Altria: Why I Continue Reinvesting (NYSE:MO)

Mario Tama

2022 has been one of those years where even one of the best performing large stocks, Altria Group, Inc. (NYSE:MO), is down about 3% for the year. But that does not diminish the fact that Altria has been one of the strongest stocks in my portfolio, which I believe is accelerated by my choice to reinvest dividends. I’ve stated in some of my recent Altria articles’ comments stream that I’d continue reinvesting dividends back into the stock at least until the current yield remains above 6%. Why 6%? No hard science, but:

- the stock’s five year average yield stands at about 6%

- stocks like Altria that operate in perennially declining industries and are under various onslaughts constantly need to offer much higher yield than the average stock.

It is simple math that reinvesting (commonly referred as “DRIP” aka Dividend Reinvestment Plan) at lows should lead to better returns over the long-run if and when Mr. Market realizes the undervaluation. In other words, compounded returns. But accumulating the wrong stock may turn out to be compounding your miseries rather than your returns. So, what gives you the confidence that you are accumulating the right stock? Although nothing is guaranteed in the world of investing, Altria, with a combination of factors like the ones mentioned below, provides me that confidence:

- A stated policy of paying 80% of earnings to shareholders as dividends.

- A history of backing up the stated policy through thick and thin.

- Strong free cash flow backing up the dividends.

I currently hold approximately 1,140 shares of Altria and my records indicate that I purchased only about 900 of those. That means, I’ve accumulated about 240 shares of Altria through dividend reinvestment. As things stand right now, at the current price of $46.56 per share and annual dividend of $3.76/share, I get about 90 shares through reinvestment. Since I’ve held Altria for a long period of time (across multiple accounts), with some carefully planned trimming along the way, it is a bit hard for me to say how much exactly the reinvestments have contributed over the years.

How can a new investor decide if reinvesting in Altria (especially when the stock price is under pressure) will be worth it in the long run? Let’s find out using the experiment below. I am using the following starting points:

- Initial shares purchased: 100

- Current annual dividend per share of $3.76

- Current 52 week high share price of ~$57

- Current 52 week low of ~$40

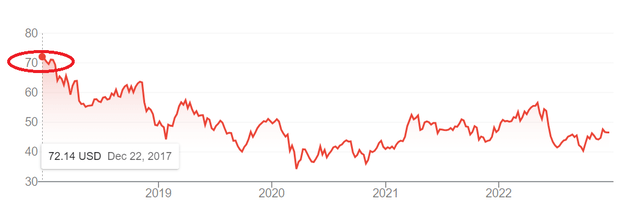

- Eventual sell price: $70 (Although I am unlikely to ever sell out of Altria completely, l am using the 5 year high shown in the chart below for the sake of calculations)

- Duration: 3 years.

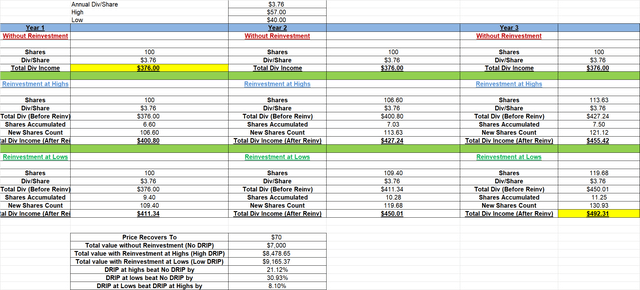

Altria Chart (Google Finance) Altria DRIP Results (Compiled by Author)

(Read the table top down to compare No-Drip vs. High Drip vs. Low Drip for each year. Read it left to right to compare the returns for each year across the same category.)

Turbo-Charged Income

There is no doubt that a vast majority of investors hold Altria for its dividend, but that does necessarily mean everyone holding it is a retiree who is consuming the dividend income. This stock can work its charm for much younger investors as well with a long term horizon. For such folks, unless you need the dividend income immediately, turning your automatic reinvestment is a no-brainer as well. The table above shows that in just three years, an investor generates $116 more ($492 minus $376) in additional income when choosing to reinvest at lows while reinvesting at highs provides an additional income of $70 ($455 minus $376).

Not Just Income But Overall Returns Too

Obviously, all the accumulated shares have an impact on your overall returns as well and not just the potential dividend income. As stated earlier, I am unlikely to ever sell out of Altria completely but should a compelling situation presents itself, it is nice to have the option. The table shows that as a result of the accumulated shares, reinvesting at lows beats no reinvestment by 30% while reinvesting at lows beats reinvestment at highs by 8%.

The Arguments

- Obviously, no one knows the exact highs or lows, but using the average of the returns in high DRIP and low DRIP scenarios still nets better returns. For example, the low DRIP scenario gets an investor 11 shares every 3 years in the experiment above while the high DRIP scenario gets 7. The average of 9 does not sound bad to me at all.

- Bear in mind that the actual difference in returns will likely be much starker under real-world circumstances due to a longer time frame than 3 years and a growing dividend (the table assumes a constant $3.76/share).

- On the flip side, one can argue that using the dividends paid, an investor can seek better returns elsewhere. Sure. But that means having to do the whole nine yards with another stock, from initial analysis, to monitoring, to getting used to the nuances associated with the company and stock. For example, at this point, I can separate the news from noise with respect to Altria and most of the stocks I own. Personally, I prefer sticking with the stocks I’ve already analyzed and am confident about instead of going shopping with and for just the dividends received.

Conclusion

Altria is extremely likely to increase its annual dividend in August 2023, which I project to push the annual dividend to at least $4.00 per share. And reinvesting at that rate is likely to get me almost 100 new shares per year (1,140 shares times $4, reinvested at about $46). These accumulated shares do turbo charge the overall returns when the market realizes the undervaluation of the underlying stock. This happened for me with this very same stock around 2016/2017 when dividend paying stocks went on a crazy run to the extent that stocks like Altria and Realty Income (O) yielded less than 4%.

Words like dividends and reinvestments sound like they are just for retirees but nothing could be farther from the truth. If 100 shares can net an investor an average of 9 additional shares in 3 years under the average conditions, imagine the returns with a much longer horizon. I look forward to many years of investing and reinvesting with Altria (with careful pruning along the way to not over-allocate further). What about you?