BASF Stock A Potential Loser; Dow A Likely Winner (OTCMKTS:BASFY)

anusorn nakdee/iStock via Getty Images

Investment thesis

The unfortunate explosion at the Texas LNG export facility may have reduced LNG supplies to the EU by as much as 1.2 Bcf/day, for months to come. If that were not bad enough, Siemens (OTCPK:SIEGY) failed to deliver some components that were sent to Canada for servicing back to Gazprom, which apparently are crucial for the proper operation of the NS1 pipeline, which seems to be limiting Russian gas exports. Between these two factors, and possibly more severe escalations of this nature going forward, the EU could find itself experiencing yet another year of natural gas shortfalls. BASF (OTCQX:BASFY) may see a dramatic impact on its EU activities, as higher natural gas prices are set to cut deep into its profit margins.

Dow Inc (NYSE:DOW) on the other hand could benefit from lower natural gas prices in the US, in part thanks to the LNG facility being offline. Things may look dire for EU natural gas supply security prospects for the long term if a political backlash against converging natural gas prices between the Americas and Europe will materialize, even as it ruptures its energy ties to Russia. In a worst-case scenario, the EU is likely to ask BASF as well as other industrial operators to idle their plants in order to preserve natural gas supplies for residential needs in the winter. The impact on its profits, therefore its stock price is potentially dramatic. Dow has an ample supply of affordable natural gas to power its American operations available. The price of natural gas in North America has every chance of remaining low relative to European prices for the foreseeable future, and the odds of outright disruptions are arguably low. Dow is therefore a buy, while BASF is a sell.

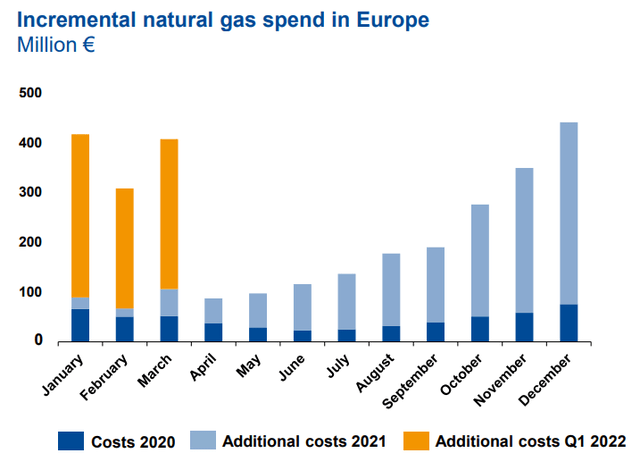

BASF’s profits have been impacted by higher natural gas prices in the past few quarters

BASF natural gas price burden (BASF)

For the first quarter of this year, BASF is claiming that the added cost of natural gas came in at an additional .9 billion euros. In other words, almost $1 billion more was needed to be spent at its European plants in the last quarter compared with the first quarter of 2021 in order to purchase its prime production input.

In part due to the price pressures stemming from natural gas price spikes in Europe, BASF saw a decline in net income for the first quarter of the year of 29%, compared with the first quarter of 2021, even as revenues increased by 19%. As a result, profit margins declined from 8.9% for the first quarter of 2021, to 5.3%. It is still able to stay profitable within what is arguably the most severe possible natural gas price environment that one can expect in the EU. As I shall explain soon, however, things may yet get a lot worse for BASF in Europe, possibly leading to significant disruptions to its activities, at which point BASF may no longer be able to continue being profitable, while revenue volumes will also plunge.

