the proposed merger with Altus Strategies, another royalty company in the sector that employs a slightly different business model. In Altus’ case, the company has a diversified portfolio of royalty assets that include Caserones, Bonikro, and South Kalgoorlie, with solid operators that include JX Nippon Mining & Metals and Northern Star Resources (OTCPK:NESRF). However, unlike most of its peers, Altus has a project and royalty generator model, advancing projects with modest upfront capital with plans to monetize them later and ideally retain a royalty.

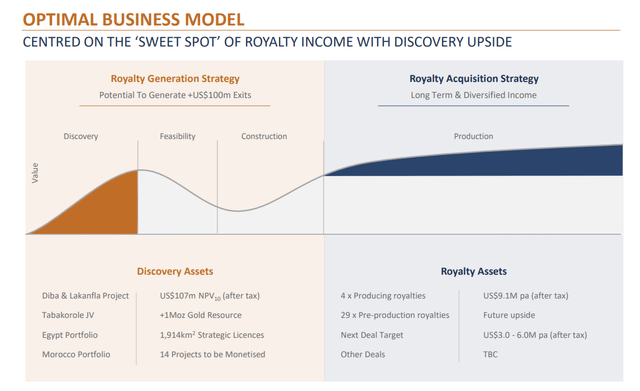

Altus Strategies Business Model (Company Presentation)

Altus also differs from its peers on the basis that it has no issue venturing into Africa, given that the continent has some of the shallowest gold deposits globally, meaning that operators can find out whether they’re right about a prospective deposit as quickly and cheaply as possible. This has paid off in the case of its Diba/Lakanfla, which showed an After-Tax NPV (10%) of over $125 million at $1,700/oz gold, with very modest upfront capex. It’s important to note that this PEA was completed with the benefit of H1 2020 pricing ahead of significant inflationary pressures sector-wide. Still, I would expect upfront capex to be below $40 million even with tightened costs and adjustments for inflationary pressures, making it a relatively attractive project for a prospective buyer.

The negative to this business model is that Altus spends upwards of $700,000 in exploration per quarter on a trailing-twelve-month basis, and most royalty/streaming investors are there for the high margins and cash flow generation, not the more hybrid business model. However, with over $10 million in revenue per annum (2024 estimates) and additional upside from monetizing assets, the exploration costs are easily financed, providing investors exposure to a steadily growing royalty portfolio with optionality in the case of a major discovery.

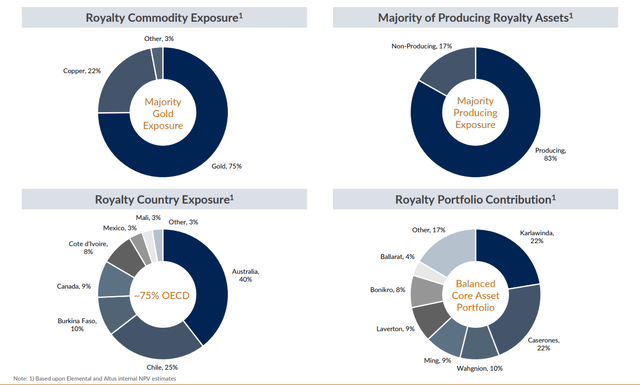

Elemental/Altus Diversification (Company Presentation)

Looking at the above charts, we can see that the rationale for the merger is quite clear, with benefits to both parties. In Altus’ case, it adds more producing royalties and diversifies into some Tier-1 jurisdictions like Canada, plus added exposure to Australia. For Elemental, the company adds a key royalty in Bonikro, and it enjoys improved diversification, no longer having ~75% of its attributable GEOs coming from just two assets (Wahgnion, Karlawinda). Meanwhile, it picks up some additional revenue growth from Bonikro, which Allied Gold operates. Finally, Elemental gains some copper exposure to Caserones and adds two experienced and world-class operators as partners (Northern Star and JX Nippon Mining & Metals).

Overall, this looks like a smart move for both companies, especially if they can gain access to a lower cost of capital given their size. The one drawback, though, is that it’s unclear how the market will value a company that has gone from a pure-play royalty story to a semi-hybrid royalty model, even if the portfolio has increased in size from both a revenue and number of assets standpoint. It’s also worth noting that while Altus adds depth to Elemental, which Elemental clearly lacked with a tiny pipeline, few of Altus’ pre-production royalty assets look to be near production (ex-Bonikro), so while the total royalty figure soars (10 to 40+) for the combined company, there’s not much immediate growth set to come online.

Finally, while Elemental will see some immediate growth from the Ming gold-copper mine and the Mercedes Mine, neither operator is what I would consider strong, with sub $100 million market capitalization. One of these assets (Mercedes) has changed hands multiple times this decade and is saddled with royalties/streams, and was most recently sold by Equinox (EQX) after the company previously appeared to have high hopes for the project, looking to increase production to 100,000 ounces per annum.

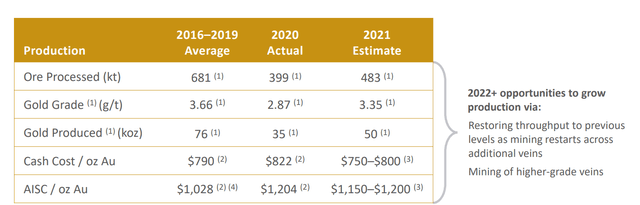

Mercedes Mine Costs (Bear Creek Presentation)

Mercedes could end up working out for Bear Creek (OTCQX:BCEKF) and its royalty partners, but I don’t have high hopes for the project, especially given that it was a very high-cost asset under Equinox and Premier, which was before the last bout of inflationary pressures that have further dented margins sector-wide. Most mines will absorb these costs, see some margin hit long-term, but do just fine. However, I have a less optimistic view post-2025 on mines that are likely to have $1,300/oz+ all-in sustaining costs and have relatively short reserve lives.

