Agree Realty Stock: Underperformed Since July, Now It’s A Buy (NYSE:ADC)

Mongkol Onnuan

Thesis

We informed investors in our July update not to join the rally in Agree Realty Corporation (NYSE:ADC) stock as it was moving into a potentially significant resistance zone.

Accordingly, ADC re-tested that zone before sellers swamped its buying momentum and forced ADC down, digesting its summer rally and sending its buyers fleeing toward its October lows.

Hence, we encourage investors to pay attention to price action and discern potential red flags through their price structures. The market clearly drew investors into a bull trap (indicating the market denied further buying upside decisively) before unleashing its avalanche of sell orders.

Accordingly, the leading triple-net lease retailed-focused REIT has underperformed the broad market since our update, posting a total return of -15% against the SPDR S&P 500 ETF’s (SPY) -8.9% gain.

Hence, we believe it’s another timely reminder for investors to be mindful of valuations, even for high-quality REITs like ADC. Also, please pay attention to price action, as it often provides clues into the market’s forward intentions.

Given the significant decline in ADC from its August highs (down more than 20% through October’s lows), we discuss whether it’s reasonable for investors to add more positions.

Agree Realty’s Near-Term Selling Momentum Likely Exhausted

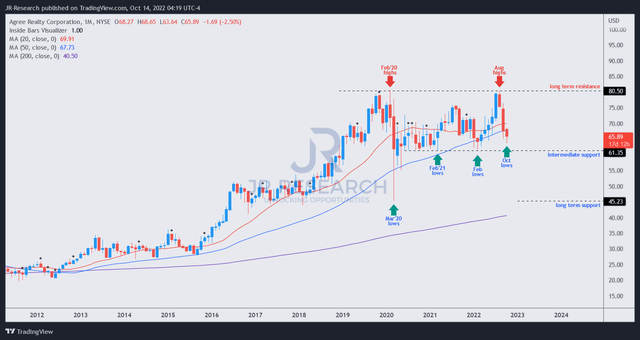

ADC price chart (monthly) (TradingView)

As seen in ADC’s long-term chart, the market drew ADC buyers in rapidly from its February 2022 lows toward its August highs, with the momentum reaching a climax vertical spike in July before topping out in August. As a result, we saw that momentum surge and urged investors to be very cautious.

Notably, ADC’s August highs also coincided with its solid Q2 earnings release, indicating the market was waiting for buyers to join the summer rally before taking them out decisively. As seen above, its August highs were also in line with ADC’s pre-COVID highs of February 2020, corroborating the market’s intention to prevent further buying upside from its long-term resistance.

However, the steep selloff from its August highs has also created a capitulation move, as weak holders fled, with ADC closing in on its robust intermediate support zone.

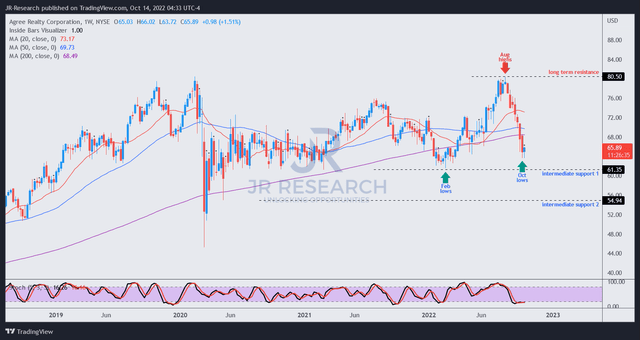

ADC price chart (weekly) (TradingView)

As seen in its medium-term chart, the sharp selldown has likely dissipated a significant level of near-term downside. We also gleaned that ADC’s “intermediate support 1” could also stanch further selling momentum, as that level has defended ADC’s medium-term bullish bias since June 2020.

We assess that ADC would likely re-test its “intermediate support 1” after a short-term consolidation. Therefore, investors looking to add more positions should consider layering in their exposure, capitalizing on downside volatility.

A further selloff to form an eventual bottom within the zone of its “intermediate support 2” is possible if the market anticipates further earnings estimates cuts are necessary to de-risk ADC’s execution risks through the recession.

ADC Stock’s Valuation Has Been De-risked

Management emphasized its confidence in its execution by raising its monthly dividend to $0.24 per share for October. Furthermore, with a well-laddered debt maturity schedule with just $28M due in 2023, we believe Agree Realty’s balance sheet risks are well-managed through the Fed’s rate hikes and coming economic recession.

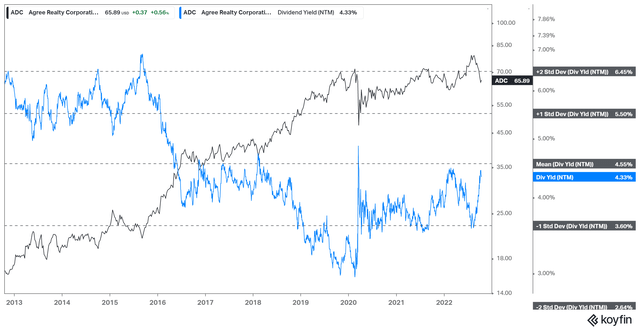

ADC NTM Dividend yields % valuation trend (koyfin)

ADC last traded at an NTM dividend yield of 4.37%, close to its 10Y mean of 4.55%. The risks of a further selloff to de-risk its valuations is possible, depending on whether the market expects a worse-than-expected recession to pan out.

Based on our assessment of ADC’s “intermediate support 2,” ADC’s forward yields could improve to 5.2% (barring any dividend cuts), just below the one standard deviation zone under its 10Y mean.

As a result, it would push ADC’s yields even higher than its COVID highs, which suggests that investors should consider adding aggressively. We are not concerned that a global recession could worsen Agree Realty’s growth prospects to such an extent, even in the face of potential AFFO per share estimates revisions.

Hence, we believe the battering in ADC has improved its valuations significantly for investors with less aggressive entry levels and a relatively attractive forward yield.

Coupled with a long-term uptrend bias, we revise our rating on ADC from Hold to Buy.