Direxion Energy Bull 2X Shares: Buy After Assessing Windfall Taxes

William_Potter

In my recent article on the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares ETF (NYSEARCA:GUSH), I used data provided by the International Energy Agency (“IEA”) concerning expectations for oil demand in 2022 to justify my bullish instance. With this thesis, I provide arguments for trading the Direxion Daily Energy Bull 2X Shares (NYSEARCA:ERX) based on a more recent update by the Organization of Petrol Exporting Countries (OPEC), but there has been another important development pertaining to major oil companies possibly being inflicted with windfall gains taxes by the Biden Administration.

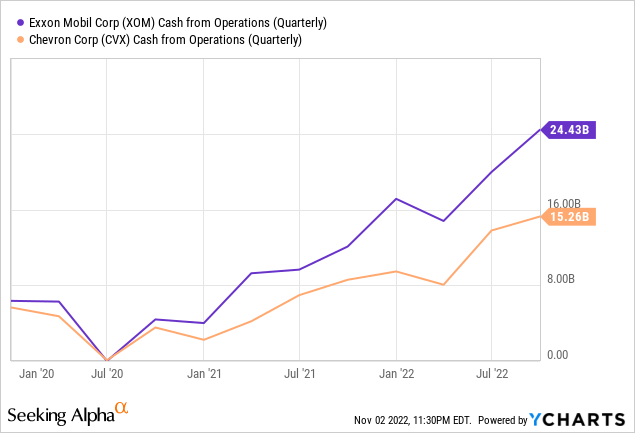

Now, as seen below, the cash from operations of Exxon Mobil (XOM) and Chevron (CVX), two of ERX’s holdings, has indeed increased by more than 200% over the last three years, but this thesis will also show that it is improbable for them to be taxed more than what they are already paying.

I start with the factors which may have prompted lawmakers to consider an increase in taxation, especially after the application of the Tax Cuts and Jobs Acts in 2017 which decreased the tax rate for U.S. corporations including oil corporations from 35% to 21% mostly as a result of the deferred taxes mechanism.

The French Precedent and High Gas Prices

Thus, for those who wonder where the U.S. government got this inspiration, look no further than Europe, more particularly France. In this respect, the French authorities have already drafted an amendment to the 2023 finance bill aimed at introducing an exceptional contribution to the “excessive profits” of the oil industry. One major French company that took full advantage of the spectacular rise in oil, gas, and electricity prices is TotalEnergies (TTE), which just like some of its other European or American counterparts rapidly swung from losses in 2020 to record profits in 2021.

Secondly, with the midterm elections looming and with people unhappy with inflation and rising gas prices at the pump, it seemed natural to once again put pressure on the oil majors to help keep rising energy costs in check. For this matter, a reduction in gas prices would certainly have a major impact on the daily lives of millions of Americans, who face exceptionally high prices at the pump given that the price of a gallon of gasoline had already exceeded $5 in the spring of 2022.

However, with the U.S. President’s “governing majorities on the line“, as of November 3, it is unlikely for the current Administration to implement such fiscal measures. Along these same lines, adverse fiscal measures may also prove counterproductive as oil companies have to spend a large chunk of profits as Capex for drilling and producing more hydrocarbons to offset the loss in supply resulting from the Ukrainian conflict and cutting off the flow of Russian natural gas to Europe.

Coincidentally, these arguments also justify a bullish case on oil or ERX.

Bullish on ERX

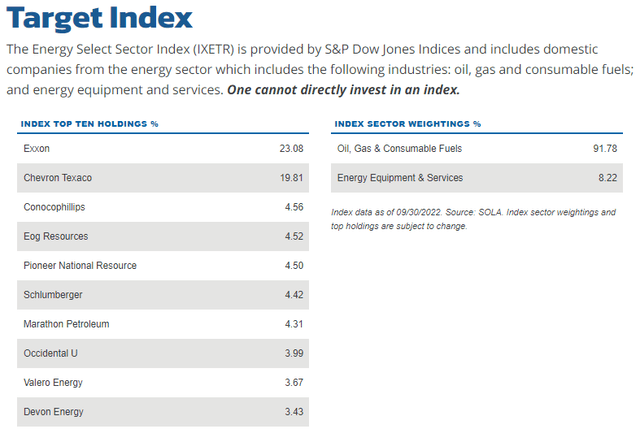

As seen in the table below, the ETF tracks S&P Dow Jones’ Energy Sector Select Index, whose underlying fund includes domestic companies from oil, gas, and consumable fuels at 91.78%. There is also equipment and services at 8.22%. Equally important, ERX tracks the index at an accelerated rate of two times (2x).

ERX’s Target Index and Holdings (www.direxion.com)

Looking at the list of holdings above, there are two U.S. oil majors.

Their peers in the U.K are likely to see a financial burden of about $45.55 billion over five years as a result of the new government’s plan to impose windfall taxes in order to raise money for subsidizing people afflicted by soaring electricity bills. Thinking aloud, the ETF, through its holdings may even profit from more inflows as new investors or existing ones wishing to put money in the energy sector choose U.S. companies that are seen as relatively immune to windfall taxes on their profits.

