Buy The Crash With 2 Fat Dividends

DNY59/E+ via Getty Images

Co-produced with “Hidden Opportunities.”

Dividends are one of the most misunderstood perks of investing. During a bear market, equities across the board take a beating, including dividend-paying ones.

I often see investors telling me that the dividends paid by these equities won’t compensate for the losses they suffered. They are looking at it incorrectly. Dividends aren’t meant to “make up” for temporary drops in prices. Dividends are a fee you are getting paid to patiently wait for the market to turn around and prices to recover.

The most important thing an investor can do during a bear market is to wait it out. While watching your holdings plunge and listening to traders speak about selling everything off isn’t easy, remember that investing is a game best played long. Successful investors are molded by what they do during the downturns, which defines their performance over time.

Investing for passive income can be very useful during difficult market conditions. When those dividends show up like clockwork, there is little incentive to sell your stocks. It supplements your income from your full-time job and enhances your quality of life.

“Residual income is passive income that comes in every month whether you show up or not. It’s when you no longer get paid on your personal efforts alone, but you get paid on the efforts of hundreds or even thousands of others and on the efforts of your money! It’s one of the keys to financial freedom and time freedom.” – Steve Fisher

Bear markets are the perfect time to buy discounted dividend payers because their depressed stock prices and higher yields make way for juicy passive income and significant capital upsides when the markets recover. Our favorite investor praises such market conditions and takes full advantage of them.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” – Warren Buffett

I will follow Mr. Buffett’s lead and put out a bucket to collect big dividends using these two picks with yields of up to 9% to get you started.

Pick #1: PFFA, Yield 9.2%

Discounted preferred securities provide dual benefits of bonds and equities during fearful times. They fill your pockets with predictable income while offering room for the capital upside. Successful investors like Warren Buffett have repeatedly taken advantage of discounted preferred units of the most impacted companies during recessions – notably in Bank of America (BAC) and Goldman Sachs (GS) in 2008 and Occidental Petroleum (OXY) in 2020. Not only did he collect juicy dividends, but he also achieved multi-bagger returns as the markets recovered.

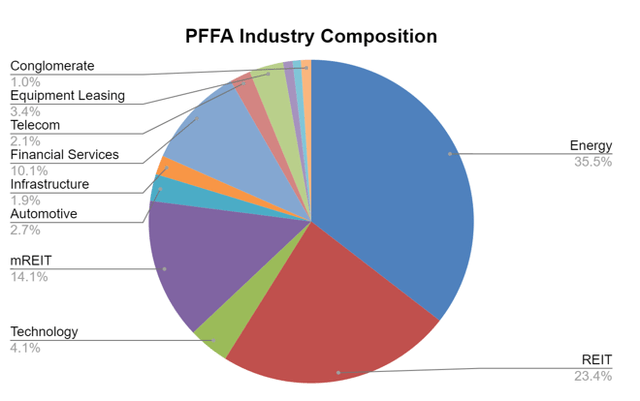

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is an actively managed fund with a primary emphasis on current income from a diversified portfolio of preferred securities.

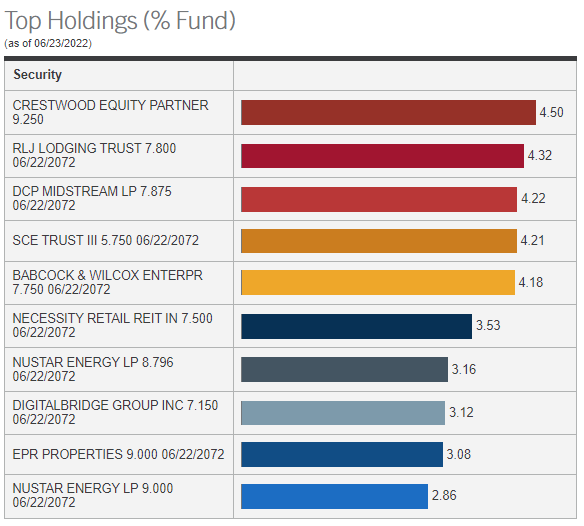

PFFA’s top positions include some HDO favorite names such as AQNU, CEPQ-, and RLJ-A.

