Accenture: Attractive Dividend Growth Company (NYSE:ACN)

JHVEPhoto

Introduction

As a dividend growth investor, I constantly seek opportunities to acquire more income-producing assets to supplement my dividend stream. Sometimes I add to my existing positions, and on other occasions, I start new positions in sectors and industries I lack exposure. The current volatility may offer an opportunity to buy more assets for attractive prices.

The most elusive sector for me was always the technology sector. Companies in this segment kept trading for a high valuation as the Nasdaq broke yearly records. The current business environment has negatively influenced many tech stocks, and I am looking for opportunities in the segment. An exciting prospect in the sector is Accenture (NYSE:ACN).

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Accenture is a professional services company providing strategy and consulting, interactive, industry X, song, and technology and operation services worldwide. The company offers application services, including agile transformation, DevOps, application modernization, enterprise architecture, software, and quality engineering, data management, intelligent automation comprised of robotic process automation, natural language processing, virtual agents, and application management services, as well as software engineering services, strategy and consulting services, data and analytics strategy, data discovery and augmentation, data management and beyond.

Fundamentals

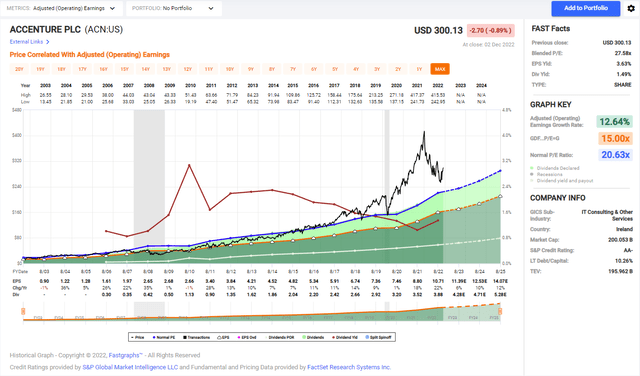

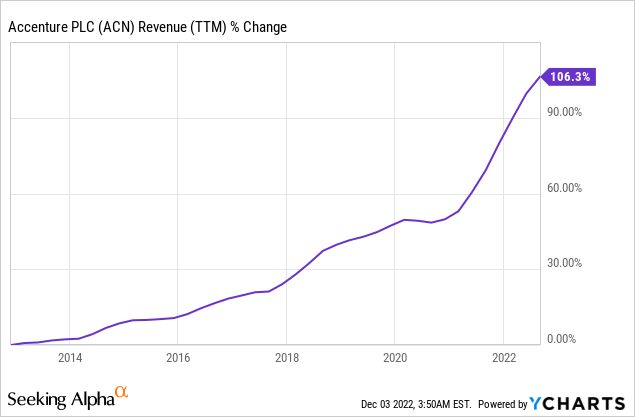

Revenues have increased by more than 100% over the last decade. Doubling sales over a decade equates to a roughly 7% annual increase in sales. Accenture manages to increase sales both organically and through M&A. Most of the growth is organic, as the company uses acquisitions to improve its capabilities and value proposition. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Accenture to keep growing sales at an annual rate of ~6.5% in the medium term.

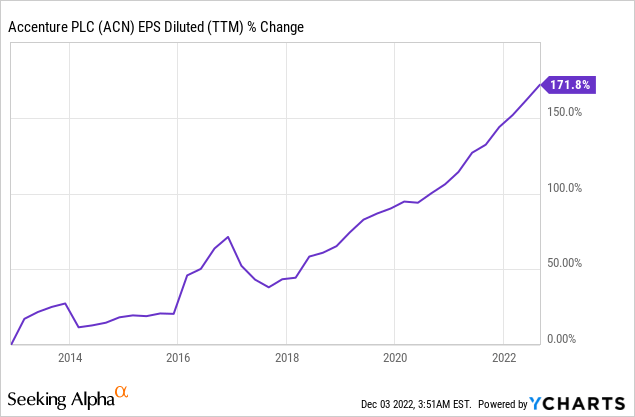

The EPS (earnings per share) has increased significantly faster than the sales. Over the last decade, the EPS has been up 172%. The faster EPS growth is due to sales growth and improved margins. The company offers more services and solutions than its professional services, allowing it to improve its margins as existing clients require little expenditure. In the future, analysts’ consensus, as seen on Seeking Alpha, expects Accenture to keep growing EPS at an annual rate of ~8.5% in the medium term.

