BTZ: Getting To A Better Valuation For This Multi-Sector Bond Fund

Mongkol Onnuan

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 19th, 2022.

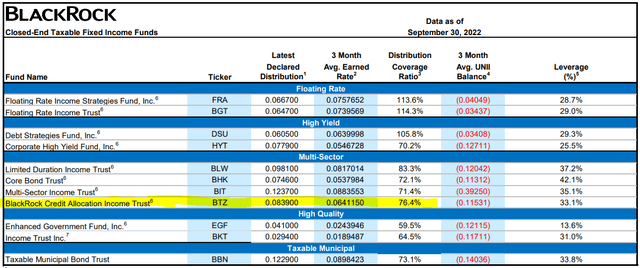

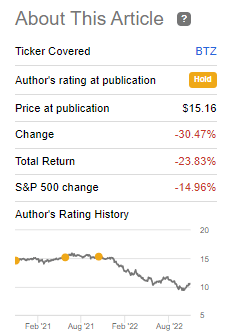

The last time I covered BlackRock Credit Allocation Income Trust (NYSE:BTZ) was over a year ago. At that time, it seemed that with higher interest rates coming, BTZ was particularly susceptible due to trading at quite close to parity with its NAV and due to a sizeable allocation to investment-grade bonds. At that time, the Fed was beginning to think about raising interest rates but was still remaining patient.

Of course, we now know that the Fed quickly had to turn aggressive and raise rates rapidly to combat inflation. That saw a significant drop in all assets, not just funds like BTZ. Therefore, while I thought interest rates could be a risk, I wasn’t expecting how big of a risk it would become.

BTZ Since Previous Update (Seeking Alpha)

Thanks to the investment-grade credit rating, this fund’s duration are quite elevated. That’s what originally made me more cautious overall. The fund’s duration was 6.98 years, and it is similar now at 7.09 years. While the fund has some floating rate exposure, it isn’t an overly large portion of the fund.

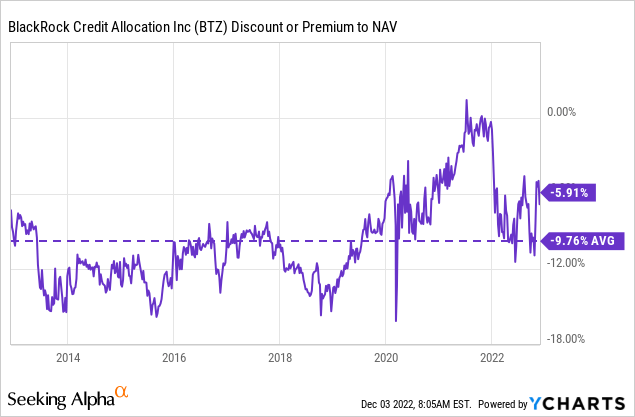

However, a year later, the fund’s discount is becoming relatively attractive compared to the last several years. We should also be seeing most of the damage from interest rates as we get closer to peak rates. I think it could be presenting a more attractive opportunity to wade in cautiously through a dollar-cost average method. The fund briefly even touched its longer-term average discount for those that were quick enough to snag shares; it would have been a great move.

The Basics

- 1-Year Z-score: 0.35

- Discount: 6.23%

- Distribution Yield: 9.30%

- Expense Ratio: 1.12%

- Leverage: 28.47%

- Managed Assets: $1.04 billion

- Structure: Perpetual

BTZ invests with an objective to “provide current income, current gains, and capital appreciation.” They intend to achieve this through investing “…under normal market conditions, at least 80% of its assets in credit-related securities, including, but not limited to, investment-grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these credit-related securities.”

Higher interest rates not only impacted the underlying portfolio but the fund’s leverage expenses were also impacted. They aren’t totally at the mercy of higher rates, though. They utilize mostly reverse repurchase agreements for their leverage. As of their latest semi-annual report, these are all based on variable rates.

