Delek Logistics: Positive Momentum Heading Into 2023 (NYSE:DKL)

tortoon

Introduction

Following a stellar performance during both 2020 and 2021, Delek Logistics Partners (NYSE:DKL) was leveraging up to boost distribution growth via their 3Bear Energy acquisition earlier in 2022, as my previous article highlighted. Thanks to their effective integration during the subsequent second and third quarters, they have created positive momentum heading into 2023 and beyond, as discussed within this follow-up analysis.

Coverage Summary & Ratings

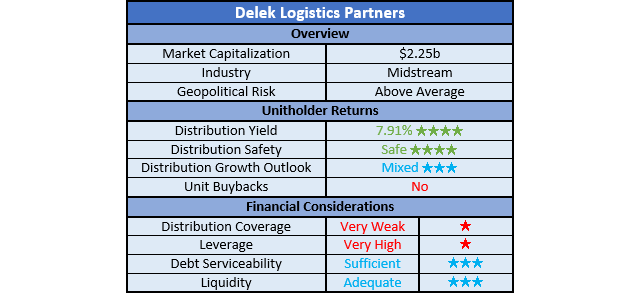

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

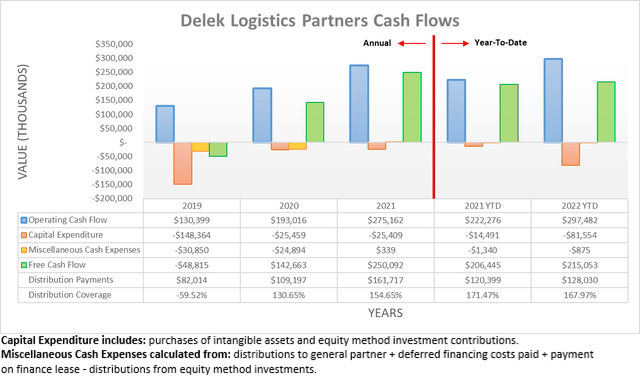

Following steady and business-as-usual cash flow performance during the first quarter of 2022, their operating cash flow surged ahead following the second and third quarters. Obviously, this was helped along by their 3Bear Energy acquisition that was completed right at the end of the second quarter and as a result, their operating cash flow during the first nine months landed at $297.5m and thus one-third higher year-on-year versus their previous result of $222.3m during the first nine months of 2021.

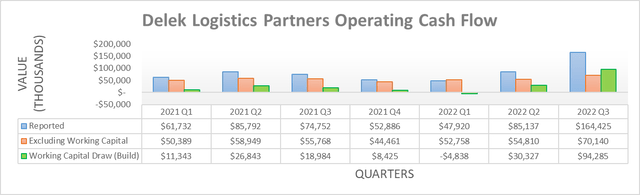

When zooming into their quarterly results, their operating cash flow during the third quarter of 2022 represents most of this increase as they enjoyed an entire quarter of contributions from 3Bear Energy and as such, their result of $164.4m is almost twice their previous result of $85.1m during the second quarter. However, it should be considered they saw a surprisingly large working capital draw in the former compared to the latter at $94.3m and $30.3m respectively, thereby boosting this comparison.

If instead viewing their underlying operating cash flow that excludes said working capital draws, they saw a result of $70.1m during the third quarter of 2022, thereby up about 28% sequentially versus their previous equivalent result of $54.8m during the second quarter. If compared against the first quarter that predated any contributions from 3Bear Energy, their underlying operating cash flow during the third quarter was almost 33% higher than this previous result of $52.8m. This indicates they are off to a positive start because my previous analysis estimated a 37% increase, which seems likely to be forthcoming as they continue integrating this acquisition and thus see lower associated costs. It is not uncommon for acquisitions to disappoint unitholders but thankfully this time, there is clear evidence to the contrary, which creates positive momentum heading into 2023 and beyond.