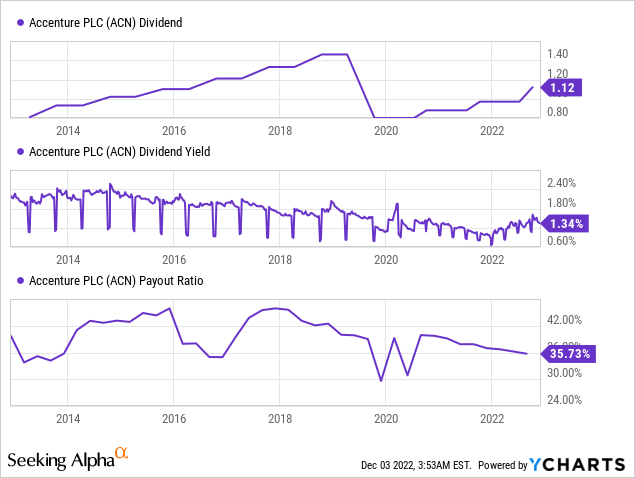

The dividend may look a bit misleading in the following graph. Accenture has been growing its annual dividend for 17 years, including a 15.5% increase in 2022. The decline in the dividend, as seen below, is because the company shifted from paying a biannual dividend to a quarterly payment. The dividend is likely safe as the payout ratio stands at 36%. The only disadvantage here is the dividend yield which hovers around 1.5% following the dividend increase.

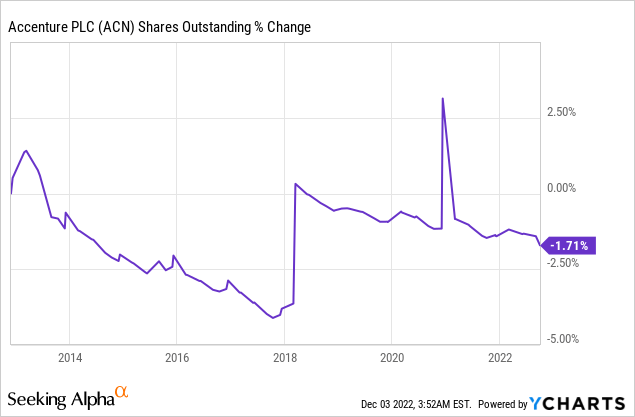

In addition to dividends, share repurchasing plans are the primary method to return capital to shareholders. Over the last decade, the number of shares outstanding remained almost flat as Accenture bought back 2% of its shares. The buybacks negate the issuance of new shares as part of acquisitions and employee compensation. Buybacks are efficient when the shares are cheap, which is not the case with Accenture. Thus it makes sense to maintain the limited buybacks.

Valuation

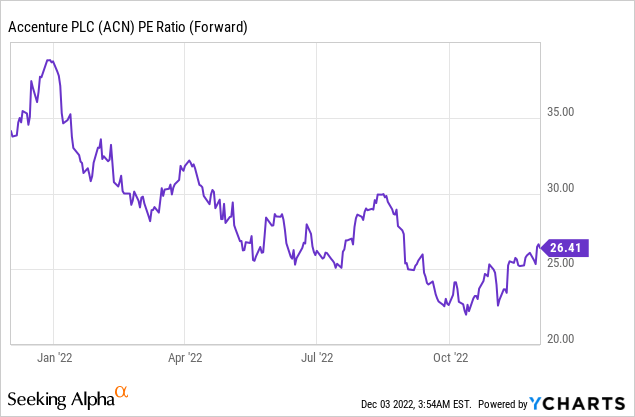

The P/E (price to earnings) ratio of Accenture stands at 26 when using the forward EPS estimates. It is a high valuation compared to the general market, as the S&P 500 trades for roughly 16 times earnings. However, the graph below shows how the valuation decreased over the last twelve months. Despite the decline, the shares still seem to trade for a premium.

The graph below from FAST Graphs amplifies that Accenture is trading for a premium. Since 2017 the company’s share price has detached from its valuation. The average P/E ratio of Accenture over the last twenty years was 20, which is significantly lower than the current P/E ratio of 26. The valuation has improved, yet there is still some significant premium.

