BrightSpire Capital Stock: Big Yield But Bearish Chart (NYSE:BRSP)

Maria Vonotna

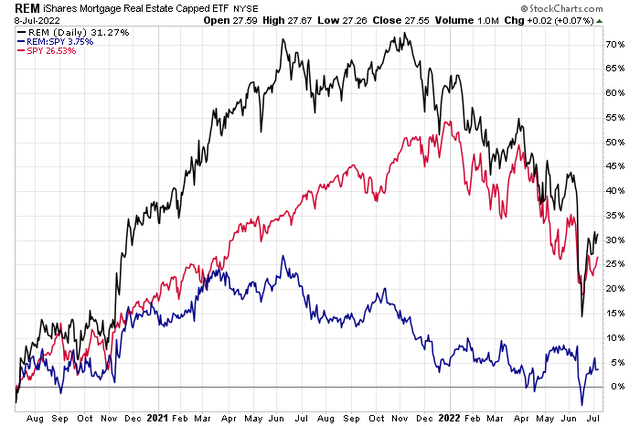

Mortgage REITs have been a tough place to stash cash this year as interest rates have marched higher. Relative industry weakness versus the broad domestic stock market has been ongoing for more than a year. The iShares Mortgage Real Estate ETF (REM) had a strong first half of 2021 but has since gone on to underperform SPY by about 20% in the last 13 months. Income investors might be questioning whether REITS are worth it right now considering default-risk-free short-term Treasurys sport a yield north of 3%.

Mortgage REITs Underperform SPY since Mid-2021

Still, there are big dividend yields to be had among some niche REIT players. One such name is BrightSpire Capital (NYSE:BRSP). According to Bank of America Global Research, BRSP is an internally-managed commercial real estate mortgage REIT that focuses on originating, acquiring, financing, and managing a portfolio of U.S.-based CRE debt investments and net leased properties. CRE debt investments are primarily first mortgage loans. BRSP may selectively originate mezzanine loans and preferred equity investments, often in conjunction with the origination of the corresponding first mortgages on the same properties.

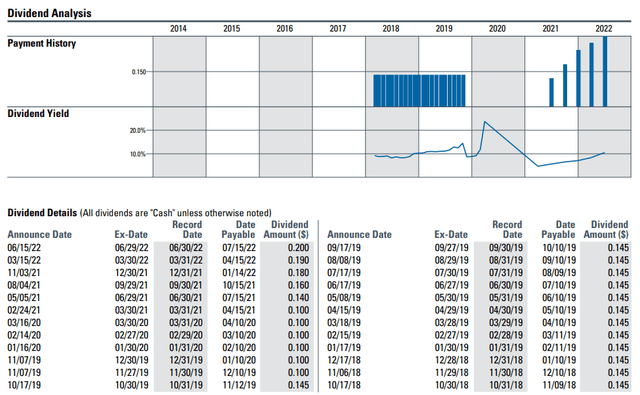

The New York-based $1 billion market cap REIT boasts a trailing 12-month yield of 10.44%, according to The Wall Street Journal. Its most recent $0.20 ex-dividend date was June 29 and that will be paid out this coming Friday (July 15). After dipping to $0.10 per payout, BRSP has increased the dividend in each of the past five quarters. BrightSpire also recently announced a $100 million stock buyback program that concludes on April 30, 2023, according to BofA.

BrightSpire Dividend History

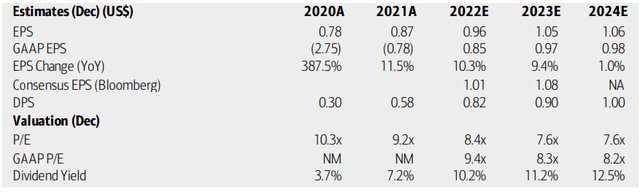

On valuation, forward earnings suggest shares trade at an attractive price. BofA analysts see EPS climbing above $1.00, before growth stalls in 2024. Of course, REITs are required to distribute at least 90% of earnings in the form of dividends, so even if EPS growth retreats, investors can still earn a solid yield. Moreover, a share repurchase program is also accretive.

BrightSpire Earnings, Valuation, Yield Forecasts

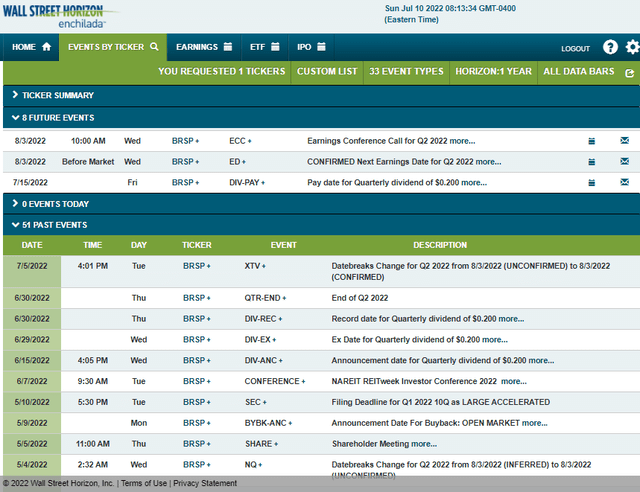

The next earnings date for BrightSpire is confirmed to be Wednesday, August 3, BMO, according to Wall Street Horizon.

Corporate Event Calendar: Q2 Earnings August 3 BMO

The Technical Take

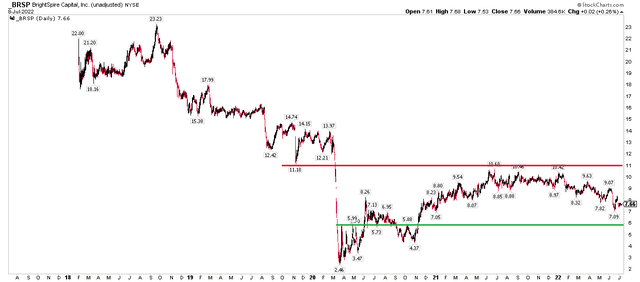

While BRSP has a good P/E ratio and juicy dividend yield, the chart tells a more bearish story. After trading above $20 per share in 2018, the stock has been in a downtrend for nearly four years. A key bearish breakdown happened in early 2020 when the stock fell under $11. Sure enough, an impressive rally off the March 2020 low of $2.46 met resistance at that 2019 low. A rounded-top pattern continues through today. I see support around $6 – a pivotal spot in 2020 – while $11 remains resistance.

BRSP: Rounded Top After Bearish Breakdown Below $11. Support at $6.

The Bottom Line

BrightSpire sports a high dividend yield and low P/E multiple, but a bearish chart makes me cautious on this REIT. I assert that buying the dip when shares approach $6 makes sense. Also, booking profits on a move toward $11 is warranted based on the technicals.