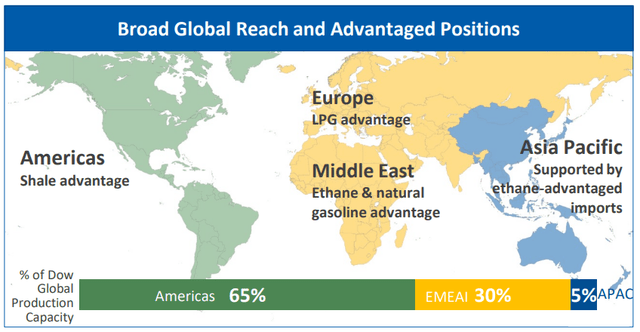

Dow is also facing higher natural gas prices compared with last year, but prices are many times lower than they are in Europe and the future outlook may not be as risky

For the first quarter of this year, Dow saw an increase in revenues of 22% compared with the same quarter a year ago, while earnings saw an increase of 35%. Part of the reason why Dow is doing much better in regard to profitability is that most of its business operations are in the Americas, where natural gas prices are still far more reasonable compared with Europe and to some extent in Asia.

Dow Chemical operations map (Dow Inc)

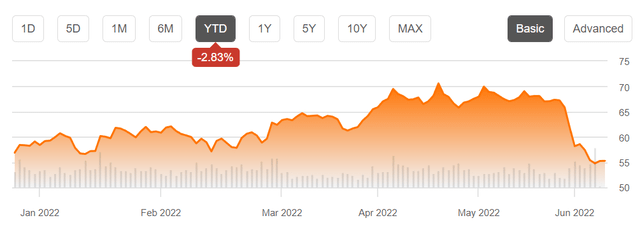

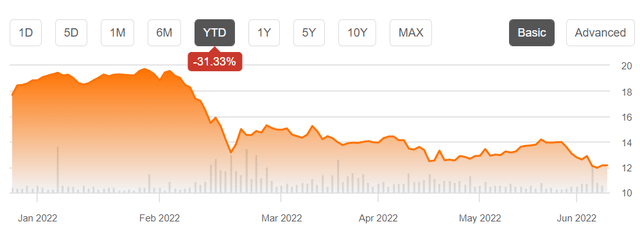

As things stand right now, clearly Dow is better positioned than BASF, in relation to geopolitical events that are having an increasingly severe impact on regional natural gas prices. These differences are seen in their stock performance YTD.

DOW Inc stock price YTD (Seeking Alpha) BASF stock price YTD (Seeking Alpha)

Of course, as investors, we have to be forward-looking, and most certainly one might argue that BASF is a buy, since it is still a solid company, while the geopolitical turbulence that has its stock price so heavily battered, and its financial results deeply impacted, is just a temporary factor. At the same time, Dow stock is down less than the overall US market indexes, meaning that one is far from getting a bargain entry point. BASF has a forward P/E of just under 8 as I write this, while Dow has a forward P/E of less than 7, meaning that there are fundamental reasons why the two stocks are treated by the market the way that we see in their stock performance.

I myself think that there is a reasonable chance to expect the geopolitical headwinds to dissipate for BASF’s European operations, at which point there can be some significant upside to its stock price. For this reason, I took a small nibble at its stock recently. I am only keeping a minor position in the stock, because while the upside potential is there, there is still significant downside risk, as I shall explain. And while there is a chance that things will normalize in terms of EU-Russia relations, with every day of escalation, we move further and further away from such a prospect.

Since Dow is not trading at a significant discount YTD, it is arguably a stock that has less upside potential. At the same time, it did trade as high as over $70/share this year, so at the current stock price of around $52/share, it is perhaps not such a bad entry point either, which is why I recently bought some shares. If one also takes the most likely outlook for regional natural gas markets into account, given continued geopolitical, geological as well as political evolutions currently in progress, Dow is looking increasingly like a much better bet, with a far better risk/reward profile than BASF.

The continued deterioration of EU-Russia relations makes BASF a far riskier bet than Dow in the short term, as well as for the longer term

While the upside potential of an increasingly unlikely geopolitical outcome, namely the full normalization of EU-Russian relations, in regards to BASF’s potential stock price upside is hard to ignore, it is also getting to be harder to ignore the increasingly low odds of such an outcome. The EU declared its intention to fully cut its energy import ties with Russia, and it will be very hard for its leadership to back out, given that it has been presented as a moral as well as the geostrategically vital imperative to do so, even if it will happen at a steep economic cost. Just to understand how committed the EU’s leaders are to this goal, there are green politicians who are now encouraging the burning of more coal as a necessary evil substitute for Russian gas.

