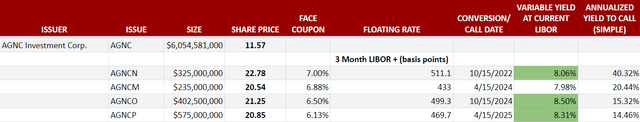

AGNC Corp Preferred O: Floating 8.5% Yield, 15% Yield To Call

Jennifer_Sharp/E+ via Getty Images

A $7.2 Billion Opportunity

REIT fixed to floating preferreds have a total market cap of about $7.2 Billion. Most of them are substantially mispriced as the market has treated them as fixed rate securities even though the overwhelming majority of future cash flows are variable rate in nature.

On Portfolio Income Solutions we have complied a spreadsheet that tracks this opportunity in real time. It tells you when each individual security converts to floating rate and what that floating rate will be. This allows us to see in real time which are the most opportunistic sources of yield. Presently the New Residential (NRZ) preferreds and AGNC Investment Corp. (NASDAQ:AGNC) preferreds offer the best opportunity, but prices are volatile and I am confident that as the Fed continues to hike, others will become great total return plays as well.

Let me begin by discussing the underlying mechanisms of the mispricing and then hone in on the specific mispricing of AGNCO.

The Origin of Opportunity

When a pebble is dropped in a pond, the water ripples out in a predictable pattern. Similarly, when the financial system is agitated, the various financial instruments should move in a predictable fashion determined by mathematics.

For the most part, the various instruments have moved properly, but I like to look at the entire web of instruments available for investment and find the area that is moving improperly. Improper movement breeds mispricing which is synonymous with opportunity.

Let me begin by showing two yield instruments that have moved approximately as they should have.

Specifically, we will look at the fixed income market in the presence of rising interest rates as the agitation.

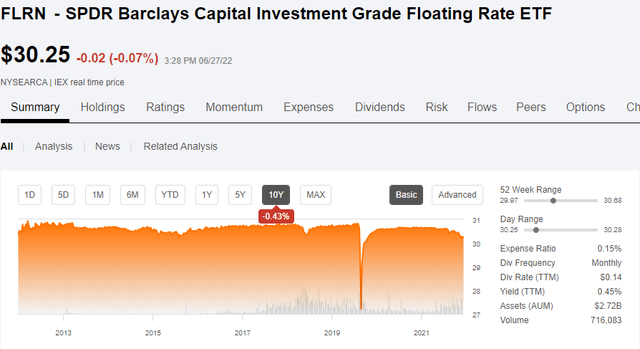

Floating rate securities have been correctly unaffected or minimally affected by rising interest rates.

SA

As interest rates rise, floating rate securities provide the investor more yield, but the higher yield is offset by a higher discount rate on all investment. These largely net out and floating rate instruments should trade approximately flat as a result of interest rate agitation.

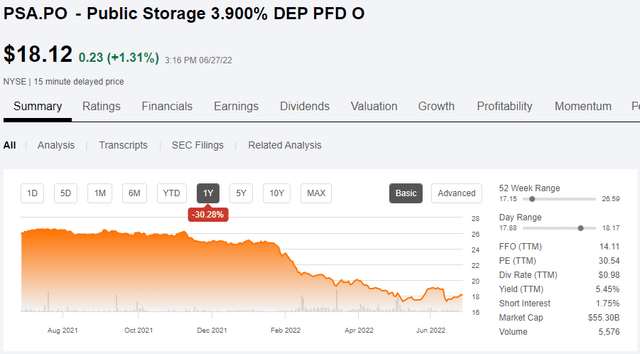

Fixed rate securities, however, still suffer from the higher discount rate but do not have a higher income stream to compensate. If we look at Public Storage (PSA) Preferred O (PSA.PO), for example, investors are still getting the same 3.9% coupon but now have a much higher discount rate. This security is correctly down 30% on the year.

SA

If it was still trading at par value of $25, the dividend yield would have almost no spread above the 10-year treasury so there would be no reason to own it. Thus, its price has fallen and will continue to fall as rates rise further so as to maintain a reasonable risk premium.

So, with that backdrop in mind as to how such instruments should move, I want to present a 3rd type of instrument: fixed to floating preferreds.

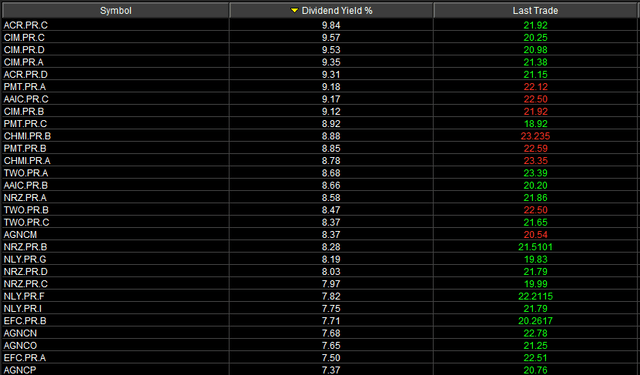

These are preferred securities of REITs that currently have a fixed coupon but at some designated time in the future switch to a variable rate. There are quite a few of them totaling about $7.2B in total market cap; here is the list.

