Consolidated Edison Could Be A Winner In The Current Market Environment (NYSE:ED)

Philippe TURPIN/Photononstop via Getty Images

Consolidated Edison (NYSE:ED) is a firm operating in the multi-utilities industry and plays a role in the regulated electric, gas, and steam delivery across the United States.

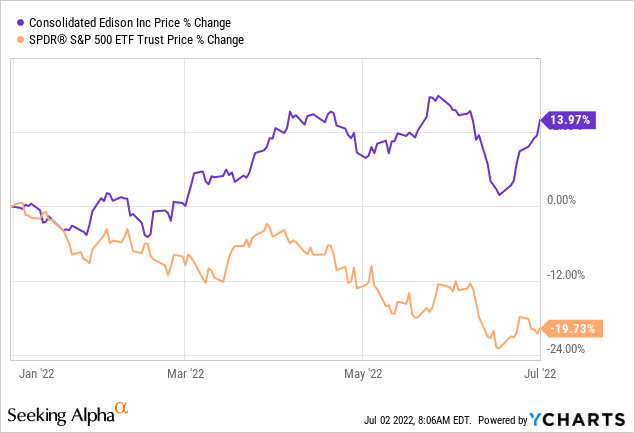

The firm’s stock has substantially outperformed the broader market year to date.

While the broader market has seen a decline of almost 20%, ED’s stock price has gained ~14%.

While a large portion of the market is significantly influenced by the declining consumer confidence and the overall macroeconomic situation, we believe that ED’s business is relatively recession-proof and has a strong track record of outperforming the market during times of low consumer confidence.

We expect the firm to outperform the broader market in the near term, therefore, our current rating on Consolidated Edison is “buy”.

Let us take a closer look, why in our opinion ED could be an attractive investment option in the current environment.

Consumer confidence

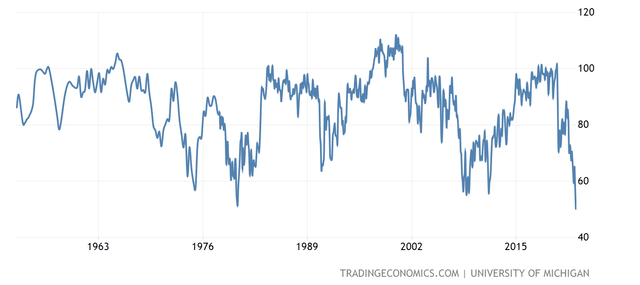

Consumer confidence is often regarded as a leading economic indicator, which could signal potential changes in the spending behavior of the consumer. Although consumer spending has remained healthy in the first half of 2022, we believe that the declining level of consumer confidence will eventually have a negative impact on the spending in the near future.

U.S. Consumer confidence (Tradingeconomics.com)

During times of low consumer confidence, firms that are selling durable goods and non-essential, discretionary products are affected the most. Consumers are likely to cut or delay purchases of these goods or shift to lower-cost alternatives. As the current consumer confidence is even below the levels seen during the financial crisis in 2008-2009, we believe that it will have a meaningful negative impact on the broader market. On the other hand, we expect firms in the utilities sector to remain relatively unaffected.

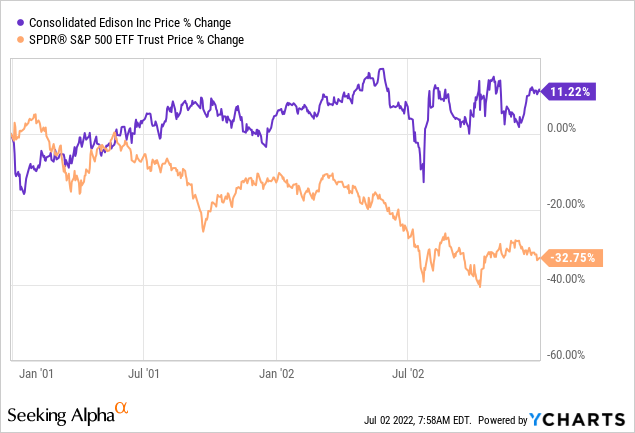

If we take a look at three periods in the last 20 years during which consumer confidence was low, we find that two out of three times Consolidated Edison outperformed the broader market, while once it performed in line with the S&P 500 (SPY).

2001-2003

While in this two-year time frame, the SPY has declined by more than 30%, ED’s stock price has increased by 11%, with relatively low volatility in the period.

