Applied Materials Stock: Bulls Look To Be Taking Control (NASDAQ:AMAT)

jiefeng jiang/iStock via Getty Images

The absolutely wild action we’ve seen in the past few weeks, particularly in growth stocks, has created some truly outstanding buying chances in many places. I think we’ve either seen the bottom, or are very close, and as such, I’ve been shopping in the past week or so. Last week was monstrous to the upside, and that feels great, but we still need to keep on our toes for signs this this another bull trap. Like I said, I don’t think it is, but we have to remain objective.

In viewing the market through the lens that we’ve bottomed (or will shortly), I’m looking for exposure to high-growth areas that should provide the best returns during the next broad market rally. You don’t want to own things like utilities, consumer staples, etc., because those areas will underperform during most bull periods. Areas with high growth and depressed valuations will lead, and one of those areas is semiconductors.

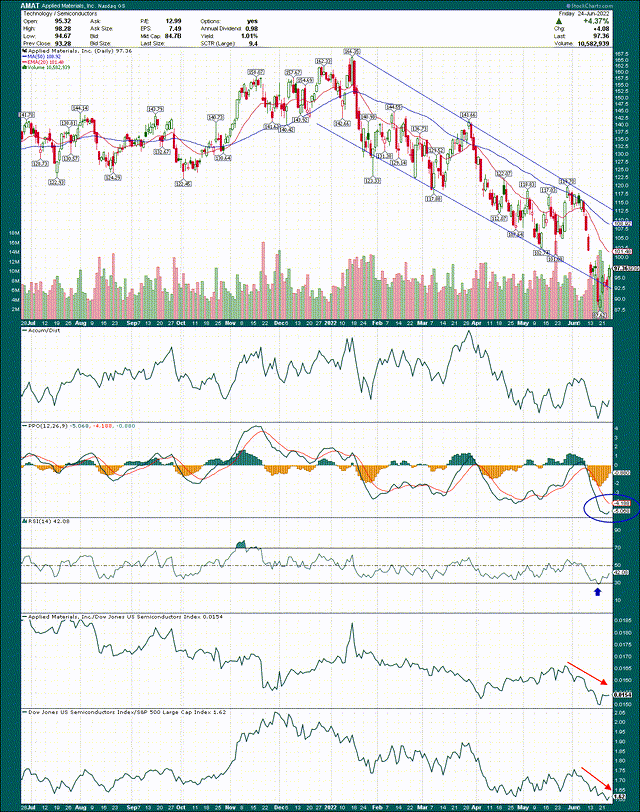

The semis have been destroyed since the top late last year, leading us down as effectively as they’d led us higher in 2021. However, I think the time is now to pick up exposure to semis, and one way to do that is with Applied Materials (NASDAQ:AMAT). The chart is certainly not particularly bullish at the moment, but remember we’ve been going straight down for seven months. However, I do think it’s at the point where increasing exposure makes sense.

I’ve drawn in the trendline that began late last year with the peak, and carries on through today. One important thing I want to note on the trendline is that AMAT broke through the channel last week, only to quickly and convincingly rally back into the channel. That kind of false break down is generally very bullish, in the same way that failed breakouts to the upside are generally very bearish. I think the reaction to the break down last week was very telling and makes it much safer to buy the stock now.

I’ll note the accumulation/distribution line remains weak, and that’s something I’d like to see turn higher. It’s okay, but could be better.

In addition, the relative strength of the semis versus the S&P 500 hasn’t improved, but it isn’t weakening further. Same goes for AMAT against the semis; it’s okay, but could be better.

Where I think things get interesting is with the PPO, which is my preferred measure of medium-term momentum. The PPO plunged from the centerline a few weeks ago to -5 today, which is a very large move. It indicates AMAT was extremely oversold, and almost certainly contributed to the failed break down last week. The PPO is also turning higher pretty rapidly, so barring disaster this upcoming week, I expect to see a crossover of the short-term line over the long-term line, which generally portends a rally.

This chart is far from bullish, but keep in mind where we’ve come from. Seven months of relentless pounding makes an ugly chart, but the signs are there that suggest the worst is behind us, and that the risk is to the upside. If you trade AMAT, place your stops at or just below the most recent low, or the bottom of the channel whichever is highest. That preserves your capital against large losses, but maintains your upside potential.

