Amazon Stock: Rich Valuation Implies Another 30% Downside (NASDAQ:AMZN)

4kodiak/iStock Unreleased via Getty Images

Thesis

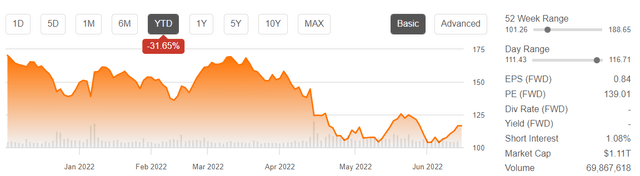

Amazon (NASDAQ:AMZN) stock is down more than 30% YTD and investors might be tempted to consider the company as a bargain opportunity. However, at over x50 P/E the stock is still relatively expensive. Personally, I see Amazon’s e-commerce business entering a downturn as the global economic outlook worsens. The company’s cloud and streaming business, however, are likely to sustain strong topline growth.

I value AMZN shares based on a residual earnings framework and calculate a fair base-case target price of $81.94/share, implying that Amazon stock could have another 30% downside. Thus, as a function of the target-price, I assign a Sell recommendation.

Seeking Alpha

Challenging outlook for e-commerce

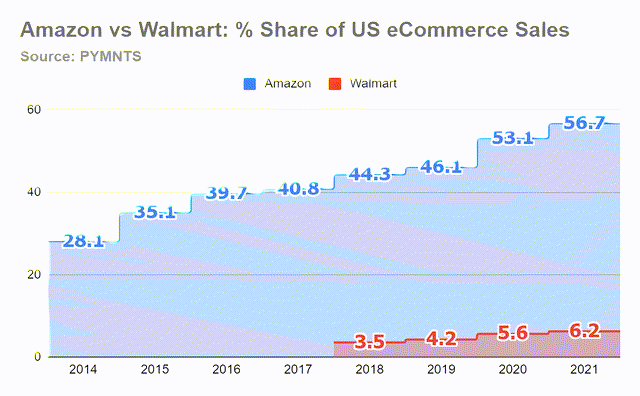

After many years of enormous growth, Amazon’s e-commerce business has arguably achieved a level of business scale that makes sustained market growth difficult. There are two reasons to this claim: First, many of Amazon’s primary target markets, notably NAM and Europe, have reached close to full e-commerce penetration. At the same time, Amazon’s expansion in growth markets such as LATM and SEA sees increasing competitive pressure from local players, including Sea Limited (SE), Mercado Libre (MELI), JD.com (JD), Alibaba (BABA). Second, market share gain is also difficult. As of Q1 2022, Amazon claims already a >50% market share in the US. I believe any additional claim would only provoke already alerted anti-trust officials. While the company has managed to defend past lawsuits in the EU and the US, the anti-competition allegations against Amazon could accelerate and either force the company to spin-off units and/or slow market expansion.

PYMNTS

Moreover, Amazon’s e-commerce sales are likely to suffer in a recession–as all commerce activity does. While I do acknowledge that Amazon’s brand equity and favorable price-to-service ratio might prove quite defensive in a recession, I feel the data is too clouded to support high-conviction. The financial crisis is no suitable reference, in my opinion, as Amazon’s business operations and scale of activity have changed considerably since then. Similarly, the 2020 stay-at-home recession driven by Covid-19 doesn’t reflect an ordinary economic slow-down.

Expecting strong AWS topline growth

I support a strongly bullish outlook for Amazon’s cloud business, as there are multiple things to like. First, the global cloud computing market is expected to grow at an 8-year CAGR >17%, reaching a market size of more than 1.6 trillion by 2030. Secondly, Amazon’s cloud services are likely to support an operating income margin between 35% – 40% (Source: Bloomberg Terminal, Intelligence primer). Third, AWS is expected to give a stronger focus on Product-as-a-Service (PaaS) opportunites, which have a materially higher margin than Software-as-a-Service (SaaS) offerings. As of 2021, approximately 75% of AWS business is based on SaaS. That said, given a 30% growth expectation for 2022, paired with a 40% operating income margin, AWS operating profitability can be estimated at $25 billion. By 2025 this number could likely expand to >$40 billion.

