Companies That Offer Free Stock

Are you looking for a chance at a free share of stock or two? If so, you are in the right place. Silicon Valley has revolutionized investing, making it possible for the everyday individual to trade like an online Wolf of Wall Street. While the idea of digital investing platforms is still catching on, many of these firms are offering free shares of stock in exchange for member sign-ups or refer-a-friend promotions.

Why Are Companies Offering Free Stocks?

For starters, there is no such thing as a “free stock.” These companies are offering you a trade. They want to build an investor base and are willing to pay you for it. So, you agree to join their potential customer base in return for the firm’s free stock incentive and access to capital markets.

How To Approach This Article

Good quality companies tend to increase in value, especially if you reinvest in dividends. Our recommendation is to sign up for ALL of these companies, get the free stocks, and let the value compound. The shares you receive may be worth significantly more in the future.

Another consideration is that free stocks are a great way to branch out without assuming any risk. Taking advantage of these opportunities means learning about different companies and industries that you might never have on your own. You can also get exposure to the stock markets without risking any of your own money.

So, here is the list. There are others, but these are the most established.

Robinhood is an investing app popular among active traders because it allows them to make equity and options trades for free. The app doesn’t charge a maintenance fee or require a minimum investment, making it a low-cost way to start investing.

Robinhood will give one free stock when a user signs up and links a bank account as a bonus. It’s likely the stock on offer will be worth between $4 and $10. Most of the shares given away are in companies that are not performing, such as Limelight Networks or Ayro, Inc. But, things can change quickly, so don’t discount your little starter stock.

Robinhood’s reputation took a hit during the 2021 Gamestop craze after small investors rallied together across online forums such as Facebook and Reddit to drive up the price of Gamestop. The move caused hedge funds planning on short-selling the stock to incur huge losses — a situation known as a “short squeeze.”

About two days after this occurred, Robinhood stopped trading in Gamestop. It’s unclear why, but the firm may be trying to salvage its relationships with the hedge funds involved in the Gamestop debacle. So, while its model relies on small investors, the company may have competing priorities. As a result its been out of favor recently.

On the other hand, Robinhood has lightning-fast transfers and trade execution. If you did spot an opportunity and wanted in on it right away, Robinhood is best of breed.

Firstrade is another discount broker that allows you to trade stocks, ETFs, mutual funds, and options for free. It also offers complimentary trade ideas and access to research by trusted firms such as Morningstar and Briefing.com at no cost.

Firstrade is a privately held New York-based brokerage firm. Founded by John Liu in 1985, it was initially started to serve the needs of the Chinese American community in Queens, New York. Since Firstrade is privately held, it maintains a lower profile than some of its competition. It’s rated well for account set-up, research capability, and trade execution. However, the firm’s customer service leaves something to be desired.

On another front, Firstrade has had several run-ins with FINRA. Regulators took a dim view of the fintech’s lack of internal controls, leading to potential stock price manipulation. Despite the intrigue of insider machinations, FINRA’s investigation found that the failure was due to technical limitations in Firstrade’s internal reporting. The firm has since upgraded its computing resources and control systems.

Firstrade is following a similar model as Robinhood. It wants to expand its investor base by offering free stocks for sign-ups. What’s nice about it is giving you a free share for signing up custodial and joint accounts. If you have children, this will help them get started investing.

Public fashions itself as an investing social network. Originally named Matador, the firm was the brainchild of entrepreneurs Matt Kennedy and Jannick Malling. The platform takes a slightly different approach by offering members fractional shares from top-flight companies and popular ETFs. The site also boasts a community space for members to support each other, trade ideas, and learn more about the stock market.

Public’s sign-up is pretty straightforward. You download the app and answer a bunch of standard questions. As part of the sign-up process, you are required to link your bank account and move some money into its brokerage platform.

You’ll also get to select which company you want to have a chunk of — there are about ten options to look over. The good news is all the options are good. It will likely give you about $10 bucks worth of the company — a fractional share.

Public also has a clean regulatory bill of health.