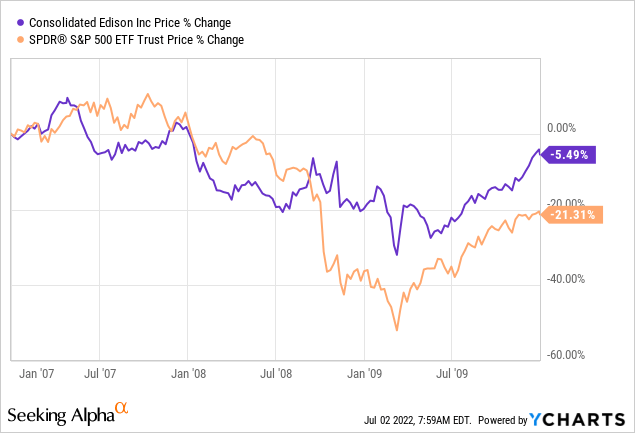

2007-2010

In this period, which also contains the 2008-2009 financial crisis, both ED and SPY have closed in the negative territory. However, ED has lost only 5% of its market value, while the SPY has declined by more than 20%.

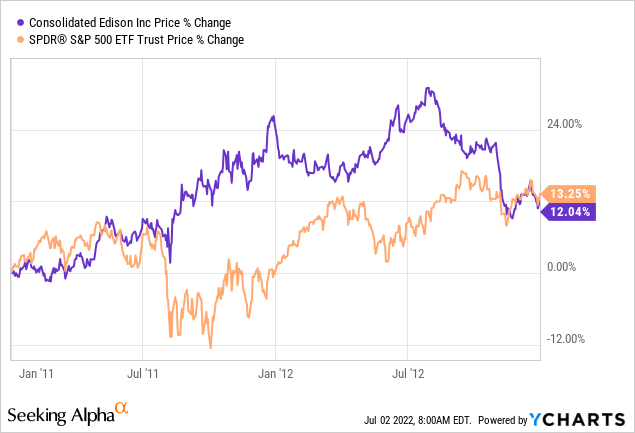

2011-2013

Between 2001 and 2013, both Consolidated Edison and the broader market have performed well, growing by more than 10%. Although initially ED performed much better than the SPY, at the end of the period, their performance was about in line.

While past performance is not always a good indicator of future performance, we believe that the relative independence of the utilities sector from the consumer confidence makes ED an attractive candidate now.

Not only the past performance but also ED’s dividend yield could be appealing for many investors.

Dividend

Consolidated Edison currently pays a quarterly dividend of $0.79 per share, which is equivalent to an annual dividend yield of about 3.2%.

Not only the firm’s relatively high yield but also its dividend history makes Consolidated Edison attractive. The firm has been paying dividends to its shareholder for 48 consecutive years, and they even managed to increase these dividend payments each year.

We also believe that the current dividend is safe and sustainable, despite the 72% dividend payout ratio (TTM) (GAAP). This payout ratio is not uncommon in the utilities sector. Although currently the sector median payout ratio is slightly lower, about 64%, the firm’s 5-year average payout ratio is as much as 74%.

All in all, we believe that ED could be an attractive addition to a dividend, dividend growth portfolio, especially in the current, volatile market environment.

Clean Energy

We like Consolidated Edison’s clean energy strategy. The firm has presented its 5 pillars of extended clean energy commitment during the first quarter earnings presentation.

In this strategy, the firm outlines its intention to aggressively transition away from fossil fuels and take a leadership role in the delivery of clean energy to its customers by investing in the construction and operation of a resilient, reliable, and innovative energy infrastructure.

The five strategic pillars of the firms are:

1.) Building the grid of the future, which would deliver 100% clean energy by 2040.

2.) Empower all customers to meet their climate goals. This entails the improvement of energy efficiency and the electrification of heating systems by 2050.

3.) Reimagining the gas system. Consolidated Edison aims to reduce the utilization of fossil natural gas and to find new ways of utilizing the already existing gas infrastructure.

4.) Reducing the company’s own carbon footprint and achieving net-zero by 2040 (scope 1), which could be reached by focusing on decarbonizing the steam system.

5.) Partnering with stakeholders to improve the quality of their lives.

The firm’s full clean energy commitment can be found here.

In our view, the firm’s focus on clean energy can create growth and significant value for the shareholders in the long term. As these initiatives are likely to have results in 2040 and beyond, they are not likely to influence the stock price in the near term.

For investors with a long time horizon and a focus on ESG, ED could be an attractive choice.

Key takeaways

In our opinion, Consolidated Edison is not likely to be substantially affected by the declining consumer confidence in the U.S. Further, the firm has a strong track record of outperforming the broader market during times of low consumer confidence.

The company has a strong track record of returning value to its shareholders in the form of dividend payments. ED has been paying dividends for 48 consecutive years, while also increasing the payments each year.

The firm’s clean energy commitment could be appealing for investors with a focus on ESG.