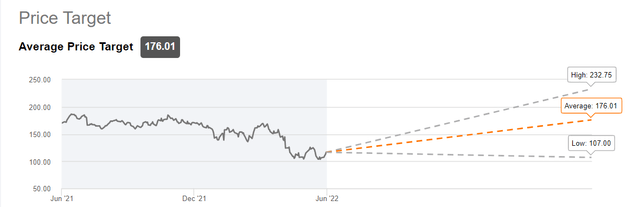

How analysts see AMZN

Analysts are very bullish on Amazon stock. Based on 44 analysts who cover the stock, there are 36 strong buy ratings, 13 buy ratings, 1 sell rating and 1 strong sell rating. The average target is $176.01/share, implying >50% upside. The highest target stands at $232.75/share.

Seeking Alpha

Moreover, according to the Bloomberg Terminal, as of June 2022, analysts see Amazon’s business fundamentals to remain strong. Revenues for 2022 and 2023 are estimated at $524.4 billion and $610.8 billion. Respectively, EPS are estimated at $0.84, and $2.68. In this article I do not want to challenge analyst consensus–given that analyst consensus estimates are usually very precise for a 2-year outlook (but the stock price ratings are not).

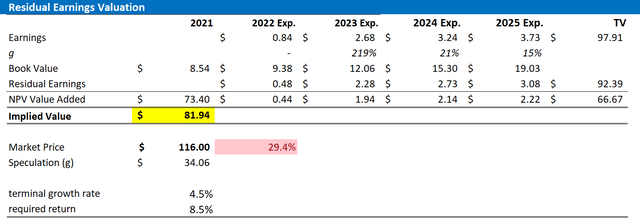

Residual Earnings valuation

So, if analyst consensus is right about AMZN’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal. As I mentioned, challenging analyst consensus is out of scope for this article.

- The estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of June 23, 2022. My calculation indicates a fair WACC of 8.5%.

- To derive Amazon’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5% plus one percentage point. Higher than GDP growth is justified, in my opinion, as the company is spending aggressively in R&D and management is arguably best-in-class.

- I do not model any share-buyback–reflecting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for AMZN of $81.94/share, implying that Amazon stock could have another 30% downside.

Analyst Consensus; Author’s Calculation

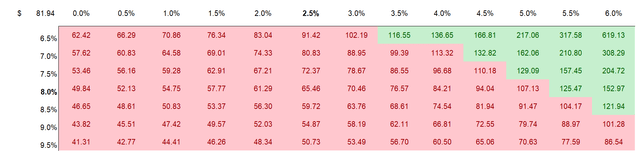

I understand that investors might have different assumptions with regards to Amazon’ required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. The risk/reward looks relatively unfavorable.

Analyst Consensus; Author’s Calculation

Some investors might suggest to split Amazon into multiple segments–such as commerce, cloud and streaming–and value the company based on a SOTP valuation. However, I personally strongly disagree with the thesis that Amazon can be split into parts, as I see the business model of the segments as highly interrelated. Amazon expends e-commerce ecosystem to gain scale and consumer brand equity, which the company then leverages into new verticals such as streaming. At the same time, the profitability of the Cloud business allows Amazon to support low-margin commerce operations to attract customers and gain scale.

Risks

Investors looking to short-sell AMZN’s equity – given the stock’s valuation premium – should be aware of the following upside risks to my target price:

First, an improving macro-economy, including easing of inflation and supply-chain challenges, could positively stimulate consumer confidence and buying power. In addition, even in a recessionary environment, Amazon’s strong brand equity could cushion the company against price-sensitive consumer choices. Second, Amazon’s cloud business could outpace expectations, as the company might manage to build a portfolio of high-margin PaaS faster than expected. Third, Amazon has a rich history of successful innovation and lives a culture of constructive creativity. Thus, I do not see it as unlikely that the company will claim–or create–new market opportunities that drive growth and share-holder returns. Forth, much of Amazon’s current share price volatility is currently driven by investor sentiment towards risk and growth assets. That said, if investor sentiment turns bullish, Amazon could see upside pressure–without any fundamental driver.

Conclusion

Amazon is without a doubt an amazing business. But investors should be cautious of paying too much for the company’s stock. While I do model continued strength in Amazon’s AWS business, I see a difficult environment for the company’s retail e-commerce activities. That said, I value AMZN shares based on a residual earnings framework and calculate a fair base-case target price of $81.94/share, implying that Amazon stock could have another 30% downside. My Sell recommendation is exclusively driven as a function of the target price. Given the current environment, I just see too many unquestionable bargains to speculate on an implied overvalued stock such as AMZN. My top picks are Meta (META) and Apple (AAPL). (See here and here).