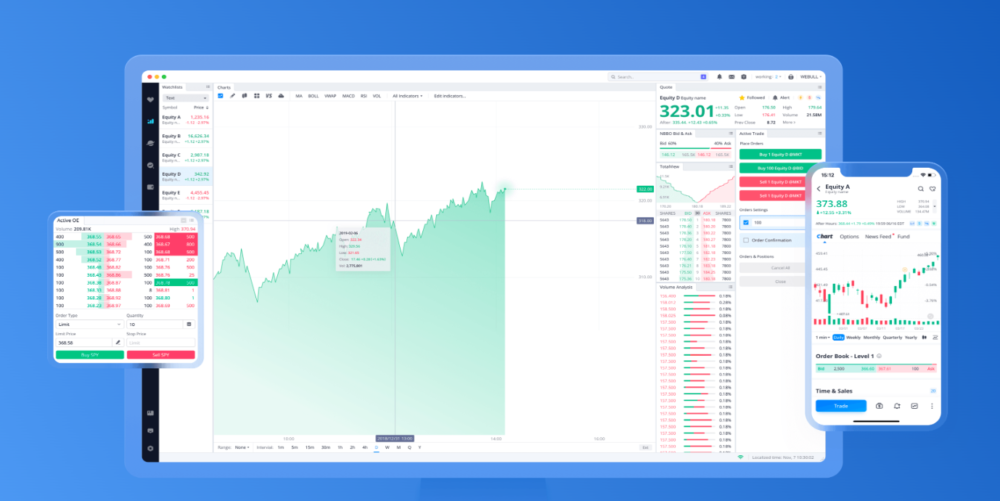

Webull is an investing app that allows you to trade stocks, ETFs, and options for free. Users can even buy and sell cryptocurrencies on the platform, making it an excellent choice for traders who want to dabble in alternative investments. Despite the impressive array of investing options, the app has a few service gaps due to a lack of mutual fund or fractional share offerings.

If you’re interested in signing up for Webull, you can get six free shares of stock worth anywhere from $2.50 to $250 when you open an account. You can also earn more stock worth up to $1,600 when you fund your account with at least $100. Realistically, you’ll get shares worth between $3 and $15.

You’ll also get additional stocks for referring your friends.

On the downside, Webull’s desktop interface isn’t amazing, and its customer service sometimes leaves much to be desired.

Honorable Mention: Coinbase

Coinbase is a popular cryptocurrency exchange in the United States. It’s a one-stop-shop for all your digital currency needs, and trading is as easy as one, two, *fee*. It’s true, this platform does cost something to use. However, a wallet app option enables you to securely store your holdings and shop at stores that accept crypto.

The way to maximize the value here is by signing up, collecting your $5 in bitcoin, and fulfilling the conditions of the promotional offer. There are a few things that make Coinbase’s rewards program attractive to customers. First, it’s a nice chunk of crypto-change at about $20 to $30. Second, it’s an introduction to the world of cryptocurrency.

Crypto is fun because it’s like the wild west of investing. You can trade 24/7 and is not subject to the same regulations as the stock market. Some of the concepts such as tokenization, blockchains, and distributed computing are amazingly energetic and fresh.

Digital currency is mysterious to many and prone to dramatic highs and lows. It may strike fear into the heart of the uninitiated investor, but there is potential for a savvy individual willing to bet low and learn as they go.

The companies featured in Coinbase rewards are often already part of its portfolio via the firm’s investment arm. But the platform is not offering rewards out of the goodness of its investing heart; it’s about building up demand and marketing awareness for its crypto-ventures. As with anything, caveat emptor.

Sign up for all of these, get your friends involved

These offers are basically free money. Sign up for all of these. Then get your friends to do it. All of these options allow you to get friends to sign up. Usually, the offer is if you get a friend to sign up, you’ll get another share of stock, and your friend will get one too. If you have a spouse or partner who is interested in personal finance, this is generally a good way to double the value proposition.

Do you know any additional sites where you can get free stocks? If so, please let us know in the comments below.

Read More

Ten Frugal Lessons From The Amish

Seventeen Bills In Your Wallet Worth More Than Face Value

Need To Save Money? Take the 365 Day Money Challenge

Check out these helpful tools to help you save more. For investing advice, visit The Motley Fool.

James Hendrickson is an internet entrepreneur, blogging junky, hunter and personal finance geek. When he’s not lurking in coffee shops in Portland, Oregon, you’ll find him in the Pacific Northwest’s great outdoors. James has a masters degree in Sociology from the University of Maryland at College Park and a Bachelors degree on Sociology from Earlham College. He loves individual stocks, bonds and precious metals.