Diversified Royalty Stock: The 7.6% Yielding Debentures Are Very Appealing (BEVFF)

Kevin Brine/iStock Editorial via Getty Images

Introduction

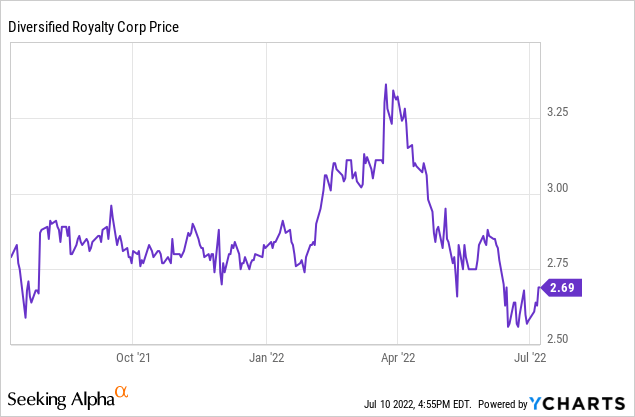

In an April article, I discussed how Diversified Royalty Corp. (OTCPK:BEVFF) was getting back on the right track as the economic situation improved and its royalty income streams were increasing. Back in April, the debt had a higher yield to maturity than the dividend yield of the common shares but that has now changed as the share price lost about 16%, pushing the dividend yield to 8.2% based on the current share price (in Canadian Dollar).

Diversified’s primary listing is on the Toronto Stock Exchange where it’s trading with DIV as its ticker symbol. The average daily volume in Toronto is approximately 300,000 shares per day, making it a much more liquid listing than its US listing which has an average volume of just a few thousand shares per day.

As Diversified Royalty reports its financial results in Canadian Dollar, I will use the CAD as base currency throughout the article. To see a breakdown of the royalties owned by Diversified, I’d suggest to read the previous article or the company’s annual information form as this article is meant as an update on my investment thesis.

The year started well and the dividends were fully covered

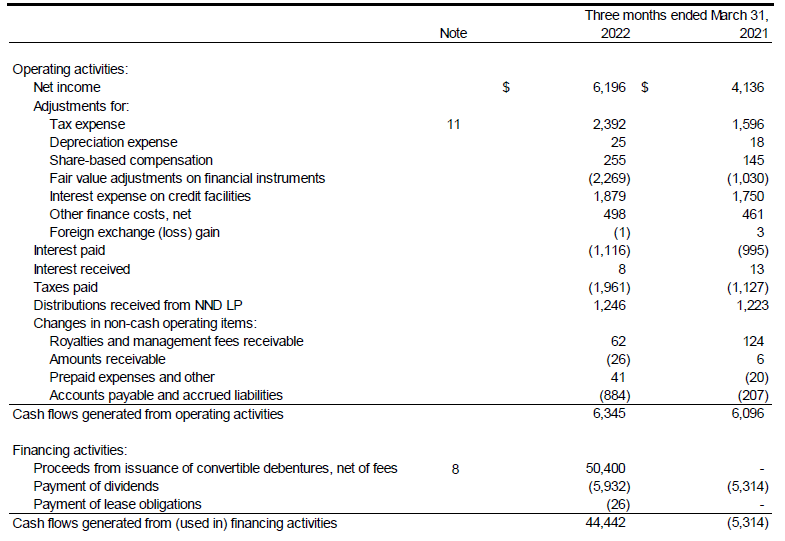

The cash flow results are more important for Diversified Royalty than its income statement as the company pretty much pays out its entire incoming cash flow as a dividend to its shareholders.

Looking at the Q1 results, we see Diversified reported an operating cash flow of C$6.35M and after adjusting this for changes in the working capital position, the adjusted operating cash flow was C$7.15M.

DIV Investor Relations

As you can see in the image above, the amount of taxes due based on the income statement came in at C$2.4M but as the pre-tax income included the fair value adjustments on financial instruments which boosted the reported income but mainly consisted of unrealized items, the total amount of taxes effectively paid by the company came in at just C$2M.

As Diversified is a royalty company taking a cut from the top line from the results of its royalty payers, there’s no capex involved. The only capex Diversified ever has to incur would be buying new desk chairs or laptops, as a figure of speech. This means the C$7.15M adjusted operating cash flow also is the free cash flow with the caveat the interest payments fluctuate throughout the year as the company pays the interest on its convertible debentures in Q2 and Q4 on a semi-annual basis. This means Q1 and Q3 are traditionally pretty light on cash interest payments.

With a total share count of 122.9M shares outstanding, the Q1 FCF per share was around C$0.058 which fully covers the C$0.055 quarterly dividend (paid out as C$0.018333 per share per month).

I still prefer to be a creditor rather than a shareholder, especially given the Air Miles uncertainty

With the stock trading at C$2.69, the dividend yield has now increased to in excess of 8%, but at this point I’m still not interested in buying the stock. As of the end of March, the net debt was approximately C$156M and considering Diversified has a dividend payout ratio of close to 100%, there isn’t much room for debt reduction.

Additionally, Loyalty Ventures (LYLT) announced a key participant of its Air Miles loyalty program, the Safeway and Sobeys grocery chain, was cancelling its contract and is setting up its own loyalty program. Although Loyalty Ventures tries to downplay the impact saying the contract only contributed 10% to Air Miles’ EBITDA in 2021, this will for sure hit the revenue of the program and will have a direct impact on Diversified’s royalty income. And as we saw in Q1, there’s very little wiggle room for Diversified Royalty on its dividend payments considering its payout ratio is close to 100%. Unless the Air Miles program can find new major customers and/or Diversified adds another asset to its stable, it is possible the dividend won’t be fully covered anymore in 2023 when Sobeys is phasing out its participation.

And this suddenly makes the newly issued 6% debentures more interesting. The company issued C$52.5M of 2027 debentures with a 6% coupon at the end of Q1. These debt securities will mature on June 30, 2027. As they are trading at just 93.5% of par, the yield to maturity is actually 7.6%.

TMX Group

While I may be missing out on capital appreciation and inflation-related revenue increases and thus royalty income increases for Diversified Royalty Corp, I like the risk/reward ratio of the debentures better. Sure I won’t be participating in any capital gains but as the company has a payout ratio of close to 100% it should be seen as an income stock rather than a capital gains stock. And I just feel more comfortable holding the 5 year debt earning 7.6% while knowing a creditor always has an advantage over the shareholder of a company.

Investment thesis

If it wasn’t for the Sobeys/Air Miles news I likely would have been very interested in picking up the stock again at the current price level. But seeing how a major participant is leaving the Air Miles loyalty program, I think it could be difficult for Diversified to keep the dividend fully covered.

Inflation may actually help DIV as the higher prices charged by the Mr Lube car service stations should also increase the royalty revenue so there is a chance Diversified could keep the impact limited. But seeing how I can earn a yield of about 7.6% on the debt, I think that is the better/safer option for me and my portfolio.

I have a long position in Diversified Royalty’s debenture and may continue to add on weakness. At 92% of par, for instance, the YTM increases to just under 8%.