5 Reasons To Call An Investment Time-Out

shapecharge

Rick Rieder and team argue that a remarkable shift in the market’s perception of growth, inflation, and policy trajectories means investors should consider calling the market equivalent of a time-out to reassess portfolios.

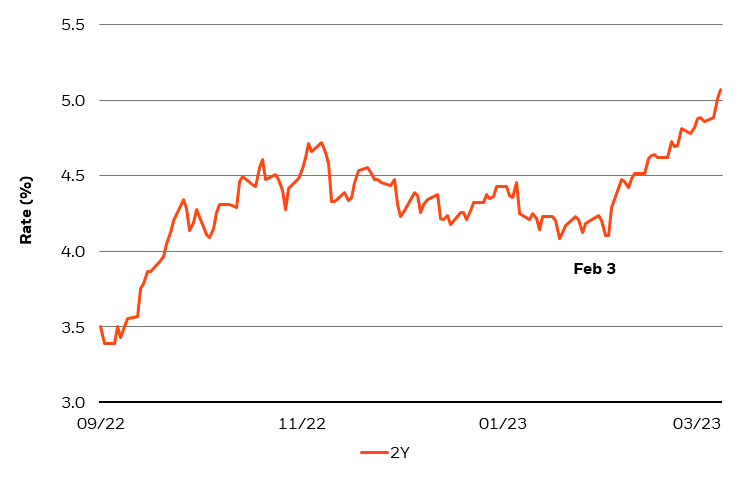

As the United States approaches the end of college basketball’s March Madness season, financial market participants have already endured almost three months of “madness” via the fastest repricing in the trajectory of growth, inflation, and monetary policy in decades. The first pivotal moment for the repricing in question occurred around the time of the U.S. employment report on the morning of February the 3rd, where incredible strength in the labor market spurred the financial markets to rethink expectations of an economic hard landing (see Figure 1). Much of the data since then has continued to surprise to the upside.

While we had written about the underappreciated resilience of the U.S. labor market, and the world economy more broadly, to tighter financial conditions (see our last piece: The Polyurethane Economy), even we could not have predicted just how strong the January employment report would be, and how violently markets would respond to it. A near-uniform rally across major markets in January quickly turned to a universal selloff in February, compounded (for risk assets) in early-to-mid March by the second largest bank failure in U.S. history and its aftermath, leaving market participants wondering exactly how long and how variable today’s monetary policy lags will end up being when applied to the largest and most resilient economy in the world.

In college basketball, such momentous, unanticipated twists, and turns in the game would likely result in a coach calling a time-out (source: The 5 Moments Throughout a Game You Must Call a Timeout). In a similar fashion, we think there are 5 reasons investors should call the market equivalent of a time-out in March 2023, to reassess portfolio strategy amidst rapidly evolving conditions.

Figure 1: The Feb 3 payroll report led to a sharp selloff and new cycle high in 2-Year UST rates

Source: Bloomberg, data as of March 8, 2023

Why calling a time-out can make sense #1: Stop the momentum of the other team

The “other team” is now controlling the game, at least from the Fed’s perspective with regard to inflation. While last year’s elevated inflation peak is unlikely to be exceeded, recent inflation data has regained some surprising momentum, alongside impressive economic growth readings. Further, the source of this persistence in inflation has been somewhat of a mystery, with market participants attributing each consequent surprise to different underlying factors. Some reasons stand out though: durable goods consumption has mean-reverted lower in the wake of the pandemic, without a commensurate decline in prices; the inventory of existing homes is near multi-decade lows, keeping a high floor under prices; and consumers have not cut back on spending in light of healthy balance sheets and a stock (albeit a declining one) of pandemic-era savings still sitting in bank accounts.

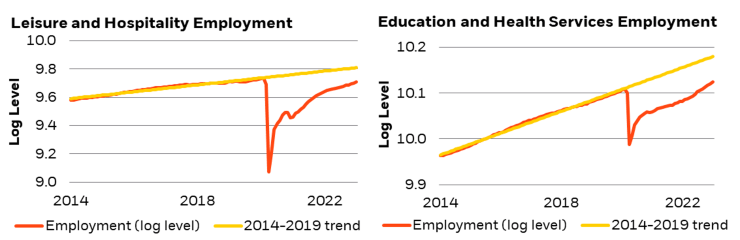

Still, perhaps the single biggest reason for underlying economic strength is that there are still a vast number of job openings that have yet to be filled (see Figure 2), pinning unemployment down at a half-century low, and elevating wages, especially in sectors where wages are the lowest. With most pandemic-impacted services yet to return to their pre-pandemic trends, it is not clear how, when, or at what policy rate, the labor market will “cease to be strong.” In December, we asked where the peak of the “interest rate mountain” might be (see: Zooming in on Fixed Income), and while that peak has almost certainly drifted higher than we thought it would in December, we may be getting very near to it now.

