Cutera Stock: AviClear Key Differentiator, Reaffirm Buy (NASDAQ:CUTR)

Jun/iStock via Getty Images

Investment Summary

Since our last publication on Cutera, Inc. (NASDAQ:CUTR), we’ve been more than satisfied to see the developments that have unfolded. We remain bullish on the company’s ability to unlock long-term risk capital, and advocate for its inclusion as a tactical long in equity portfolios, as a differentiated offering within the broad health care spectrum. We noted several key factors in our last examination of the company, including, but not limited too, strong revenue growth across the core portfolio; equally as positive return on invested capital trends; no CMS/reimbursement overhang; and supportive valuations. After careful inspection of CUTR’s latest set of numbers we’re back today to reinstate our buy thesis. Simply, we continue to seek an initial price objective of $50–$53, and we present our latest findings below.

CUTR Q3 financial results: FX a challenge, overcome by AviClear upside

Turning first to the company’s Q2 financials, the most obvious standout was the impact of foreign exchange (“FX”) related headwinds to the company’s top line. For instance, revenue growth was reported at 9% YoY for the period. However, when adjusting in constant currency (“cc.”) terms, was closer to 17%.

The bulk of pressure stemmed from the company’s heavy exposure to Japan – and hence, the Japanese Yen. Japan is the 2nd largest end-market for CUTR behind its North American footprint. Therefore, the JPY/USD cross significantly clamped revenue upside, and also watered down demand for the company’s product line in the region. Unfortunately, CUTR was unable to absorb this within their margins via growth in other segments. Nevertheless, the Yen issue won’t be around forever, it remains a key risk to our investment thesis and the company’s growth route looking ahead.

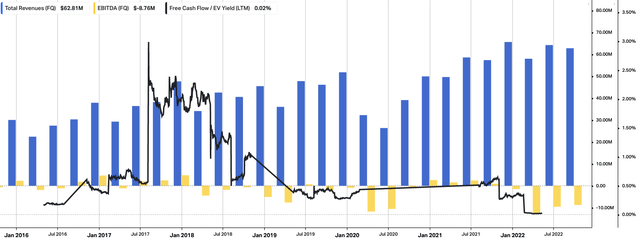

Switching to the numbers, the company pulled in $62.8.mm at the top line despite the headwinds above. The double-digit cc. growth was underlined by 32% YoY growth in capital equipment sales. International capital equipment growth was the standout here, posting 50% YoY growth in cc. terms. Meanwhile, North American capital equipment posted a 23% increase compared to the same time last year. A backward look at CUTR’s operating performance is located in Exhibit 1.

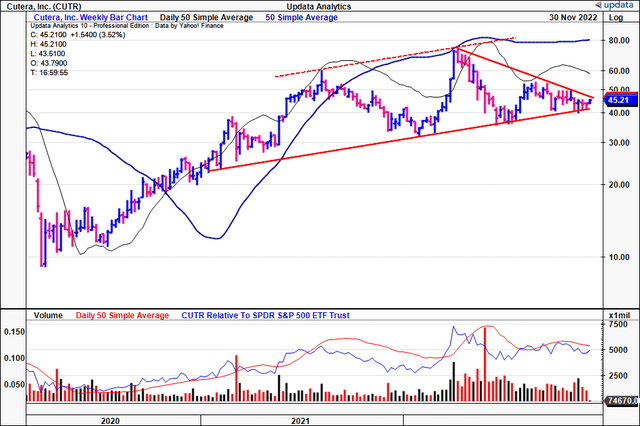

Exhibit 1. CUTR quarterly operating walk-through, FY16–date. Core EBITDA loss improving, but we’d like to see some upside on this.

Note: Seeing as the last 2 periods have resulted in FCF outflows for CUTR we’ve opted to leave the negative FCF yield out of the chart for these periods. FCF yield here is calculated as [FCF TTM / rolling enterprise value]. (Data: HBI. Refinitiv Eikon, Koyfin)

It also booked $21.8mm in recurring revenue, a 13% decrease from the prior corresponding period, immediately offset but the 43% cc. growth in the skin care consumables division. Note, this result excludes turnover from AviClear.

