Bayer AG: Turnaround Value Stock (BAYZF)

Editor’s note: Seeking Alpha is proud to welcome Quantric Capital as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

JHVEPhoto/iStock Editorial via Getty Images

Thesis

Bayer (OTCPK:BAYZF) has been on a downturn for quite some while, after acquiring Monsanto in 2018 for $63 billion, due to countless lawsuits stemming from its Roundup herbicide product. During the last 5 years, the stock value has roughly halved. The company has, however, been turning itself around recently as it has increased profitability and has been winning most of its lawsuits over its herbicide product Roundup. Over the last year the stock is actually up almost 10%. Finally, it is priced attractively with a P/B ratio of just 1.26 with rising earnings and increasing profitability. Bayer appears to be a classic turnaround story in the making, so I assign a Buy rating.

Bayer Stock (Tikr.com)

Earnings on the rise

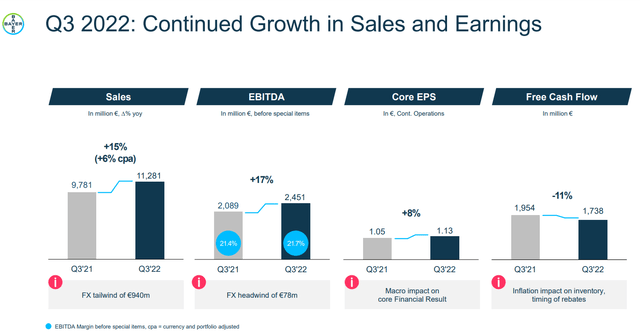

Bayer reported strong Q3 results last month, posting revenue of €11.3 billion this quarter compared to €9.8 billion in Q3 2021. Net income increased to €552 million in Q3 of this year, compared to €90 million in Q3 2021, continuing the trend of restoring pre-Monsanto profitability. Free cash flow is also strong at €1.7 billion this quarter, though down 11% from last year due to the strong dollar. Expected free cash flow for the fiscal year of 2022 is €3 billion, yielding us a free cash flow per share of €3.1. This strengthens my belief that the company is back on track of becoming at least just as profitable as it was before the Monsanto acquisition. A lot of its profitability had been compromised by the numerous law suits that followed from this acquisition, but a lot of legal costs have already been made and the firm has been winning most of its cases recently. A turnaround seems to be in the making.

Bayer Q3 Results (Bayer.com)

Strong, diversified, balance sheet

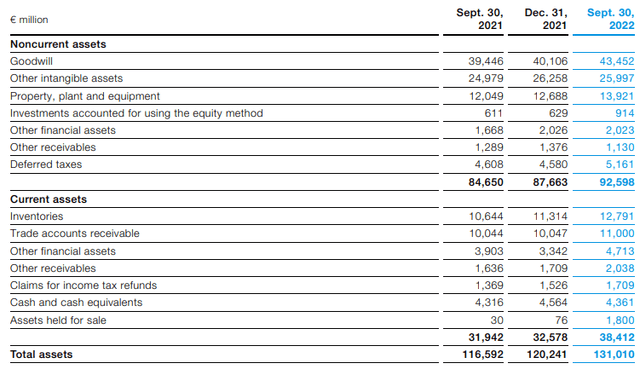

Besides earnings on the rise again, Bayer is priced cheaply. It is a true value stock as it boasts a solid balance sheet, offering a P/B ratio of just 1.26. It has €9.1 billion in cash and short-term investments at hand and a total amount of assets of €131 billion euros. Long-term debt has been high but stable at €39.4 billion, stemming from its acquisition of Monsanto in 2018. With free cash flow however picking up, Bayer is in a comfortable position liquidity wise. An important factor of its strong and attractively priced financial balance sheet is that the company boasts a strong portfolio of patents, playing a crucial role in pharmaceuticals, consumer health and agriculture. Its medicine portfolio comprises well-known household names as Asprin and MiraLAX and it is a crucial player in the agricultural industry. Especially the agricultural industry is in my opinion crucial to Bayer, as the growing world population and environmental problems, such as droughts, create a need for more and more (adaptive) technology in the agricultural sector, especially for strong and climate-resilient seeds.

Bayer Assets (Bayer.com)

Risks: Macroeconomic and legal uncertainty

As already expressed, the company unfortunately finds itself in unruly waters legally. Since its acquisition of Monsanto in 2018 it has faced countless lawsuits concerning the health risks of its glyphosate product Roundup. As also stated before, it has recently been winning a lot of these lawsuits and a lot of costs have already been made. Next to this, the war in Ukraine has exposed Europe’s industrial sector as heavenly dependent on Russian natural gas, driving up energy prices on the continent this year. Precautions have though been made and have even driven LNG prices into negative territory. This, however, remains a risk, as the continent has to adapt from a Russian gas dependent economy to an LNG fueled economy. Germany’s industry, though, has been very competitive, with Bayer being one of the nation’s strongest and largest industrial powerhouses, having countless patents and significant market power. Due to its innovative character and tons of IP it has a large moat in a lot of the sectors it operates in.