Figure 2: Large employment gaps persist in leisure, hospitality, education, and health services

Source: Bureau of Labor Statistics, data as of February 1, 2023

In fact, the FOMC is attempting to thread a tricky policy needle. At its March meeting, the Fed raised its policy rate by 25 basis points but also committed to keeping liquidity in the system (the Fed increased its balance sheet by $300 billion so far in March) and leaving its estimate of the year-end policy rate unchanged at 5.1%. Additionally, Chair Powell suggested that the Fed could pause rate hikes, as we are moving closer to the end of the hiking cycle (in our view, given recent events, the terminal funds rate will likely reside around 5.25%), and they’re likely to reach that point at the next meeting.

There have been some clear changes in the direction in monetary policy emphasis this year: at the February FOMC meeting we saw a recognition of some disinflationary influences, a reversal in the Humphrey Hawkins testimony, which emphasized more intransigent inflation that needed to be addressed, and now a recognition that the economy will slow from here, somewhat related to stresses in the financial system. The Summary of Economic Projections has 2023 growth of 0.4%, which would suggest negative growth from here, given the run rate strength of today’s economy. In addition, the 2023 unemployment projection of 4.5% is well above today’s prevailing 3.6%, suggesting a tangible deterioration in employment conditions as the year wears on. Plus, the new insertion into the FOMC statement of “recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation,” suggests a more dovish reaction function than at the end of last year, particularly in light of the increased left-tail risks facing the economy and financial markets today.

As a result, the real challenge for the Fed will be to slow inflation without damaging many of the good things that are still happening in the labor market, or risking further financial instability. While more blockbuster payroll prints of January’s proportions seem unlikely, the Fed will have to be careful not to indirectly harm a shift in wealth from capital to labor, a welcome development that largely benefits disposable income for lower-income cohorts, even as inflation moves (hopefully) progressively lower.

Stubborn inflation and sticky employment continue to make the case for “the next” rate hike. Payroll growth simply may not reverse soon enough to preclude that outcome: history suggests that there is a 9-to-12-month lag between the time when policy rates peak and when payroll growth turns negative. Contrast that with the most interest rate-sensitive sectors, like banks, housing, and commercial real estate, which tend to decline almost on cue (and have shown tangible weakness as the current tightening cycle has progressed). For a broader growth slowdown to occur (a recession), rate hikes need to hit non-financial segments of the economy, such as corporate capital expenditures – companies need to develop a more dire view of future prospects and consequently stop investing, or begin reducing headcount more meaningfully.

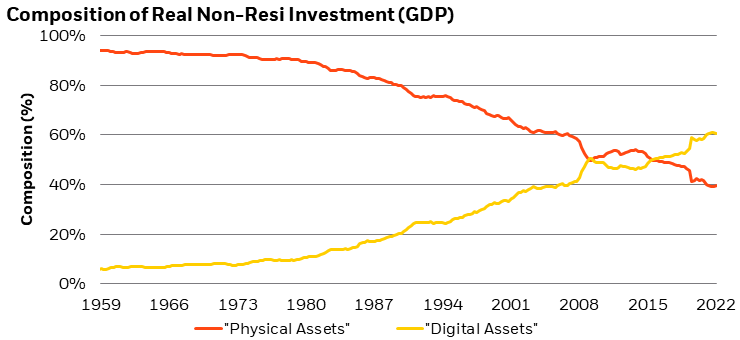

In prior decades, when the Fed raised rates to fight inflation, a subsequent contraction in non-residential investment preceded an employment contraction. This investment spend used to be made up of buildings, transportation equipment, and large capital-intensive, levered, interest-rate-sensitive projects. The challenge today is that the composition of non-residential investment has changed dramatically. In 2016, digital assets overtook physical assets for the first time, taking the lion’s share of non-residential investment (see Figure 3). Software, artificial intelligence, and research & development (R&D) are not debt intensive, highly levered physical assets, like a new factory or a fleet of trucks. As a result, the influence and impact of rate hikes are much more muted on digital assets, and the transmission mechanism of monetary policy is grossly different. Further, and importantly, these digital assets are largely disinflationary investments in the long run.

Hence, between the long and variable lags of policy implementation, the less sincere impact that interest rates should have on much of the economy, but the more intense impact from policy on places like real estate and the financial economy, this would all suggest that while the Fed could justify an even more restrictive rate based on trailing economic momentum, some patience and a heightened sensitivity to both data and financial stability should be the prevailing mindset from here, something Chair Powell alluded to at the March FOMC meeting.