Now, let’s take a look at why we’d want to own semi exposure through Applied Materials.

Why Applied Materials?

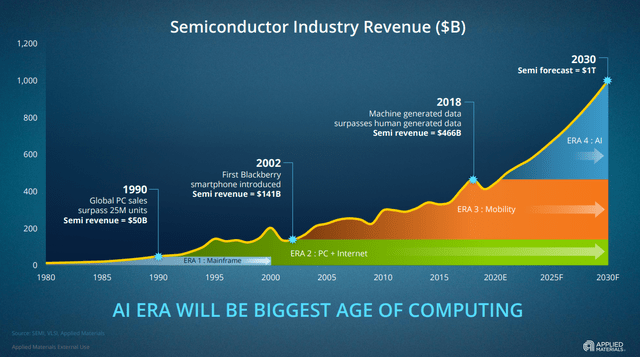

The biggest reason I like AMAT is because the semiconductor industry, although it has produced massive rates of growth in recent years, is on the cusp of something much larger. Semi components in everyday devices continue to soar over time, as more and more devices are connected.

This chart from AMAT shows the exponential growth of the industry, and what the company believes will be the next up move in the market, which is another doubling (roughly) of total revenue by 2030. AMAT has positioned itself to take full advantage of these market opportunities with a diversified slate of class-leading products.

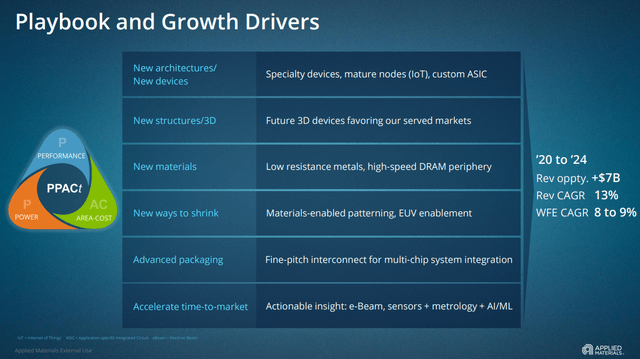

This table is handy in showing the “chips in everything” tailwind for the industry. Not only is the number of products needing chips growing all the time, but so is the number and cost of chips in products that already have them. Smartphones and automotive are the two biggest areas of growth in the next few years, as they see tailwinds from both very high volumes, and high levels of chip usage. There are other areas of growth as well, but for sheer volume and size, autos and phones are the big ones.

AMAT stands to take advantage of these trends through its diverse product portfolio that offer real solutions to customers.

The company sees a variety of tailwinds in the years to come, as listed above, and ~$7 billion in incremental revenue opportunity through 2024. This is a big reason I like the semis, because as the tide rises, it tends to raise all boats. There’s just so much revenue to be captured in the years to come, I think you need exposure to the group, and AMAT is a fine way to accomplish that.

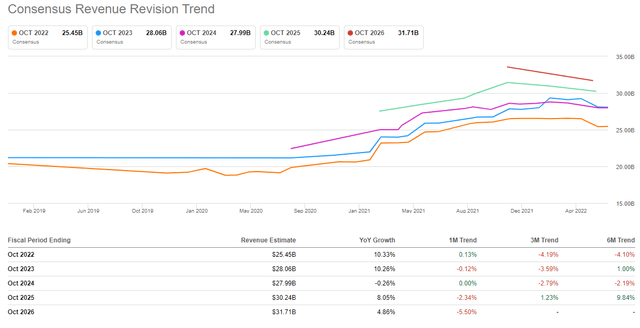

Now, let’s take a look at revenue estimates to see where AMAT has been and where it might be going.

Estimates have come down in recent months, and that’s certainly not a good thing. However, keep in mind they’d soared for a year or more prior to that, so we’re seeing some reversion. The important thing is that they’ve leveled out in the past couple of months, and that we’re still looking at double-digit growth this year and next, even with downward revisions. I think that once the fear of this recession that we’re either already in – or about to enter – subsides, we’ll see semi revenue forecasts rise again. Keep in mind that for growth areas like semis, sentiment is everything because it drives the valuation premium investors are willing to pay. Right now, there’s no premium, but if I’m right, the premium will return in the back half of this year, and AMAT should be off to the races.