Virtus

The ETF is well-diversified into over 170 preferred securities to provide a cushion against any shock of a distribution cut from individual companies. Moreover, PFFA is more oriented toward energy (mainly midstream and utility), and REITs have historically proven to be recession-resistant sectors.

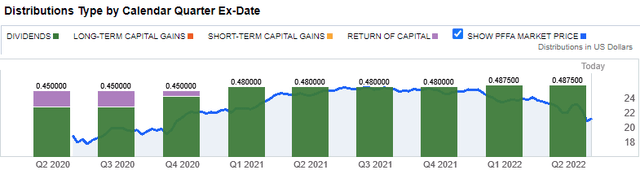

PFFA has sustained growing distributions despite fluctuating stock prices since the pandemic-induced reduction in early 2020. Its current $0.1625/share monthly payment calculates to a 9.2% annualized yield. Notably, the ETF earns 100% of its distributions through dividends paid by its constituent securities.

The ETF invests in preferred securities of several MLPs but issues a form 1099 to keep your tax filing straightforward. Moreover, PFFA offers much higher liquidity for investors to quickly build a sizable position compared to directly taking a stake in its constituent securities. PFFA is an essential asset for an income investor, and this bear market just gave an opportunity to lock in 9.2% yields from this discounted ETF.

Pick #2: OKE, Yield 6.6%

President Biden recently dragged Exxon Mobil (XOM) into the spotlight, accusing the Big Oil corporation of keeping supplies tight amid high energy prices. XOM responded elaborately with what we knew all along.

“Longer term, the government can promote investment through clear and consistent policy that supports U.S. resource development, such as regular and predictable lease sales, as well as streamlined regulatory approval and support for infrastructure such as pipelines.” – Exxon Mobil’s letter to the President of the United States

They may blame the Russo-Ukraine war or Big Oil’s price gouging at the pump. But underinvestment in hydrocarbons is the number one cause of today’s higher prices.

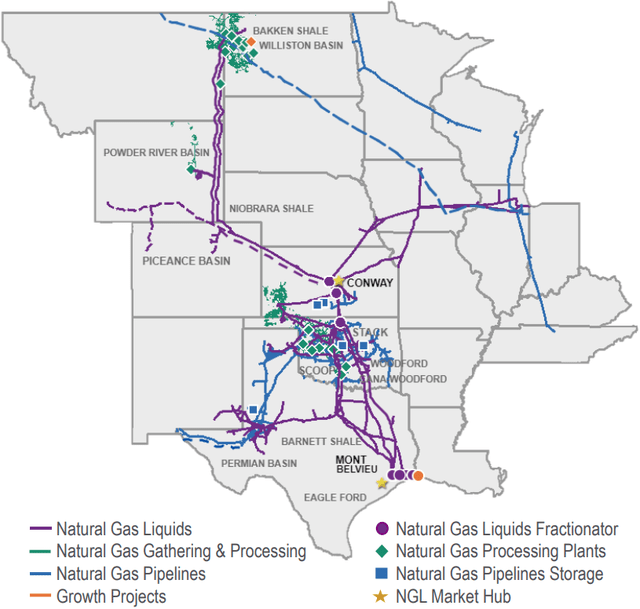

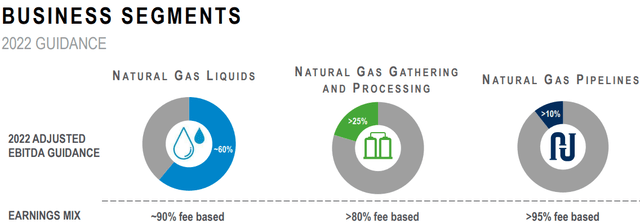

A vast network of pipelines is critical to safely and cost-effectively transporting and storing energy commodities. ONEOK, Inc. (OKE) is a leading midstream service provider that caters to the gathering, processing, transportation, storage, and distribution of Natural Gas and NGLs in the U.S. OKE owns 40,000 miles of pipeline and other infrastructure, playing a key role in connecting the NGL supply in the Rocky Mountain, Permian, and Mid-Continent regions with key market centers. (Source: June 2022 Investor Presentation)