Valuation

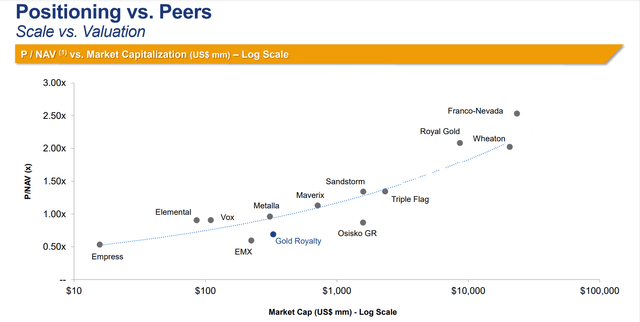

Based on ~82 million fully diluted shares and a share price of US$1.03, Elemental Royalties trades at a market cap of ~$85 million. This leaves the company trading at approximately 7.7x FY2022 revenue estimates (~$11 million), a very reasonable valuation for a royalty/streaming company, and a deep discount to its peer group of Metalla (MTA), Maverix (MMX), and Orogen (OTCQX:OGNRF). However, from a more relevant P/NAV basis standpoint, Elemental continues to trade at near 1.0x P/NAV, which is actually a slight premium to Metalla and Osisko Gold Royalties (OR), and a significant premium to EMX Royalties (EMX).

Peer Group Valuations (Thomson One Analytics, FactSet, Author Estimates, Gold Royalty Corp. Chart)

In my view, this slight premium is not justified, given that Elemental has much less depth to its portfolio with just ten total assets, and its non-producing assets are held by relatively small operators (Focus Minerals, Future Metals, Rumble). Meanwhile, nearly half its producing royalties aren’t held by strong operators either, with three of its operators sporting market caps below $100 million. This is not the case with Metalla and Osisko Gold Royalties, which have multiple larger operators as partners, with multiple development-stage royalties also held by much larger operators like Yamana (AUY) and Agnico Eagle (AEM).

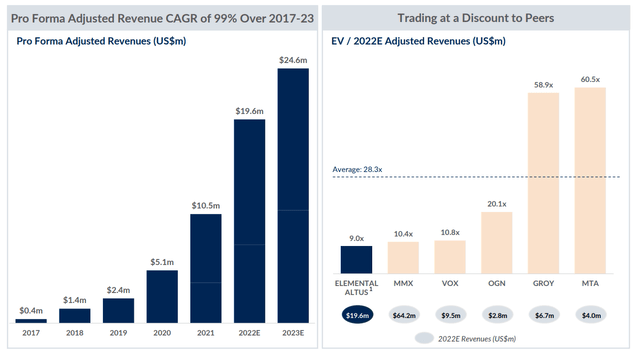

Some investors might argue that the proposed merger (Altus/Elemental) could help close this valuation gap and contribute to a premium multiple, asserting that the combined scale, diversification, and added depth will be a game-changer. I would disagree, given that the combined company’s scale will improve but not be all that significant relative to junior and mid-tier peers (~$24 million in annual revenue in 2023). Meanwhile, given Altus’ more hybrid model, which the market has not embraced that favorably in the past, this could actually offset any multiple expansion from the improved size and diversification.

Pro-Forma Figures – Elemental/Altus (Company Presentation)

In fact, we have seen this with other royalty companies previously with hybrid models and continue to see this with EMX Royalty, which consistently trades at a deep discount to peers with a less pure-play royalty/streaming model. This doesn’t mean that this isn’t an interesting strategy that can pay off in spades, and both EMX and Altus have a history of generating a solid return on their pre-royalty generation strategy. Still, regardless of how one feels about the business, it’s yet to attract premium multiples to these companies and often leads to the opposite (lower multiples), at least post-2016.

Updated Asset Portfolio – Elemental/Altus (Company Presentation)

Finally, although this improved scale will catapult the combined company past companies like Empress (OTCQB:EMPYF), Orogen, and EMX from an annual revenue standpoint, we’ve seen consolidation in the space recently and several positive developments among the junior/mid-tier royalty names. For example, we saw the acquisition of Nomad (NSR) to create a larger company, and Maverix looks to have a solid path to $100+ million in revenue by 2026. So, even if one argues that Elemental just got more attractive if this merger goes through, its peers like Maverix have also become more attractive, as have their valuations, making it harder to justify stooping to owning a small royalty company with a semi-hybrid model.

Summary

At ~1.0x P/NAV and less than 8x forward sales, Elemental has become much more reasonably valued, both on an individual basis (no merger), or an amalgamated basis, assuming the proposed merger goes through. Having said that, its peers have also become more attractive, with Osisko Gold Royalties (OR) now trading at less than 0.80x P/NAV with an industry-leading growth profile, a more mature portfolio, and a Tier-1 focus from a jurisdictional standpoint. For this reason, while Elemental is attractively priced, I continue to see far more relative value in the sector. In summary, while I would view pullbacks below US$0.88 as medium-risk buying opportunities, I have no plans to buy Elemental at current levels.