To conclude, Accenture is a fantastic company with great fundamentals. We see how the company grows its sales and EPS. The company uses its cash to reward shareholders using both dividends and buybacks. However, the current valuation seems to be high as the company trades for a higher P/E than its historical average. The company must show significant growth opportunities and limited business risks to justify this valuation.

Opportunities

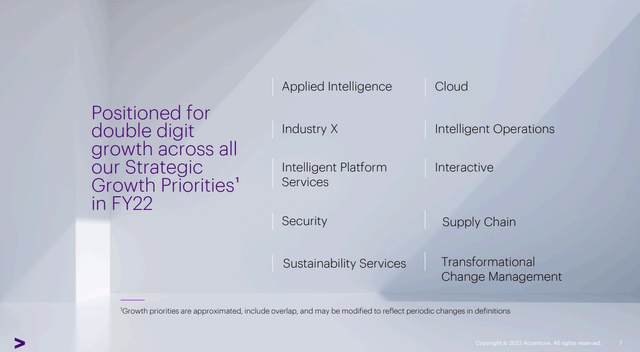

The company focuses on ten primary offerings, where it sees the most potential growth for its top and bottom line. The company offers technological solutions and consulting as it helps corporations improve these central aspects of their business. Cloud migration and security are essential in almost every industry, and supply chain is a hot topic as the world deals with challenging shipping costs. The cloud and security businesses grew at 35% and 30% CAGR, respectively, over the last three years, and there is still room to grow.

Accenture Investor & Analyst Conference

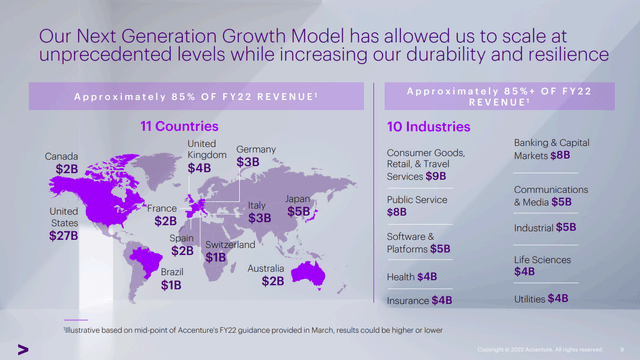

Diversification is another key growth opportunity for Accenture. The company diversifies its business into two axes: the geographical axis and the industry axis. The company’s value proposition helps business transform and adapt to the new, ever-changing world. It is a needed offering across industries and geographies. Therefore, Accenture doesn’t rely on a single sector or country to grow its business, despite the U.S. being its primary market.

Accenture Investor & Analyst Conference

Smart M&A is another significant growth opportunity for Accenture. Accenture constantly seeks and buys smaller companies that can widen its value propositions for its client. When Accenture buys a small startup with a promising offering, it can later channel this new capability and new offering to its entire client base. Therefore, small acquisitions can have an impact on the business.

Risks

The current business environment is riskier. There is a higher level of uncertainty, and economists believe we may be heading into a recession. During recessions, there is pressure on companies to limit expenses, and consultancies will suffer as there will be fewer projects. Operational excellence projects aiming for lower costs are the focus of more traditional companies like McKinsey. Therefore, a major recession may have a significant impact on Accenture.

Moreover, a slight slowdown may significantly impact the company’s share price. While a slowdown may not affect the fundamentals heavily, the company offers no margin of safety at the current prices. Therefore, even a slight downturn may scare investors and lead to a valuation that aligns with the company’s historical valuation. Thus, the lack of margin of safety is a risk from the investors’ perspective.

Another risk for the company’s business model is the competition. The company is competing with different consultancies for clients. Moreover, some tech companies establish their deployment capabilities and prefer to deploy, install, and offer services themselves as they see the importance of owning the relationship with the end client and users.

Conclusions

Accenture is a great company when looking at its fundamentals and opportunities. The company’s sales growth leads to EPS growth which fuels dividends and buybacks. The company has much room to grow as the demand for its services will increase in the long term, and it operates worldwide in many industries. Therefore, there is no doubt that it is a high-quality company.

However, the company is not cheap, and this quality trades for a premium. There is no margin of safety in case the risks materialize, and Accenture won’t perform well. With no margin of safety, investors should choose to accumulate shares slowly. I believe that to become a strong buy, Accenture should trade for around $230, which implies a P/E ratio of 20. I think it is a BUY due to its excellent prospects and its position as a market leader.