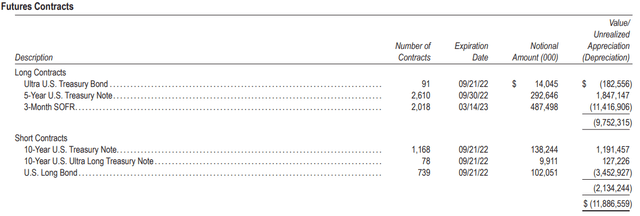

With those, they’ve also employed various derivatives to offset some of the negative impacts. They are short and long various U.S. Treasury futures contracts securities. Being short these contracts means they can benefit from an increase in interest rates.

BTZ Futures Contracts (BlackRock)

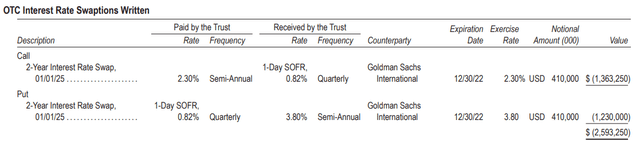

They also have interest rate swaptions that they’ve written. Again, this is in an attempt to help hedge interest rates.

BTZ Interest Rate Swaptions (BlackRock)

From that last report, it would appear that these would have helped by contributing to some material realized capital gains. We will look at this more below when discussing the distribution coverage.

Performance – Discount Opening Up

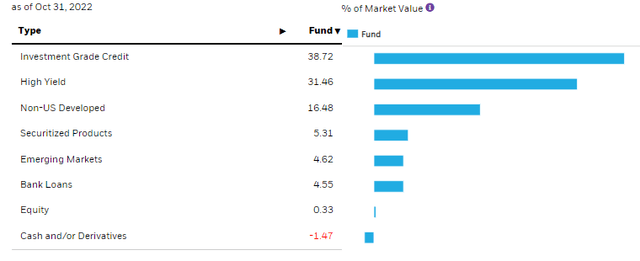

BTZ is a multi-sector bond fund, which is fairly free to invest in whatever types of fixed-income investments the managers want. However, the portfolio is primarily dominated by investment-grade and high-yield corporates. Exposure to non-US Developed is also fairly meaningful too.

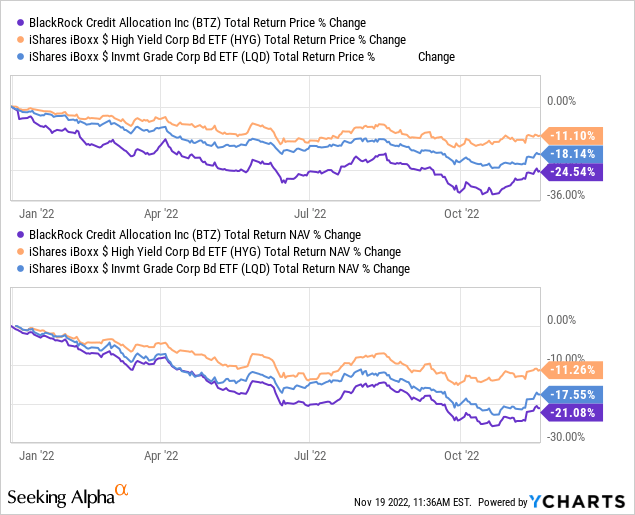

High-yield bonds are more susceptible to credit risks. However, the negative impact of higher interest rates has been a bigger drag on the market on a YTD basis. We can see that when we compare the performance between iShares iBoxx $ High Yield Corporate Bond (HYG) and iShares iBoxx $ Investment Grade Corporate Bond (LQD). LQD has performed worse due to the greater impact of negative interest rates. This almost seems like 2022 has us living in some upside-down world.

Ycharts

We can also see that BTZ has performed worse than both of these despite what should probably be assumed at first, that it would come somewhere in the middle. It would appear the fund’s leverage, greater expenses and portfolio mix is leading to an even worse result.

Of course, it is also an income investment and provides significantly higher payouts than HYG and LQD. It can do so by having a level distribution policy, whether it is being covered or not. That’s likely to attract income investors looking for higher rates and accept higher risks too.

The other silver lining here is that BTZ can be bought at a relatively attractive discount compared to where it had been trading in the last couple of years.

For quicker investors that follow this fund very closely, the fund could have even been picked up at closer to the average of the last decade just a short period ago.

