Community Trust Bancorp Stock: Earnings Likely To Dip (NASDAQ:CTBI)

RiverNorthPhotography/iStock Unreleased via Getty Images

Earnings of Community Trust Bancorp (NASDAQ:CTBI) will most probably dip this year on the back of provision normalization amid a rising interest-rate environment. On the other hand, expansionary efforts and a strong job market will likely drive loan growth, which will, in turn, support the bottom line. Further, the margin will somewhat expand as interest rates surge. Overall, I’m expecting Community Trust Bancorp to report earnings of $4.31 per share for 2022, down 13% year-over-year. Compared to my last report on the company, I’ve revised upwards my earnings estimate partly because I’ve tweaked upwards both my loan and margin estimates. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Community Trust Bancorp.

Internal and External Factors to Drive Loan Growth

The loan portfolio of Community Trust Bancorp grew by a strong 3.2% in the first quarter of 2022, or 12.6% annualized, which beat my expectations. As the first quarter’s growth was out of the ordinary and too high to be sustained, loan growth will likely decelerate in the year ahead. Nevertheless, loan growth will likely remain robust thanks to external economic factors as well as internal factors.

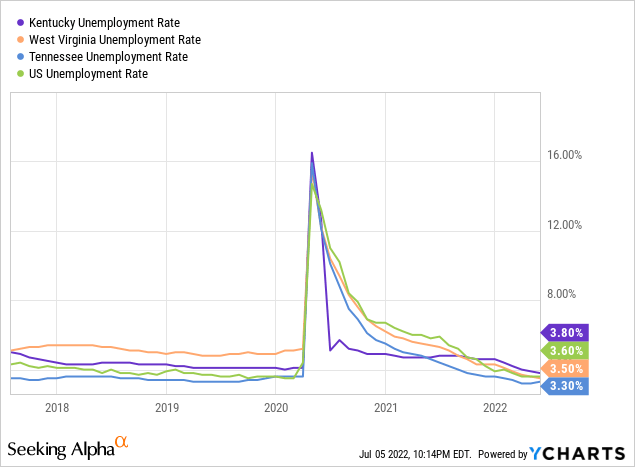

Community Trust Bancorp operates mostly in Kentucky with some presence in West Virginia and Tennessee. The job markets of all three states have returned to the pre-pandemic level, which bodes well for loan growth, especially consumer and residential loans.

Further, the management’s expansion efforts will likely boost loan growth this year. As mentioned in the annual shareholders’ presentation, Community Trust is looking to set up new branches. Further, the management is prioritizing growth through acquisitions. However, the company is yet to announce any specific acquisition plans.

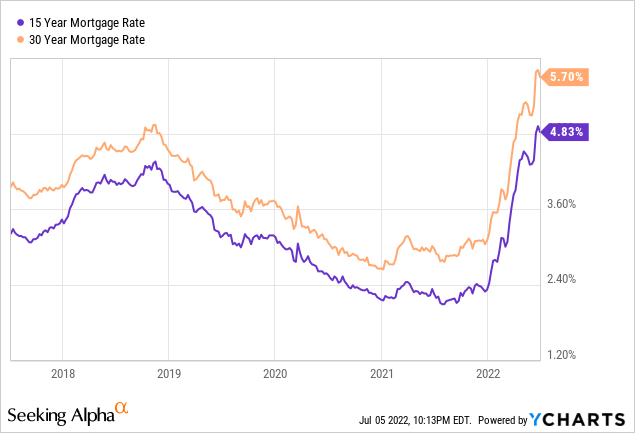

On the other hand, the recent surge in mortgage rates is likely to hinder residential mortgage growth. The Federal Reserve projects the upper limit of the Fed Funds target rate to double from the current level of 1.75% to around 3.50% in the year ahead. Therefore, mortgage rates can be expected to rise even further in the remainder of the year. Residential loans make up a quarter of total loans; therefore, the negative impact on the residential portfolio will have a material impact on total loans.

Considering these factors, I’m expecting the loan portfolio to increase by 6% by the end of 2022 from the end of 2021. In my last report on Community Trust Bancorp, I estimated the loan portfolio to increase by only 2% this year. I have revised upwards my loan growth estimate mostly due to the first quarter’s performance. Further, the upward revision is attributable to the overall improvement in the loan growth outlook.

Meanwhile, I’m expecting deposits to grow more or less in line with loans for the last three quarters of 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Net Loans | 3,087 | 3,173 | 3,214 | 3,506 | 3,367 | 3,578 | |

| Growth of Net Loans | 6.4% | 2.8% | 1.3% | 9.1% | (4.0)% | 6.3% | |

| Other Earning Assets | 725 | 679 | 810 | 1,307 | 1,726 | 1,638 | |

| Deposits | 3,264 | 3,306 | 3,406 | 4,016 | 4,344 | 4,562 | |

| Borrowings and Sub-Debt | 311 | 294 | 308 | 429 | 331 | 331 | |

| Common equity | 531 | 564 | 615 | 655 | 698 | 688 | |

| Book Value Per Share ($) | 30.1 | 31.9 | 34.7 | 36.9 | 39.2 | 38.6 | |

| Tangible BVPS ($) | 26.4 | 28.2 | 31.0 | 33.2 | 35.5 | 34.9 | |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

Margin Appears to be Only Moderately Sensitive to Rate Hikes

Community Trust Bancorp’s interest income is only moderately sensitive to interest rate hikes. This is partly because residential and consumer loans, which make up 49% of total loans, are mostly based on fixed rates, as can be deciphered from details given in the 10-Q filing. Further, the large balance of debt securities will anchor the average earning-asset yield amid a rising interest-rate environment. Debt securities made up 30% of total earning assets at the end of March 2022.