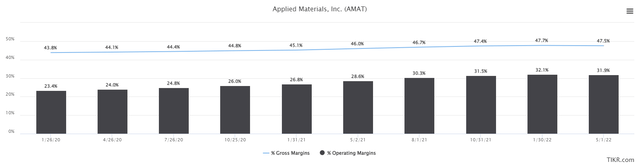

Now, AMAT is not just a revenue growth story, and it has actually publicly stated it expects to grow EPS at 1.7X to 2.0X the rate of revenue growth. That’s a very bold thing to say, but if we look at some hard math, it’s not that farfetched. Let’s start with gross margins and operating margins on a trailing-twelve month basis for the past few years.

Gross margins haven’t moved a great deal but operating margins have. The company has done a great job of leveraging down costs with incremental revenue, and the beauty of this is that so long as revenue continues to grow, this should continue to improve. It’s entirely possible we see another 200bps of operating margin improvement in the next couple of years. If there’s upside to revenue forecasts, as I believe there will be, it could be more. That makes every dollar of revenue more profitable, and juices EPS upside potential.

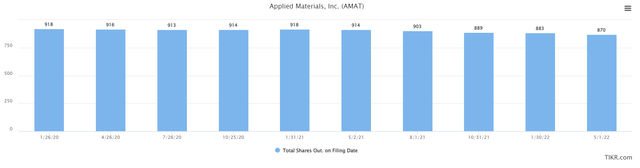

The other factor is AMAT’s share repurchases, which it is doing quite a lot of with the share price down as it is. Below are shares outstanding at the end of the quarter for the past three years, in millions.

In the past twelve months, we’ve seen shares decline from 914 million to 870 million, or ~5%. That means that all else equal, EPS rises 5% more than it otherwise would have, as the denominator in the EPS equation shrinks. This is why I love share repurchases, and with AMAT producing billions of dollars in free cash flow annually, I suspect we’ll see more of this.

While stating a goal of essentially doubling the rate of revenue growth in terms of EPS growth is bold, if we combine share repurchases and margin growth, it’s certainly possible.

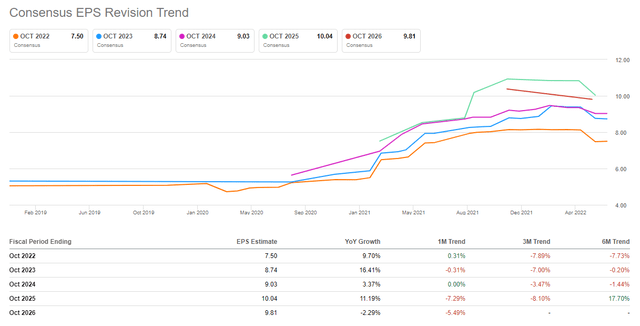

What’s interesting is that analysts aren’t that bullish. Below we can see that growth in EPS for this year is expected to be about equal to revenue growth, although that’s set to improve in fiscal 2023.

We see a similar story with the slope of revisions as we did with revenue, so again, I see upside risk here. Given the pace of share repurchases, 10% revenue growth, and a measure of margin expansion, these estimates look too low to me.

A trough valuation? Yes, please

The thing about growth stocks is that when they decline, they tend to really decline. Growth areas of the market tend to get way too expensive at the top, and way too cheap at the bottom. AMAT at 22X earnings was too expensive last year, but today at 12X earnings, it is too cheap.

The average valuation in the past three years is 16X earnings, and that’s a conservative base case for what we should expect. Keep in mind the mega-trend of ever-increasing chip usage, which I believe will drive higher average valuations in the sector.

Thus, I see 16X to 18X forward earnings as fair value for AMAT, and that means we could see 33% to 50% upside from the valuation alone. Coupled with EPS growth, that gives us a 12-month price target of $153 (on $9.00 in EPS). As I said above, I see upside to EPS estimates, but even without that, we’re looking at the potential for ~55% returns, and little downside risk if you use stop losses. That looks pretty attractive to me.