Discounted cash flow analysis shows undervaluation

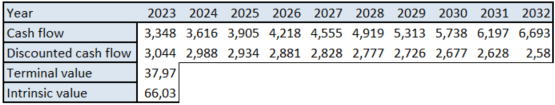

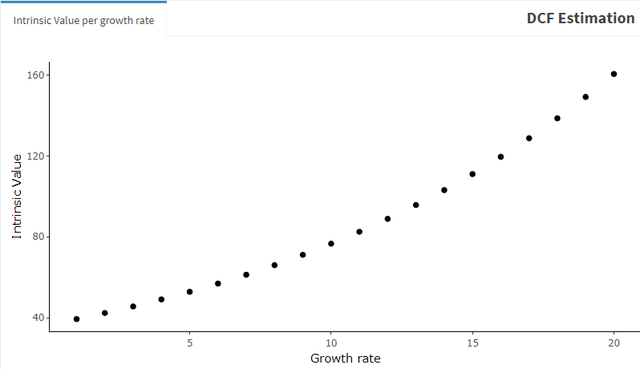

Going a little more in-depth and quantifying my investment thesis, I’ve performed a DCF analysis. For my calculation I will use Bayer’s total free cash flow guidance for the fiscal year of 2022 at €3 billion. This gives us a free cash flow per share of approximately €3.1. Furthermore, I will use a terminal growth rate of 3%, a discount rate of 10%, a very conservative growth rate of 1% and a time horizon of 10 years, and this yields us an intrinsic value of just under €40. This functions as a lower bound on Bayer’s stock price, as it assumes that the law suits will persist over the coming 10 years. I however expect Bayer to return to pre-Monsanto profitability. Before the Monsanto lawsuits, Bayer’s free cash flow per share was almost double its current cash flow per share. Taking the same growth rate (of 1%) as before and expecting the firm to solve its legal problems in the coming 10 years, I estimate the growth rate to be more in the region of 8%. I arrive at this number as it assumes that Bayer’s free cash flow per share in 10 years will be up to par with pre-Monsanto levels, thus doubling to €6.2, and growing with 1% per year extra resulting in a free cash flow per share of €6.7 in FY 2032. I thus arrive at a price target of €66 for Bayer, a €17 premium over the current stock price. In a more optimistic setting, the stock will recover to pre-Monsanto free cash flow levels quicker and will have a 5% growth rate on top. Then the intrinsic value of the stock would be just under €89, a 83% premium over the current stock price. In the figure below I’ve provided intrinsic value calculations with growth rates varying from 1% to 20%.

DCF model – 8% growth rate (Own calculation)

DCF calculation for varying growth rates (Own calculations)

Peer comparison is favorable

Also taking a look at the competitive scene, we know that Bayer’s closest German competitor is BASF (OTCQX:BASFY). Compared to BASF, Bayer has a higher EBITDA margin (TTM) of 28% compared to BASF’s 13%, signaling a stronger moat. Bayer is slightly more expensive though, as it has a current P/E ratio of 11.9, compared to BASF’s 8.6. Other close competitors of Bayer are more similar with regards to their P/E ratios and EBITDA margins, such as for example GSK (10.8 and 30.5%, (OTCQX:GSK)), Novartis (15.0 and 37.8%, (OTCQX:NVS)) and Johnson & Johnson (17.67 and 33.3%, (OTCQX:JNJ)). Even here though, Bayer seems to be priced on the low side. This, together with the strong balance sheet, diminishing risk of lawsuit costs and my DCF analysis, leaves me with a ‘Buy’ rating for Bayer.

Conclusion

Bayer has been trading at very attractive prices recently, as its P/B of 1.26 and P/E of 11.9 show. The company has also been winning most of its lawsuits recently and has already made significant legal costs. Moreover, earnings are on the rise as the 2022 Q3 results have shown. My discounted free cash flow analysis has shown that the intrinsic value of Bayer is around €66 if it solves its lawsuits in FY2032 and has a very conservative growth rate of 1%. Long-term debt levels are however high, resulting from the acquisition of Monsanto in 2018, at €39.4 billion. Taking into account Bayer’s decent cash position and cash flow, they nonetheless should not pose any acute problems. Acute problems do however stem from Europe’s macroeconomic situation, but the continent is quickly shifting to LNG and seems to be on the right track. In my opinion the pros definitely outweigh the cons and the company therefore receives a ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.