Figure 3: Digital assets have overtaken physical assets when it comes to corporate investment

Source: Bureau of Economic Analysis, data as of December 30, 2022

Other reasons for policymakers across the world to proceed at a slower pace of tightening include an aging (and retiring) workforce, leaving employers bidding for a smaller pool of workers, and thus keeping employment conditions tighter than they otherwise would be, and the consequent rise in fiscal spending to support that retiring demographic over the next few decades. These issues are not unique to the United States, and in fact, are more acute in industrial economies elsewhere.

Why calling a time-out can make sense #2: Give your players a rest

An enormous amount of fixed income supply has come to market and has been absorbed by the substantial stock of cash sitting on investors’ balance sheets. Indeed, 2023 is expected to be the highest issuance year in the U.S. since 2020, and one of the highest of any year before 2020. In Europe, 2023 issuance is expected to dwarf that of 2020, with no respite anticipated (according to Goldman Sachs data, as of March 2023). Credit markets on both sides of the Atlantic have followed suit, posting record issuance to start the year. Investors could use a time-out to gauge the market’s propensity for indigestion, as record supply has coincided with record volatility in yields.

Why calling a time-out can make sense #3: Change your game strategy

At the end of 2020, when cash rates were close to 0%, there wasn’t a huge degree of dispersion across fixed income in terms of risk-adjusted yield, but in March 2023 almost the opposite is true. A cash rate of 5% has left many fixed income assets below the incremental carry required to compensate investors for an additional unit of volatility. Investment Grade Commercial Paper, for example, offers nearly a 6% yield over 9-12 months, with almost no duration and little credit risk. Further, cash and cash equivalents are the only major asset class to post a positive return both before and after that pivotal January jobs report release.

It’s hard to overlook an uncorrelated asset that is delivering 30-40 bps of risk-free return a month, so we think cash and cash-like instruments should rightfully play a greater role in portfolios today.

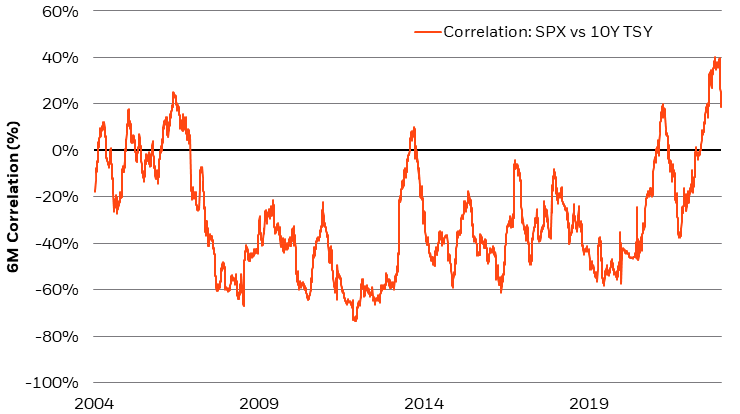

Figure 4: The correlation of risky assets (like the S&P 500) to Treasuries is crossing an inflection point

Source: Bloomberg, data as of March 24, 2023

Our desire to take a temporary time-out should not be mistaken for a structural shift in our view of duration’s long-term role in portfolios though. Uncorrelated assets may be so important for portfolio construction that a Monte Carlo simulation using inputs of a 7% real return for the S&P 500 (the 30-year average) and a -1% real return for long Treasuries still suggests that a quarter of the portfolio should be in Treasuries, to maximize risk-adjusted return, if the correlation is -40% (also the 30-year average). As the Fed’s hiking cycle begins to come to an end, and we get closer to a potential pause, we’ve already started to see a significant drop in the correlation between risky assets and rates (see Figure 4).

Why calling a time-out can make sense #4: Draw up a specific play for today’s portfolio positioning

To hit a 6%, or 6.5%, yield target in the years between the Global Financial Crisis (GFC) and 2022, it was almost a given that investors needed to own a primarily low-quality, high-yield portfolio. Today, given the repricing in risk-free rates, high-quality fixed income can become the dominant fixture of a similarly yielding portfolio. A recession is still a distinct enough possibility in the intermediate-term, such that the concept of upgrading from a low-BB-rated portfolio to a single-A portfolio is an ideal way to call a market time-out.

Why calling a time-out can make sense #5: Fire up your team

As an asset allocation thought exercise, we often ask: “What would it take for fixed income to deliver equity-like returns?” For U.S. Investment Grade credit, a 60-bps rally in yields over the course of a year might be sufficient. For the Long Treasury index, a mere 37 bps rally in yields would be sufficient to deliver equity-like returns this year. It is incredible how small the price contributions would need to be in high-quality fixed income to achieve this equity-like return profile, given the embedded carry today (Sources: Bloomberg, data as of March 2, 2023).