Author Note: It appears Ycharts hasn’t updated the latest discount. The current discount is -6.23%, as reported by BlackRock for the close of December 2nd, 2022. The below chart still gives us an idea of the historical average discount.

Distribution – Attractive, But Caution On Sustainability

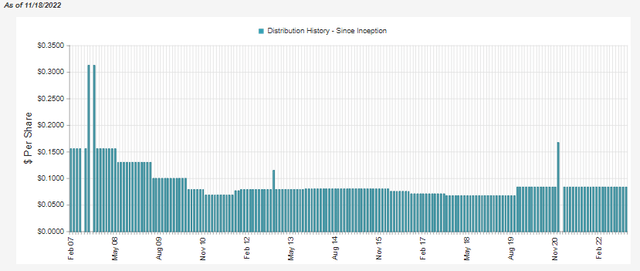

BTZ has paid a relatively stable distribution to shareholders since 2010. About as stable as can be expected for a fixed income, which typically saw more adjustments in the last decade.

BTZ Distribution History (CEFConnect)

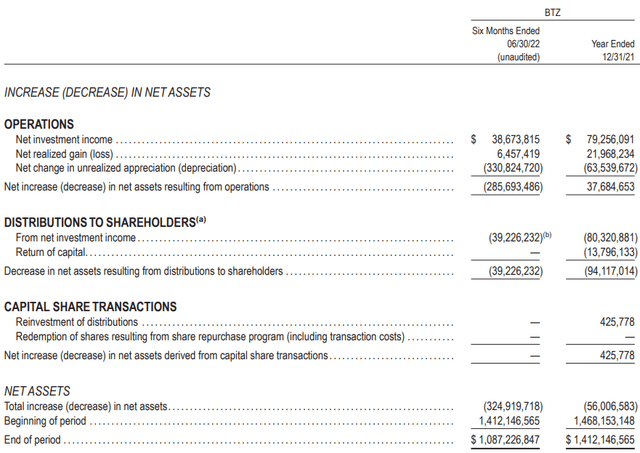

The fund’s last semi-annual report showed that net investment income coverage was looking fairly strong. At a 98.6% NII coverage, things were looking quite strong. While we ideally want to see over 100% coverage, a small shortfall isn’t too detrimental. We also see enough realized gains to bring coverage to over 100%

BTZ Semi-Annual Report (BlackRock)

However, with more recent reports, the fund’s coverage has dropped quite substantially. So the higher distribution yield is quite attractive, but I would caution against being comfortable with the sustainability of the payout at present. Coverage has dropped materially to only 76.4% for the last three months.

At the end of 2021, the interest rate on the reverse repurchase agreements was around 0.28 to 0.60%. This has now moved from 1.62% to 1.95% on the bulk of these. With rates rising further since the end of June, we should only expect that this is even higher now.

With a reduced NII coverage, that will mean that capital gains from their hedges primarily will have to cover an even larger gap now. It certainly is possible as interest rates have risen rapidly higher since this report, meaning that the hedges should have produced more gains. At the same time, we can’t ignore the significant unrealized depreciation in the fund.

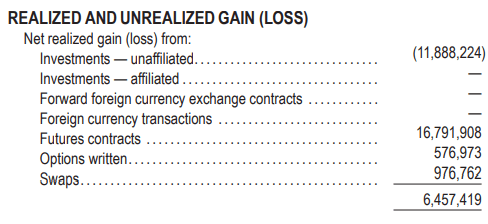

Here’s a look at what they’ve been able to generate with the futures contracts, options and swaps to the capital gains bucket. The futures contracts, in particular, were a strong contributor to gains in the first six months of the year.

BTZ Realized Gain Breakdown (BTZ Semi-Annual Report)

BTZ’s Portfolio

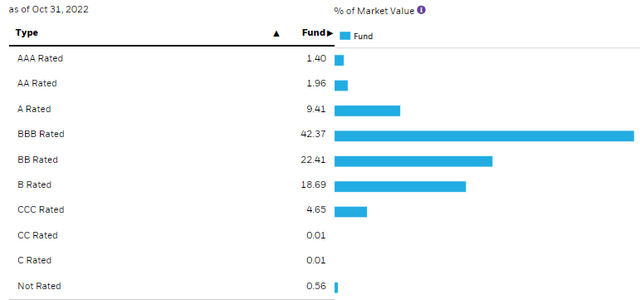

As mentioned, the fund is invested primarily in investment-grade and high-yield corporate bonds.