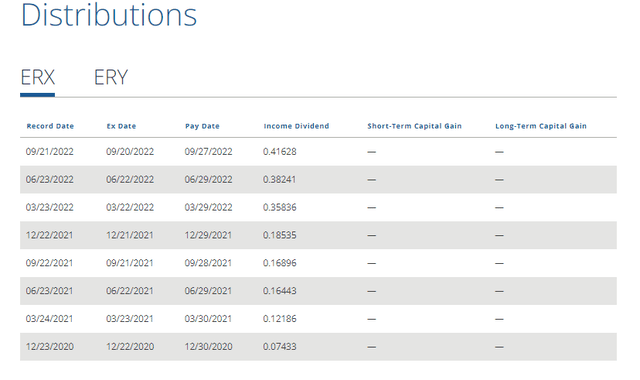

As a result, the stocks composing the Direxion ETF are unlikely to cut dividends and in this respect, they pay some of the most enticing dividend yields in the stock market. It is this ability to regularly make distributions to shareholders which also explains why in addition to capital appreciation, ERX pays dividends at a forward yield of 2.42%. The regular quarterly distributions are shown in the table below.

Quarterly Distributions (www.direxion.com)

Still, investors are reminded that its peer the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (ERY) as pictured above, which by the way profits when energy companies’ stocks suffer from downsides does not provide any distributions currently. In fact the last time, the bear ETF did make distributions was on March 25, 2020, at a time when most investors were dumping oil stocks and the S&P Energy Select Sector Index (as per the blue chart below) was down by more than 50% only in a matter of weeks.

The Compounding Risks and Timing

With COVID now a distant nightmare in most parts of the world excluding China, it is better to stick with ERX whose net expense ratio of 0.94% is offset by its above-2% dividend yields.

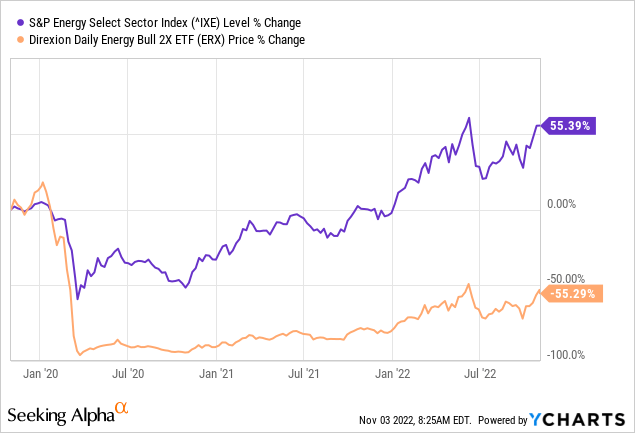

On the other hand, the bull ETF remains vulnerable to risks related to the compounding effect, where a trader can see his gains trimmed, or not being 200% (as advertised by the issuers) when the index has appreciated by 100%. To illustrate my point, one can notice that ERX as per the orange chart below has appreciated less than the Energy sector during the last three years, which is abnormal given the two times acceleration.

This abnormality is explained by the compounding effect whereby the index has indeed appreciated but its path has been highly volatile. For this matter, there is so much news that hit the market on a daily basis which has the potential to drive the price of crude oil higher or lower. As a result, energy companies that depend on the commodity also suffer the same fate.

Furthermore, it may seem illogical for an ETF that thrives on volatility, to have its gains trimmed by market fluctuations, but this is something that is common to all highly leveraged ETFs. This is the reason why, unlike a buy-and-hold approach, you want to be invested only for a relatively limited period of time, possibly 1-3 months.

Here, it is important to get the timing right.

Hence, with an RSI of 62.83, or above 50 by at least 12 points, the ETF could fall further from its share price of $68.94, possibly to $62-64, a support level that it has reached at least four times this year. This could constitute an entry level for those wishing to position themselves.

Moreover, one can learn from the reasons for the recent fall from the $73.32 level. First, there is the recent hike in interest rates by 75 basis points and the Fed’s Chairman clearly indicated that this was no time for a pause. This boosted the U.S. dollar which adversely impacted commodities all across the board including precious and industrials metals, as well as oil. Second, there has been some unverified news emanating from China about lockdowns being removed by March 2023 which triggered a rally in Chinese stocks and may also have helped oil prices on Wednesday.

Now, in case of lockdowns are removed in China which was the world’s largest automobile market by new registrations in 2021 the demand for oil would certainly get a boost, and prices too. Thus, in addition to monetary policy, factors like demand and supply are also at play here.

Conclusion

Staying with demand-supply dynamics and coming back to OPEC, it predicts that the world oil demand is expected to reach 107 Mb/d or million barrels per day in 2027. This looks like a continuous increase over the 99.7 mb/d and 101.8 mb/d projected by the EIA for 2022 and 2023 respectively. Now, these are long-term factors, but there are short-term ones too, specifically limitations on the import of Russian crude oil by European countries and Saudi Arabia having urged OPEC+ members to cut production by a hefty 1 Md/d. These two factors basically limit supply while at the same time a recovery in airline travel is also helping demand.

Finally, this thesis has made a bullish case for ERX, but bear in mind that volatility is a constant for oil traders. Also, with the U.S. remaining a solid bastion of the free market economy, it is less likely for windfall gains taxes to be imposed on oil stocks. In fact, they should be rewarded for increasing production while Russia is sidelined and OPEC wants to cut production. As for ERX, it could again flirt with the $78.8 level after benefiting from more inflows as oil investors and traders switch to American producers since taxes may limit the ability of European peers to increment dividend payments to shareholders.