To circle back to their working capital movements, speaking anecdotally after conducting literally hundreds of these analyses, I cannot recall seeing seven consecutive quarters with only one working capital build amid a sea of large draws. Apart from being oddly consistent, their extent is also surprisingly large, as they totaled $65.6m during 2021, plus a further staggering $119.8m during the first nine months of 2022, net of the one minor build.

In theory, across the years working capital draws and builds should broadly equal each other and thus as a result, this tailwind stands to turn into a headwind one day, quite likely very soon. Even if they manage to maintain the present balance between their current assets and liabilities, these still cannot continue forever and thus at a bare minimum, this tailwind will cease one day.

Interestingly, this means a massive circa 56% of their $215.1m of free cash flow during the first nine months of 2022 was actually simply due to their working capital draws. If excluded, it leaves their underlying free cash flow at only $95.8m, which concurrently fails to cover the entirety of their distribution payments of $128m. This is far less than my previous article expected, although it stems from their higher capital expenditure of $81.6m, which increased far more than expected versus its previous level of $14.5m during the first nine months of 2021.

Despite pulling cash away from distribution growth in the short-term, it is not necessarily a negative because higher investments should translate into more free cash flow in the future, thereby further building upon their positive momentum. As such, it will be interesting to see how this tracks throughout 2023 and beyond given the lack of exact guidance so far, although I see no reasons to be concerned presently. More so, their operating cash flow is significantly higher after their 3Bear Energy acquisition compared to their otherwise broadly static distribution payments, even without the boost from their working capital draws. In the medium to long-term, this improves the prospects for distribution growth outlined within my previous analysis.

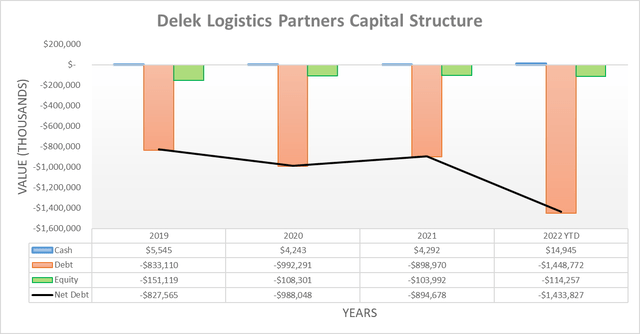

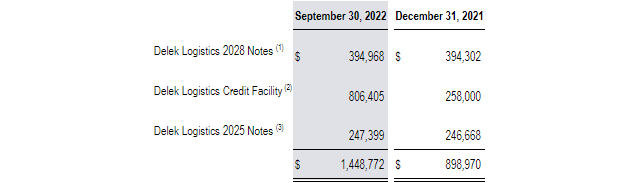

When reviewing their net debt, it surged dramatically higher during the second and third quarters of 2022 on the back of their 3Bear Energy acquisition to now land at $1.434b versus its previous level of $902.8m. Obviously, this was expected when conducting the previous analysis and thus came as no surprise, in fact, if anything, thanks to their surprisingly large working capital draw, it is actually a notch below the $1.528b mentioned within my previous analysis. The direction of their working capital movements and the extent of their yet-to-be-known capital expenditure during 2023 will determine the direction their net debt takes going forwards.

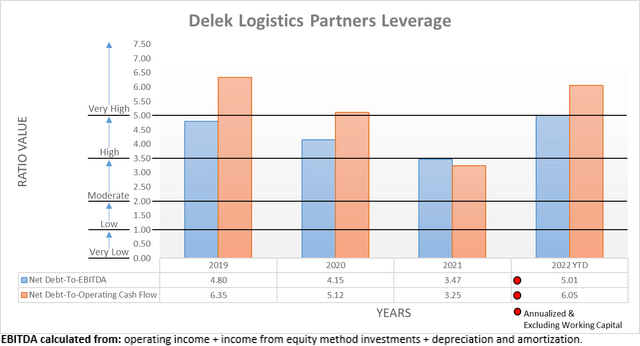

Apart from seeing dramatically higher net debt, the second and third quarters of 2022 also saw their leverage surge in tandem with their net debt-to-EBITDA now landing at 5.01 and thus well above its previous result of 3.52 and coincidentally, right on the threshold for the very high territory. If looking elsewhere, their net debt-to-operating cash flow also increased comparably to 6.05 versus its previous result of 4.28 across these same two points in time, obviously also sitting within the very high territory.

