Can We Trust This Rally?

Markets are moving their way higher. Can we trust the move? marchmeena29

Brian Dress, CFA – Director of Research, Investment Advisor

No matter whether you are a conservative or an aggressive investor, whether stocks, bonds, or other assets, 2022 has been a year full of struggle and agony.

With such a challenging environment, it is no wonder that investors are excited to see a shift in sentiment, as all the market’s broader indexes finished the last week significantly higher.

On the other hand, we have seen a number of false bottoms in 2022, so many investors are understandably and justifiably suspicious when they see a sharp rally like the one we’ve seen over the past two weeks of trading. In today’s Jarvis® Newsletter, we will try to answer the question on all of our minds: “Can We Trust the Rally?”

In this week’s newsletter, we are going to take a deeper look at the stocks that are leading the market during the last two weeks of positive action and see what insights we can gain from the types of stocks that are outperforming in this mini market resurgence. After all, not all market rallies are predictive of follow-through, which we have learned all too well in the first half of 2022.

One sector that is not participating in the market renaissance of the past two weeks has been commodities. This has been especially painful for us here at Left Brain, since the sectors in which we have had the most conviction in 2022 have been oil/gas and the materials sectors. Over the last month, we have seen down moves on the order of 25% in a number of important commodity indicators, including Energy Select Sector SPDR Fund (XLE), SPDR S&P Metals and Mining ETF (XME), and along with Copper Futures (HG1:COM) on the Chicago Mercantile Exchange.

We will give you our thoughts on whether this significant pullback is an opportunity for investors to gain exposure to the strongest sectors in first half 2022, or whether we think this is the beginning of just the next bubble to burst. In doing so, we will revisit a couple of our favorite stocks which we have discussed here over the first half of the year.

While it can be easy to get caught up in the daily gyrations in the stock market, we have been reminded in the first half of 2022 that chasing strength has been a recipe for disaster (see financials, tech, healthcare, and consumer staples for clear examples of this in the current year). This summer we are encouraging investors (and ourselves) to think with a long term perspective and identify stocks and bonds that could perform for us over the next 2-5 years. We remain cautious investing with the current environment, but we are using this time to dig deep for securities we think will perform once markets do finally settle.

With that all being said, let’s get into it!

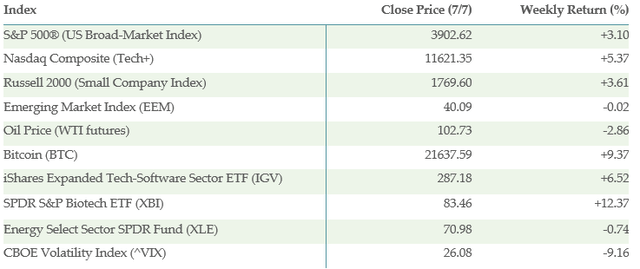

Below is the performance data of key indices, exchange traded fund (“ETFs”) for the five trading days between 6/30/22 and 7/7/22:

What is/is not Working?

Just 2 of the S&P 500’s 11 sectors were down for the last 5 days of trading, following the pattern from the last month: energy and materials. Again, we will give our thoughts in the last section of this week’s newsletter whether we think this demonstrates an opportunity for investors. Plenty of positive news on the board this week or as we often say “green on the screen,” which is a welcome change from what we have seen for most of 2022.

The strongest sector ETF we saw this week mirrored the same from the week before and that was SPDR S&P Biotech ETF (XBI), which gained more than 15% over the last week’s trading. This marks the second straight week of double-digit gains for biotech, which is one of the clearest “risk-on” indicators. Other healthcare names have been dragged higher in the wake of biotech, with the SPDR S&P Health Care Services ETF (XHS) and SPDR S&P Pharmaceuticals ETF (XPH) among the strongest ETFs in our list this week. We continue to like healthcare as an investment thesis, with an attractive blend of defensive qualities, along with a decent potential for growth and some dividend yield, especially in the pharmaceutical space.

If you have been following cryptocurrencies even tangentially, you will know that 2022 has been even more brutal in that space than in the wider financial markets. We saw a significant reversal in that move this week in the form of an 11% weekly rise in Grayscale Ethereum Trust (OTCQX:ETHE).

One area of strength we find interesting, given the fact that treasury rates have started to inch back up above 3%, is the strength in municipal bonds. Among our top 20 ETFs this week included Pimco Municipal Income Fund (PMF) and Invesco Value Municipal (IIM). We take this as an indicator that investors are starting to find bond yields attractive after they have risen steadily throughout 2022. We do think there are opportunities developing in quality bonds like munis, but continue to favor bonds further down the credit spectrum in the high yield corporate segment of the bond market.

In terms of the weakest performing ETFs, metals both precious and industrial led the way. In our worst performing ETF list, we saw iShares Silver Trust (SLV), VanEck Gold Miners ETF (GDX), and iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC). Additionally, we saw more weakness in iPath Pure Beta Crude Oil ETN (OIL). Despite recovery in Thursday’s session, commodities lost ground this week, as investors abandoned some of the most profitable plays from the first half of 2022. We will give our thoughts below whether this is a developing opportunity for investors and reexamine a company in the space that we consider a core holding.

Can We Trust the Risk-On Rally?

One of the top performing ETFs on the board was one we didn’t mention above: ARK Innovation ETF (ARKK), which gained nearly 10% in value over the last 5 days of trading. For those who are unfamiliar with ARKK, the fund holds many of the worst performing shares in 2022, including Roku Inc (ROKU), Teladoc Health (TDOC), Square (SQ), Zoom Video (ZM), and Shopify (SHOP). We continue to think that these stocks, most of which are pre-profit (lose money) and continue to trade at sky-high multiples, are high-risk plays in the current environment.