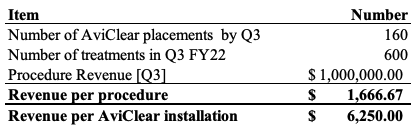

Speaking of AviClear, the company’s energy device indicated in the treatment of mild to severe acne, there were several notable takeouts. To name a few:

- We should advise that just 2 quarters in to the limited commercial release of the AviClear product, CUTR now has more than 160 systems placed in the field, surpassing its commitment of 100 placements by this time.

- During the period, it should be noted that >600 patients were treated with AviClear devices during Q3, generating procedural turnover of ~$1mm. On these numbers our calculations suggest the company recognized an average $1,666.70 per procedure, and $6,250 per AviClear installation [Exhibit 2].

- Management expect to have an additional 200 AviClear devices installed by the end of this year, bringing the installed base to 360. This would imply a revenue clip of $2.25mm based on the below rudimentary calculations.

Exhibit 2. AviClear Q3 FY22 revenue breakdown

Data: HBI, CUTR SEC Filings

CUTR Technical Studies

In the absence of earnings growth we found it prudent to examine various chart studies for CUTR, in order to gauge the market’s positioning on the stock.

You’ll see below that the stock has traded in an ascending channel since the depths of the March 2020 selloff. Price action has stretched up in an ascending channel with the 50DMA and 250DMA following suit in cyclical fashion.

Looking closer, you’ll see that CUTR has faced strong resistance at these moving averages in 2021 and then again in 2022. Recently it’s pulled away from both moving averages to the downside, with a second impulse of price action failing to breakout to previous highs.

Instead, we now have a descending triangle with the mouth currently squeezing down into the support level. Key to the picture is that, despite 3x attempts to break the floor of support, CUTR has bounced away each time whilst price action has held continued with a series of tight weekly closes for the past 8 weeks. The volume reversal and breakout 3 weeks ago is also noted and is a positive sign, in our opinion.

Exhibit 3. CUTR price evolution, March FY20’–date [weekly bars, log scale]

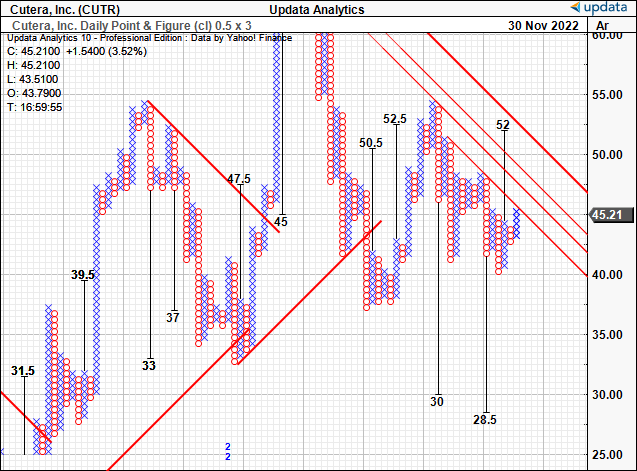

Similarly, we see strong confluence to an upside target range of $50–$52 based on our point and figure studies [Exhibit 4]. As seen below, we’ve now got 3 instances showing this price objective, whilst the stock is now currently testing the inner resistance line shown below. A breakout above this line would add a substantially bullish tilt to the risk/reward asymmetry in our opinion. Nevertheless, there appears to be good confidence around the $50–$52 estimate.

Exhibit 4. Multiple upside targets to $50–$52

Data: Updata

Valuation and conclusion

Last time, we had priced CUTR at $52.90 after applying the consensus’ 3.4x forward sales multiple.

Note, this is precisely in line with the technical targets outlined above. Management reiterated its full-year revenue guidance and expects to hit the upper end of range. It calls for $255–$260mm at the top for FY22, even with FX headwinds baked into its assumptions. All-in-all, it expects FX headwinds of $17mm at the top line. Adjusting for this, it sees 18–20% growth in turnover for this year. On this result, it believes CUTR can hit breakeven adjusted EBITDA for the year.

We’re aligned with managements growth assumptions and had outlined $258mm in projected revenue, and today we’re reiterating this number. Alas, we are concurrently reinstating our price target of $53 at 3.4x forward sales. As noted, there’s good confluence around this number as an initial price objective. Net-net we rate CUTR a buy.