The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200-basis points hike in interest rates could boost the net interest income by only 3.99% over twelve months. Considering these factors, I’m expecting the margin to increase by 16 basis points in 2022. In my last report on Community Trust Bancorp, I estimated the margin to increase by 12 basis points this year. I have tweaked upwards my margin estimate because the Federal Reserve has revised upwards its fed funds rate projection for the year.

Reserve Releases to Decline Amid Headwinds

Community Trust Bancorp released a large part of its loan loss reserves last year as the portfolio’s asset quality improved amid the waning pandemic. Nonperforming loans dipped to 0.39% of total loans at the end of March 2022 from 0.59% at the end of March 2021. As a result, the reserve coverage, calculated as allowances divided by nonperforming loans, increased to 309.1% by the end of March 2022 from 215.5% at the end of March 2021.

Nevertheless, I’m not expecting large reserve releases this year, unlike last year. This is partly because heightened reserve releases cannot naturally be sustained for a prolonged period. Further, the rising interest-rate environment will hurt borrowers’ ability to service their debt. Moreover, the threats of an economic recession will likely encourage the management to build up its reserves as a precautionary measure.

Overall, I’m expecting the provision expense, net of reversals, to return to a normal level this year. I’m expecting the net provision expense to make up 0.19% of total loans in 2022. In comparison, the net provision expense averaged 0.20% from 2017 to 2019.

Expecting Earnings to Dip by 13%

Provision normalization will likely be the biggest contributor to an earnings decline this year. On the other hand, decent loan growth and margin expansion will likely support the bottom line. Overall, I’m expecting Community Trust Bancorp to report earnings of $4.31 per share for 2022, down 13% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 137 | 142 | 145 | 151 | 163 | 171 | |

| Provision for loan losses | 8 | 6 | 5 | 16 | (6) | 7 | |

| Non-interest income | 49 | 52 | 50 | 55 | 60 | 55 | |

| Non-interest expense | 110 | 117 | 118 | 119 | 119 | 123 | |

| Net income – Common Sh. | 51 | 59 | 65 | 60 | 88 | 77 | |

| EPS – Diluted ($) | 2.92 | 3.35 | 3.64 | 3.35 | 4.94 | 4.31 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

In my last report on Community Trust Bancorp, I projected earnings of $3.95 per share for 2022. I have now increased my earnings estimate because I’ve revised upwards both my loan balance and net interest margin estimates. Further, I’ve tweaked upwards my noninterest income estimate and tweaked downwards my noninterest expense estimate following the first quarter’s results.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

High Total Expected Return Calls for a Buy Rating

Community Trust Bancorp has a long-standing tradition of increasing its dividend in the third quarter of the year. Considering the earnings outlook, I believe the company can easily maintain the dividend trend this year. I’m expecting CTBI to increase its dividend by $0.02 per share to $0.42 per share, which will result in a full-year payout ratio of 38.0%. This payout ratio is close to the last five-year average of 40.8%. Further, the estimated payout for 2022 implies a dividend yield of 4.0%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Community Trust Bancorp. The stock has traded at an average P/TB ratio of 1.32 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 28.2 | 31.0 | 33.2 | 35.5 | ||

| Average Market Price ($) | 47.3 | 42.1 | 34.4 | 42.3 | ||

| Historical P/TB | 1.68x | 1.36x | 1.04x | 1.19x | 1.32x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $34.9 gives a target price of $46.0 for the end of 2022. This price target implies an 11.5% upside from the July 5 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.12x | 1.22x | 1.32x | 1.42x | 1.52x |

| TBVPS – Dec 2022 ($) | 34.9 | 34.9 | 34.9 | 34.9 | 34.9 |

| Target Price ($) | 39.0 | 42.5 | 46.0 | 49.5 | 53.0 |

| Market Price ($) | 41.3 | 41.3 | 41.3 | 41.3 | 41.3 |

| Upside/(Downside) | (5.5)% | 3.0% | 11.5% | 19.9% | 28.4% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.1x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.35 | 3.64 | 3.35 | 4.94 | ||

| Average Market Price ($) | 47.3 | 42.1 | 34.4 | 42.3 | ||

| Historical P/E | 14.1x | 11.6x | 10.3x | 8.6x | 11.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.31 gives a target price of $48.0 for the end of 2022. This price target implies a 16.4% upside from the July 5 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.1x | 10.1x | 11.1x | 12.1x | 13.1x |

| EPS 2022 ($) | 4.31 | 4.31 | 4.31 | 4.31 | 4.31 |

| Target Price ($) | 39.4 | 43.7 | 48.0 | 52.3 | 56.6 |

| Market Price ($) | 41.3 | 41.3 | 41.3 | 41.3 | 41.3 |

| Upside/(Downside) | (4.5)% | 5.9% | 16.4% | 26.8% | 37.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $47.0, which implies a 13.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 17.9%. Hence, I’m maintaining a buy rating on Community Trust Bancorp.