Capital Southwest Stock: Price Dislocation Spells Opportunity

Andrii Yalanskyi

Having read many reader comments on BDCs, I get the sense that Price to NAV is an important measure of valuation for this segment. While I believe this is a relevant metric for externally-managed BDCs, well-run internally managed BDCs are simply more efficient, and is efficiency translates into earnings power.

This brings me to Capital Southwest (NASDAQ:CSWC), which remains attractively valued compared to its internally managed peers. In this article, I highlight its fundamentals, and show why this stock is a sound pick for high income, so let’s get started.

Why CSWC?

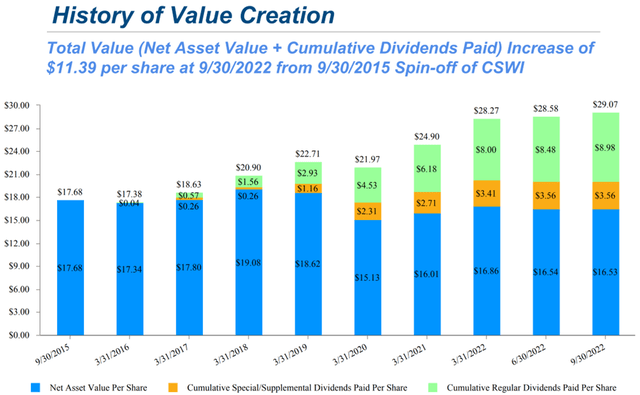

Capital Southwest is one of just a handful of internally-managed BDCs and is based in Dallas, Texas. It carries an investment portfolio with a $1.1 billion fair value that’s well-diversified across 78 investments. CSWC has a very solid track record of returning value to its shareholders. As shown below, CSWC has created substantial value primarily through a combination of regular and special dividends.

CSWC Value Creation (Investor Presentation)

At the same time, management has transitioned the portfolio towards a safer profile. This is reflected by the increase in first lien debt investments, rising from 86% of the debt portfolio to 94% at present, with the remaining 6% comprised of also relatively safe second lien secured debt.

Notably, CSWC is focused on the highly fragmented and less competitive lower middle market, and the investments are spread across everyday industries, with media/marketing, business services, consumer products & services, and healthcare comprising its top sectors, representing nearly half of portfolio fair value.

Meanwhile, CSWC continues to see healthy deal activity amidst market volatility, with $85 million worth of new committed credit investments during its second fiscal quarter (ended Sep. 30). It also carries a robust weighted average yield of 10.6% on debt investments, and non-accruals remain low, representing just 0.9% of the investment portfolio at fair value. Importantly, CSWC paid a regular $0.50 dividend in the month of September, which was well covered by the $0.54 NII per share generated in that quarter.

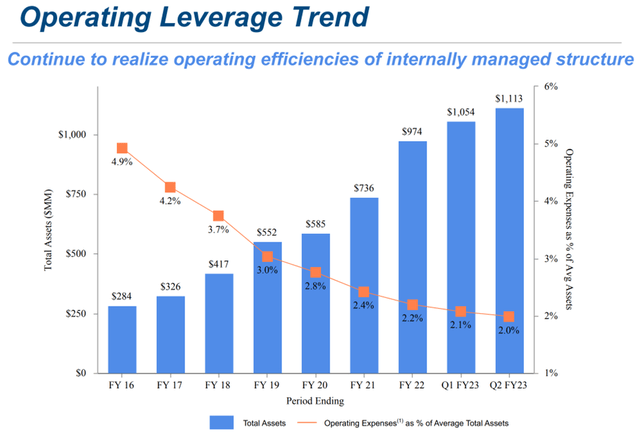

Also encouraging, CSWC continues to realize operating leverage, as its percentage of operating expenses to total assets continues to trend down. As shown below, this ratio now sits at 2.0%.

CSWC Operating Leverage (Investor Presentation)

Looking forward, it appears that management is confident about the future, as it raised the regular quarterly dividend to $0.52. This should be supported by rising rates, as 98% of CSWC’s investment debt is based on floating rate. It also maintains sound leverage, with a regulatory debt to equity ratio of 1.11x, sitting well below the 2.0x statutory threshold.

Notably, about half of CSWC’s debt liabilities are fixed rate unsecured bonds and its earliest debt maturity isn’t until 2026. Management also remarked on low refinancing activity in a rising rate environment, which benefits CSWC, and the health of the deal pipeline during the recent conference call:

The market for acquisition capital continues to be active. Not surprisingly, we have also seen a slowdown in refinancing activity. As a result, we would expect continued solid net portfolio growth in the near term. The activity in our investment pipeline is strong in terms of both volume and breadth of deal sources. We are pleased with the strong market position our team has established in the lower middle market as a premier debt and equity capital partner as evidenced by the broad array of relationships across the country, from which our team is sourcing quality opportunities.

Turning to valuation, I find CSWC to be attractively valued at a PE of just 8.5, sitting well below that of other well-run internally-managed peers. This is reflected by Main Street Capital’s (MAIN) PE of 12.0, and Hercules Capital’s (HTGC) PE of 9.9. Given CSWC’s track record and operating efficiency improvements, I would expect for it to trade at a PE of 11x. Analysts have a consensus Buy rating on CSWC with an average price target of $22.14.

Investor Takeaway

CSWC is a well-run BDC with an impressive track record of returning value to shareholders through regular and special dividends. It maintains a strong portfolio, carries healthy yields on its investments, and has solid operating leverage. Meanwhile, it trades at a meaningful discount compared to other peers, making it an attractive buy for income investors.