Corus Entertainment: A Compelling >30% FCF Yield Opportunity

JHVEPhoto

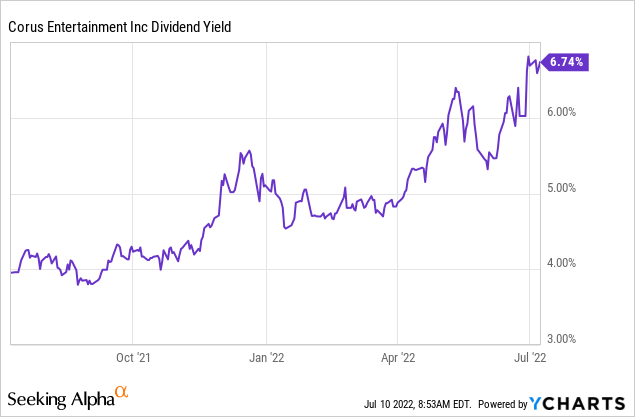

Corus Entertainment (OTCPK:CJREF), a legacy spinoff of the media assets (television, radio, and content) originally owned by Shaw Communications (SJR), posted a mixed set of Q3 2022 results amid signs of an advertising slowdown. While the economic outlook isn’t getting any brighter near-term nor are there clear catalysts on the horizon for a meaningful stock price recovery, Corus still has several things going for it, including its increased balance sheet capacity and an active repurchase program. Plus, the current FCF yield of >30% has likely priced in most of the negatives, capping the downside from here. Investors get paid a >6% dividend yield in the meantime.

Cost Management Is The Key Focus Amid Demand Headwinds

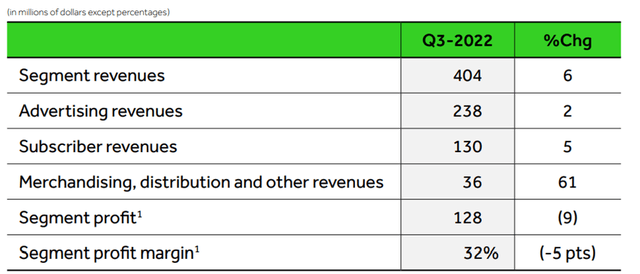

Corus’ latest quarterly report was marred by television EBITDA margins falling to 31.6% (down ~5% pts YoY) on the back of elevated general & administrative (G&A) and programming expenses. Outside of television, though, most of the ~5% YoY EBITDA decline would have been well accounted for by non-recurring COVID benefits such as wage subsidies and waived broadcast license fees. While television margins could still see more headwinds amid rising programming costs over time, Q3 2022 margins might well be the bottom, in my view. Not only has the broadcasting schedule now been normalized to a full programming slate, but major output deals have also seen renewals, helping to offset the challenging post-COVID YoY comparable.

Next, I would be wary of extrapolating Corus’ underwhelming group-wide P&L into the coming quarters. The macro will certainly be a headwind, but management’s ability to manage costs into FY23 will bear watching, particularly with ~C$50m in lower-margin Canadian content spend set to phase out in FY24. Commentary on the Q3 2022 call also points to G&A inflation moderating in the near term, while the flexibility of FY23 spending (mainly marketing/promotional for Corus’ digital platforms) will be a useful lever to manage the macro changes. Assuming Corus also taps into similar cost levers elsewhere (e.g., programming investment) to manage through a downturn, I view the low-30% margin range as a key medium to long-term support level.

Subscriber And Digital Growth Offer Reasons for Optimism

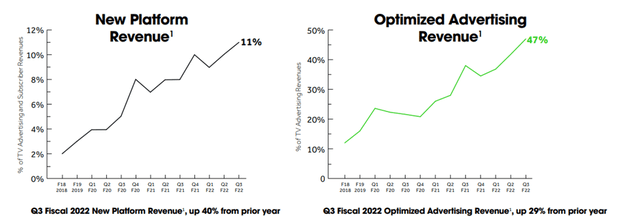

The strength in Corus’ overall subscriber revenues was a key bright spot in the Q3 2022 quarterly report, with new platform revenue (comprising OTT and digital platforms) up an impressive 40% YoY to ~C$41m (or ~11% of television advertising and subscriber revenues). Of note, the recent Aircraft Pictures acquisition is already a positive contributor to the merchandise and distribution line, with incremental benefits from Corus’ multi-year Hulu licensing deal also set to drive upside on the content front.

While StackTV’s moderating subscriber growth has been disappointing on the digital side, Corus’ increased investments in Advertising-Based Video on Demand (AVOD) and its Pluto TV partnership (for its Canadian launch) could still entail upside to Corus’ new platform revenue mix. That said, the partnership likely won’t have a significant impact anytime soon – the platform is not set for launch until Corus’ FY23 and even then, will likely take some time to scale. The long-term benefits are compelling, though, as Corus’ cut of ad revenue and licensed content will entail strong incremental margins as the platform take-up rises across the Canadian market.

Balance Sheet De-levering Creates Valuable Optionality

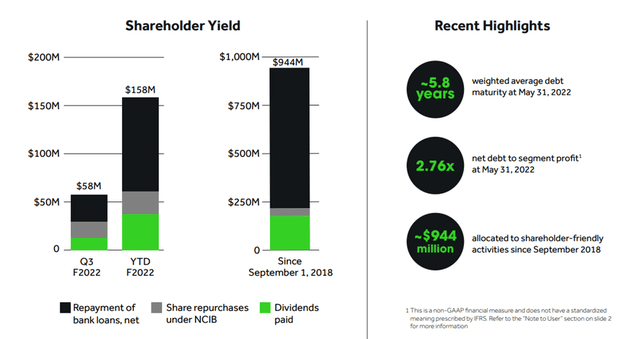

An often under-discussed part of the Corus story is its rapidly improving risk profile – the balance sheet has already been de-levered to <3x net debt/EBITDA and should head much lower as the working capital burn seen in recent months eases. While I expect the net debt ratio to further de-lever to <2x through FY23 and beyond in a base case scenario, the path of underlying EBITDA generation (trailing adj EBITDA run rate is at ~C$490m) will be key. I’ve also penciled in more buybacks – Corus has been active during the month of May, in particular, having set up a normal course issuer bid (NCIB) to repurchase ~5% of the class B float (equivalent to 9-10 million shares). On a YTD basis, Corus has bought back 55% of the total allocation under the active NCIB, so there remains ample room for more buyback activity in 4Q22 and into FY23 as well. Given the business’ through-cycle free cash flow generation, Corus should have more than enough capacity to balance growth investments as well as debt paydowns, and continued share buybacks ahead.

A Compelling >30% FCF Yield Opportunity

Corus’ quarterly result was mixed and there aren’t a lot of near-term catalysts to drive a meaningful stock price rebound, but at an FCF yield of >30%, investors don’t need a lot to go right for the stock to work. Plus, the balance sheet position is improving and the consistent through-cycle FCF generation (despite macro and program spend headwinds) means a step-up in buybacks could be on the cards. In the meantime, investors also get paid an attractive >6% dividend yield to wait.

| CAD ‘M | |

| Market Cap (8th July 2022) | 736 |

| (/) Free Cash Flow (FY23e) | 237 |

| = FCF Yield | 32% |

Source: Author, Market Data