As we sift through our list of top performing shares of the week, we are struck by the 10, 20, and even 30% moves in just one week’s time, in a number of shares. Among these are again the downtrodden names of 2022, including Beyond Meat (BYND), Wayfair (W), MicroStrategy (MSTR), Etsy (ETSY), and Fastly (FSLY). Note also that many of these shares are among the most heavily shorted on Wall Street.

As our CEO Noland Langford says, short covering is still buying, so we take this as a positive, though we remain skeptical. However, we would caution investors against chasing after these stocks. We are fully aware of the urge many may have to do so, given that many of these stocks are down more than 50% just in 2022. We will gladly stand on the sidelines as some of these pummeled stocks gain momentum, as we generally look to avoid investing in companies with high multiples (price/earnings >30x and/or price/sales ratios in excess of 10x). Since the path of interest rates is most likely to remain higher near term, we think it is difficult for investors to expect sustainable multiple expansion in high multiple companies, particularly those that do not generate positive Free Cash Flow.

We want to remind readers of what we observed in March of this year, in similar stocks. In late March, we saw roughly a 15% advance in the Invesco QQQ Trust (QQQ), which tracks the tech-heavy NASDAQ-100. At the time, this appeared to indicate an end to the selling in high-growth tech and a number of impatient investors decided to reenter tech allocations. The QQQ subsequently dropped more than 25% in the 3 months after the March 29 peak.

Now let’s bring things around to the more positive view: we do think we are moving toward the later innings of the market’s overall selloff. Markets continue to trade erratically and violently, and a week of positive action is just as likely to be followed by more buying as selling. In a market like that, it is easy to get caught up in the short-term gyrations and try to jump in behind strong buying as we all look to catch up on performance for 2022.

Do we believe in the risk-on rally this week? Our answer is a qualified YES. We are becoming more optimistic about the overall market, but still remaining cautious, particularly before earnings season begins next week. At times like these, it is important to think beyond the daily and weekly context and think about the types of companies that are well-positioned from a fundamental standpoint to grow cash flows, profit margins, and sales. These are the businesses that are most likely to deliver outsized returns in the next 3-5 years with defined risk profiles.

It is certainly possible for the Shopifys and Wayfairs of the world to do well in the coming years, but from a risk/reward standpoint, we feel most comfortable looking at lower-multiple profitable companies in the tech space. Examples of these would include Alphabet (GOOG, GOOGL) and International Business Machines (IBM).

What is Going on With Commodities?

For the first half of 2022, the only sectors giving ballast to portfolios were commodity related shares, mainly in oil/gas, but also in metals, mining, materials, and related industries. The Energy Select Sector SPDR Fund (XLE) was as much as 60% higher on a year-to-date basis as recently as early June. However, over the last month, oil prices have fallen significantly, but energy stocks have cratered by an additional factor in the same time period. After more than a 25% drawdown, the XLE now is up just 23% for 2022 and many oil stocks are down for the year!

So what happened? It is hard to pinpoint an exact cause for this move downward. Our view is that much of the selling here has been “flow based.” What does this mean? In search of securities that were performing, many investors added exposure to oil/gas in the 2nd quarter of this year. Perhaps the boat got a bit too loaded to one side and these shares got somewhat ahead of the fundamentals. Late entrants to the space were perhaps unable to take the pain and sold into the downtick over the last few weeks. This is yet another example of why we are cautious to chase performance of stocks of really any sector. We’ve seen this play out too many times in 2022.

We maintain our convictions on oil/gas. Supply/demand conditions remain in the favor of oil producing companies, many of whom have average production costs in the $40-50/barrel range. They are wildly profitable with oil still around $100. We expect the sentiment to shift here dramatically again when these companies report earnings. Many of them are generating unprecedented levels of free cash flow and returning capital to shareholders in the form of dividends and share buybacks. The recent pullback may be an opportunity if you remain underinvested in energy.

Another area that has suffered recently is base metals. One company that we have recommended a number of times in 2022, through our various content channels, is Rio Tinto (RIO). Rio Tinto is one of the world’s largest producers of base metals like copper, aluminum, and iron ore. A number of events have gone against RIO in recent months, including lockdowns in China (the biggest importer of RIO’s products) and continued fears of recession, which would, in theory, decrease demand for industrial metals. RIO shares (blue line) have fallen hard in the last month:

While many of these fears are justified, we think they may be overplayed. Though base metals prices have been volatile over the years, the company has delivered positive Free Cash Flow in every year since 2012, with strong growth on that line each of the last three years. The shares currently trade at a price to earnings multiple below 5x and at current prices, the dividend yield stands near 14%! Clearly investors are forecasting that RIO will be able to maintain earnings, but our view is that if the recession is less severe than advertised, this stock has plenty of room to run to the upside. As a bonus, consider Cleveland-Cliffs (CLF), an integrated steel producer whose stock has also been pounded in recent weeks, has very little debt, and also trades at a very low multiple.

Takeaways from this Week

It was good to see renewed buying in the markets this week. We are becoming more optimistic, but remaining cautious, as some of this week’s leaders were the most heavily shorted and downtrodden names of 2022. We think investors would do well to zoom out and keep focus on long-term investing, as many high-quality stocks are quite cheap in the context of the current market environment.

We have been frustrated with the weakness in commodities, but our view is that a lot of the selling has been “flow-based” and headline-oriented. We think the fundamentals remain strong in commodities, but especially in oil/gas. We think investors should consider whether the 25% drop in the month of June is an opportunity here, especially in cash-generative stocks that trade at extremely low multiples like Rio Tinto.