E-Trade Streamer intraday 6/27/2

They present an interesting problem to the market: should they be traded more like the floating rate instruments or the fixed instruments?

Well, the market has declared these to be fixed rate with the entire group trading down substantially so far this year. Many are trading at 20% discounts to par value which has brought current yield up to around 7%-10%.

I think this is incorrect and let me show you why.

Preferreds are perpetual securities until they are redeemed. With each of these issues trading at discounts to par, redemption is a wildly positive event for shareholders. It would mean immediate realization of a 15%-35% capital gain depending on the issue.

Thus, the bad scenario for an investor in a discounted preferred is that the security is not redeemed which results in a perpetual stream of cash flows (assuming company stays healthy enough to pay).

With such a long stream of cash flows, the first couple years are really not all that impactful toward the overall value of the security. Let us look at AGNC Investment Corp Preferred O (NASDAQ:AGNCO) as an example.

It has a fixed coupon of 6.5%, so at $21.25 where it is trading today, the current yield is 7.65%. However, in October of 2024 it starts floating at 3-month LIBOR plus 499.3 basis points.

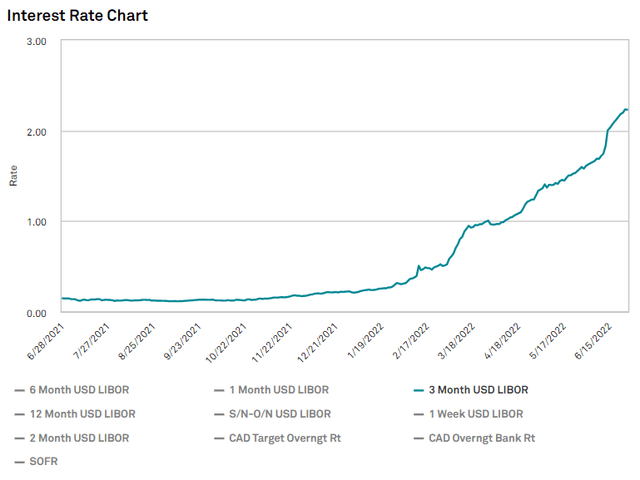

Given the Fed action, 3-month LIBOR is soaring.

S&P Global Market Intelligence

At current LIBOR, the floating yield on AGNCO would be 8.5%

Portfolio Income Solutions fixed to floating preferred spreadsheet

The Fed is expected to hike another 100 to 200 basis points over the next year or so which would likely bring short term interest rates like LIBOR up with it.

In terms of fundamental valuation, I think AGNCO is much closer to a variable rate security. The perpetual variable rate cash flows dominate the equation over the cash flows that happen between now and October of 2024.

The only scenario in which the variable rate cash flows do not dominate would be if AGNCO were redeemed, but given the discount, that is an even better outcome for investors. The capital gain resulting from redemption would give investors a 15.32% annualized yield to call (simple).

Either the market is unaware that AGNCO becomes floating soon or it has a myopic focus on the short term as it has traded down 17.5%.

SA

As we know from the study of variable rate income securities, these things should not be impacted by rising rates.

The 17.5% discount is a gift from the market and clear opportunity to get a yield substantially above the warranted risk premium.

Each of the fixed to floating preferreds has a different level of risk based on the underlying company that owes its cash flows. I particularly like AGNCO because the parent company is so solid.

AGNC’s durable ability to pay the preferred dividends

There is no doubt that agency mortgage REITs have suffered in this environment. As interest rates rise, long duration securities like agency backed RMBS decline in market price and via mark-to-market, AGNC has taken a sizable book value hit.

While clearly a negative for the common, it is not even remotely a threat to the preferreds. AGNC still has $6B of equity underneath the preferreds and the losses are one time in nature. Now that the securities have been marked down to at or below principal balance in most cases, there is not much further they can go down.

Even a massive shock to interest rates such as the 10-year treasury moving to 6% would not be enough to harm the preferreds fundamentally. There might be another mark-to-market writedown on the securities, but the principal value would remain unchanged. AGNC can simply hold them to maturity, collecting the interest along the way and then additionally recovering the principal balance.

Once an agency backed RMBS security is marked below par value, default of the lender is actually a positive event for AGNC as it results in reimbursement of the full principal balance. That is the beauty of an agency backed security.

I don’t really like the business from the perspective of the common equity as the net interest margin is small resulting in lackluster returns, but the stability of it is great for preferreds. As a preferred holder I do not care about upside, I just want stability such that the contractual level of dividend just keeps flowing.

I view AGNC’s preferreds, along with those of Annaly Capital (NLY) to be the most reliable in this list of fixed to floating.