On the other side of the equation, it goes without saying that Russia will not sit idly by either. It is diverting its LNG exports to Asia, and it is expanding its pipeline connections with other buyers such as China & Turkey. Most significantly, Russia is also diverting a growing volume of natural gas to its own growing petrochemicals industry, with long-term goals in place to grow its fertilizer and other chemical products derived from natural gas. At some point, such plans will be in stages that are advanced enough that it becomes uncertain whether there will be any turning back, even if the EU were to backtrack on its end.

There are the increasingly real prospects of dwindling Russian gas imports. There is an uncertain long-term future for Norway’s natural gas supplies, which account for about a fifth of total EU natural gas supplies. Norway’s oil & gas production is forecast to peak in 2024. An uncertain future for certain LNG export sources, such as Qatar and the US is also in the cards. The EU could easily get caught out facing severe natural gas shortages in the short term, as well as in the years ahead, given how many sources of uncertainty it is faced with. As things stand right now, we are at the stage where EU citizens are asked to engage in energy-saving activities that should not have a great deal of negative impact on the economy. It does have a significant impact on the basic comfort level that most EU citizens get to enjoy since they are asked to use their heating and air conditioning systems at a bare minimum meant to prevent extreme discomfort, as I pointed out in a recent article. As long as such personal sacrifice can be counted on to help reduce natural gas demand in the EU, companies like BASF can be spared from facing extreme measures, such as being ordered to shut down their operations.

Such measures, especially if they are mostly voluntary, can only go so far in addressing Europe’s growing risk of energy shortages. More coal can be burned, even as the green movement laments the fact that it has to come to it, but there are some logistical and infrastructural limits to that as well, especially when called upon on short notice. There is, therefore, a high degree of risk that the industry will be called upon to shut down in order to spare the general public from extreme energy-saving measures, such as blackouts, loss of gas supplies to households that depend on it for heating their homes, cooking, as well as heating water.

Shutting down industrial activities was the plan in place back in 2018, when a shortfall in natural gas inventories occurred in late winter. the EU was spared from having to take such actions by Gazprom’s intervention. There was a similar emergency plan last winter, as weather-related shortfalls in renewable energy production last year led to very low gas storage levels. Mild weather, combined with some favorable weather patterns in terms of facilitating renewable energy generation earlier this year, intervened to spare the EU from having to take drastic measures. We should not assume that just because the EU was spared the previous two times that it faced a natural gas crisis, it will squeak by again. There is a high degree of natural gas supply shortfall risk, and companies like BASF will be among the first to be told to cease operations for the duration of the shortfall.

Dow faces none of these problems in its operations in the Americas, where most of its facilities are located. In fact, there may be a trend toward energy protectionism meant to shield US consumers and businesses from spiraling global energy price spikes emerging, which will also help to shield its business. Lower energy costs and energy security will not only shield its current operations from losing revenues and profitability, but it is likely to also help it gain market share in Europe and to a lesser extent in Asia with cheaper exports of its chemical products from the US. There is therefore very little downside risk, in theory, comparatively speaking, while the upside reward potential can be significant, even if it may not be as great as one might expect with BASF, which is trading at a stock price that is roughly 1/3 of its previous record high.

The BASF/Dow comparison comes down to risk/reward considerations. BASF stock is a very high-risk asset at this point, but with significant upside potential, in the increasingly unlikely scenario where there is a normalization of EU-Russia ties. Dow stock on the other hand has significantly reduced downside risk, while it also has significant upside potential. BASF has very low odds of a perfect set of events coming together to work in its favor, while odds of things going south for Europe’s energy security, therefore the financial prospects of BASF are currently very high. I am therefore considering buying more Dow stock going forward while looking for favorable exit points for my already very limited exposure to BASF.