Whilst higher leverage was expected within my previous analysis, this is a far greater increase but thankfully, this is merely a temporary matter. As they continue to integrate 3Bear Energy and see further contributions to their financial performance in future quarters, it will automatically lower their leverage even without any help via lower net debt, thereby also lowering risks in tandem.

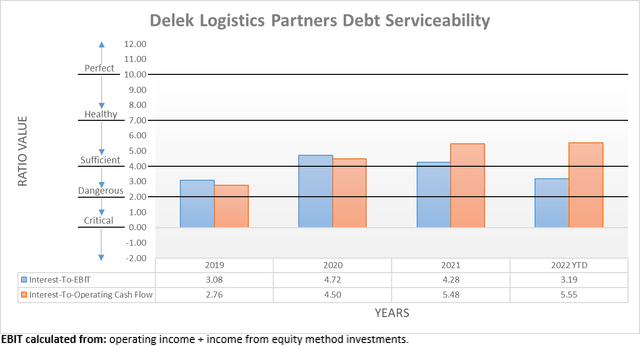

Elsewhere, their debt serviceability was also negatively impacted following the second and third quarters of 2022, as primarily evidenced when comparing their interest expense to their EBIT, which produces interest coverage of 3.19, which is down compared to their previous result of 3.52 following the first quarter. Similar to their leverage, thankfully this will be automatically improved as more time elapses and more contributions from 3Bear Energy flow through to their financial statements. In the meantime, at least this interest coverage is still sufficient, whilst the accompanying comparison to their operating cash flow sees a healthy result of 5.55.

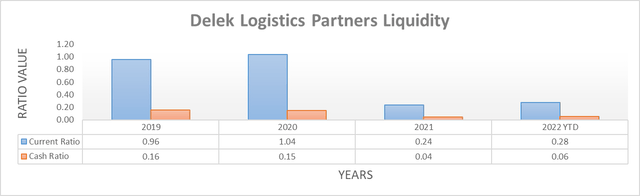

Quite interestingly, the impacts of their consistent working capital draws are laid bare when reviewing their liquidity, as primarily evidenced by their current ratio of only 0.28 following the third quarter of 2022, similar to their previous result of 0.27 following the first quarter. Whilst such a low result is normally associated with a liquidity crisis, such as an impending debt maturity, thankfully this is not the case this time. Rather, due to their consistent working capital builds, their current liabilities of $266m are mostly comprised of $173.2m of accounts payable to related parties. Although not nearly as severe as a debt maturity and still leaving their liquidity adequate, this still nevertheless indicates their operating cash flow on the surface will likely be weaker during 2023 as they make good on this mismatch of payments.

Since conducting the previous analysis, they amended their credit facility to increase its borrowing base to $1.2b, thereby now leaving a further $393.6m of availability following the third quarter of 2022, which alleviates a slight concern raised in my previous article regarding the funding of their 3Bear Energy acquisition. In addition, they extended its maturity well into the future until October 2027, which now leaves no maturities until May 2025.

Delek Logistics Partners Q3 2022 10-Q

Conclusion

Even though their cash generation during 2023 may underwhelm on the surface as their surprisingly large and oddly consistent working capital draws of 2021 and 2022 reverse into builds, thankfully there is clear evidence 3Bear Energy is not disappointing. This creates positive momentum heading into 2023 and beyond, notwithstanding the likely short-term working capital headwind. When combined with their already high near-8% distribution yield, it should not be a surprise that I continue to believe my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Delek Logistics Partners’ SEC Filings, all calculated figures were performed by the author.