The fund carries some smaller exposure to floating rate exposed positions. In the last report, the fund had 6.4% allocated to floating rate loans and another 6.4% in asset-backed securities that are primarily floating too. Apart from those, some other various and unspecified bonds are also based on a floating rate when glancing through their portfolio. While that is helpful, at a 7.09-year duration, it certainly isn’t a huge focus of the fund.

Higher-rated bonds are generally going to be more interest-rate sensitive. A significant reason for this is that they often have longer maturities. When someone or a corporation is viewed as reliable, lending to them over longer periods of time is more comfortable. Conversely, with lower-rated company debt, you want to keep maturity shorter to reduce the amount of time for default or bankruptcy.

BTZ Credit Quality (BlackRock)

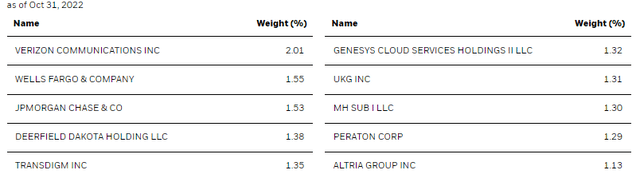

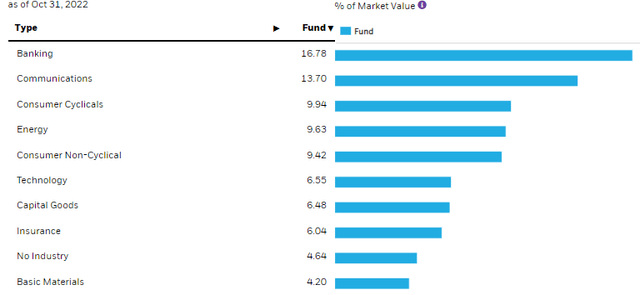

One thing to reduce risk further for fixed-income funds is to diversify. BTZ is quite diversified across a handful of industries, with no significant concentration in any individual industry. Added diversification also tends to translate into a larger number of holdings. Hundreds of positions aren’t that unusual. However, BTZ is carrying a truly staggering 1529 positions.

BTZ Sector Exposure (BlackRock)

With that number of positions, you aren’t looking to generate alpha against an index. You are simply just looking to perform somewhere in the middle. That can be a positive for some investors, and it can also be a negative for others. Depending on what you are trying to get out of the holding, BTZ could be exactly what you are looking for or what you are looking to avoid.

The largest holdings in the fund also don’t carry significant weight in any single position. Of course, this would be expected, given the high diversification level of the fund. As you near the top ten list, the weightings become materially smaller at just over a 1% weighting.

The list is led off in exposure to Verizon (VZ), Wells Fargo (WFC), and JPMorgan (JPM) debt – all highly regarded and stable institutions with investment-grade credit ratings.

Then we have Deerfield Dakota Holding. This is an example of their floating rate exposure. This is a Term Loan B based on SOFR + 3.75%. The last report showed that it came to a 5.28% yield. SOFR at the time of writing is now 3.8%. So we would be looking at a yield of 7.55% now. As rates are likely to continue higher from here, this will become even more elevated.

That brings up the fact that, at some point, rates could rise too high. At some point, interest rates become too burdensome on a business as it takes excessive cash flow to continue making payments. Of course, that’s exactly what the Fed wants. To slow down economic activity, which should slow down inflation. The exact level that starts breaking companies be different for each company. Before investing in floating rate debt, it is just something to keep in mind.

Conclusion

BTZ is in a more interesting position a year later. It isn’t without risks, but at a discount, it presents a better opportunity than when we last touched on the fund. It is still quite sensitive to interest rates, so if rates rise higher than anticipated, we could see another leg down. On the other hand, there could be some upside at this point if rates stabilize or the Fed pauses. There is no pause expected, to be sure, but we are getting hints that the pace of increases is likely to slow now. Utilizing a dollar-cost average method could be an appropriate strategy going forward.