June 2022 Investor Presentation

Thanks to a highly fearful market, OKE plunged over 20%, allowing us to grab a mouthwatering 6.6% yield.

When the stocks of stable dividend-paying businesses plunge over 20% in a few trading days, it is time to look at things with perspective. OKE projects FY 2022 earnings to be 90% fee-based. This means their bottom line will be immune to the volatility in natural gas prices.

June 2022 Investor Presentation

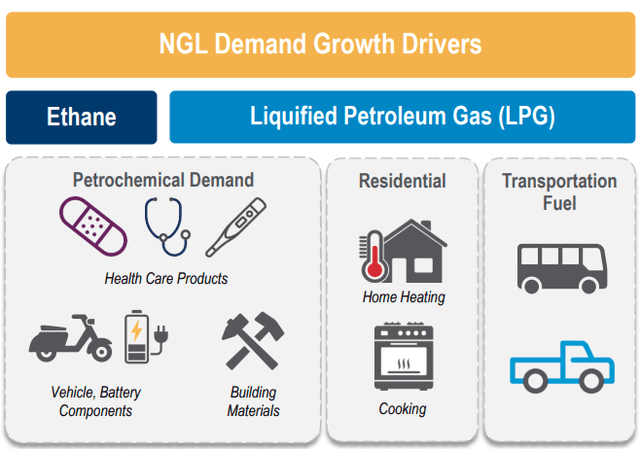

NGLs represent the most significant chunk of OKE’s EBITDA, and this commodity has among the most diversified everyday applications, making its demand almost recession-resistant.

June 2022 Investor Presentation

OKE issues a form 1099 (no K-1 tax form), making it suitable for most investors seeking a simplified tax situation. Following the drastic sell-off, it trades at a forward P/E of 12.2x. Moody’s recently affirmed OKE’s investment-grade rating and revised the outlook to positive. The cherry on the top for OKE is that it has maintained a sustainably growing dividend for 25 years. Since 2000, we have seen multiple bear markets and recessions, and witnessed commodity prices oscillate between extremes. Yet, OKE has sustained a 13% dividend CAGR. This speaks to the tangibility of OKE’s assets and the monetizing power of such assets over the long term.

Petroleum producers and processors are essential, but without the midstream link, it would be impossible to distribute commodities to the global economy at affordable prices. There is a lot of regulatory and political red-tape to obtain approval, set up these critical infrastructure assets, and make them operational. As such, they are extremely valuable for a growing economy, and OKE presents an excellent case for passive income with its attractive 6.6% yield.

Shutterstock

Conclusion

Ben Graham describes Mr. Market as manic-depressive, randomly swinging from bouts of optimism to moods of pessimism. To understand Mr. Market well and predict his next steps, I must be a psychologist, but even the best ones may not be able to diagnose and treat poor Mr. Market. I know very little about human psychology, so I will pursue steps that have been proven to work for successful investors. I will invest my capital in companies that pay dividends through thick and thin.

We all have a finite amount of time and energy, effectively limiting the number of things we can actively do to increase our income. With dividend-paying stocks in my retirement portfolio, I can amplify my income without further using my time and effort. Bear markets are the best time to plant the seeds of passive income. When markets recover from the irrationality, you will already be sitting under the shade, eating the fruits of your investment. Buy these two picks with up to 9% yields to get your passive income rolling.