Current TQQQ Metrics Still Indicate A Bear Market Bottom

Pgiam/iStock via Getty Images

This is a follow-up article to an article written on August 16th titled: Buying In ProShares TQQQ And SQQQ ETFs Appears To Confirm A New Bull Market. That article pointed out the amount of net buying in TQQQ, as well as its shares outstanding, were at or above the levels that had occurred at lows of past major market corrections or bear markets.

There is no doubt the timing of the article was bad since the S&P 500 has fallen 15.5% since publication and the price of TQQQ has gone from $38.64 to $19.50. A short-term trader or investor would have clearly benefitted by going opposite the recommendation. That said we still believe the metrics on TQQQ indicate we are in the area of the bear market lows.

Let’s go over the basic metrics of TQQQ to see what they currently show.

The Price Action of TQQQ

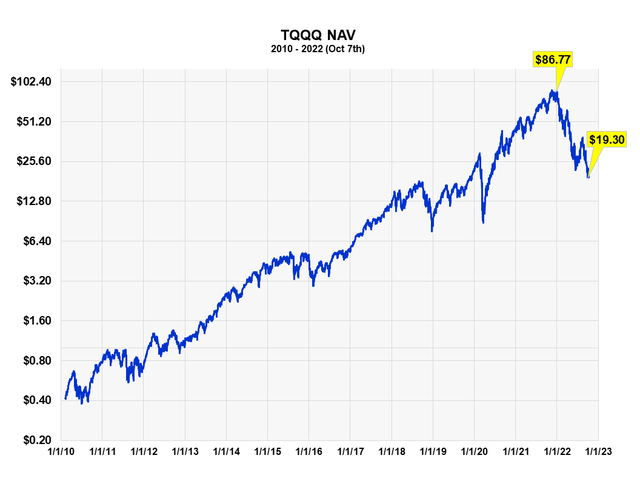

NAV of TQQQ (Michael McDonald)

It is clear from this long-term chart that TQQQ is for both short term traders and long-term investors, as long as they can emotionally withstand the uncertainties of large market declines and bear markets. Since its lows in 2010 the fund is up 4,825%.

The 3X leverage of the fund is what gives it its large, short term price changes that some traders desire. Since the start of this bear market the fund is off 77.7%. I want to reiterate that we are using TQQQ metrics to help determine long-term stock market trends, not for short-term trading.

TQQQ Shares Outstanding

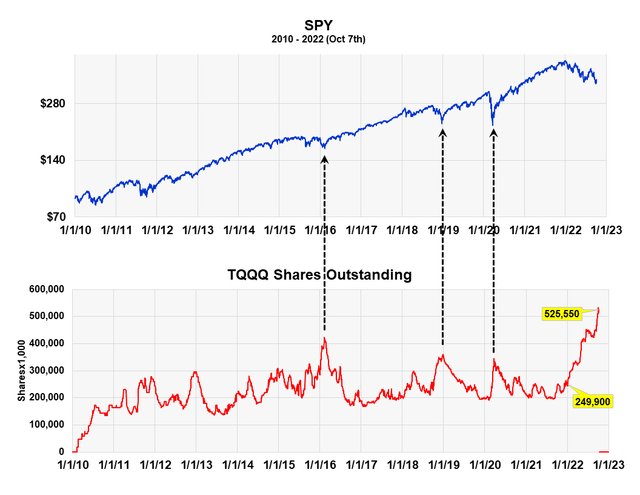

SPY and Shares Outstanding of TQQQ (Michael McDonald)

This chart plots the number of TQQQ shares outstanding against its price back to 2010, which was the funds inception. When more investors enter the fund then leave it, the number of shares increase. When more investors leave the fund then buy it, the number deceases. In truth it’s more the amount of money going in and out of the ETF that’s important, not so much the number of investors, but these two correlates.

History shows short term traders in TQQQ have a track record of good market timing. In general, they have the greatest number of long positions in TQQQ at market bottoms and a smaller number at market tops, which is the way it should be.

The chart clearly shows that important stock market bottoms seem to occur when the greatest number of shares of TQQQ are outstanding. Three major market bottoms occurred each accompanied by a surge in shares outstanding. The three dashed lines point each out. The three include the COVID induced, 2020 March bottom.

As of October7th, the number of shares outstanding has gone even higher since the first article was published and is currently at a record of 525,550,000 shares. Because of this, we believe this 110% increase in TQQQ shares over the last nine months is a sign we are probably at an intermediate term market bottom.

Market Low Confirmed by Ratio of Assets in ProShares Bull and Bear Funds

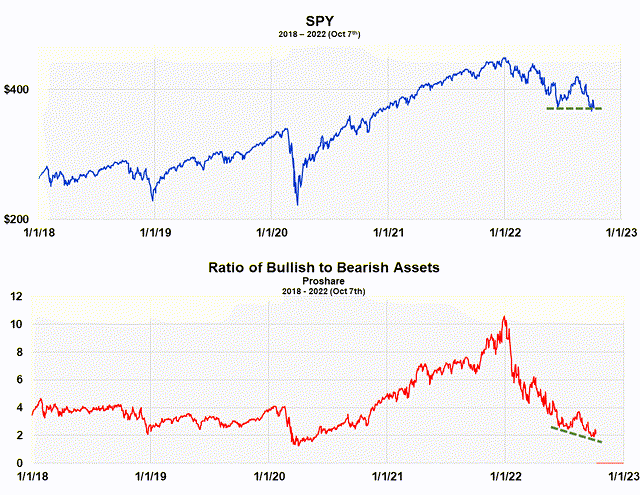

Ratio of Assets in ProShares Bull and Bear Funds (Michael McDonald)

The ProShares bull to bear asset ratio is another way we measure investor sentiment or expectations. It takes the dollar value in all the ProShares bull funds and divides it by the dollar value of all the bear funds. At the market top in December there was over 10 times more money in bullish ProShares ETFs than bear market ETFs. It is now down to a little over two.

It’s a contrary opinion indicator. For example, it clearly shows the surge of money into ProShares bull funds from September to December of last year, right before the start of the bear market. The ratio went from 6.5 to 10.5. Extremely bad timing.

What’s important now is the fact that the ratio went to new lows as the S&P returned to the price lows of May. Notice the broken green lines in the graph. It’s flat for stocks and slanted lower for the ratio. This means that even more ProShares investors believe the market’s headed lower than at the May low. This again is what you want to see if you’re a contrarian. It suggests stock prices should move higher over the intermediate term.

An Important Caveat

While I’m not so worried about the American economy dragging down the stock market, I am worried about the risk of a global financial crisis doing it, triggered by the actions of narrow-minded central bankers focused on just their own economy. While central banks are looking after their own economies, no agency is looking after the well-being of the entire global financial system. This is a serious issue which I explain in the article I just wrote on the Puts and Calls ratio.