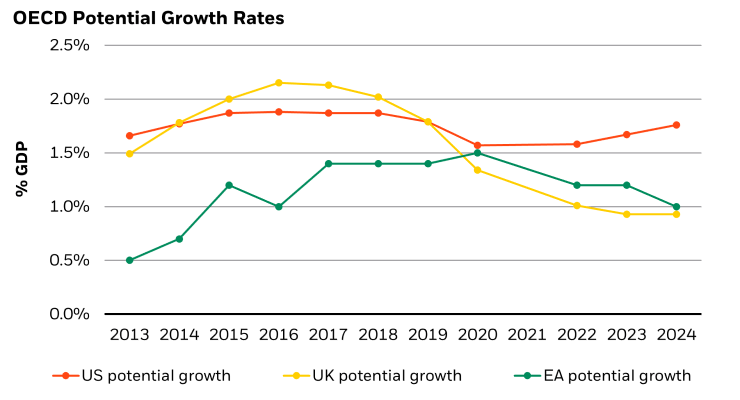

Outside the U.S., duration risk looks attractive on a longer horizon. Potential growth in Europe and in the U.K. is generally expected to be below that of the U.S., making risk-free rates in those jurisdictions that have jumped in line with rates in the U.S., look particularly interesting (see Figure 5). The caveat to this is that inflation has been arguably even stickier, especially in the Euro area. Nonetheless, we expect core inflation in Europe and in the U.K. to moderate over time, meaning EUR and GBP rates will be a top consideration for portfolios when we do emerge from our time-out. Again, timing will be critical.

Figure 5: Potential growth in Europe and the U.K. lags that of the U.S.

Sources: OECD and Bloomberg, data as of March 2, 2023

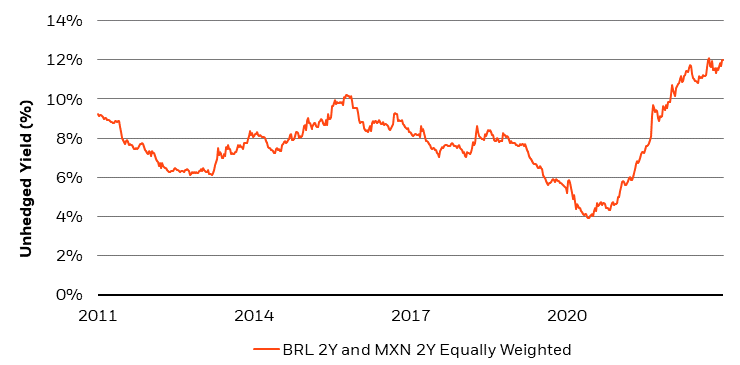

Emerging markets are another area where fixed income yields have become attractive. The average yield on a portfolio of 2-year Mexico and Brazil bonds (these are some of the largest economies in the world, not just EM) is at a whopping 12%, a yield premium over the U.S. that does start to compensate investors for a variety of risks, including FX and inflation risk. Indeed, EM central banks have been ahead of the curve in this hiking cycle, front-running the Fed for much of the journey. Some stability in U.S. rates and in the U.S., dollar would leave yields on EM local rates looking very juicy, without investors even having to dive into more idiosyncratic regions, or out the curve (see Figure 6).

Figure 6: Front-end local rates have reached 12% in major emerging markets

Sources: Bloomberg and BlackRock, data as of March 2, 2023. Past performance is no guarantee of future results.

Note: Graph represents the average yield (equally weighted) of 2-Year locally denominated Brazil and Mexico sovereign bonds.

While we like being patient today, if U.S. rates can indeed find a stable range in the coming months; that would likely mark the moment that investors should emerge from their time-out and start to deploy cash into financial assets again. We have climbed higher up the policy rate mountain than we have at any time in the last two decades, save for a brief period in 2007, such that the years of paltry fixed income returns that haunted the market in the 2010s may be coming to an end.

In fact, while the 2010s were known for outsized equity returns and tiny fixed income yields, this may be flipped in the next few years. The S&P 500 earnings yield is on par with the yield of a 6-month Treasury bill for the first time in decades, and dividend yields are vastly inferior to their respective corporate bond counterparts. On a relative valuation basis, stocks cannot be considered the cheaper asset, in our view.

Basketball coaches call time-outs when they can see a path to victory, but first, need to fire up their team to pursue it. We believe that this hiking cycle is setting the stage for a generational return profile in Fixed Income globally. In today’s rapidly changing world, we are happy to take a time-out with a portfolio that produces a great deal of carry with a high proportion of cash equivalents, yielding assets, and some moderate beta through this “March Madness.”

This post originally appeared on the iShares Market Insights.